BhaskarTiwari (🛠️,🇮🇳)

@BhaskarWeb3

Web developer |💥Web 3💥| Investor

You might like

Exiting a Stock? ~ By RAKESH JHUNJHUNWALA Exit when EPS growth expectations becomes unsustainable (e.g. Infosys in 2000, where the market assumed 100 % growth forever) Exit when P/E becomes absurd Do listen, lots of wisdom⏬ Src ~ FLAME University

Repetition rewires your brain. Repeat what you want to become. This is neuroplasticity.

Investing is simple- if you like a business on merits, you buy. After your buying, the share prices go down, you buy some more, the share prices go down further, you buy some more. The question is if the share prices keep going down say become 50% of your initial buying prices,…

i went from zero devops knowledge to getting hired in 6 months here's the exact roadmap that worked for me no fluff just actionable steps

₹1 Cr salary? You take home ₹65L after taxes. ₹1 Cr business profit? You keep ₹80L after deductions. ₹1 Cr in stock growth? ₹₹87.65L remains after 12.5% tax. The system wasn’t designed for workers. It was built for owners. Still chasing promotions instead of ownership?

Success in tech isn’t about being the smartest. It’s about being the most consistent.

This may be a mere coincidence or may be a well contrived effort to encrypt it. In either case, I find both the scenarios equally bizzare!

Favourite examples where pi appears unexpectedly?

Peter Lynch on Investing in the fast-growing businesses: The higher the potential upside, the greater the potential downside.

Mind is designed in such a way that "Immediately jump to conclusions" rather than "critical thinking" Critical thinking is the most important in Investing decisions.

You may read these two books- One up on Wall Street and Beating the Street.

To be mega successful in equity market, you need two skills- to identify undervalued quality businesses and to handle the volatility so that you can ride the bull market.

"Never confuse education with intelligence, you can have a PhD and still be an idiot"- Richard Feynman.

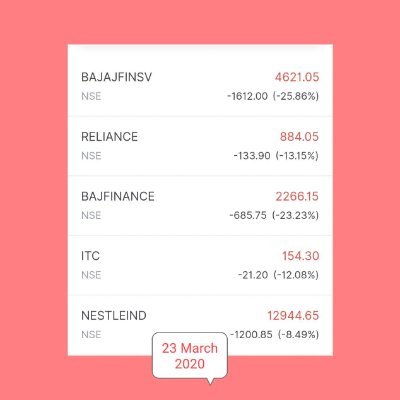

people buying in complete blood bath should be called as bulls. buying during best of the times are simply pigs waiting to be slaughtered

6-9 months ago, investors were buying in horde and now they are selling in horde. Legend Parag Parikh’s quote on crowd psychology- “In the stock markets, a small percentage of people end up being successful in the long run, whereas the majority of people, in spite of being…

AI will write code. But those who understand code will write the future.

🔥 🔥 Sensible Investing |

If you stay in your comfort zone, you’ll never know what you’re capable of.

You Need 3 Daily Wins A Physical Win Walk, run, hike, bike, stretch An Intellectual Win Read, learn, create, listen A Spiritual Win Reflect, express gratitude , Pray -Unknown

In real estate, the mantra goes "location, location, location". In the stock market, it's "earnings, earnings, earnings". - Mark Minervini.

Never expose your next step. Just step. A fish with a closed mouth never gets caught.

United States Trends

- 1. Raindotgg 1,678 posts

- 2. #TalusLabs N/A

- 3. Sam Houston 1,432 posts

- 4. Oregon State 4,802 posts

- 5. Boots 29K posts

- 6. Boots 29K posts

- 7. #T1WIN 23.4K posts

- 8. Louisville 14.3K posts

- 9. #GoAvsGo 1,524 posts

- 10. Batum N/A

- 11. UCLA 7,792 posts

- 12. Emmett Johnson 2,444 posts

- 13. #Huskers 1,088 posts

- 14. Oilers 4,969 posts

- 15. #FlyTogether 2,001 posts

- 16. Miller Moss 1,220 posts

- 17. Nuss 5,808 posts

- 18. T1 FIGHTING 3,342 posts

- 19. Bama 13.8K posts

- 20. Brohm 1,156 posts

You might like

-

Christophe Vervynck

Christophe Vervynck

@C_V_Y_N -

Garrett Gray

Garrett Gray

@getincrypto1985 -

tttts

tttts

@mihaithecoder -

Tunu Doley

Tunu Doley

@tunudoley7 -

Vikas

Vikas

@vikasdfghjl -

Germán

Germán

@germansimcovich -

Roger_Holliday

Roger_Holliday

@RHolliday21 -

☆♤♡◇♧¿

☆♤♡◇♧¿

@CodeWithShanez -

Ananya Singh

Ananya Singh

@bleminium_a -

J.A.F.O.

J.A.F.O.

@sentinel727 -

Moreshwar Pidadi

Moreshwar Pidadi

@MoreshwarPidad1 -

Shoaib Sayyed

Shoaib Sayyed

@shoaibsayyed_03 -

nanda | aoisora.base.eth EmoFi 🍊,💊

nanda | aoisora.base.eth EmoFi 🍊,💊

@nandana07580955

Something went wrong.

Something went wrong.