CA Jitendra Pawar

@CAJSPawar

Practicing Chartered Accountant | J S Pawar and Co, Chartered Accountants

قد يعجبك

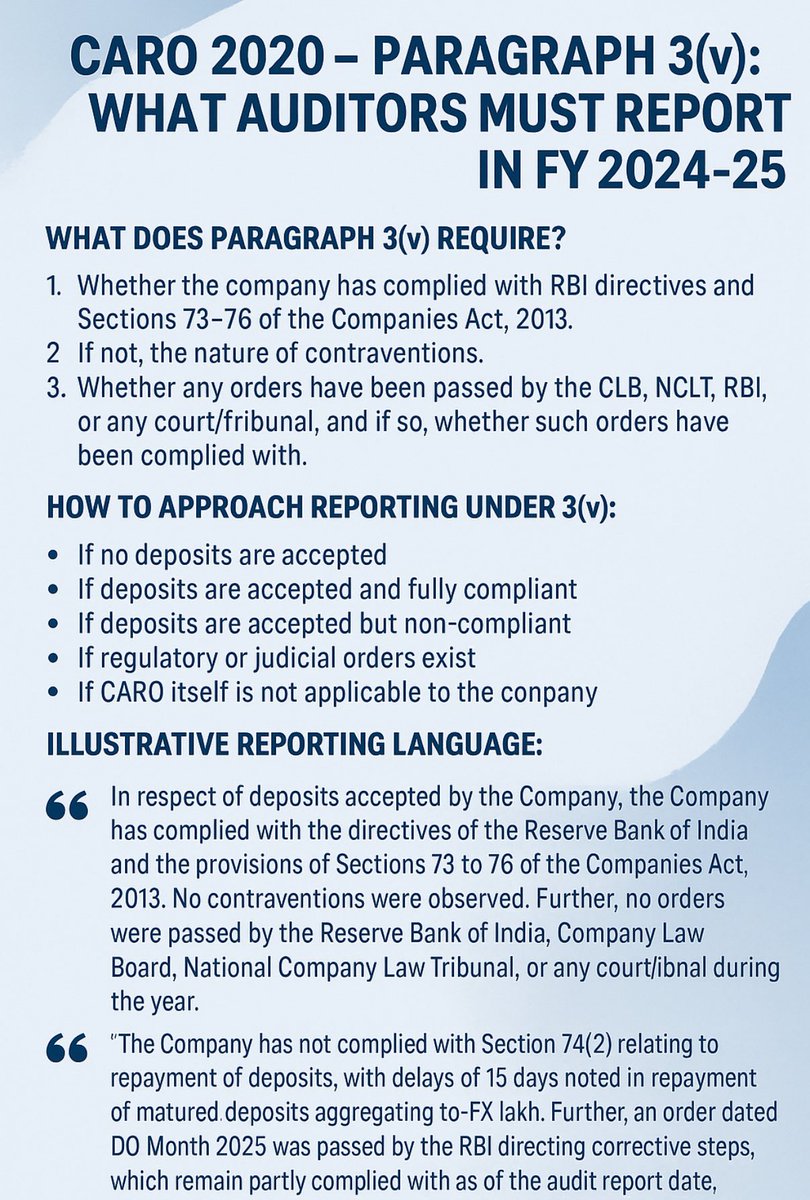

#CARO2020 – Para 3(v) ⚖️ Auditors must report for #FY2024_25: ✅ Compliance with #RBI + Sec 73–76 ✅ Nature of contraventions (if any) ✅ Orders by CLB/NCLT/RBI/Courts & compliance Scenarios: No deposits | Fully compliant | Non-compliant | Orders pending | Exemptions #Audit

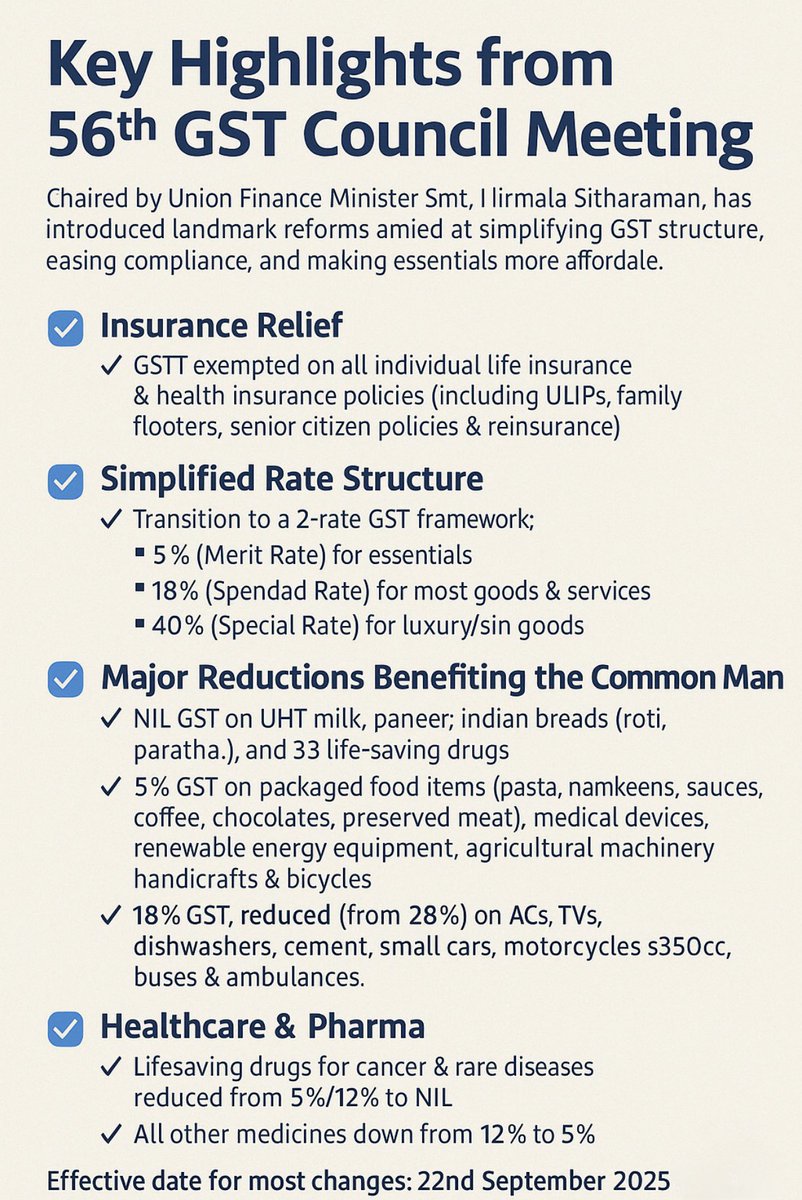

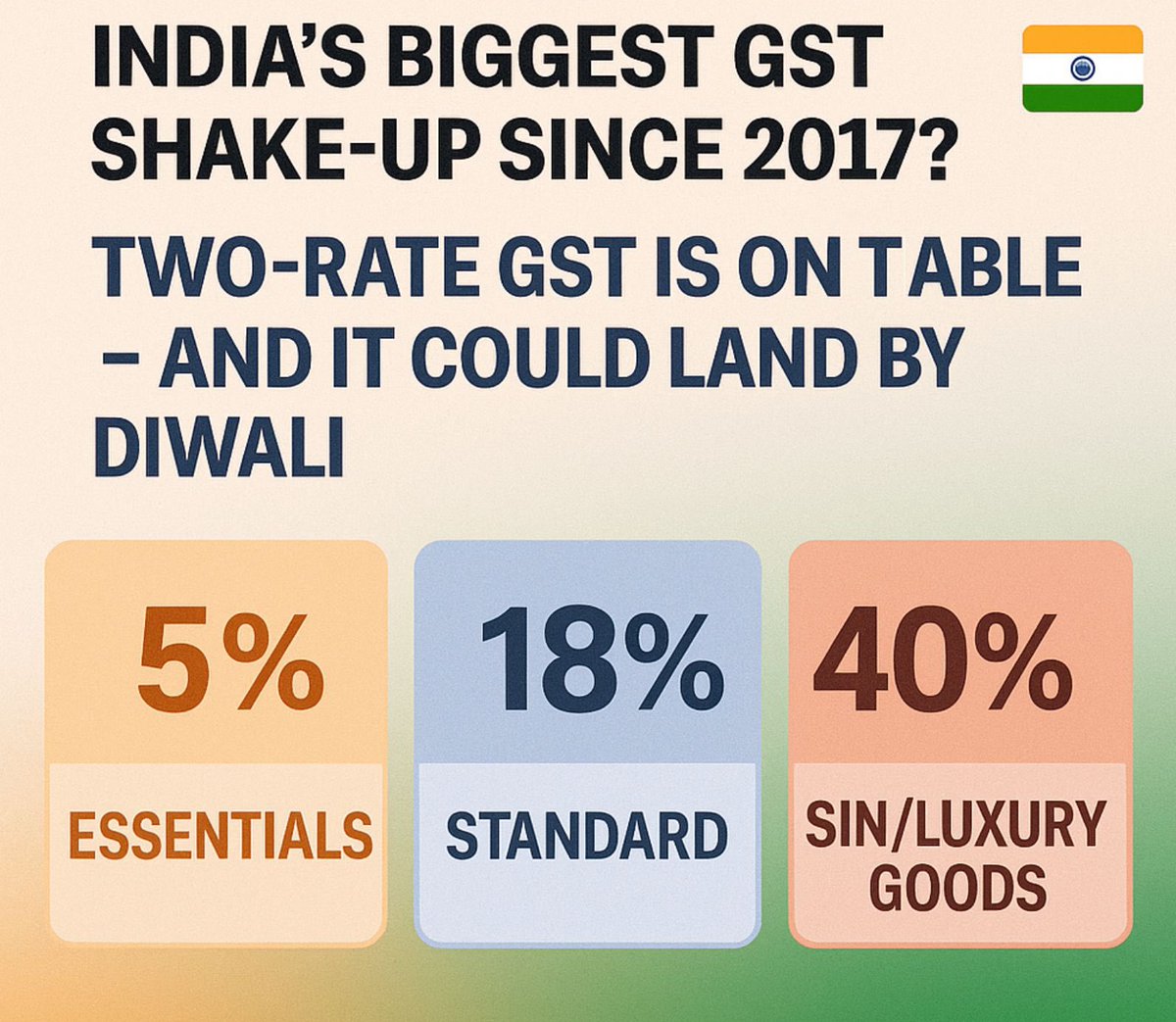

🚨 GST Council’s 56th Meeting Highlights ✅ GST exempt on life & health insurance ✅ 2-rate system: 5% & 18% (+40% on sin goods) ✅ NIL GST: milk, paneer, Indian breads, lifesaving drugs ✅ Cuts: food, agri machines, renewables, small cars 📅 From 22 Sept 2025 #GST #TaxReforms

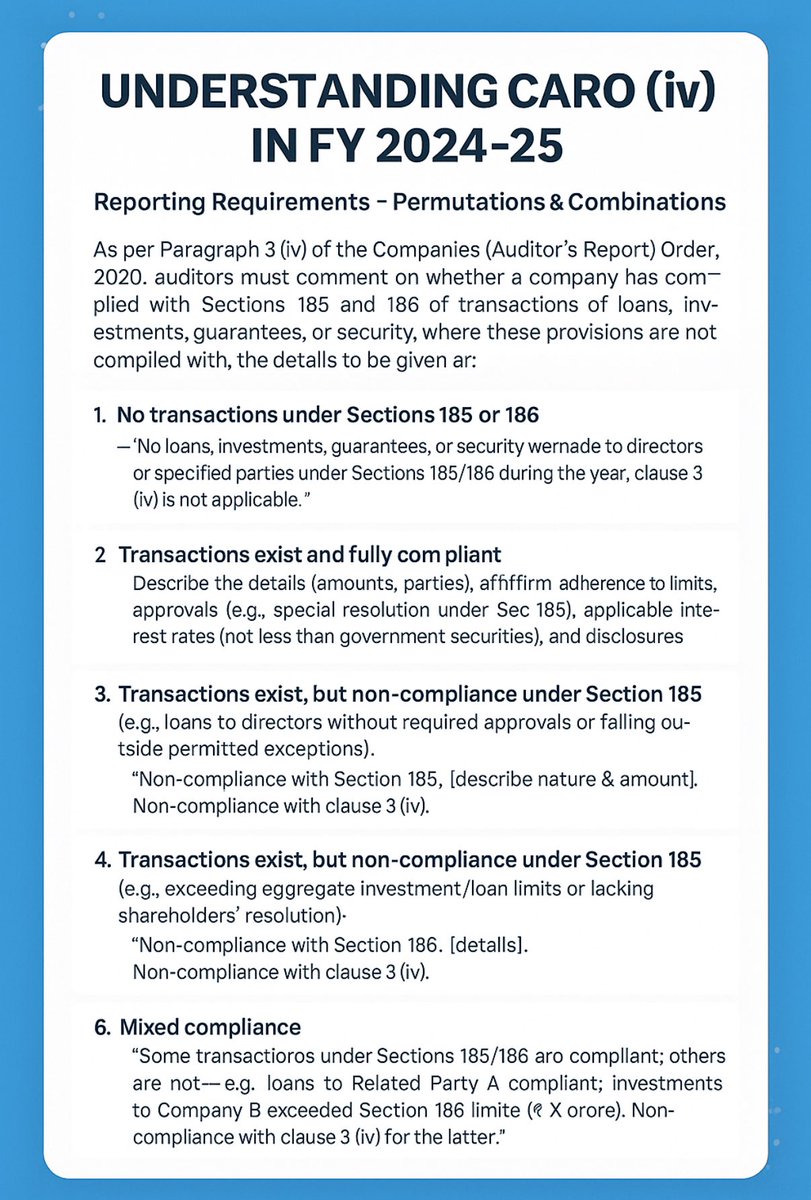

🔍 CARO 3(iv) FY 2024-25 Auditors must check compliance with Sec 185 & 186 (Loans, Guarantees, Investments, Securities): 1️⃣ No transactions→N/A 2️⃣ Fully compliant→Report compliance 3️⃣ Non-compliance→Disclose details 4️⃣ Mixed/procedural lapses→Report separately #CARO #Audit

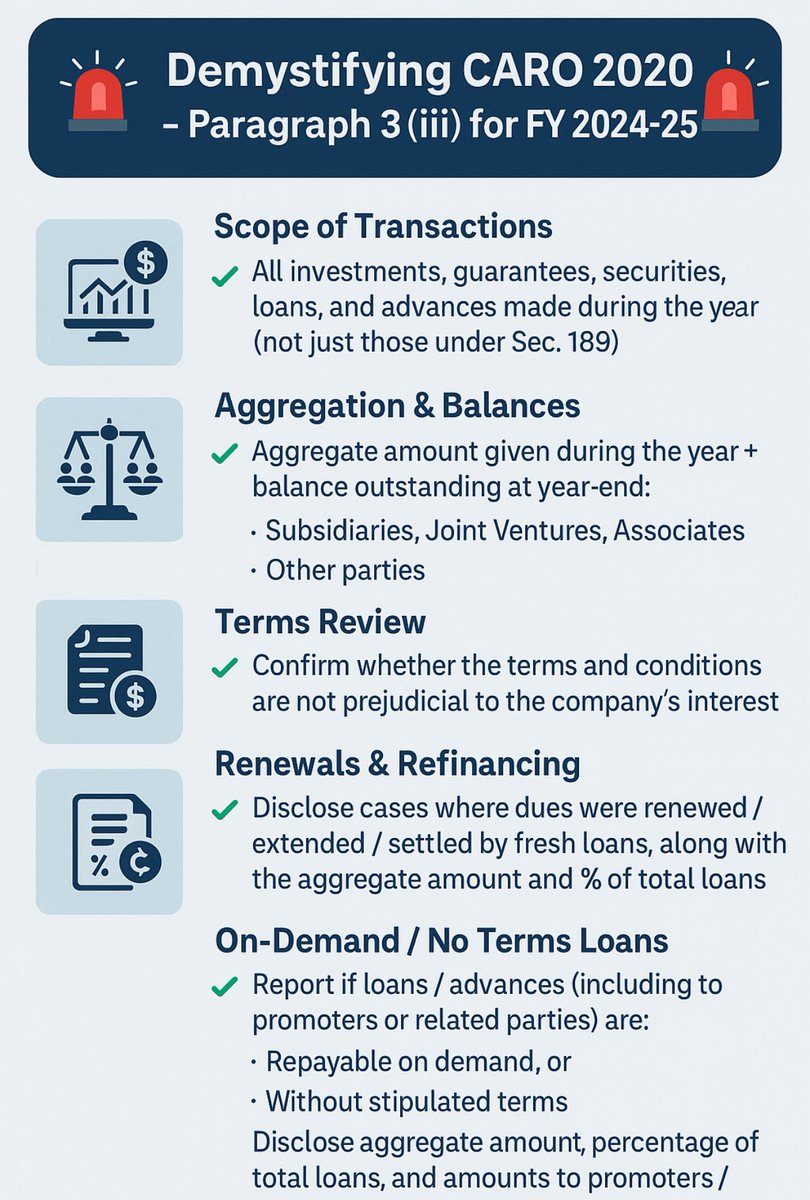

🔎 CARO 2020 Para 3(iii) for FY 24-25: Auditors must report on 👉 ✅ All loans, guarantees, investments, advances ✅ Aggregates & balances (subs vs others) ✅ Terms not prejudicial ✅ Renewals/refinancing % ✅ On-demand/related party loans #CARO2020 #Audit

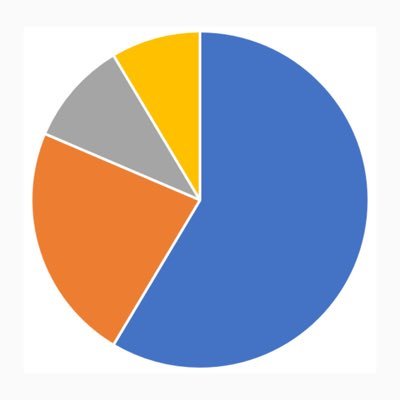

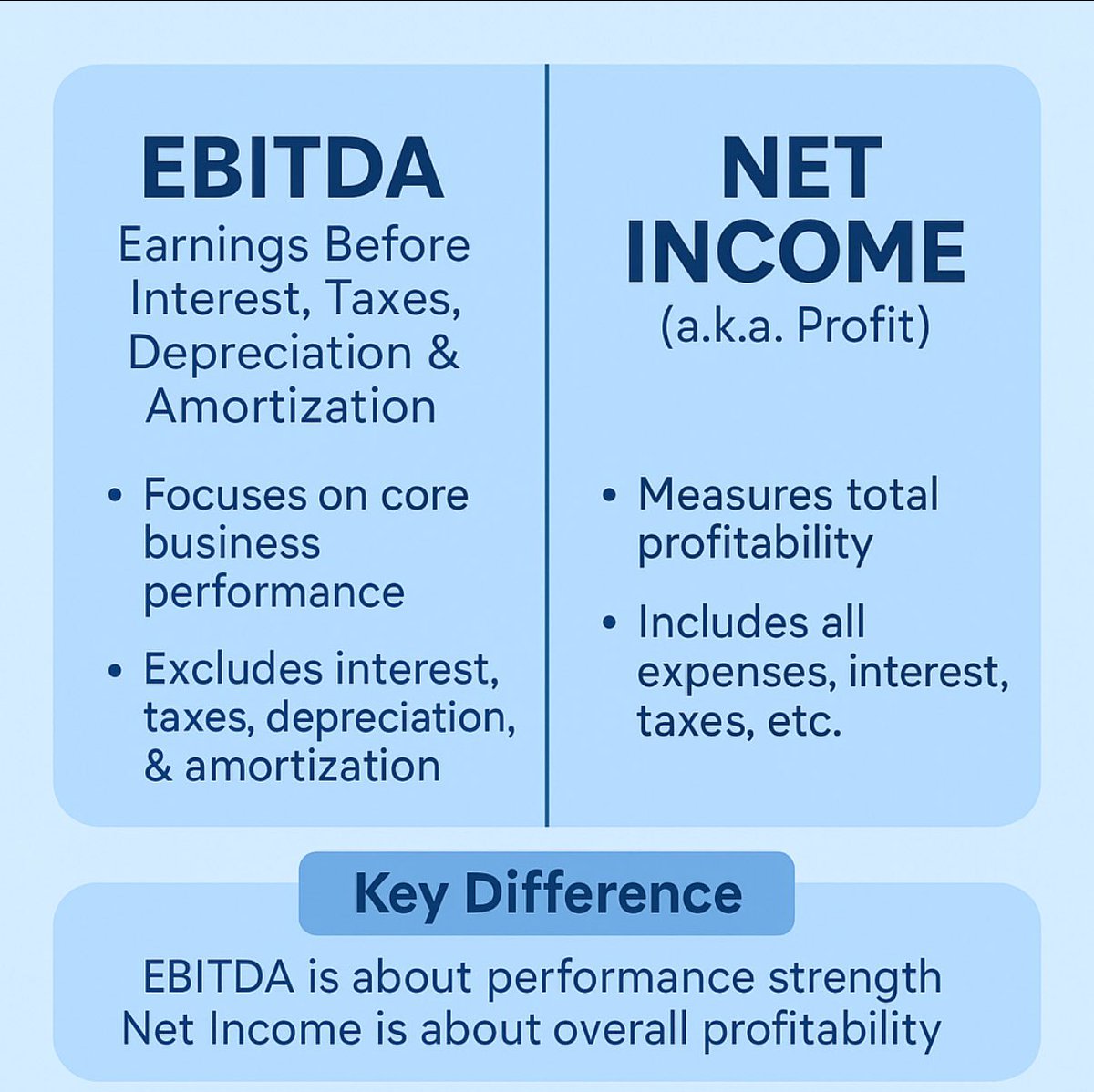

📊 EBITDA vs Net Income EBITDA = Core operating performance 💪 Net Income = Final profit after all costs, taxes & interest 💰 👉 EBITDA shows strength of operations 👉 Net Income shows overall profitability #FinanceSimplified #EBITDA #NetIncome

🚀 Reliance will file your ITR for just ₹24 (vs ₹2,000+ by CAs). But it’s not about saving money — it’s about data. 🛜 Jio playbook in finance → expect loans, insurance & investments soon. 👉 Would you trust Reliance with your financial data? #Reliance #FinTech #ITR

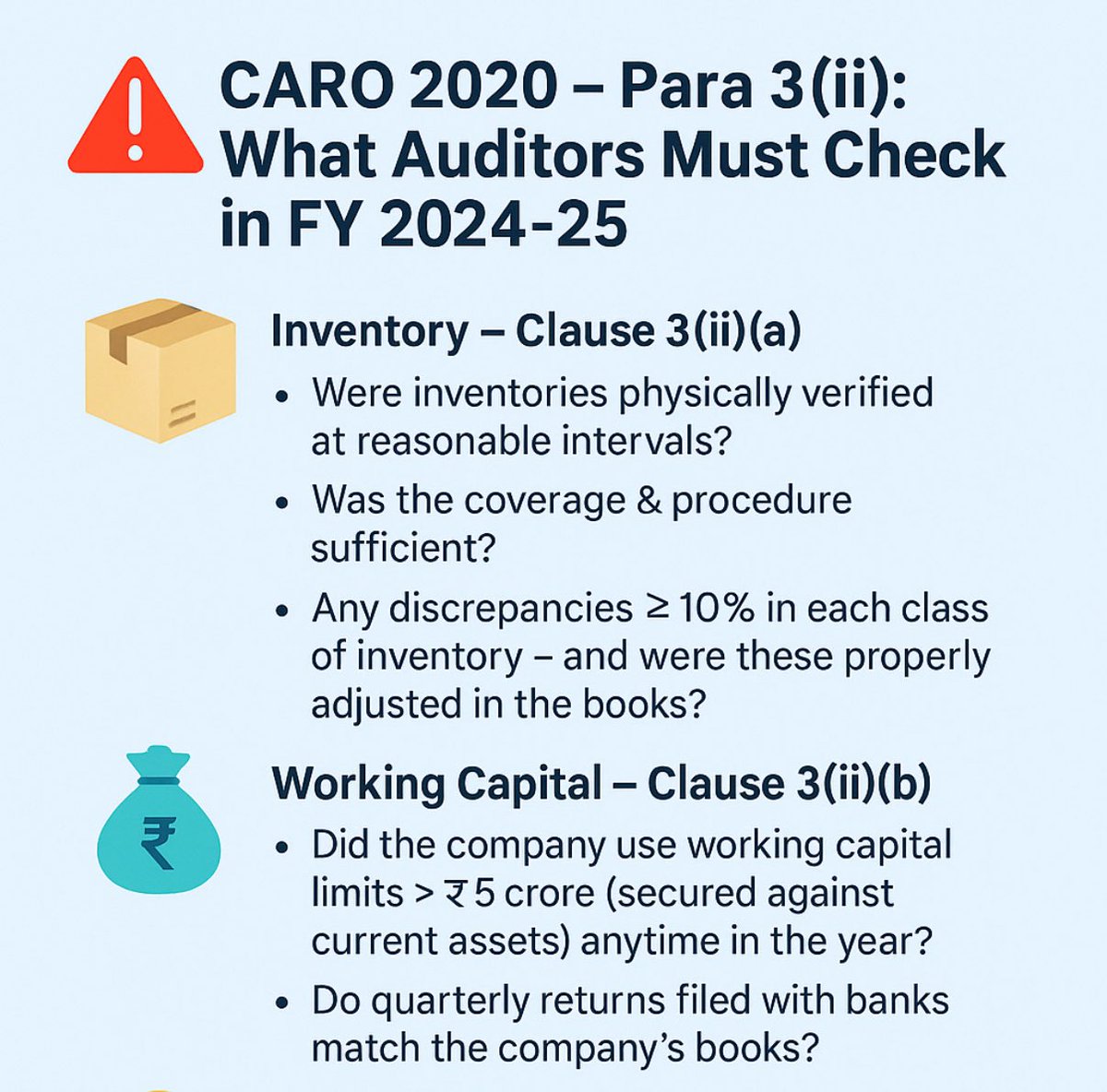

🔍 CARO 2020 – Para 3(ii) | FY 2024-25 ✅ Inventory – Physical verification, adequate coverage, discrepancies ≥10% adjusted. ✅ Working Capital – Limits > ₹5 Cr (secured by current assets), quarterly returns vs books. #Audit #CARO2020 #Finance #CorporateGovernance

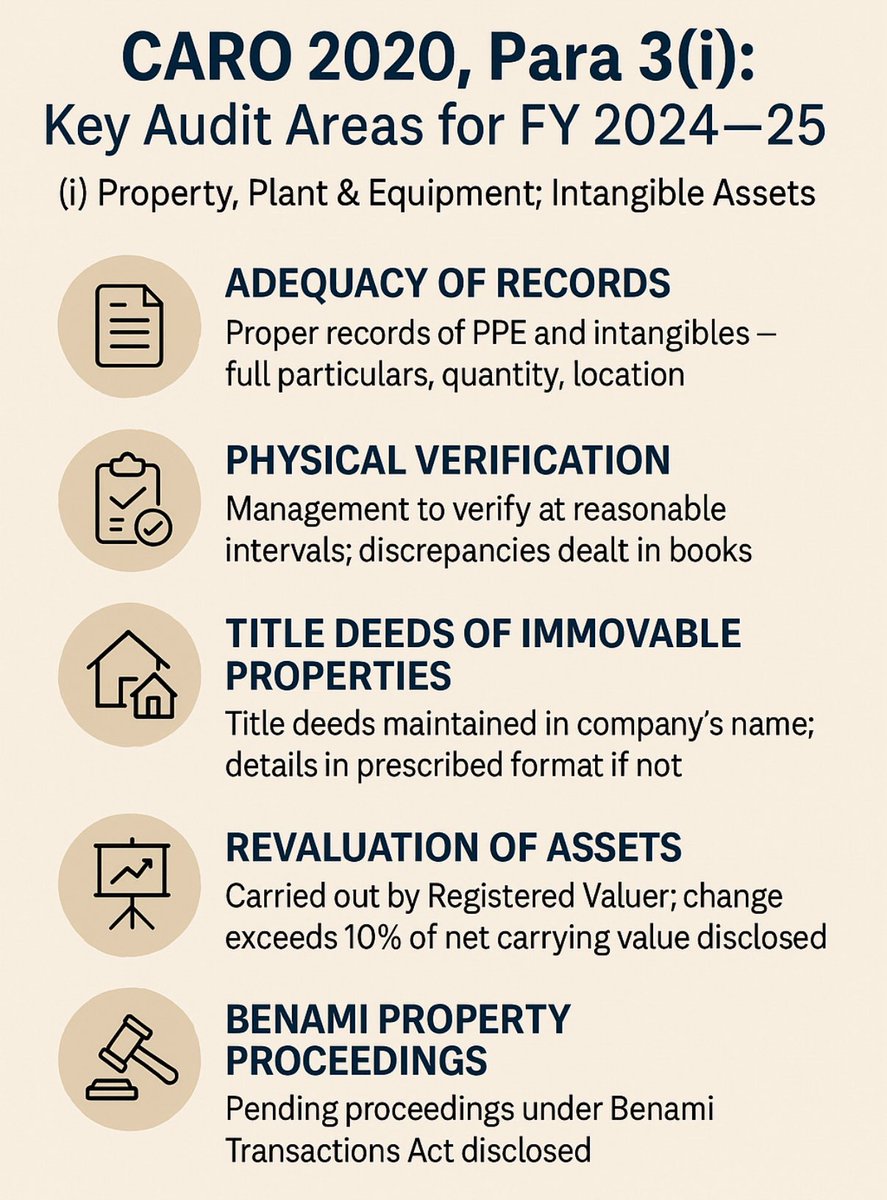

🔍 Under CARO 2020, Para 3(i), auditors must focus on: 1️⃣ Proper PPE & intangible records 2️⃣ Physical verification 3️⃣ Title deeds in co.’s name 4️⃣ Revaluation by Reg. Valuer (>10%) 5️⃣ Benami property disclosures #Audit #CARO2020 #Governance #FY2025

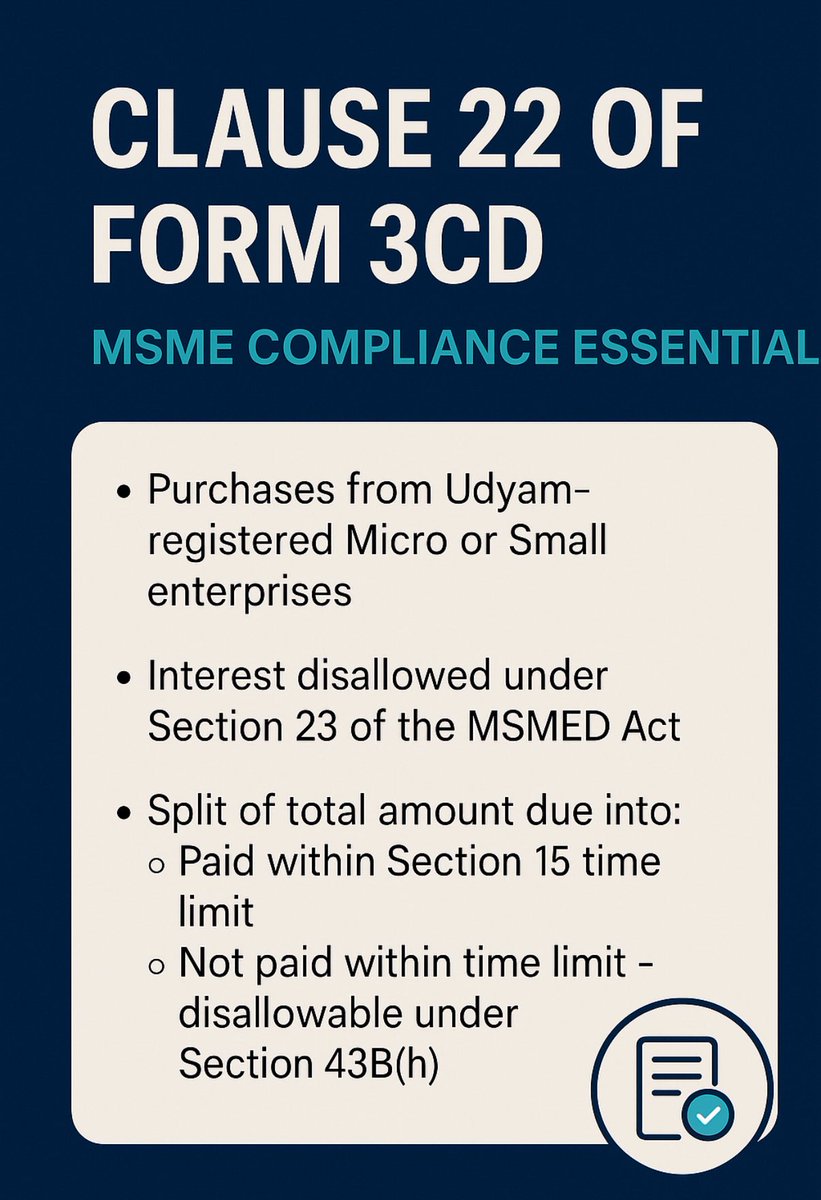

Clause 22 of Form 3CD (AY 2025-26) is a game-changer 🚨 Auditors must disclose for Udyam-registered Micro/Small suppliers: 1️⃣ Interest u/s 23 MSMED (never deductible) 2️⃣ Total dues 3️⃣ Split → Paid in time ✅ / Not paid ❌ (disallowed u/s 43B(h)) #TaxAudit #Clause22 #MSME

🚨 Goodbye AY, Hello Tax Year! India rewrites its tax law after 64 yrs. Income-tax Act, 2025 (effective 1 Apr 2026): ✔️ 819→536 sections ✔️ One Tax Year (Apr–Mar) ✔️ Refunds for belated returns ✔️ AMT scrapped for LLPs ✔️ Digital-first, transparent #TaxReforms #IncomeTax

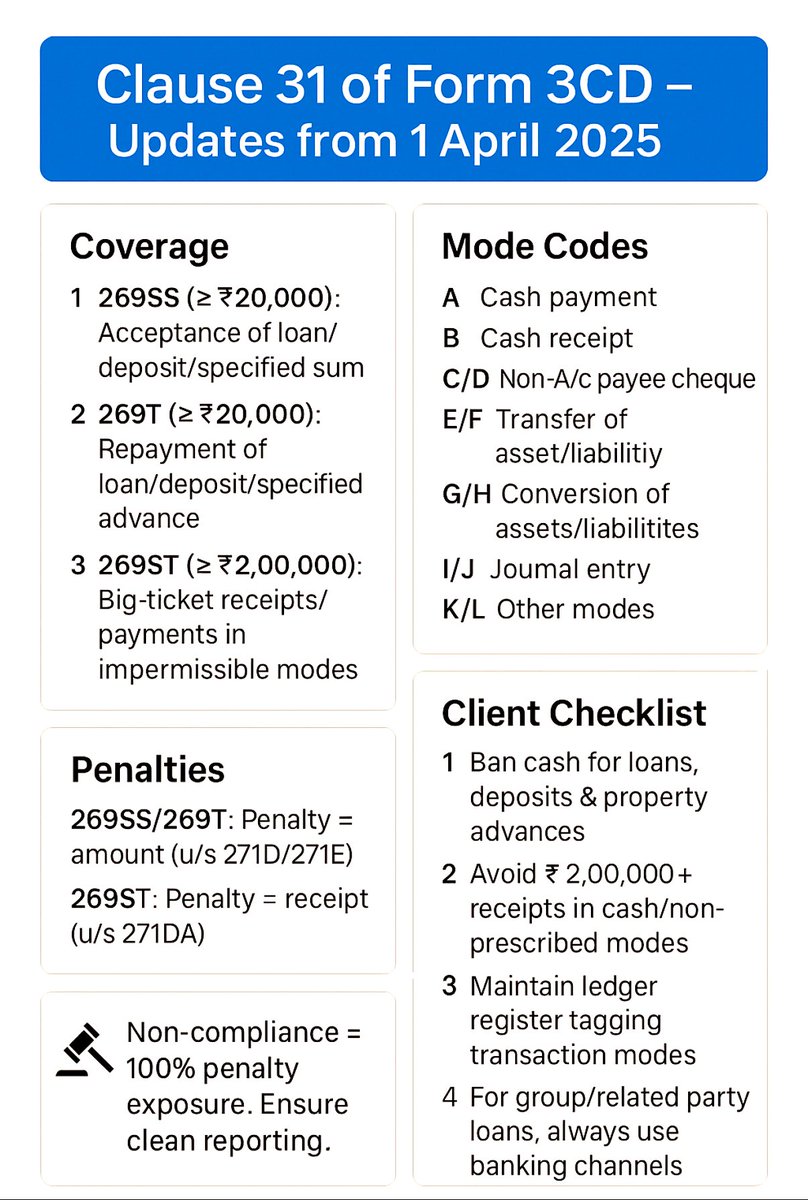

Clause 31 of Form 3CD gets tougher from AY 2025-26 🚨 🔹 Mode Codes (A–L) mandatory for loans, deposits & repayments 🔹 269SS/269T: ≥ ₹20k | 269ST: ≥ ₹2L 🔹 100% penalty risk for violations Stay compliant. Stay safe. #TaxAudit #Clause31 #Form3CD #IncomeTax

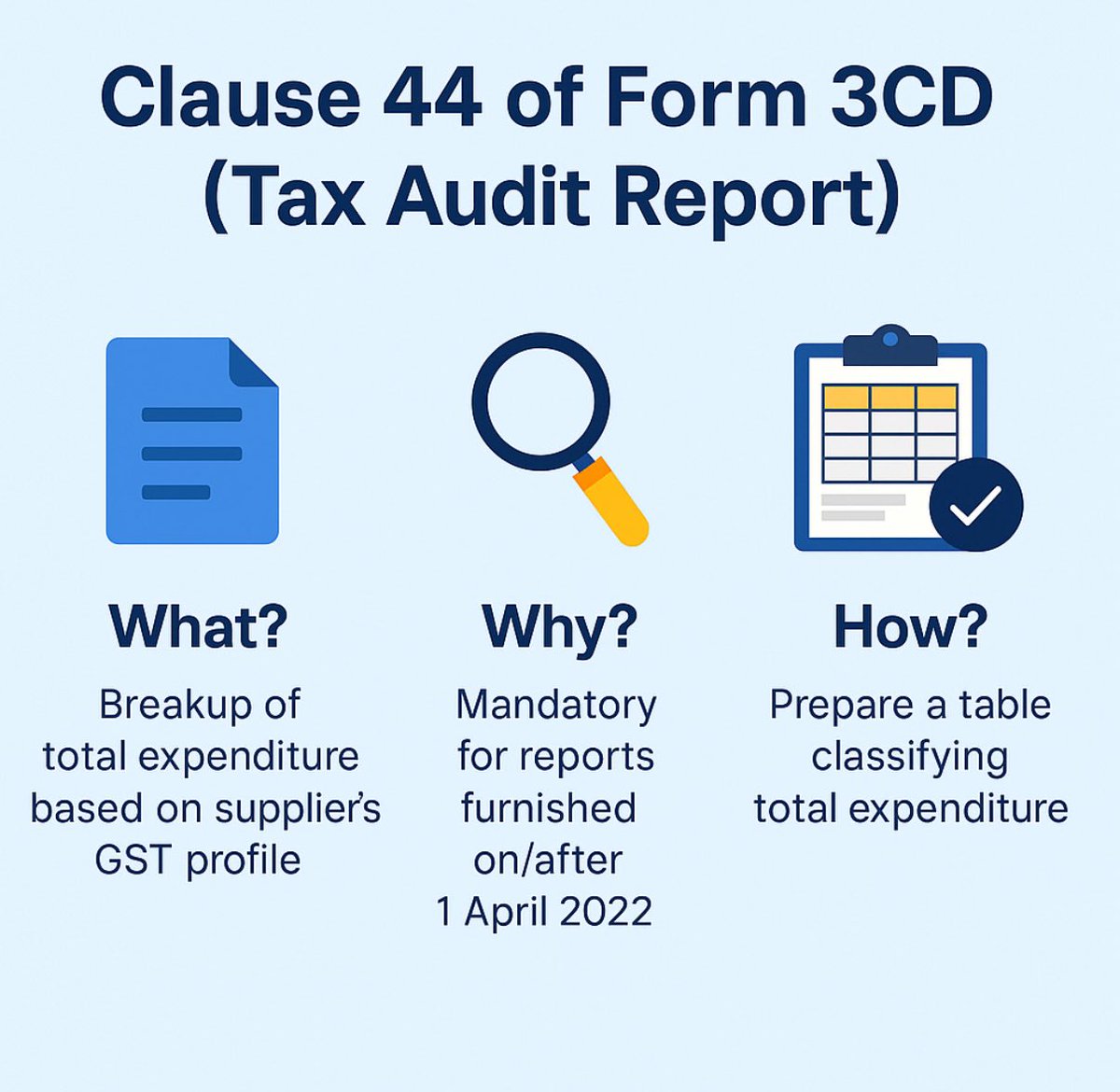

Clause 44 of Form 3CD 🔎 Tax audit reports (from AY 22-23) must disclose total expenditure split by supplier type: ✔️ GST Registered–Exempt/Nil, Composition, Other ✔️ Unregistered ❌ Exclude salaries, securities, money items A must-watch for #CAs& #CFOs! #TaxAudit #Form3CD #GST

🇮🇳 Biggest GST shake-up since 2017! PM Modi calls it a “Double Diwali Gift”: ➡️ 2 main slabs: 5%(essentials) & 18%(standard) ➡️ New~40% slab for sin/luxury goods (tobacco, SUVs) ➡️ 12% & 28% slabs to be phased out Simpler GST. Cheaper essentials. Costlier luxuries. #GST #India

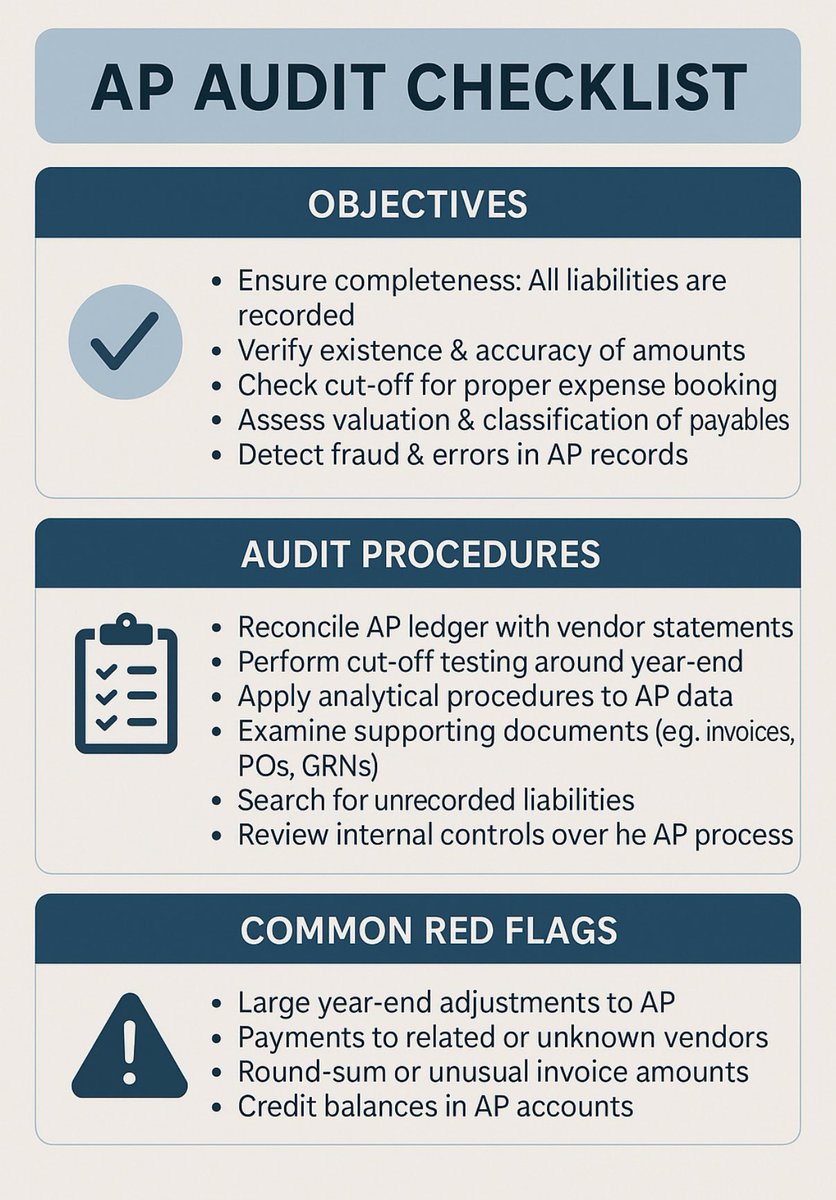

🔎 Auditing Accounts Payable is more than checking invoices—it’s about completeness, accuracy & fraud prevention. ✅ Key checks: •Vendor reconciliations •Cut-off testing •3-way matching (PO–GRN–Invoice) •Search for unrecorded liabilities #Auditing #AccountsPayable

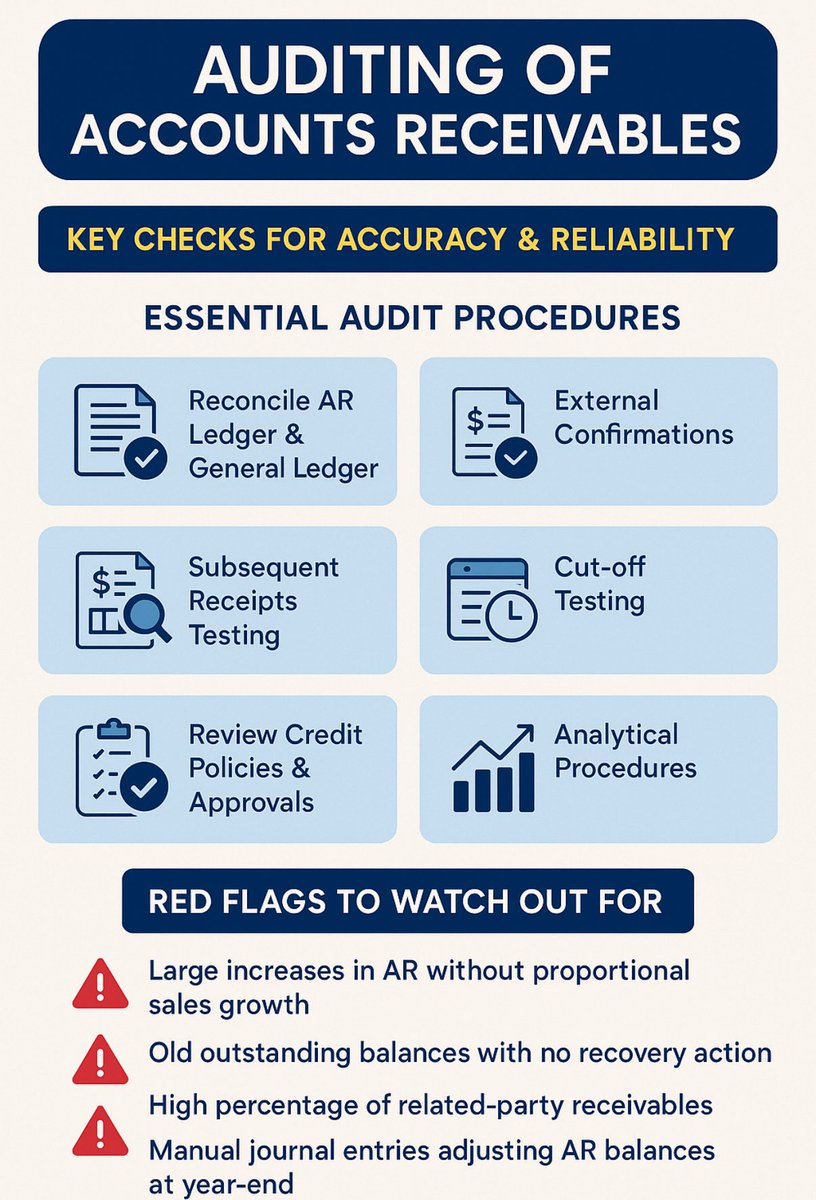

🔍 Auditing Accounts Receivables – A 360° Check ✅ Accuracy & collectability ✅ Income Tax: Bad debt write-offs, Sec 43B/145A checks ✅ Companies Act: Schedule III, ageing, RPT disclosures ✅ GST: 180-day ITC reversal, GSTR-1 vs 3B match #Audit #AccountsReceivable #CA

🚨 Transfer Pricing Audit FY 2024-25 (AY 2025-26) 🚨 📅 Due: 31 Oct 2025 ✅ Identify AEs & transactions ✅ Prepare TP documentation (Rule 10D) ✅ Benchmark transactions ✅ File Form 3CEB ⚠️ Penalty: ₹1L or 2% of transaction value for non-compliance #TransferPricing #TaxAudit

🧾 Tax Audit FY 24-25 | AY 25-26 📌 Who Needs It? •Business: Turnover>₹1 cr (₹10 cr if cash≤5%) •Profession: Receipts>₹50 lakh •Presumptive: Lower income than 44AD/44ADA/44AE & above exemption limit 📅 Due Dates •TAR: 30/09/25 •ITR: 31/10/25 #TaxAudit #CA

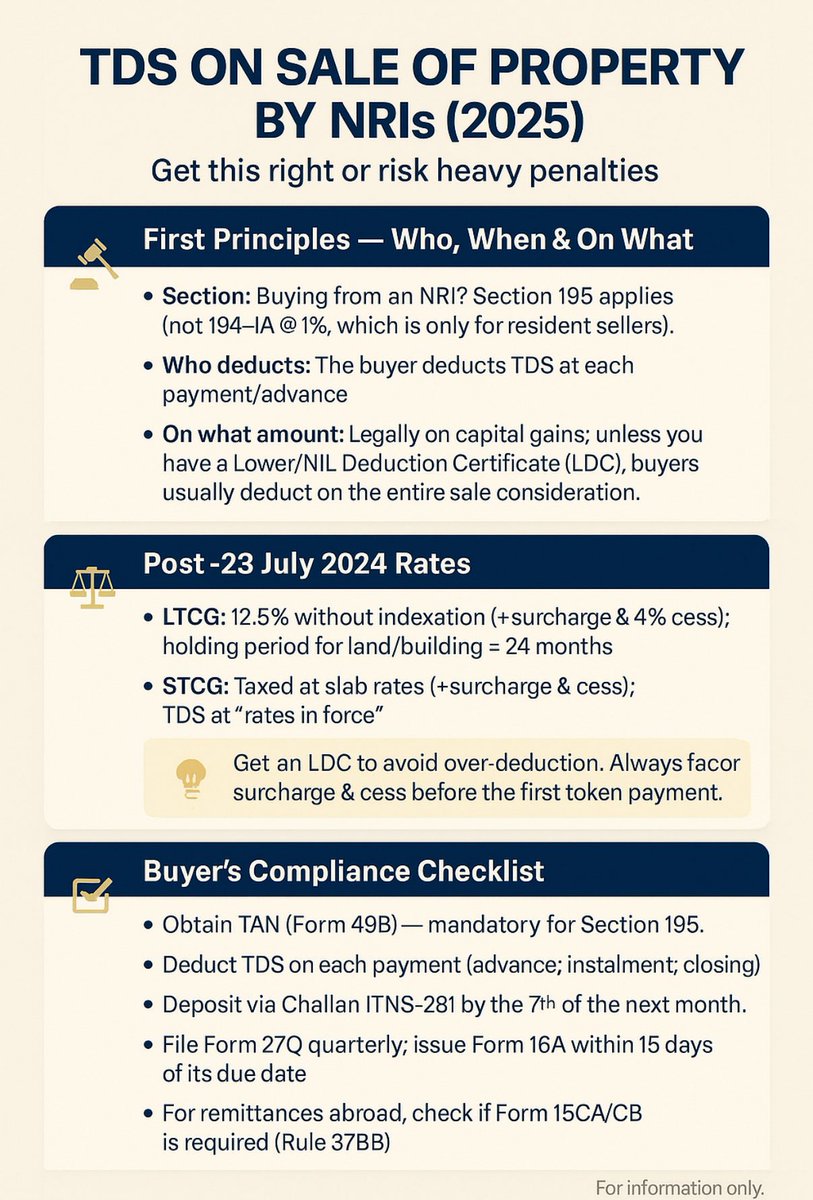

Buying from an NRI or selling as one in 2025? TDS rules changed after 23-07-2024: •Sec 195 applies (not 194-IA) •LTCG = 12.5% w/o indexation (+cess/surcharge) •Get LDC to avoid TDS on full price Miss one step & lose lakhs! #NRI #TDS

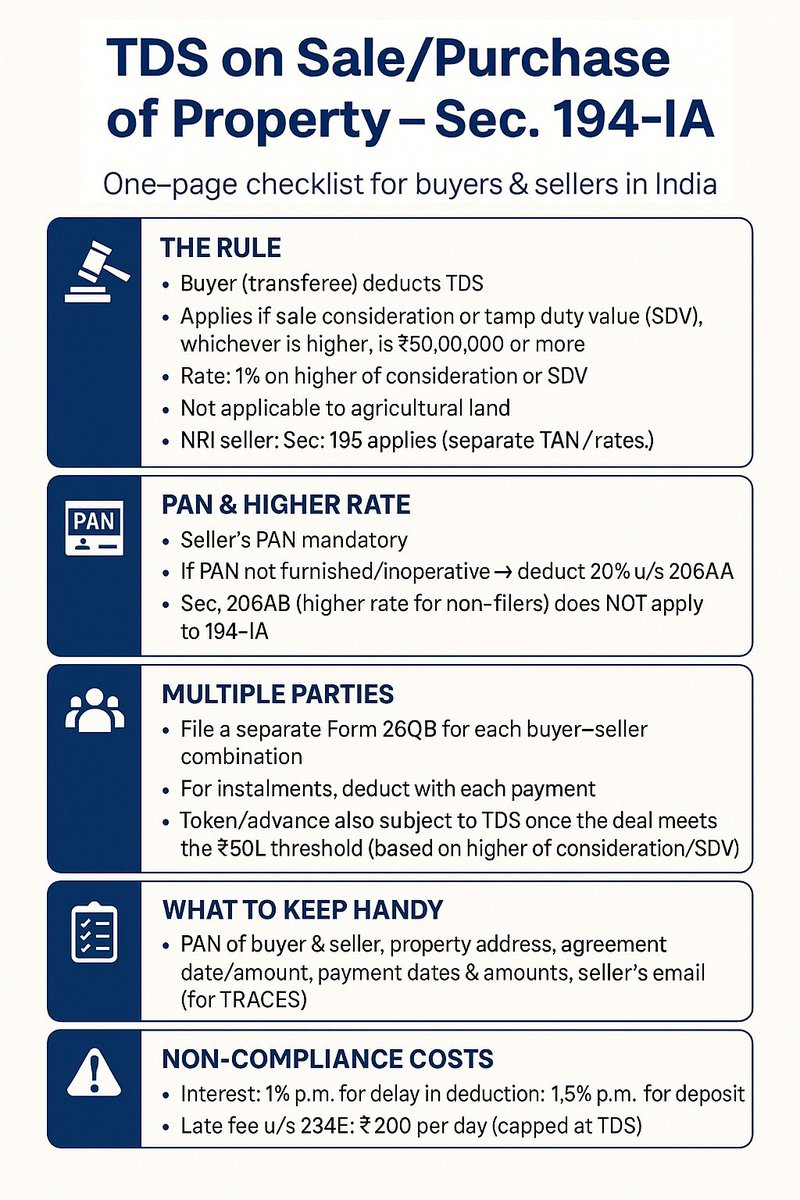

🏠💰 Selling/Buying property in India? TDS u/s 194-IA applies if sale consideration or SDV ≥ ₹50L. ✅ Buyer deducts 1% (higher of sale price/SDV) ✅ Pay via Form 26QB in 30 days ✅ Issue Form 16B in 15 days ⚠️ 20% if seller’s PAN invalid #TDS #IncomeTax #RealEstate #194IA

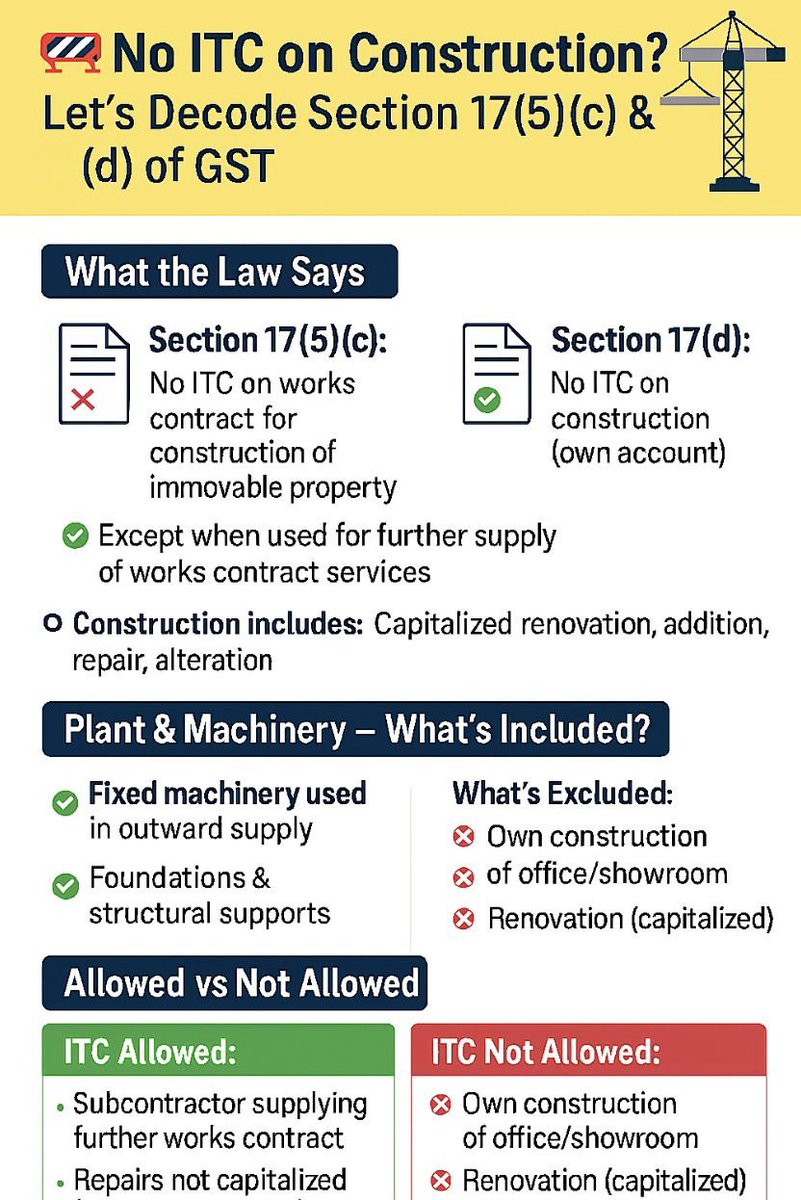

🚫 No ITC on Construction under GST? 🧱 Sec 17(5)(c)&(d) blocks ITC on: 🔸 Works contract for own construction 🔸 Goods/services used to build immovable property (unless for resale) Capitalised repairs = construction Plant & machinery = 🚫 buildings, towers, pipelines #GST

United States الاتجاهات

- 1. #twitchrecap 11.1K posts

- 2. Romero 17K posts

- 3. Penn State 17K posts

- 4. Slay 18.9K posts

- 5. Fulham 40.6K posts

- 6. #TADCFriend 1,073 posts

- 7. #GivingTuesday 30.2K posts

- 8. Lewandowski 24.3K posts

- 9. Larry 57.5K posts

- 10. Pat Kraft 1,726 posts

- 11. Zion 8,716 posts

- 12. Bentancur 2,264 posts

- 13. Olmo 18.2K posts

- 14. Adam Thielen 3,005 posts

- 15. Pedri 40.1K posts

- 16. Trump Accounts 25.2K posts

- 17. #FULMCI 5,212 posts

- 18. Newcastle 28.9K posts

- 19. Paul Dano N/A

- 20. Sleepy Don 4,572 posts

Something went wrong.

Something went wrong.