Canton Network Community Support ✪

@CantonNet_SP

The only public blockchain with privacy that works, powering Wall Street and trillions on-chain.

Canton was designed for real-world markets. Privacy by design, need-to-know data sharing, and atomic settlement across cantons, without bridges. @YuvalRooz on @Bankless breaks down why this architecture matters for regulated finance.

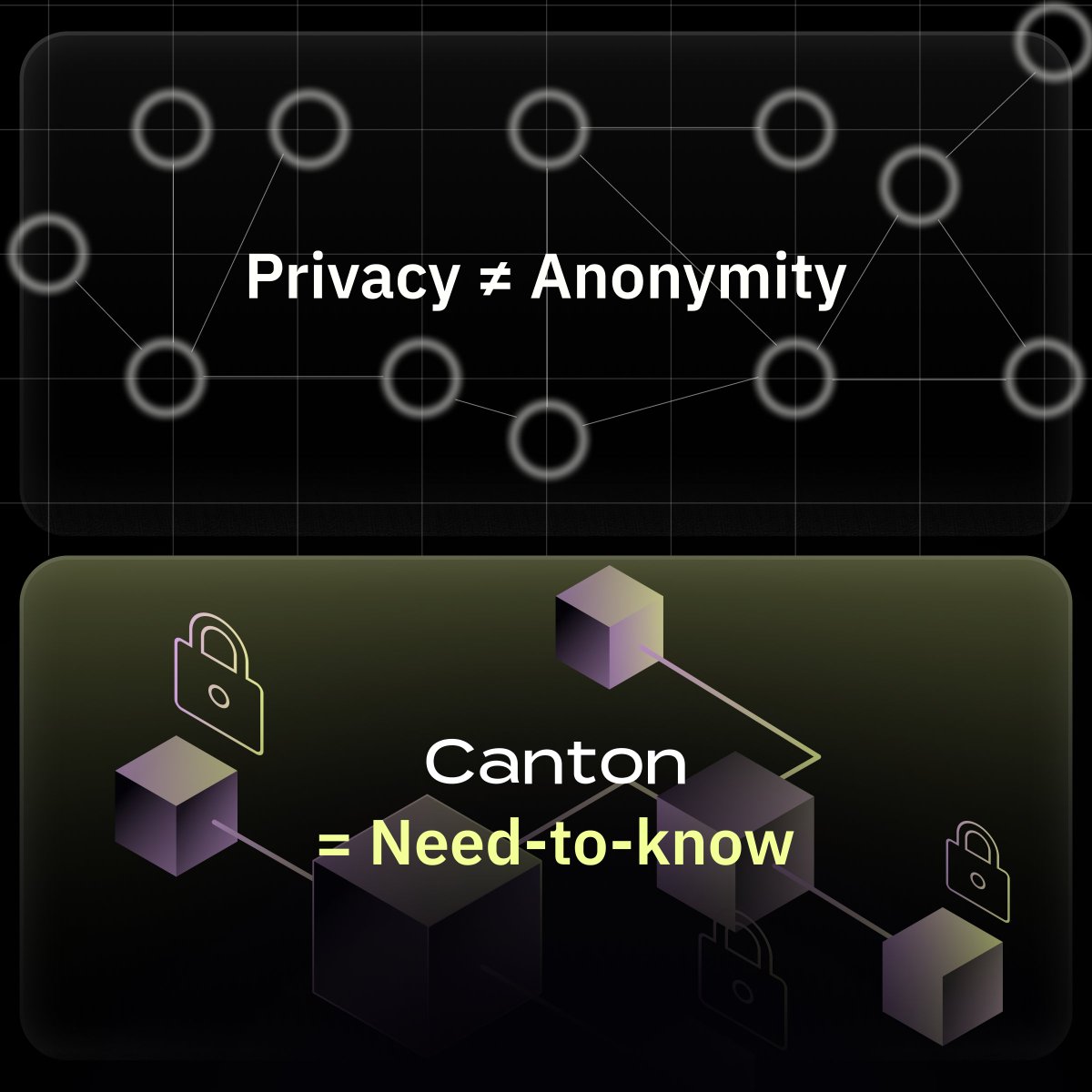

Privacy on Canton is need-to-know by design. Selective disclosure that preserves integrity, supports compliance, and earns trust.

Privacy is the key to unlock institutional capital, at scale. → Without it, blockchains are suitable for experiments, not trillions. → With it, institutions get control over who sees what, regulators get the visibility they need, and capital can finally flow 24/7. That’s how…

24/7 markets need 24/7 money. Stablecoins only scale when minting + redemption can happen in real time, and fiat can move 24/7 in every locality. The scalable on/off ramp is tokenized bonds powering continuous issuance and redemption. 👇

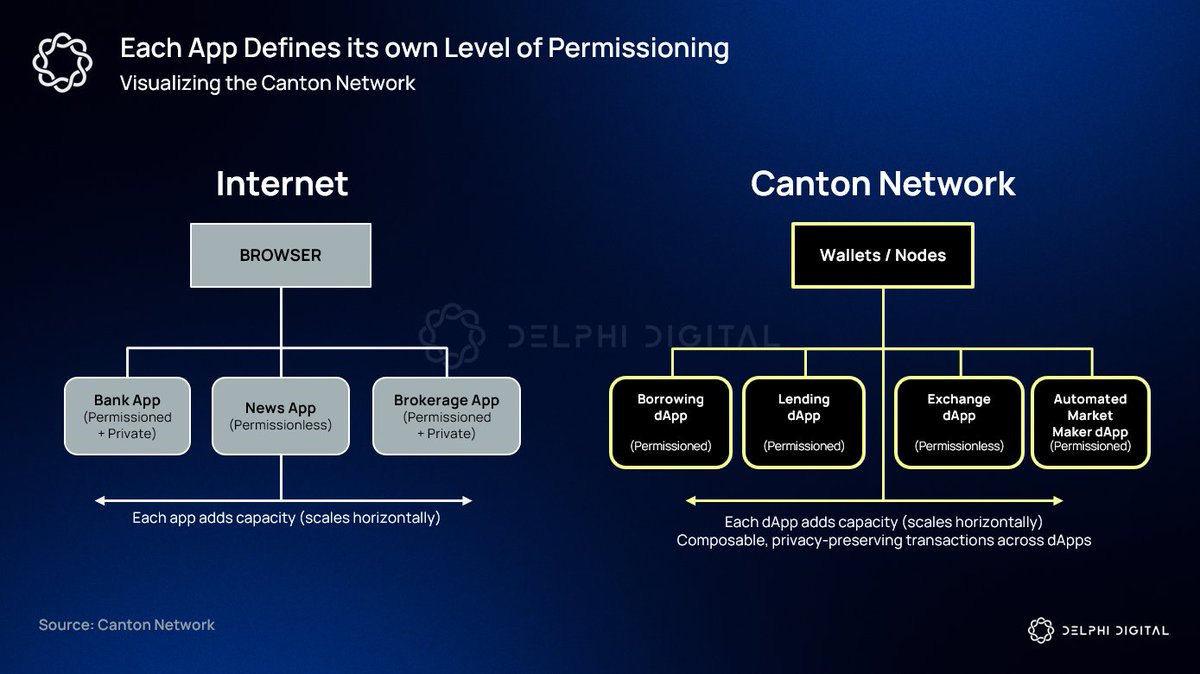

Privacy ≠ Anonymity. ❌ Too transparent for proprietary flow. ❌ Private Chains: Too siloed for liquidity. ✅ Canton: The 'Internet Architecture' for finance. Data is routed, not broadcast. Auditability for regulators, need-to-know visibility for the desk.

Canton is the blockchain designed for institutions. @CantonNetwork is a public blockchain built for regulated entities, with programmable privacy at the smart contract level through Daml. Each application provider can define their own privacy, permissions, and governance rules.…

Super Validators on Canton are chosen for the value they bring to the network, not how much capital they lock up. Governance rewards contribution, not capital hoarding. Listen to @YuvalRooz explain 👇

Watch the full @Bankless podcast episode here: x.com/Bankless/statu…

LIVE NOW - Is Canton a Real Blockchain? | Canton Founder Yuval Rooz Is @CantonNetwork a real blockchain or a new kind of capital-markets operating system? @digitalasset co-founder @YuvalRooz explains why Canton prioritizes privacy as “need-to-know” information sharing and a…

Crypto isn’t purely peer-to-peer anymore. It’s B2B2C. Wallets, exchanges, and fintechs are the interface. Capital markets are the engine. @Wesarn_real on Quadrillions explains why upgrading capital markets rails unlocks better products for everyone.

TradFi rails shut down on Friday. The Canton Network stays open. The latest report by @VXInsights in partnership with @DigitalAsset, confirms tokenized collateral unlocks 120 extra hours of liquidity per week. Stop building 24/7 trading apps on 9-to-5 settlement rails.

One of Canton’s defining design choices is sovereignty.

Onchain finance in 2026 will be shaped by architecture, not narratives. Programmable privacy, real-world settlement at scale, and institutional-grade controls are the unlock. Canton is built for it.

Privacy isn’t optional for real finance. Canton is designed so only the right parties see the right data, without sacrificing composability or compliance. That’s what makes institutions comfortable moving core workflows onchain.

Catch Canton at @Consensus_HK for the Privacy & Trust Deep Dive. We’ll dig into what it takes to bring privacy, compliance, and real-world markets onchain, without compromising institutional controls. Use code Canton20 for 20% off passes.

It's clear: tokenization can’t mean walled gardens. Interoperability, security, and risk standards come first and @The_DTCC plans to issue its first tokenized securities on Canton. The path forward is choice, connectivity, and institution-grade rails. decrypt.co/354791/dtcc-wa…

decrypt.co

DTCC 'Not Building Walled Gardens' for Tokenization, Says Digital Assets Head - Decrypt

DTCC’s vision for tokenized securities isn’t tethered to any single network, even if it’s admittedly rooted in the past.

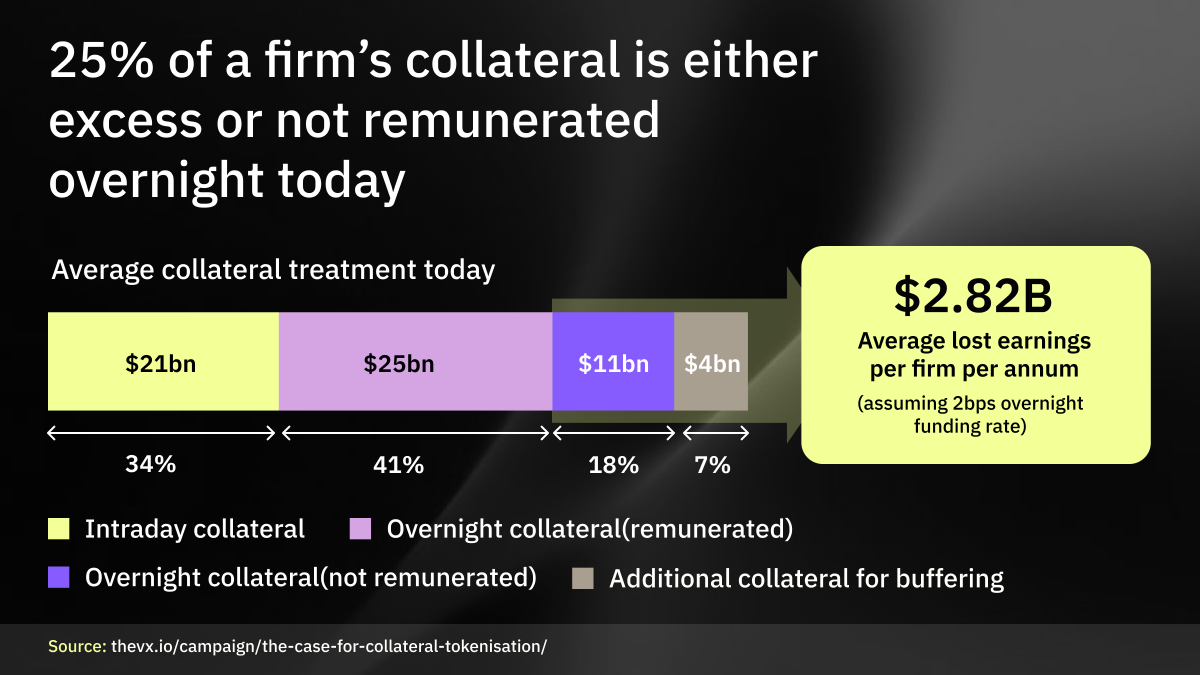

Today, trillions in collateral sit idle, over-posted, or trapped overnight, when it could be working intraday. The unlock is real-time collateral mobility onchain. Let’s dive in👇

The highest-impact use cases are already clear: ✅ Repo ✅ High-quality liquid assets ✅ Tokenized funds ✅ Digital money for settlement Together, they form the foundation of always-on markets.

This isn’t theoretical. Market participants have already completed live, fully onchain collateral financing on Canton, with real assets settling after hours and collateral reused across counterparties. Read more: canton.network/blog/why-does-…

canton.network

Why does real-time collateral matter?

Collateral can’t be utilized or mobilized efficiently because 70% of firms struggle with delivery. And even as earnings potential is lost, high operating costs - up to 57% of the cost of a trade -...

Privacy doesn’t mean anonymity. Canton shares information on a need-to-know basis.

When Canton is discussed across finance and crypto, a consistent theme emerges: Scale. Trust. Real-world utility. Here’s what’s being said 👇 @HSBC @Chainlink

Raise a hand if you're a building on Canton🙋

United States Trends

- 1. #AEWDynamite N/A

- 2. Andrade N/A

- 3. Ciampa N/A

- 4. #TheMaskedSinger N/A

- 5. Cavs N/A

- 6. Jaylon Tyson N/A

- 7. #SistasOnBET N/A

- 8. #ChicagoFire N/A

- 9. Allie N/A

- 10. Thekla N/A

- 11. #ChicagoPD N/A

- 12. Doyle N/A

- 13. Nicki N/A

- 14. Cleveland N/A

- 15. Bronny N/A

- 16. Optimus N/A

- 17. Fulton County N/A

- 18. Swerve N/A

- 19. Mikey N/A

- 20. Rand Paul N/A

Something went wrong.

Something went wrong.