Consumer Action

@consumeraction

Consumer Action is a national nonprofit consumer education and advocacy organization. We retweet news and compelling stories of consumer interest. Join us!

You might like

Rep Al Greene is right. The current plan is to "take from the needy to support the greedy."

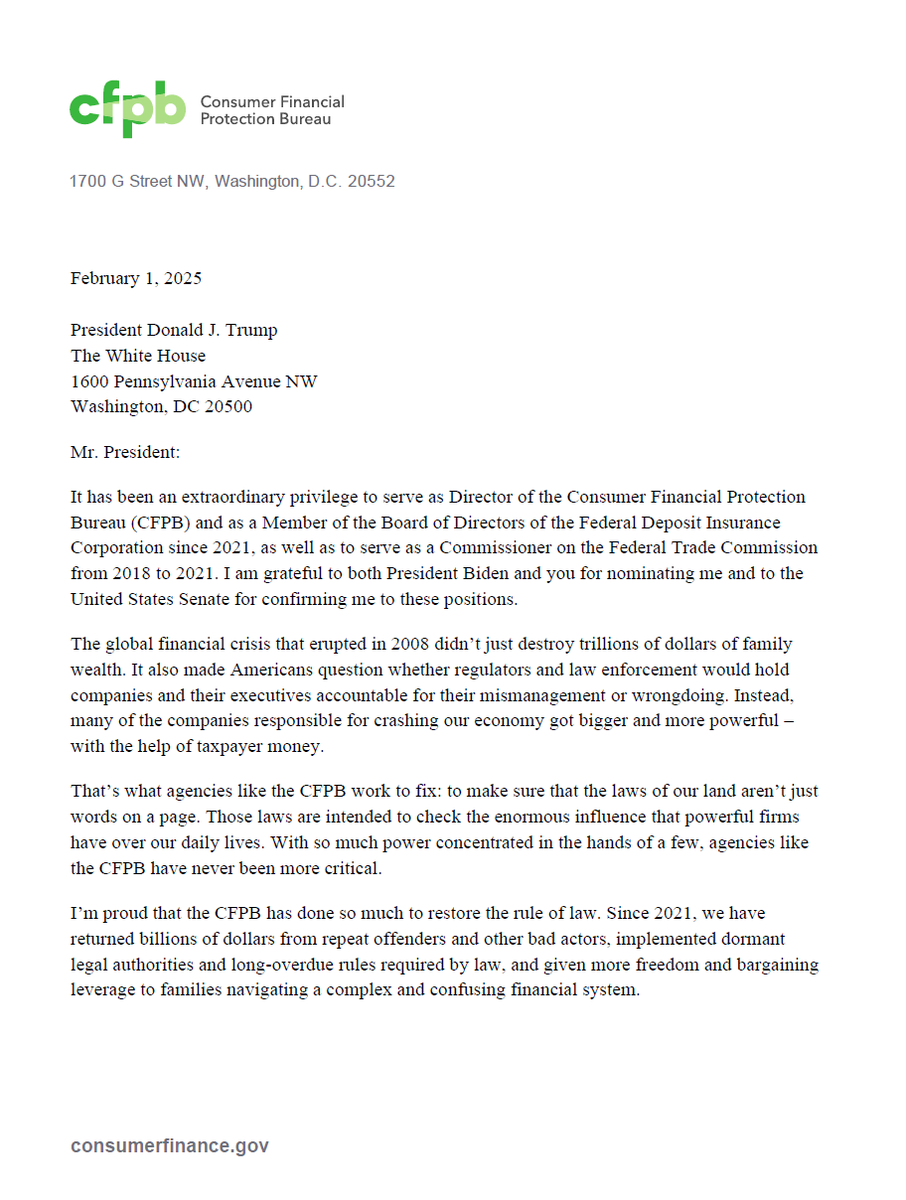

Under CFPB Director Chopra, the agency’s work saved consumers $1 billion each year from overdraft charges alone. 79% of voters approve of the CFPB's mission & work. It is because of the efficacy of Chopra's work at the CFPB that the billionaires are now gunning for its demise.

View our webinar on #ManagingDebt: @BruceMcClary of NFCC, Miriam Straus of Community Catalyst, and Dr. Hurley of @jedfoundation speak about improving #financialhealth, managing medical debt, and the relationship between financial stress and mental health: youtu.be/hZWZerAEjPU?si…

youtube.com

YouTube

Solutions for Managing Debt in Turbulent Times

Summer job hunting? Check out this alert from the FTC on how to avoid work-from-home job scams consumer.ftc.gov/consumer-alert…

Register for free training for #NewYorkCity & #NewJersey advocates. Help clients prevent #scams & #IDTheft. Gather #multilingual resources to #ProtectConsumers #seniors #ImmigrantNewYorkers. Register: surveymonkey.com/r/T9GWFNG #ProtectNewYorkers #EnglishLearners #FinancialLiteracy

What a shameful, illogical act.

"Today, they are slashing the [CFPB]'s budget by 70%. This is ridiculous because the Bureau has saved American consumers $21 billion by returning to them funds that big banks and predatory lenders swindled out of them." -@USHouseFSC Ranking Member @RepMaxineWaters #HandsOffCFPB

“The severity of this attack on the #CFPB cannot be overstated,” said Carla Sanchez-Adams @NCLC4consumers. "Financial companies have proven time and again that they cannot police themselves.” @Telemundo #ProtectConsumers #DefendCFPB telemundo52.com/tu-dinero/cons…

The Trump Administration and Senate Republicans are pushing to roll back consumer protections that capped overdraft fees at $5 and credit card late fees at $8. Americans are already facing rising costs— now is not the time to hike fees even higher.

Now Congress wants in on dismantling @CFPB consumer protection rules--it wants to prohibit a limit on bank overdraft fees. How bout they call these overdraft penalty fees what they are--a short term loan!

New leadership at CFPB may walk back some Biden-era rules that would have banned medical debt on credit reports, capped credit card late fees, and made it easier to switch banks. “As long as CFPB’s work is halted, bad actors go unpunished." @AdamRust9 cnn.com/2025/02/12/bus…

Well said! The credit bureaus who mess up your credit report, the big banks that trick you into paying overdraft fees, the payment apps that allow criminals to steal your money all would be happy to see @CFPB gone. #ProtectConsumers

UNelected, UNaccountable representatives may not value the Consumer Bureau but Consumers do--We value the $21 B the @CFPB returned to real people from unfair & deceptive dealings. @CFPB protects & empowers ordinary people. Get Real DOGE!

Easy tip for electeds looking to lower costs for Americans: close the #overdraft loophole.

Thank you @hitchop -on your watch-the @CFPB returned more than $6 billion to consumers--from corporate wrongdoing. This is the power of financial regulation—protecting everyday Americans from abusive banks and corporations.

The @CFPB under Director Rohit Chopra has been a trusted source that consumers could rely on to address disputes and hold companies accountable for unfair practices. Many thanks to @chopraCFPB who returned billions of dollars to compensate real people for real financial harms.

It's been an honor serving as your @CFPB Director. Every day, Americans from across the country shared their ideas and experiences with us. You helped us hold powerful companies & their executives accountable for breaking the law, and you made our work better. Thank you. 🇺🇸🇺🇸🇺🇸

No car dealer misrepresentations, No bogus add-ons--Provide a car's REAL price--Who could argue with that? Only shady auto dealers & now the Fifth Circuit has struck down the @FTC #CARS Rule. Wow.

The @CFPB has sued Experian for ''failing' to address mistakes on consumers' credit reports. That's the kind of help consumers count on the @CFPB for.

“The outcome of this lawsuit may turn on who is the next director of the @CFPB, but protecting people from mistakes on their credit report is not a partisan issue,” said @lsaundersnclc. "Members of both parties should support a strong & independent CFPB.” nclc.org/cfpb-sues-expe…

Overdue medical bills are no predictor of how someone will repay future debts. The CFPB is banning lenders from relying on unexpected medical debt to evaluate us for a loan. #ProtectConsumers

#MedicalDebt has ruined countless #CreditScores and pushed costs even higher for Americans struggling financially, particularly those who have turned to #CreditCards and other forms of credit to put food on the table. @CFPB #ProtectConsumers

Ahhh yes, the dark days of 'defund, defang'. Thank goodness for the @CFPB

I’ve been around long enough to have seen a half-dozen efforts to “defang, declaw, defund” @CFPB. Vivek is calling plays straight out of the bank lobby playbook. Fear mongering about “constraining credit” is always the smokescreen. CFPB constrains bank profiteering. That’s it.

🛒 Making digital savings more accessible. Stop & Shop has announced plans to install Savings Stations—kiosks in all 365 U.S. locations by January—to help customers access digital-only #coupons. While digital deals can offer significant savings, they often exclude customers…

Consumers stand with the @CFPB --one of the federal agencies that make a real difference in our lives.

Billionaires want to "delete" the @CFPB, but millions of want to keep it. The CFPB has already returned $21 billion to consumers by holding shady lenders and financial predators accountable. Who's really being protected here? latimes.com/opinion/story/…

This new rule gives big banks/credit unions options while saving consumers a bundle.

“The @CFPB's overdraft rule ensures that the most vulnerable consumers are protected from big banks trying to pad their profits with junk fees.” #ProtectConsumers #DefendCFPB nclc.org/cfpb-overdraft…

United States Trends

- 1. Wemby N/A

- 2. Pacers N/A

- 3. Rio Rico N/A

- 4. #WWENXT N/A

- 5. #OlandriaxYSLBeauty N/A

- 6. Purdue N/A

- 7. Nancy Guthrie N/A

- 8. #LoveOthers N/A

- 9. Wisconsin N/A

- 10. Nebraska N/A

- 11. Victor Wembanyama N/A

- 12. Tumbler Ridge N/A

- 13. Tucson N/A

- 14. Zaria N/A

- 15. Ty Lue N/A

- 16. #Illini N/A

- 17. British Columbia N/A

- 18. Courtney N/A

- 19. Blackwell N/A

- 20. Real ID N/A

You might like

-

Consumer Federation of America

Consumer Federation of America

@ConsumerFed -

Consumer Reports Advocacy

Consumer Reports Advocacy

@CRAdvocacy -

FTC

FTC

@FTC -

NCLC

NCLC

@NCLC4consumers -

Dylan Ratigan

Dylan Ratigan

@DylanRatigan -

National Consumers League

National Consumers League

@ncl_tweets -

U.S. PIRG

U.S. PIRG

@uspirg -

Jesse Van Tol ([email protected])

Jesse Van Tol ([email protected])

@jessevantol -

Ed Mierzwinski, #ProtectConsumers #DefendCFPB!!

Ed Mierzwinski, #ProtectConsumers #DefendCFPB!!

@edmpirg -

Adam Rust

Adam Rust

@AdamRust9 -

Center for Responsible Lending

Center for Responsible Lending

@CRLONLINE -

Consumer Watchdog

Consumer Watchdog

@ConsumerWD -

AFR

AFR

@RealBankReform -

Deirdre Cummings

Deirdre Cummings

@DeirdreMASSPIRG -

chuckbell

chuckbell

@chuckbell

Something went wrong.

Something went wrong.