Cetera Investment Management

@ceteraIM

Cetera Investment Management LLC, owned by @CeteraFinancial, provides market perspectives, portfolio guidance & other investment advice to its affiliated firms.

You might like

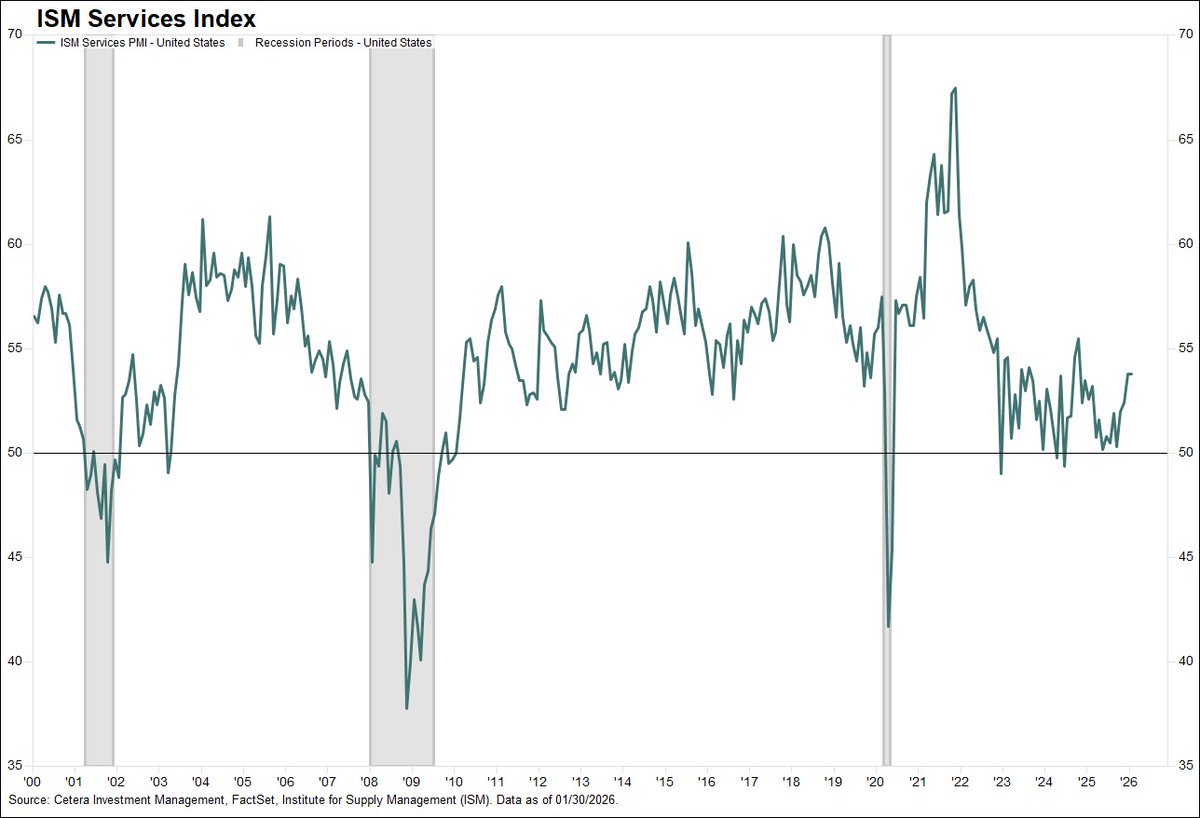

The ISM Services Index held steady at 53.8 in January, marking the 19th consecutive month of expansion in the service sector. While the new orders index eased and prices paid rose, the business activity component climbed to a 15-month high.

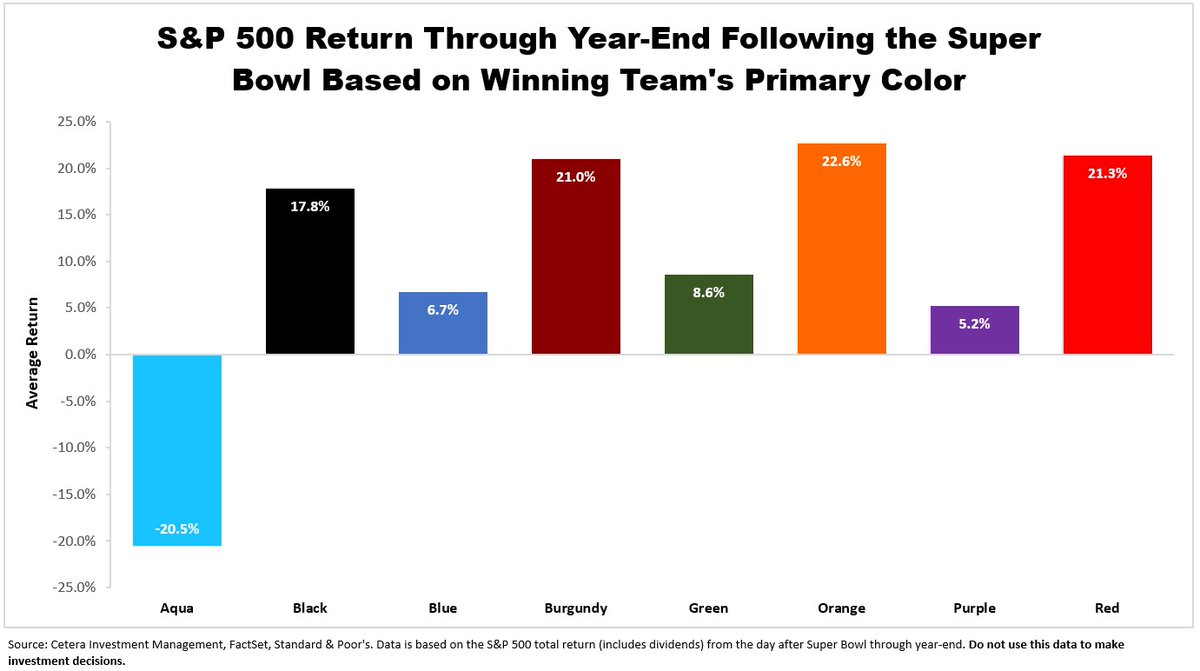

Who are you rooting for in the #SuperBowl? The market has no bias this year based on team color. When the winning team’s primary color is blue, like the Seahawks and Patriots, the S&P 500 has an average return of 6.7% through year end.

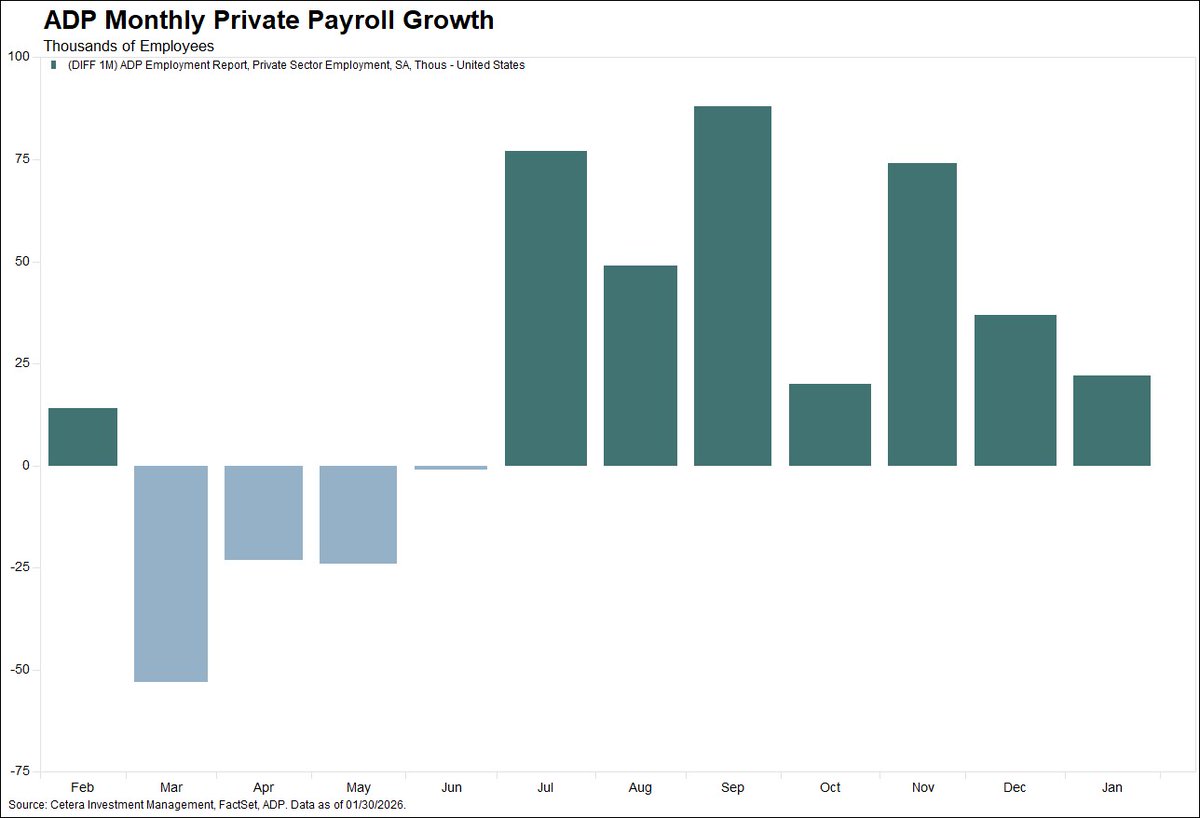

Private payrolls increased by 22K in January per ADP, missing expectations of +45K. Education and Health Services led all sectors with a 74K increase, while professional and business services had the largest employment decline at -57K.

During a recent selloff of gold and silver, CIO @GeneGoldman shared with @WSJ how pressures – including margin calls – impacted prices of the precious metals. Read more in the WSJ here: on.wsj.com/4byc9Yz

Our CIO @GeneGoldman joined @JennaDags on @AssetTVUS to share his favorite sectors and discuss his outlook for 2026 — including why he believes the U.S. economy may outperform expectations. Watch the full segment now: urldefense.com/v3/__https:/ww…$

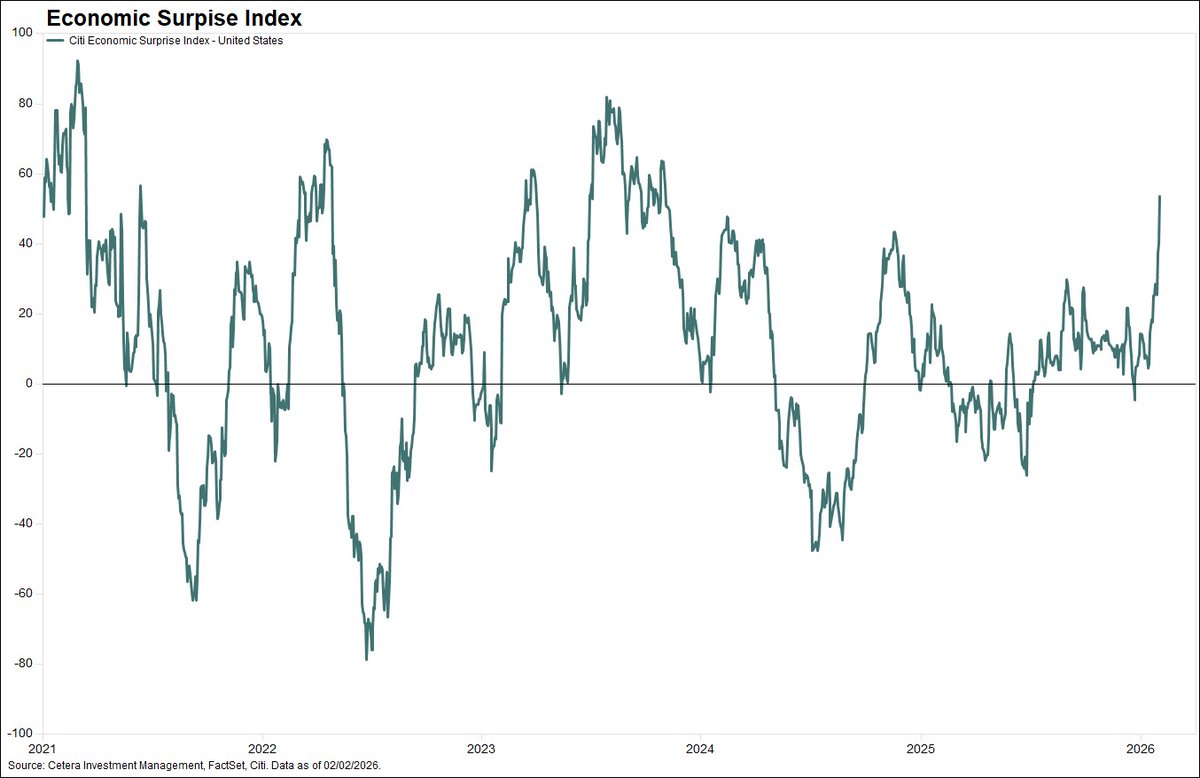

The US Economic Surprise Index has climbed to its highest level since November 2023, signaling stronger than expected momentum. The upbeat data has coincided with an uptick in bond yields as markets recalibrate the growth outlook.

The precious metals market has been anything but quiet. After a multi‑year surge in gold and silver, last week’s sharp selloff has many investors wondering what shifted — and what it means for the path forward. In this week’s #TheWeekAhead, CIO @GeneGoldman breaks down the forces…

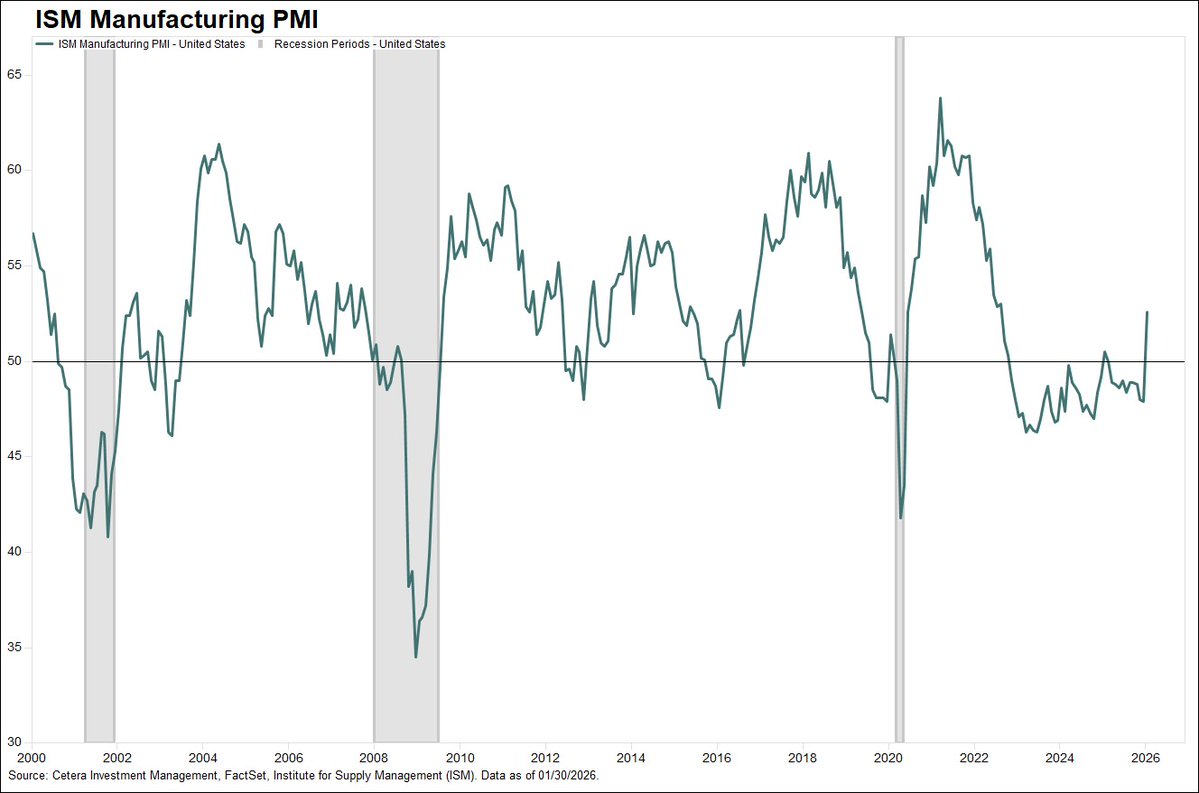

The ISM Manufacturing PMI accelerated to a 41-month high of 52.6 in January. It was the first expansionary reading in 11 months, and the largest monthly increase since June 2020, driven by a surge in new orders.

Last week’s sharp sell‑off in gold and silver took many investors by surprise. Our latest commentary breaks down what drove the move—including overbought conditions, Fed policy expectations, dollar strength, and forced selling—and what it may mean for markets going forward. Read…

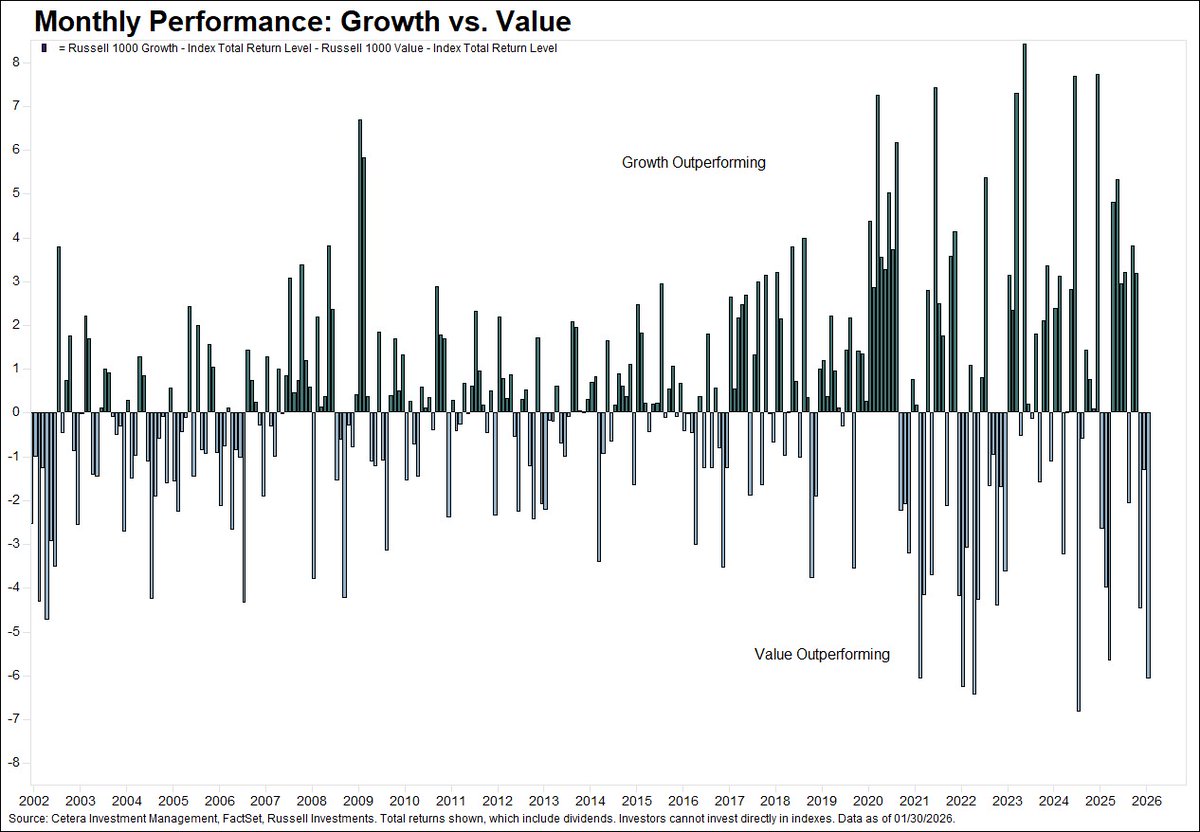

Momentum is shifting away from Growth stocks. The Russell 1000 Value index outperformed the Russell 1000 Growth index by 6.1% in January, marking the 3rd straight month of Value leadership and the 4th largest performance gap over Growth since 2002.

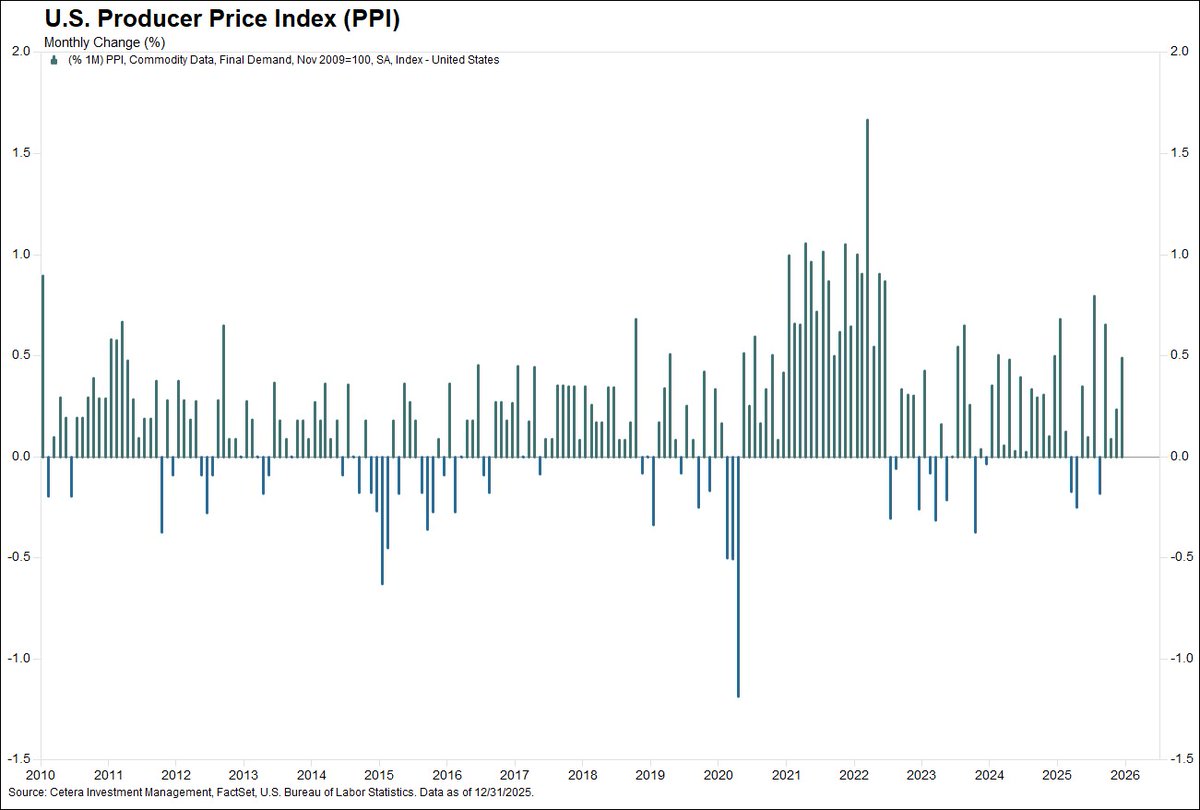

The Producer Price Index (PPI) rose 0.5% in December, outpacing expectations of +0.2%. Final demand services climbed 0.7% (largest increase since July), while goods prices were unchanged. On a year-over-year basis, PPI inflation held steady at 3.0%.

CIO @GeneGoldman sat down with @NPetallides on @SchwabNetwork to discuss what’s working – and what’s surprising – so far in 2026. Watch the full segment here: schwabnetwork.com/video/gene-gol…

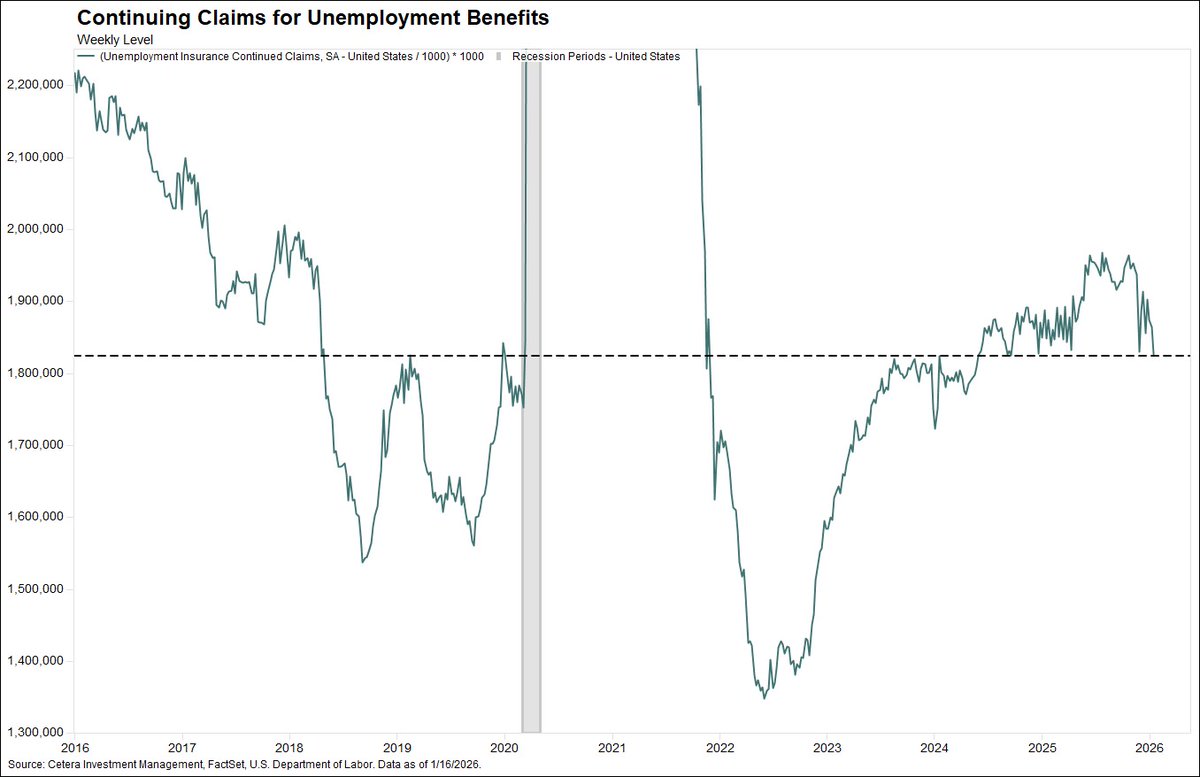

Initial jobless claims fell by 1K last week to 209K, and continuing claims declined by 38K the week prior to a 16-month low of 1.827 million. Job growth remains tepid, but easing jobless claims suggests the labor market is stabilizing.

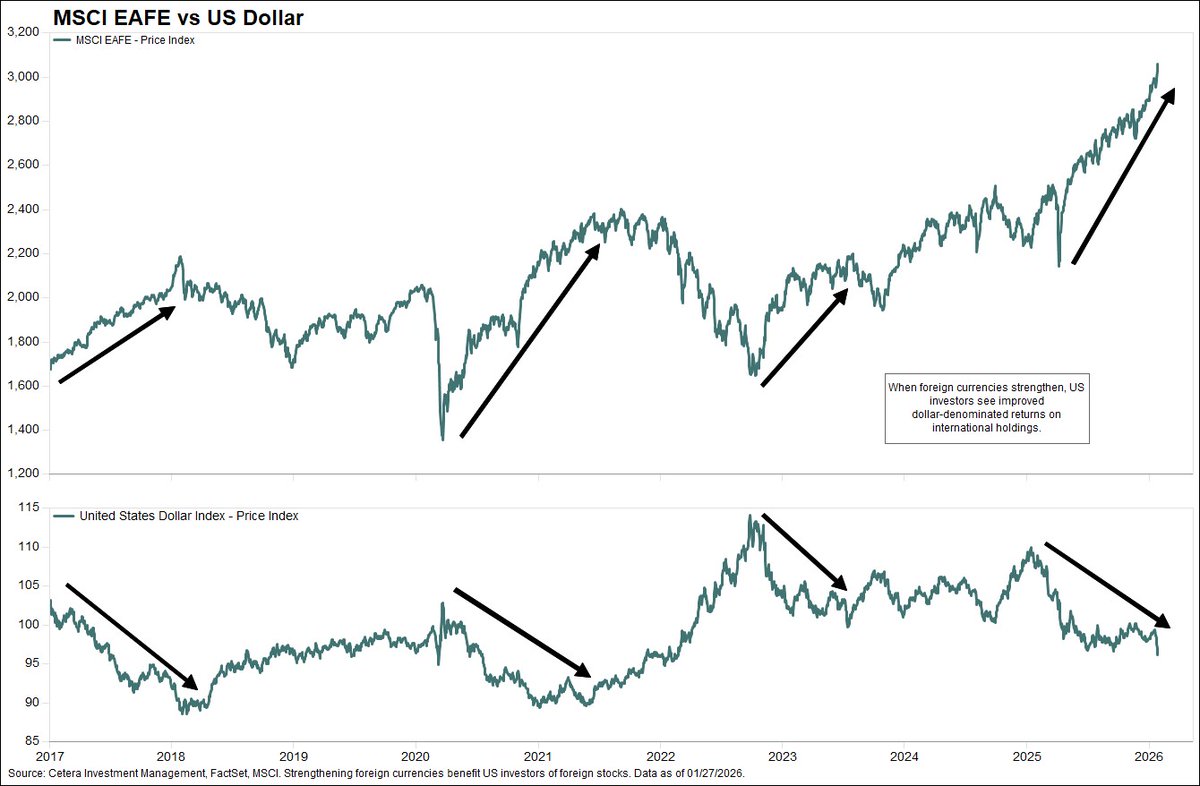

The rally in international stocks has coincided with a decline in the US dollar. US stocks have led international in 12 of the past 16 years, but a sustained cyclical shift toward international leadership may require continued foreign currency strength.

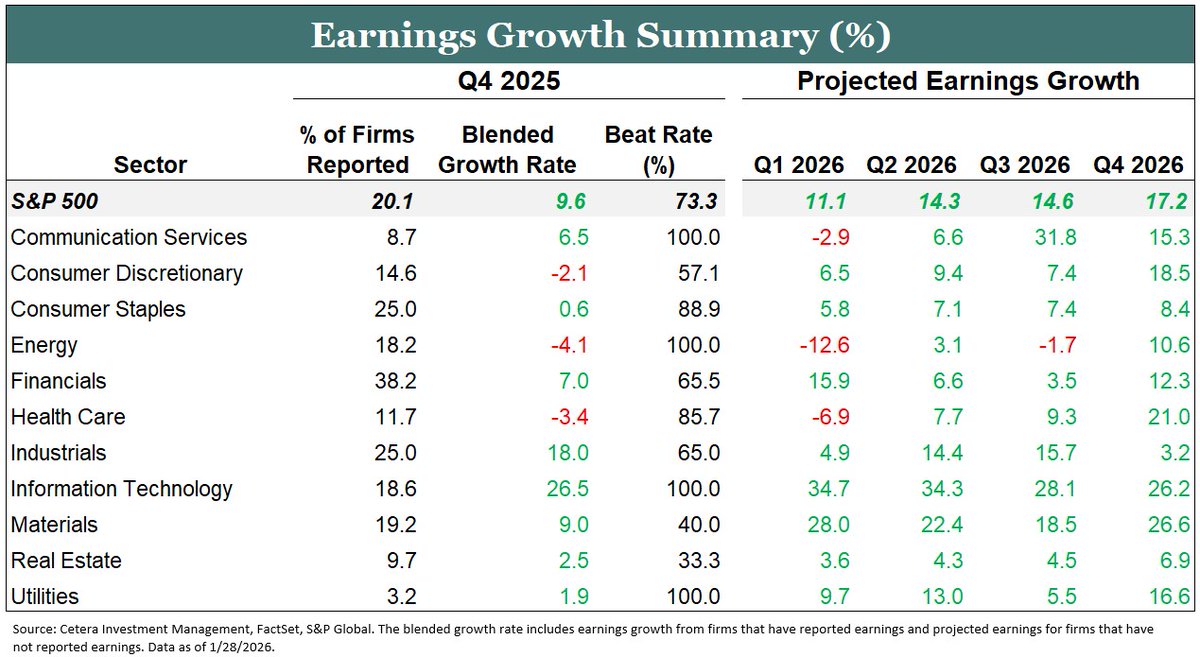

We are early in Q4 earnings season, with 20% of S&P 500 companies reporting so far. The blended EPS growth rate is 9.6%, but the beat rate is at a 3-year low of 73%. Looking ahead, @FactSet projects double-digit earnings growth in each quarter this year.

Great outcomes don't happen in silos—they come from great teams. Led by CIO @GeneGoldman, our investment team brings collaboration, experience, and shared purpose to every decision. Get an inside look in our latest video.

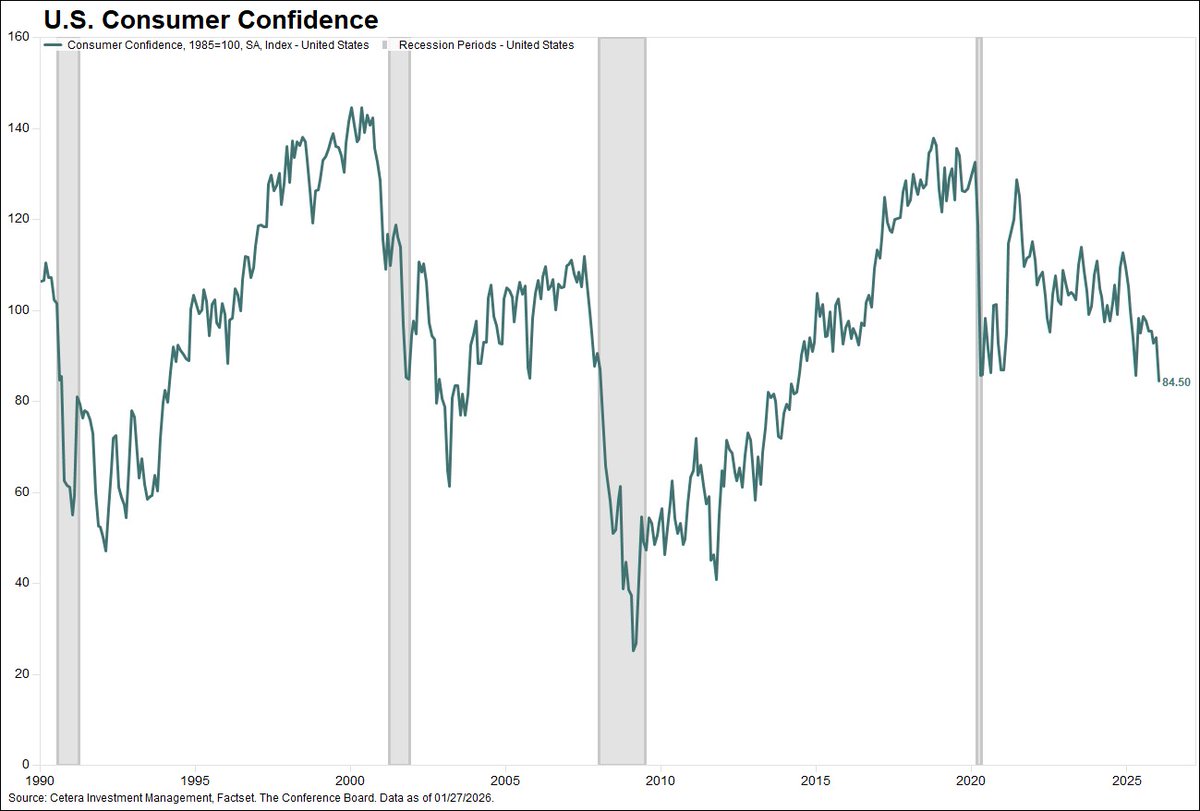

Consumer confidence dropped to a new cycle low this month, reaching its weakest reading since 2014. Sentiment fell for both the present situation and future expectations. While the mood of consumers has soured, spending growth remains healthy.

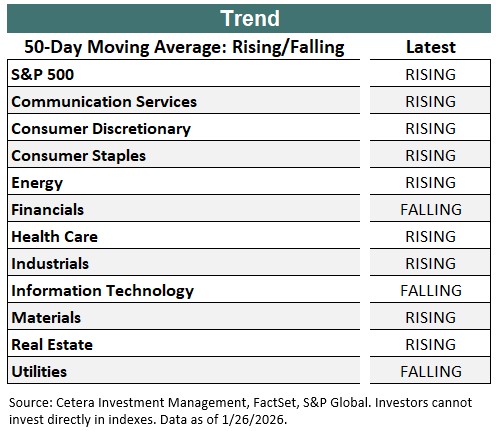

Large cap stocks are lagging small caps this year, but the S&P 500 remains in an upward trend. The 50-day moving average continues to rise for the broader index and 8 of 11 sectors. Financials, Tech, and Utilities have trended lower over the past 50 days.

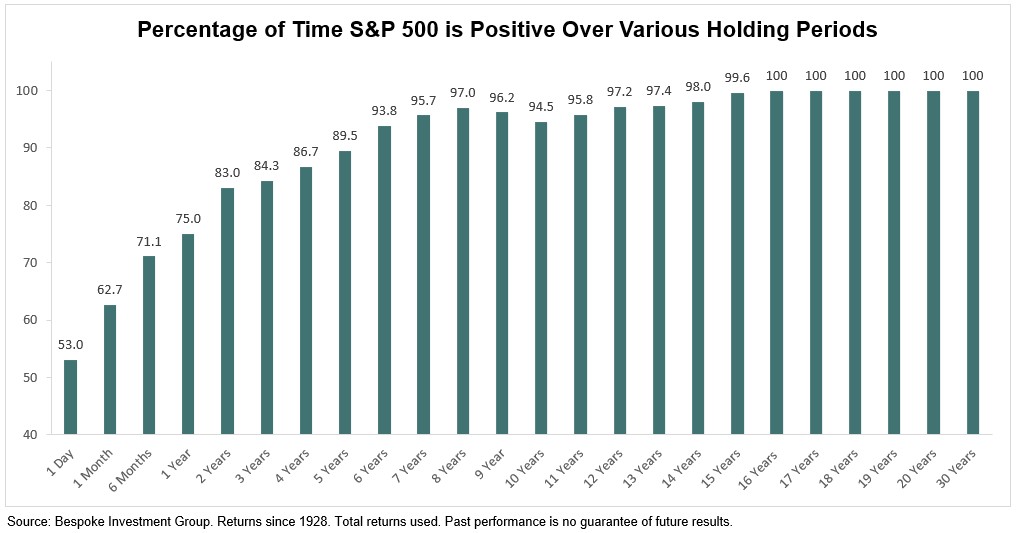

Expand your horizon. The S&P 500 is positive 53% of the time on any given day, but that rises to 75% over the course of a year, 89% over 5 years, and 94% over 10 years. Notably, the S&P 500 has been positive in all 16-year rolling periods and beyond.

United States Trends

- 1. Porzingis N/A

- 2. Kuminga N/A

- 3. Warriors N/A

- 4. Gonzaga N/A

- 5. Hield N/A

- 6. Skubal N/A

- 7. Dalen Terry N/A

- 8. Podz N/A

- 9. #AEWDynamite N/A

- 10. Yabu N/A

- 11. Thandeka N/A

- 12. Cristiano Ronaldo N/A

- 13. POTS N/A

- 14. GM CT N/A

- 15. $BFS N/A

- 16. Ty Jerome N/A

- 17. Draymond N/A

- 18. #DubNation N/A

- 19. Neymar N/A

- 20. Trey Murphy N/A

You might like

-

Cetera Financial Group

Cetera Financial Group

@CeteraFinancial -

Gene Goldman, CFA

Gene Goldman, CFA

@GeneGoldman -

Osaic

Osaic

@osaic_inc -

Wealth Management

Wealth Management

@wealth_mgmt -

Financial Planning Association (FPA)

Financial Planning Association (FPA)

@fpassociation -

Debunk Inc

Debunk Inc

@debunkinc -

Conor White, CMT, CIM

Conor White, CMT, CIM

@ConorWhiteCMT -

Sultan of Swing

Sultan of Swing

@SultanOf_Swing -

Matthias Hanauer

Matthias Hanauer

@HanauerMatthias -

$$ 𝕯𝖔𝖑𝖑𝖆𝖗 𝕭𝖎𝖑𝖑 $$

$$ 𝕯𝖔𝖑𝖑𝖆𝖗 𝕭𝖎𝖑𝖑 $$

@abdullahksa203 -

Beacon Pointe

Beacon Pointe

@BeaconPointeRIA -

Eric Krull

Eric Krull

@EricKrull1 -

Omani Carson (he/him)

Omani Carson (he/him)

@OmaniCarson -

Sammy McCallum 🥇

Sammy McCallum 🥇

@Honeystocks1 -

Louis Spector, CMT

Louis Spector, CMT

@LouisSpectorCMT

Something went wrong.

Something went wrong.