FCF or Bust

@CapStructKing

Style Agnostic | Capital Structure Agnostic | Never Long Frauds | 90% Indexed with 10% Fun Money | Mostly retweets, not investment advice

You might like

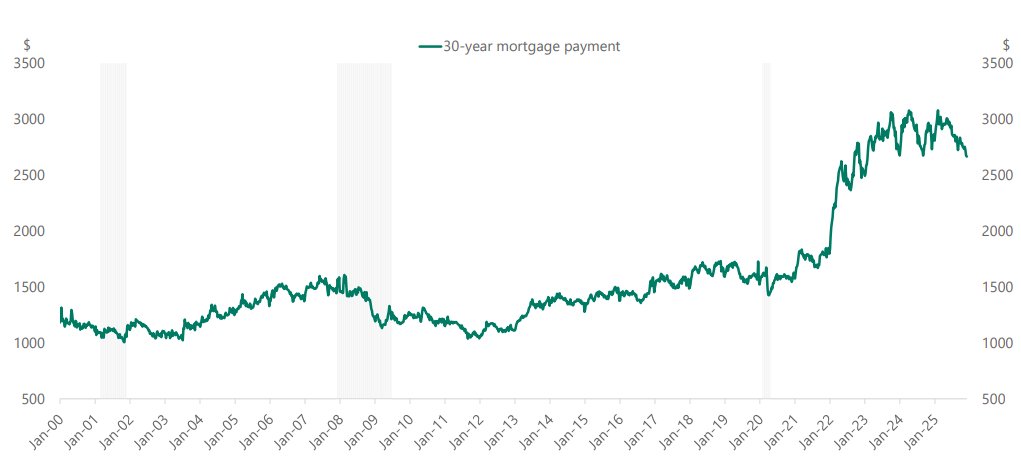

Apollo just released a 126 page report on the state of the housing and real estate market Some charts that caught my eye 🧵 1/ Average monthly mortgage payment on a new 30 year mortgage now sits at $2665

Random stuff I’m noodling: $MSFT Azure reaccel next year $ASML 🎶 memoriessssss 🎶 $BSX Watchman catalyst + consensus est revision @ too low a mult to the rest of medtech $ENR.DE sandbagging everything + power trade keeps running $SNPS EDA strong year on R&D strength in…

This article covers Ashtead Technologies $AT.L. A subsea equipment rental company with an unmatched offering down over 60% from 2024 highs. open.substack.com/pub/deepvaluec…

Wrote up $IGIC for 2024 (+92% vs +27% $KIE), and $CBL for 2025 (+39% YTD vs +2% $XLRE). I think it's worth giving rate sensitive regional banks and $OPY a closer look for 2026. Thanks for the feature @Citrini7 !

It’s the end of the year, another absolutely crazy year for that matter. That means we get to prepare to do it all again…just differently. 𝗖𝗶𝘁𝗿𝗶𝗻𝗶𝗥𝗲𝘀𝗲𝗮𝗿𝗰𝗵’𝘀 𝟮𝟲 𝗧𝗿𝗮𝗱𝗲𝘀 𝗳𝗼𝗿 𝟮𝟬𝟮𝟲 𝗶𝘀 𝗹𝗶𝘃𝗲. citriniresearch.com/p/26-trades-fo…

We're short $NUTX again Retail investors have sent shares rallying, but they misunderstand the company, its financials, and the coming revenue cliff. #KnowWhatYouOwn capybararesearch.com/reports/nutex-…

Idea thread time! What's your best idea heading into 2026? (Any style, any market cap, any geography). Be sure to add why you like it + valuation. I will compile the responses and share. Appreciate a RT for visibility! 🙏

The journey ends. It started with Covid and it’s all befitting that it ends with the AI madness. I am terminating this account on the 20/12. Everything has been said and done. Those who want to stay in touch: [email protected] @MiamKitty lives on! Lez fucking gooooo

$ENRG.L stands out early to me. The whole UK renewables space is trading at a huge discount for justified reasons. However, their portfolio is very internationally diversified (only 12% UK). They are now winding up and trading at .62x book value. Unlike UK solar and wind assets

Currently doing work on all of the beaten down UK infrastructure and energy project SPV companies like $GCP.L, $UKW.L, $FGEN.L, $HICL.L. All of them are trading at big discounts to book, with complex models and very opaque accounts hidden behind special purpose vehicles. I think

Our 30 page update on $TOI is live. We discuss the recent events in the oncology space, including how its different from $EVH and why the big three drug distributors $MCK $COR $CAH are racing to roll-up oncology assets at 18x EBITDA. open.substack.com/pub/lakecornel…

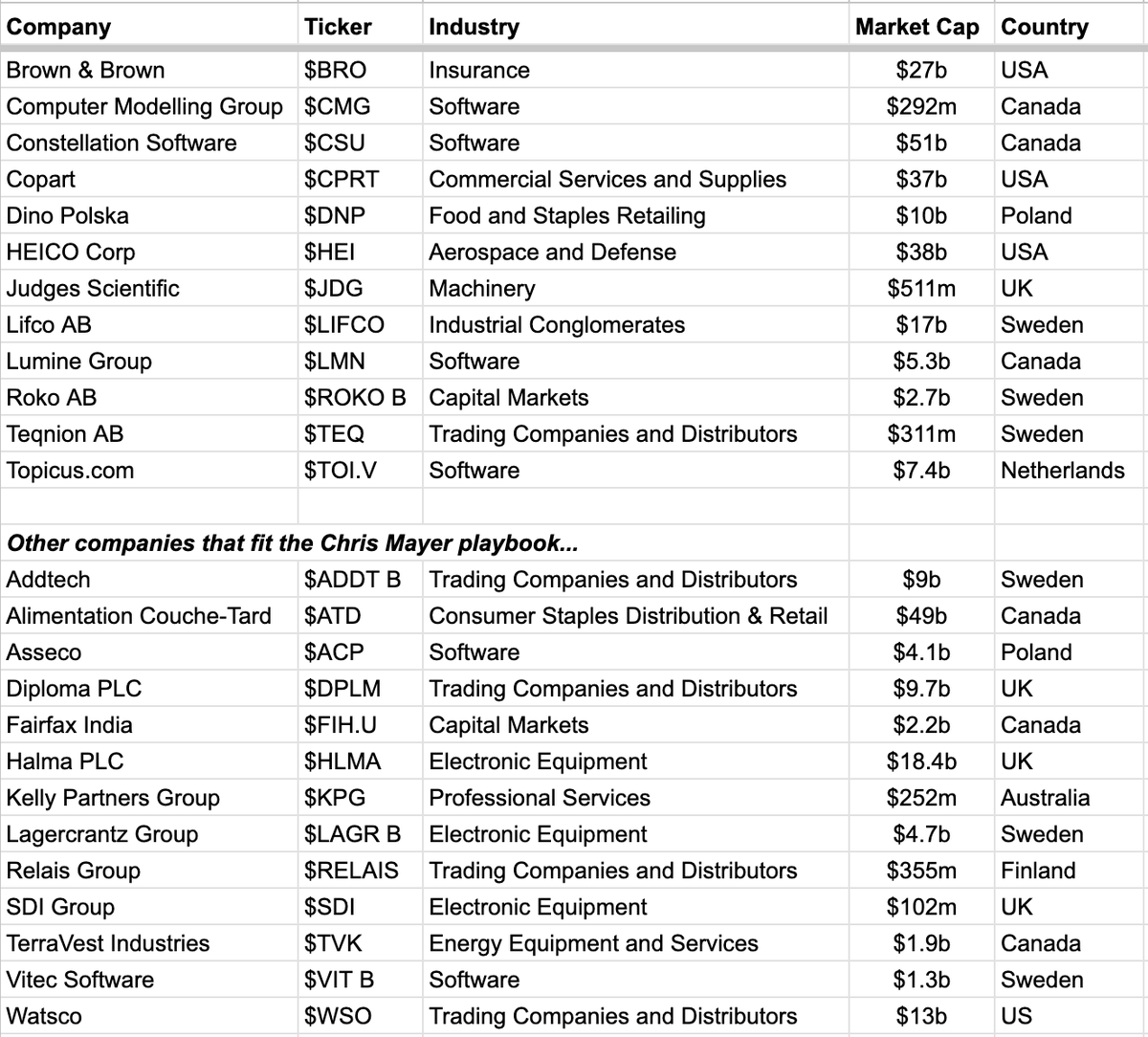

Here is my periodic update of what I believe Chris Mayer of Woodlock House Family Capital owns I've also included 13 additional companies that seem to match his investment framework

$RNAC nice candle

Stumbled across $INPP.L, UK infrastructure co that invests in Public Private Partnerships with the UK government. These investments are extraordinarily low risk and inflation linked. After a decade and a half of strong performance they've been smashed since 2022 with the combo

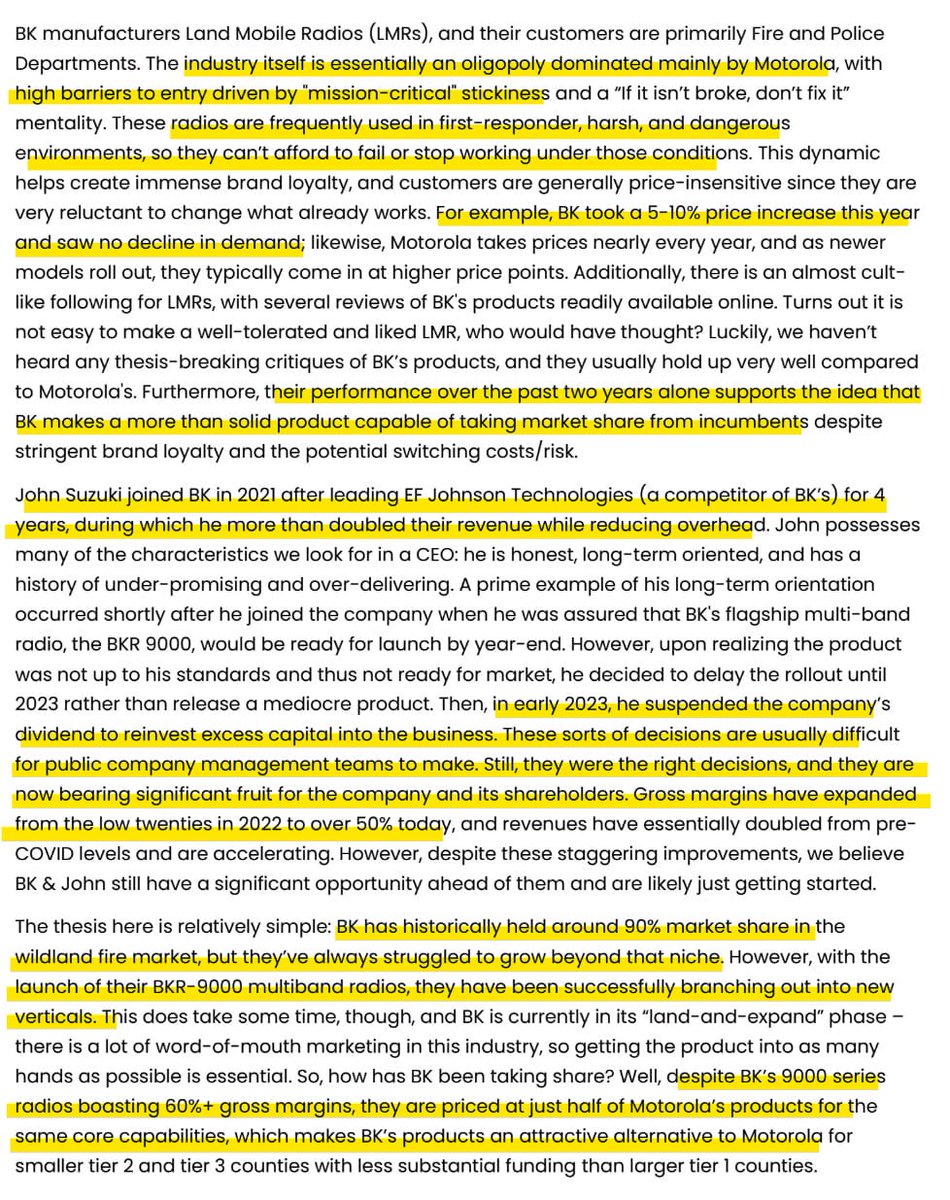

Potential multibagger pitch on $BKTI from @AtaiCapital - Mission-critical oligopoly with high switching costs - Exceptional operator driving a major turnaround - Realistic path to meaningful market share gains - Implied $190–$250 equity value vs ~$65 today

Currently doing work on all of the beaten down UK infrastructure and energy project SPV companies like $GCP.L, $UKW.L, $FGEN.L, $HICL.L. All of them are trading at big discounts to book, with complex models and very opaque accounts hidden behind special purpose vehicles. I think

Next newsletter going out tomorrow morning. Have a lot of names for this week.

$HIW $APLE looking pretty decent here...my REIT quant has been messaging me for months about how $APLE is a lowkey world cup play since they have hotels in every major world cup market, and also republican convention. no brainer long?

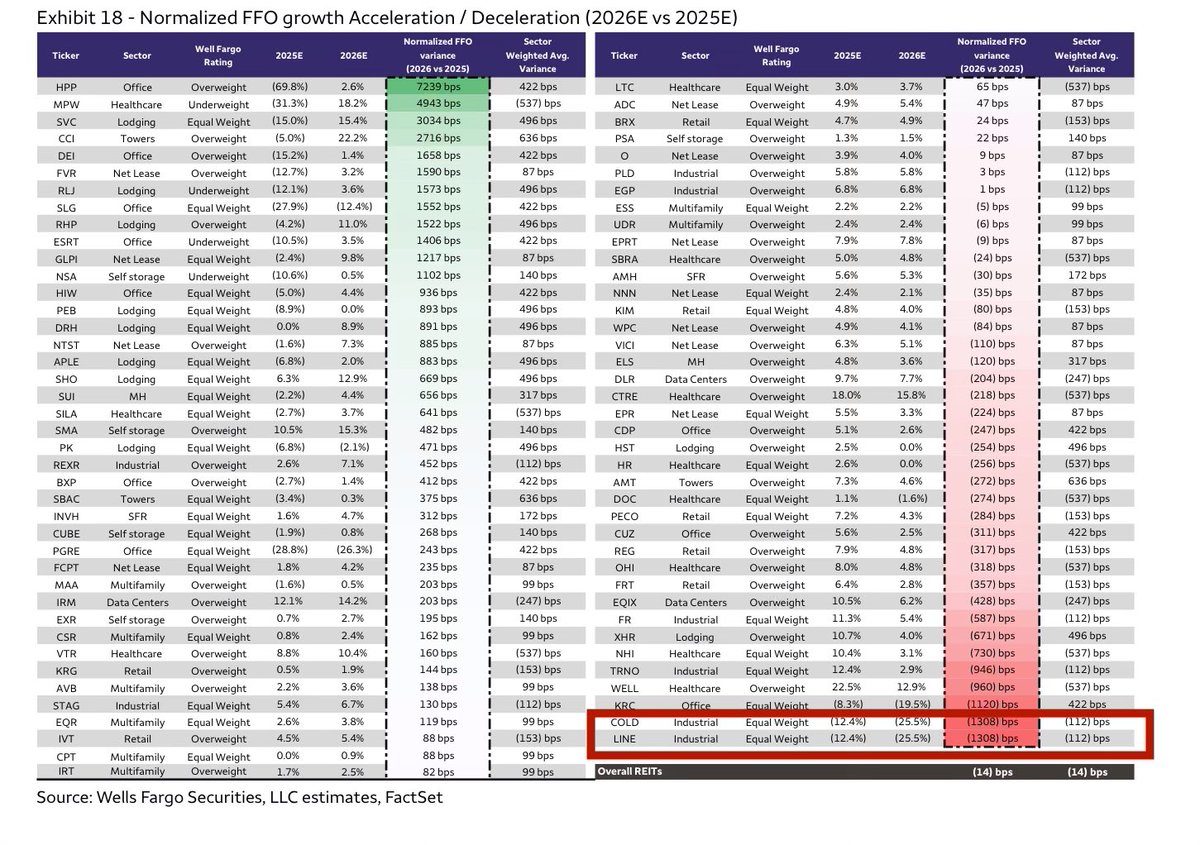

$COLD & $LINE at the bottom of Wells Fargo REITs normalized FFO deceleration into 2026. After what will likely have been really poor 2025. Even if one’s looking for bombed out REIT stocks, many other places to look?

HOW TO SPOT DECIET (Part I) My first HF job was with for a very convincing pathological liar. I’ve been conned more than I care to admit. A 🧵on 🚩’s to watch out for with investors - for LPs, employees, and other investors. Please add your stories! I think the lies people…

The Shortlist - 12/5/2025 Update

United States Trends

- 1. #SmackDown N/A

- 2. Duke N/A

- 3. Mensah N/A

- 4. Bichette N/A

- 5. Panarin N/A

- 6. #JustinStrong N/A

- 7. Andor N/A

- 8. Phillies N/A

- 9. Baty N/A

- 10. Roger Waters N/A

- 11. Kit Wilson N/A

- 12. Vincent Price N/A

- 13. Ryan Air N/A

- 14. Leon Slater N/A

- 15. Tony Blair N/A

- 16. OpenAI N/A

- 17. Drury N/A

- 18. Nobel N/A

- 19. Trick Williams N/A

- 20. Jeffers N/A

Something went wrong.

Something went wrong.