Convex Value

@ConvexValue

A financial analytics browser with a powerful suite of live options data and tools for 99/mo. Download it Now 👇

You might like

The ConvexValue Terminal - in 3 minutes 🫡

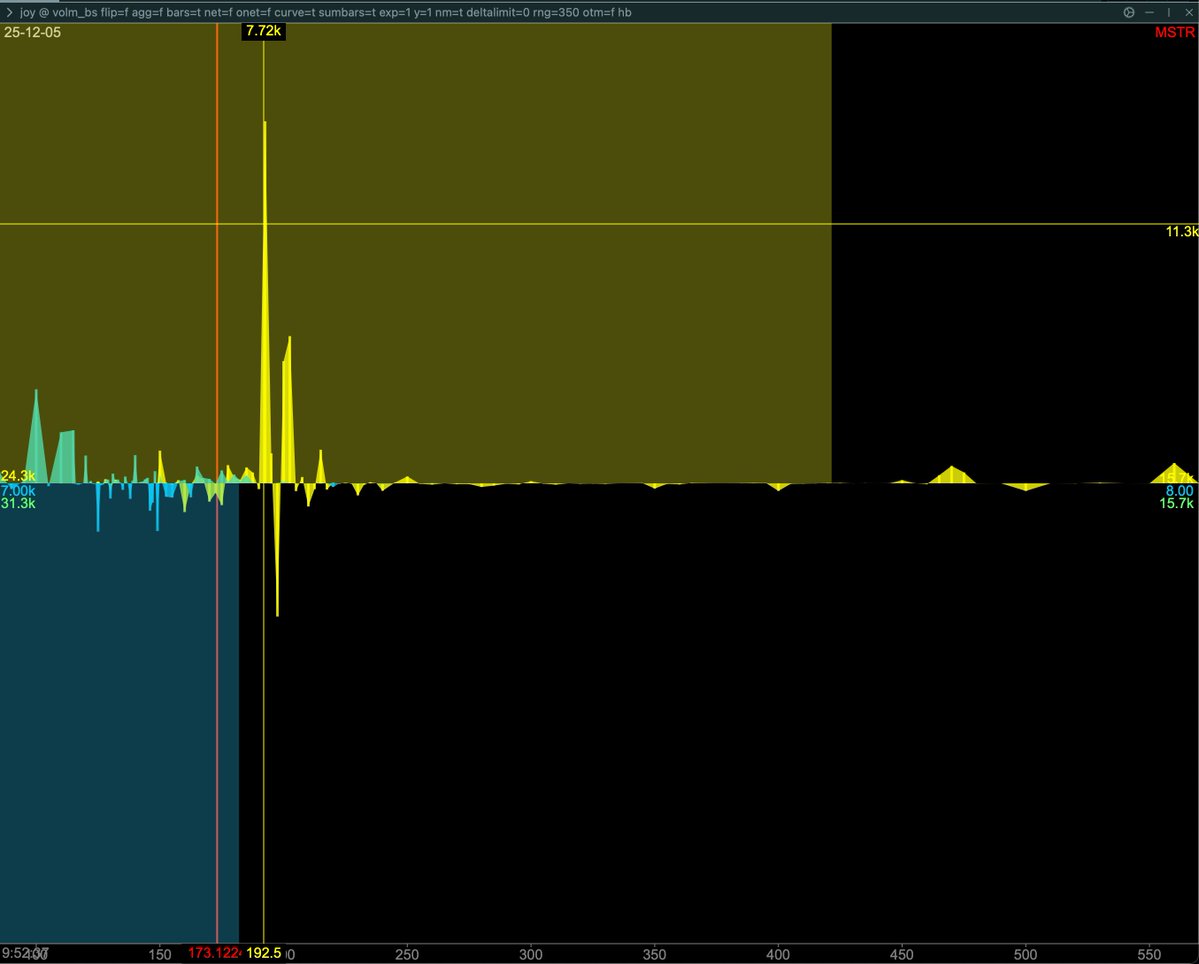

Did MSTR just bottom? 1.5M - 1.8M Notional on the 192.5C for this week Captulatory sell off type action with reversal @ConvexValue

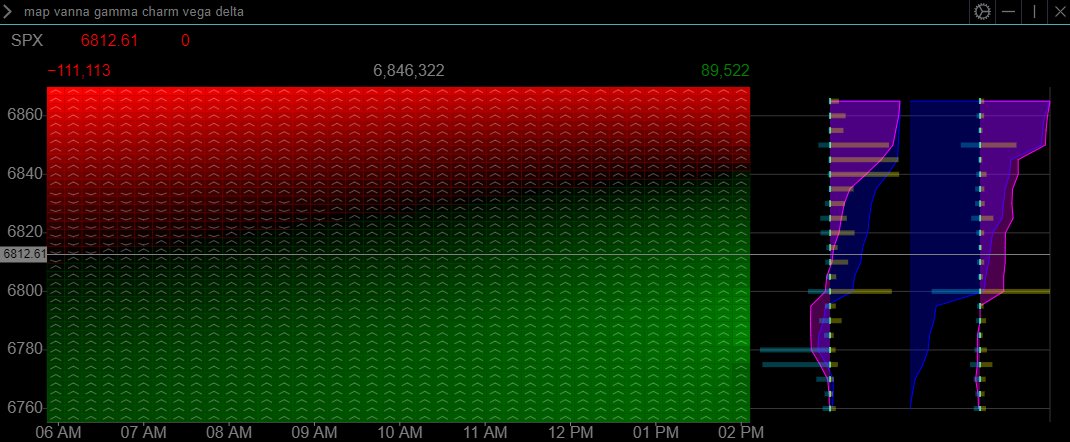

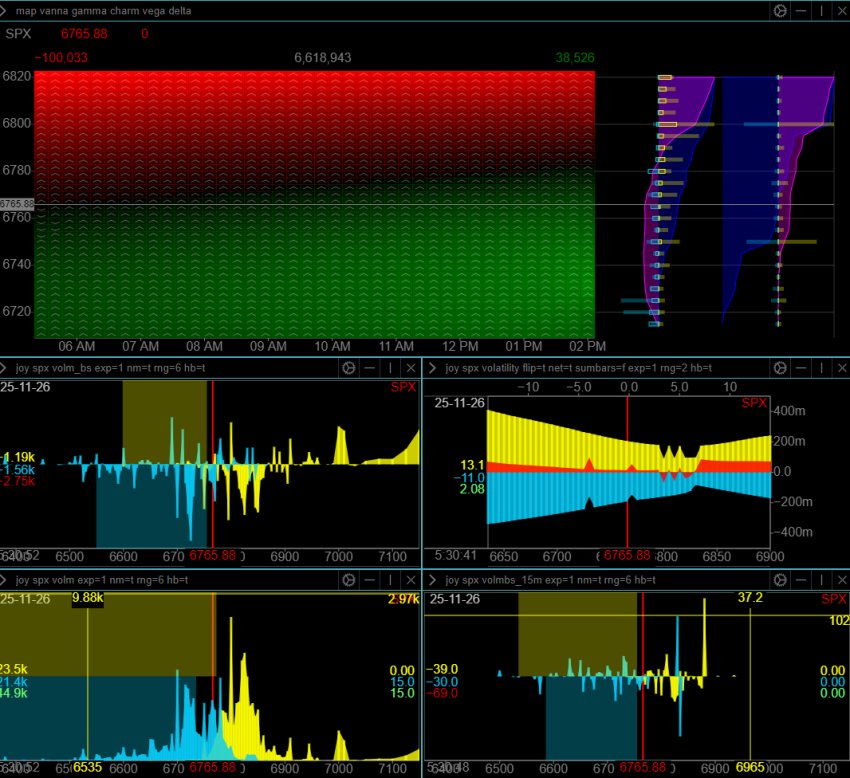

$SPX Lunch time update -How I saw the day.... I took a few momentum longs on the day but largely been a very choppy day. an dlevel to level has been the way to trade for the day. From @ConvexValue -Deltas up, VOL down -POLR to 6795 or 6845 for now. From @OptionsDepth for 0DTE…

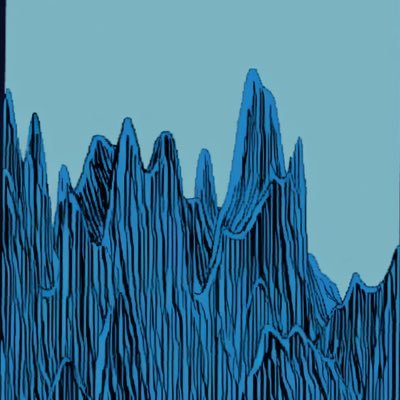

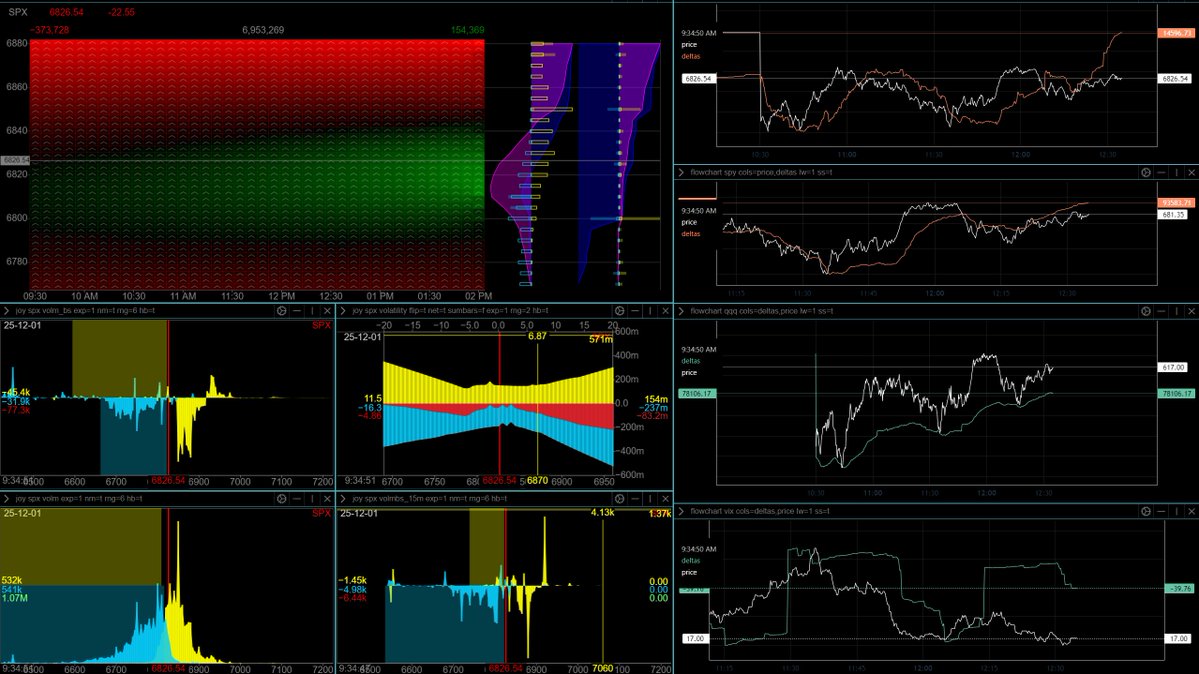

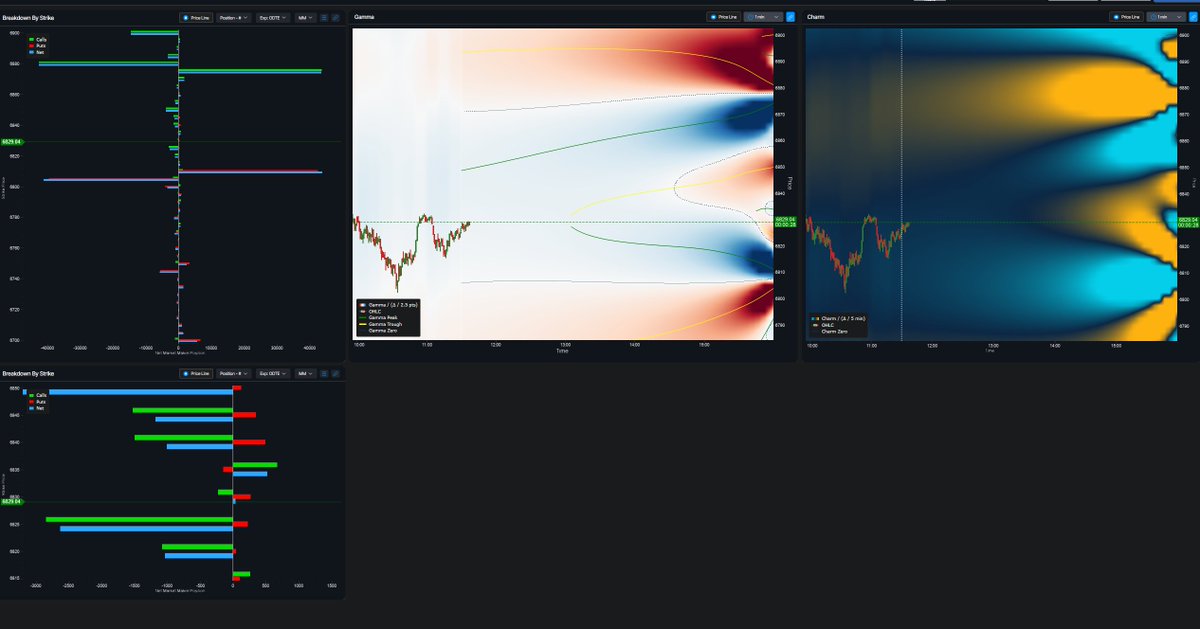

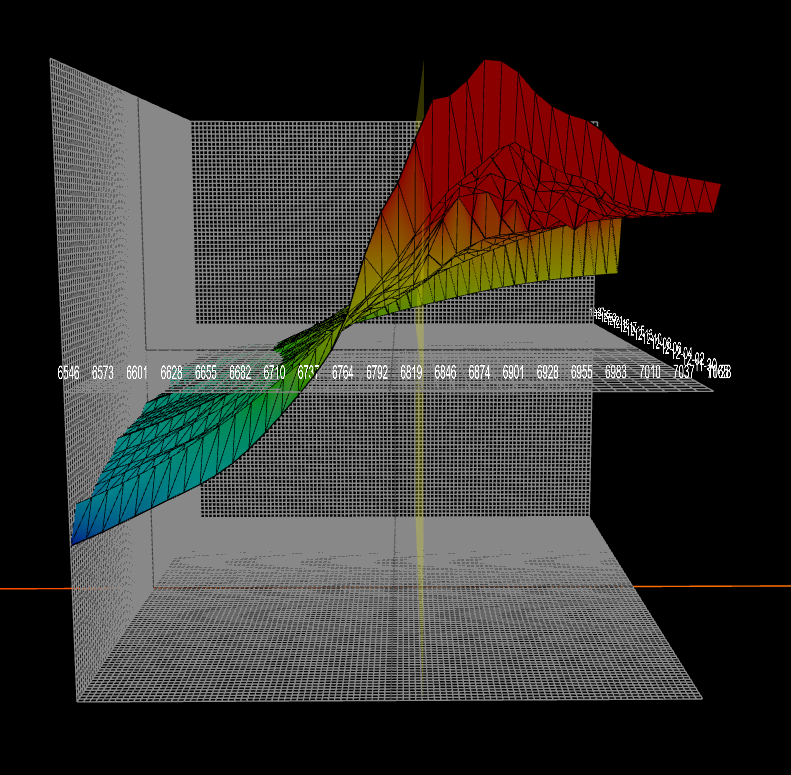

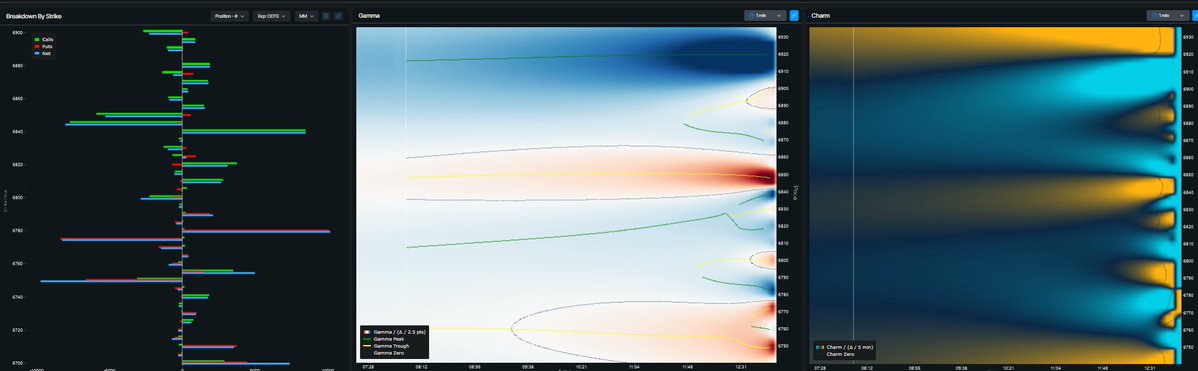

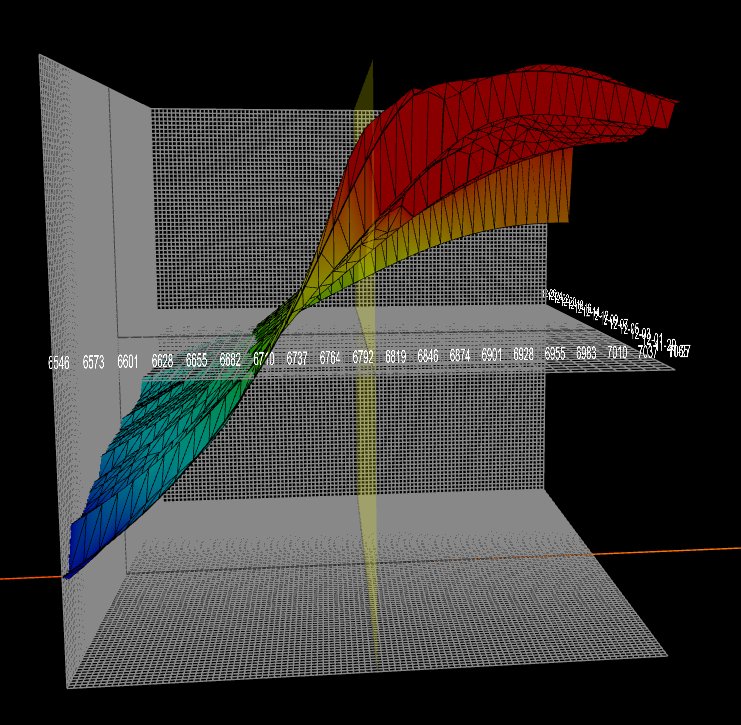

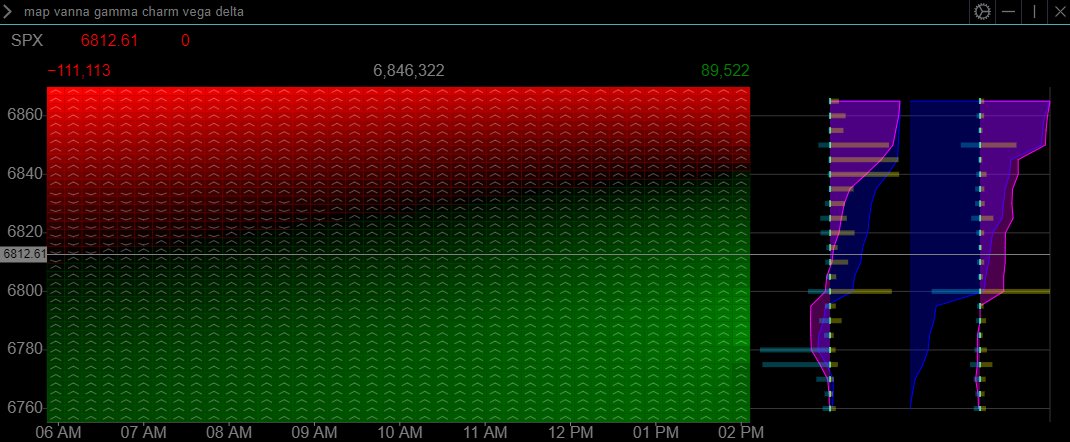

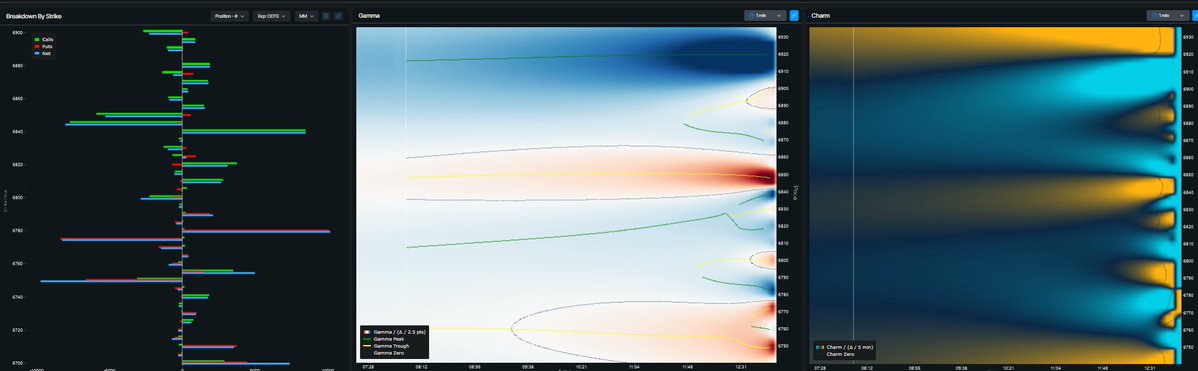

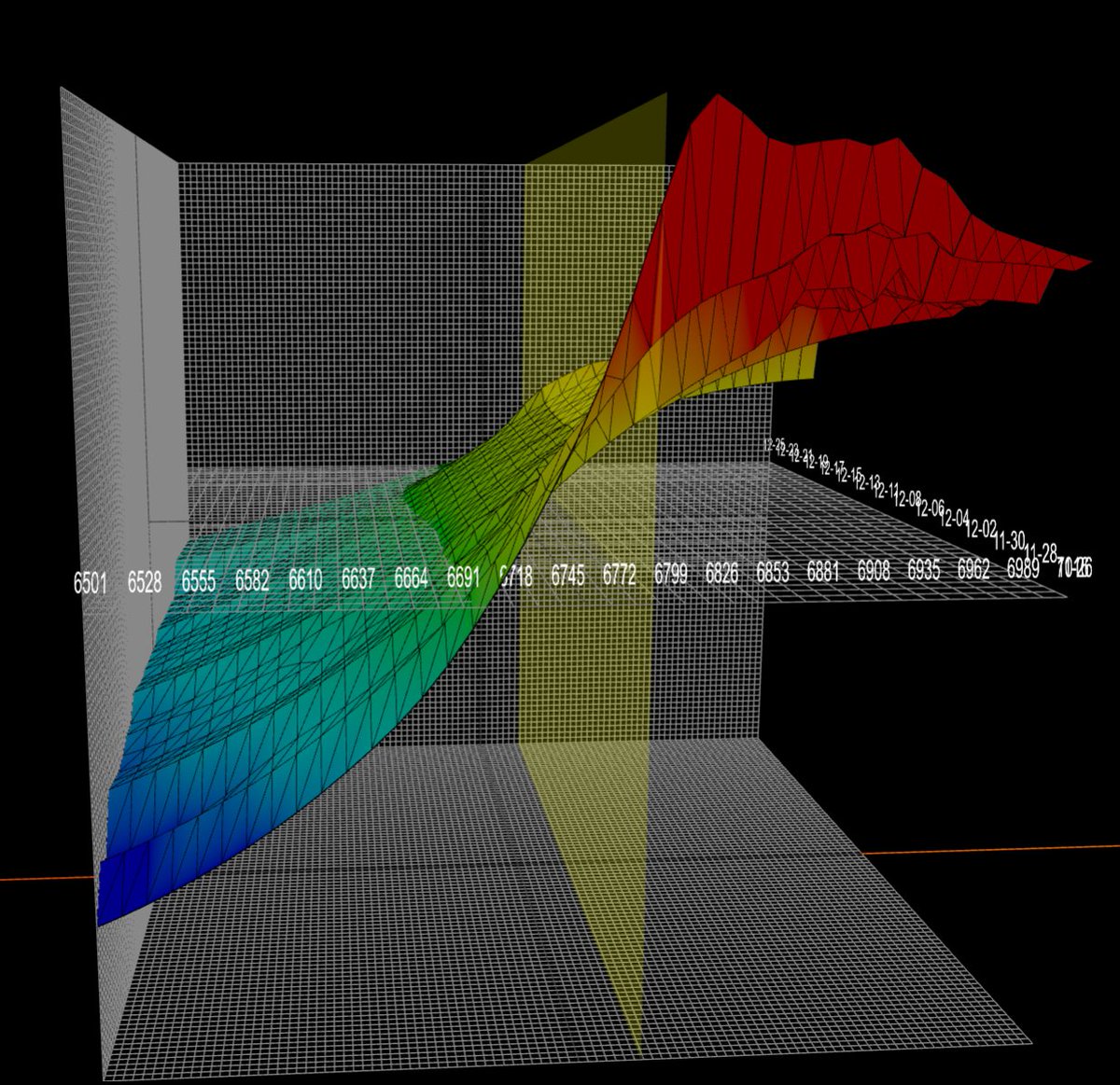

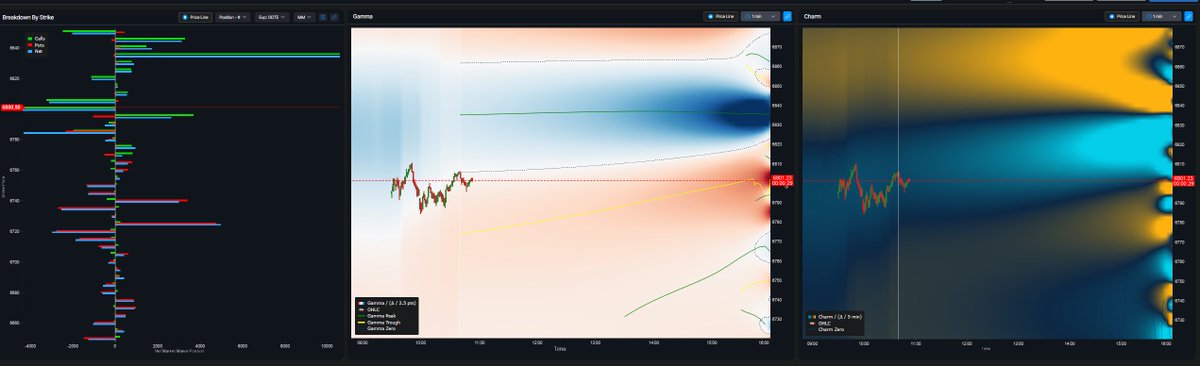

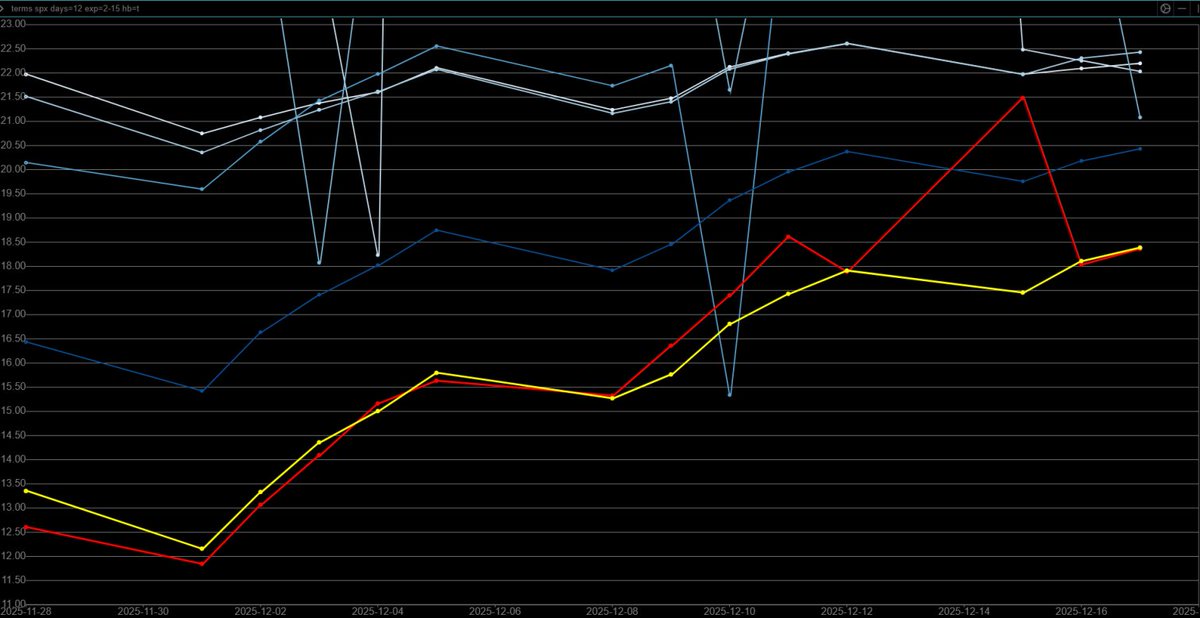

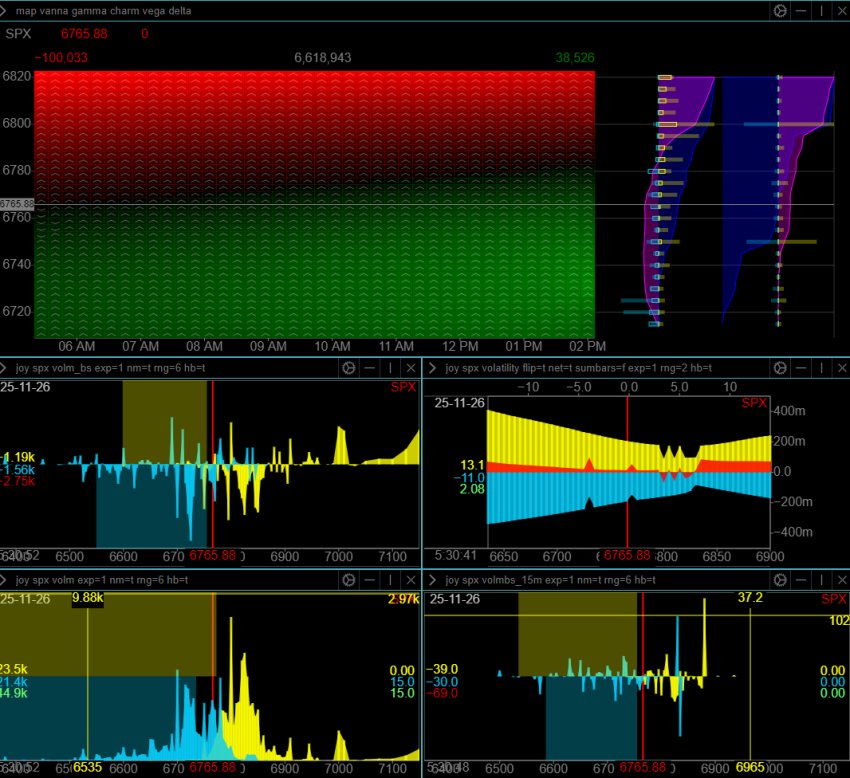

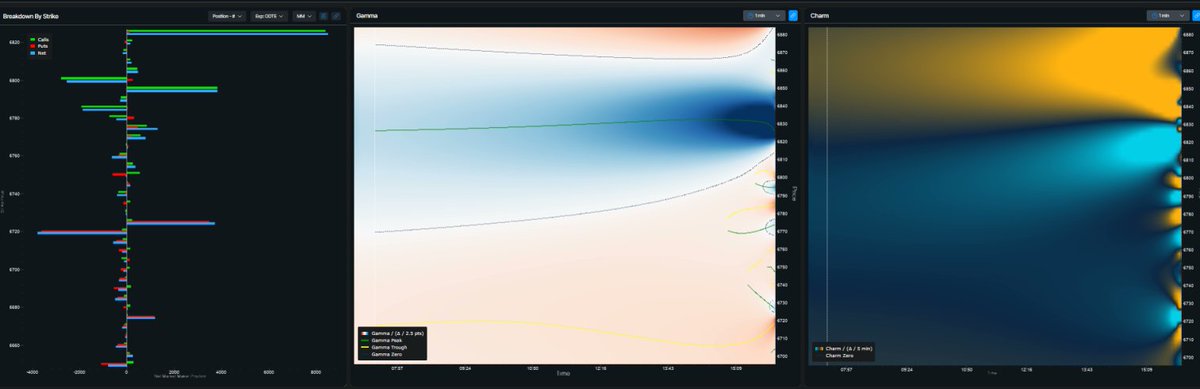

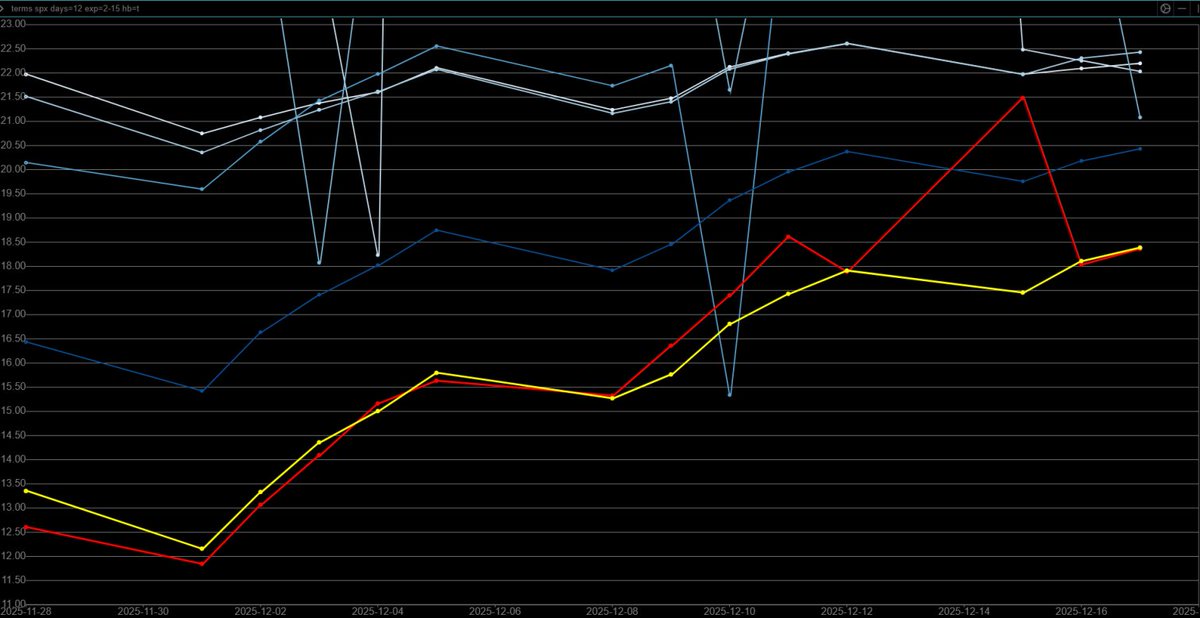

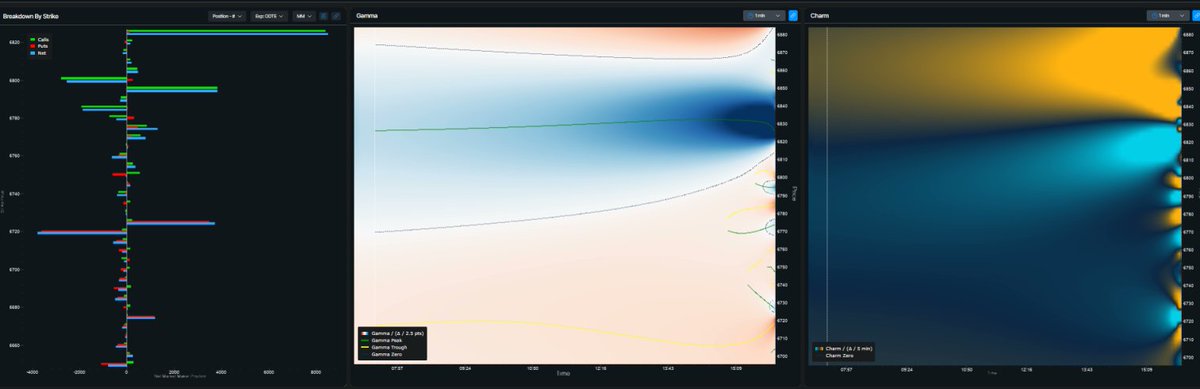

$SPX Market Data from @ConvexValue -Term structure remains low but has increased since Friday -Gamma surface shows ~ 6720 for cumulative flip as of Friday morning's run. -Overnight PM straddle is~ 33 points giving us an ON straddle range of [6816, 6882] -Current straddle as of…

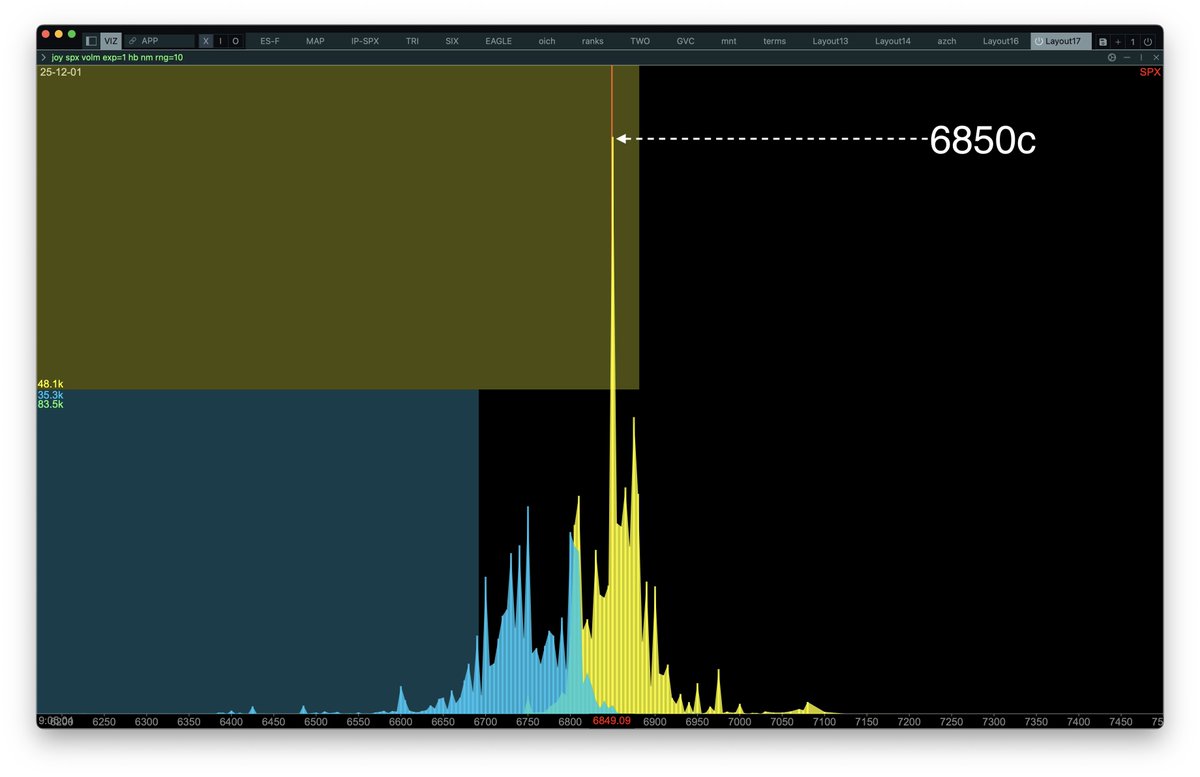

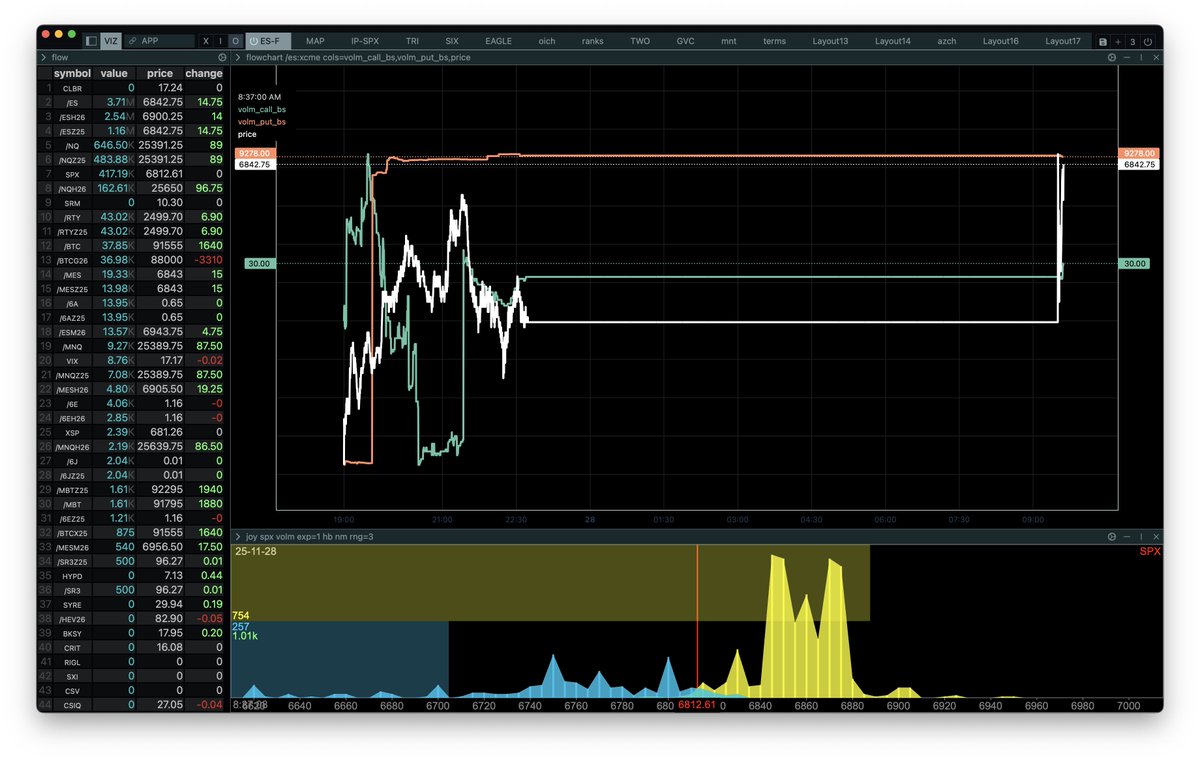

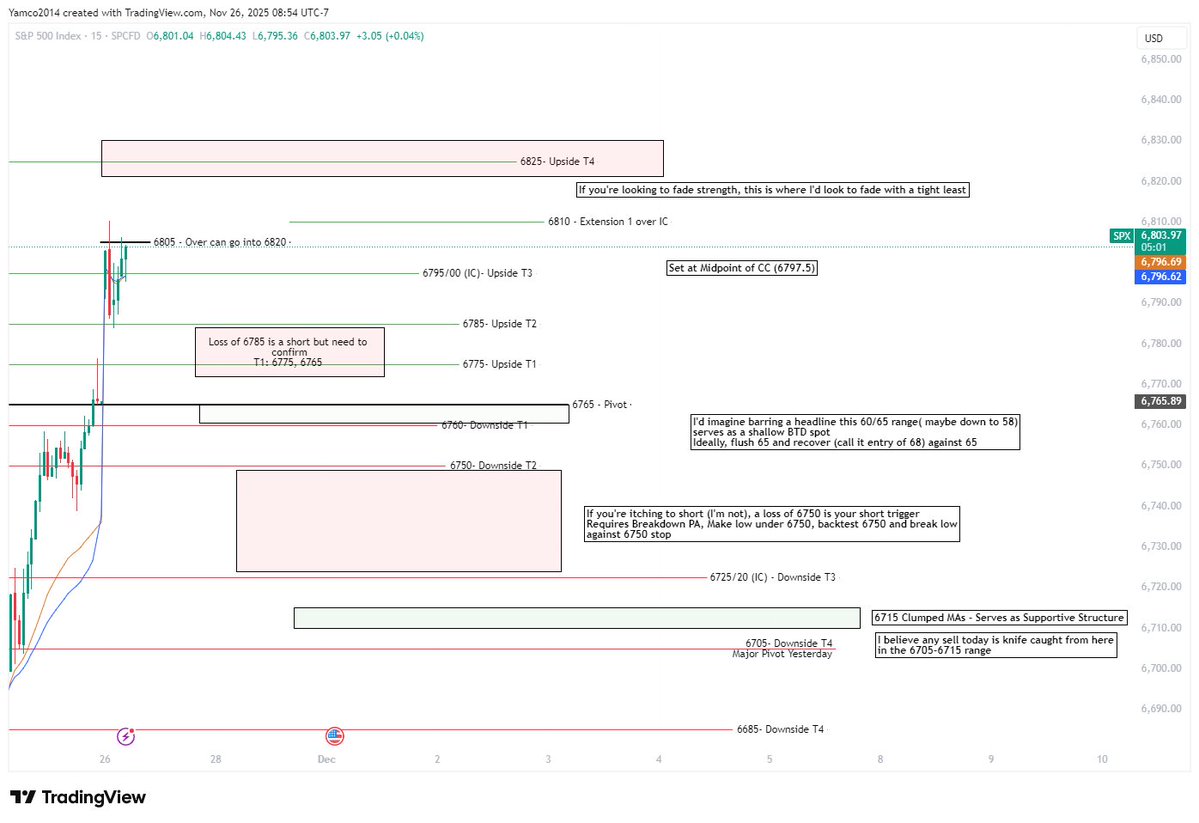

![Yam_Trades's tweet image. $SPX

Market Data from @ConvexValue

-Term structure remains low but has increased since Friday

-Gamma surface shows ~ 6720 for cumulative flip as of Friday morning's run.

-Overnight PM straddle is~ 33 points giving us an ON straddle range of [6816, 6882]

-Current straddle as of…](https://pbs.twimg.com/media/G7FcS9Zb0AAeTQc.jpg)

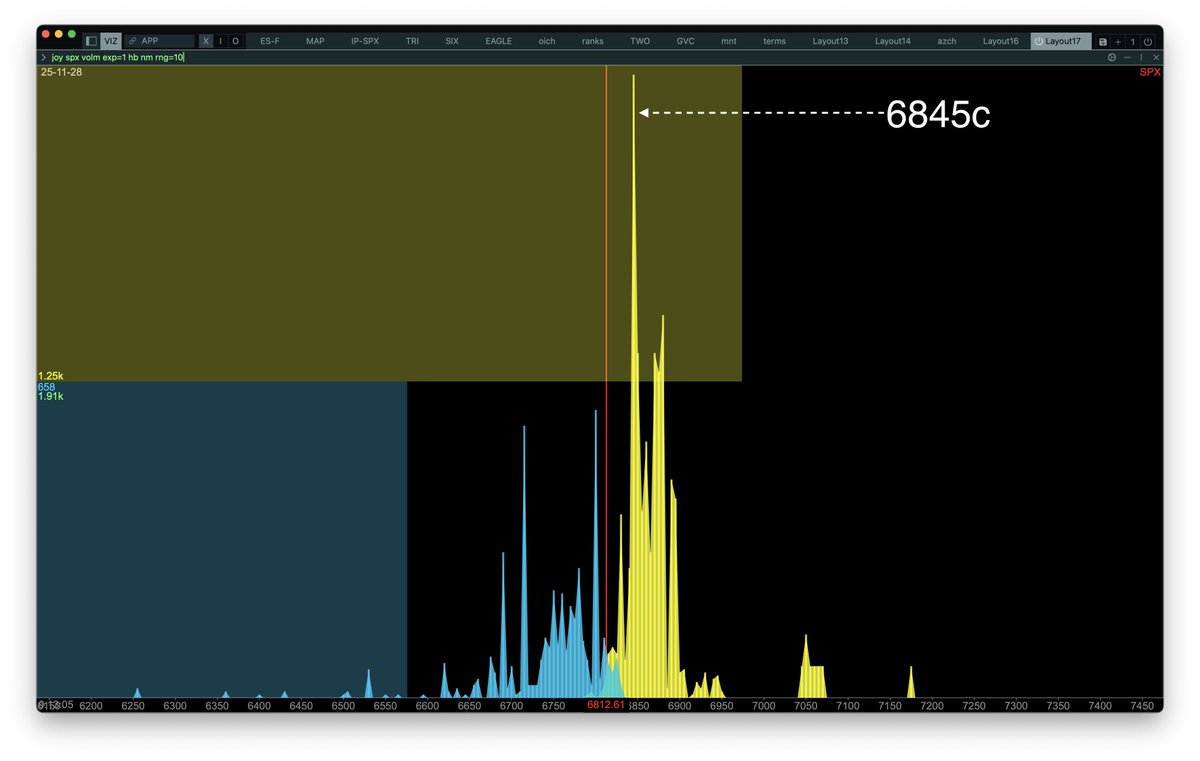

![Yam_Trades's tweet image. $SPX

Market Data from @ConvexValue

-Term structure remains low but has increased since Friday

-Gamma surface shows ~ 6720 for cumulative flip as of Friday morning's run.

-Overnight PM straddle is~ 33 points giving us an ON straddle range of [6816, 6882]

-Current straddle as of…](https://pbs.twimg.com/media/G7FcUfrbwAASEy-.jpg)

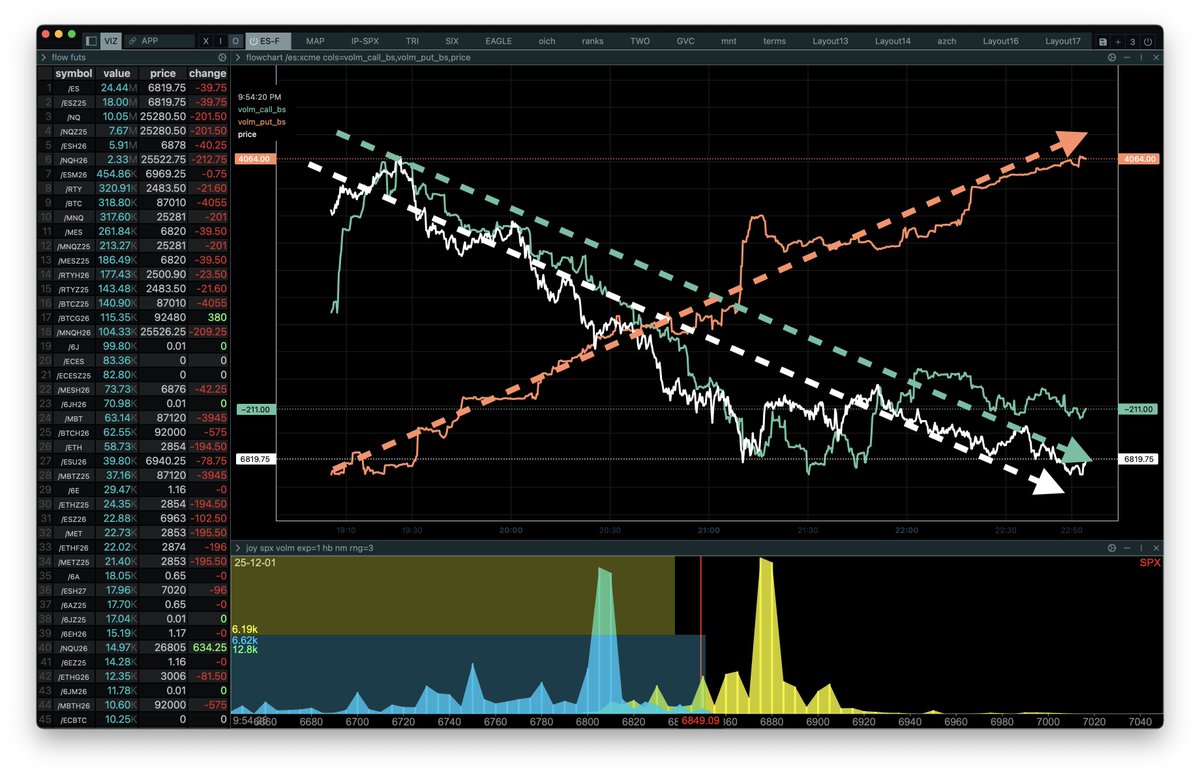

![Yam_Trades's tweet image. $SPX

Market Data from @ConvexValue

-Term structure remains low but has increased since Friday

-Gamma surface shows ~ 6720 for cumulative flip as of Friday morning's run.

-Overnight PM straddle is~ 33 points giving us an ON straddle range of [6816, 6882]

-Current straddle as of…](https://pbs.twimg.com/media/G7FcXiFaUAAIejk.jpg)

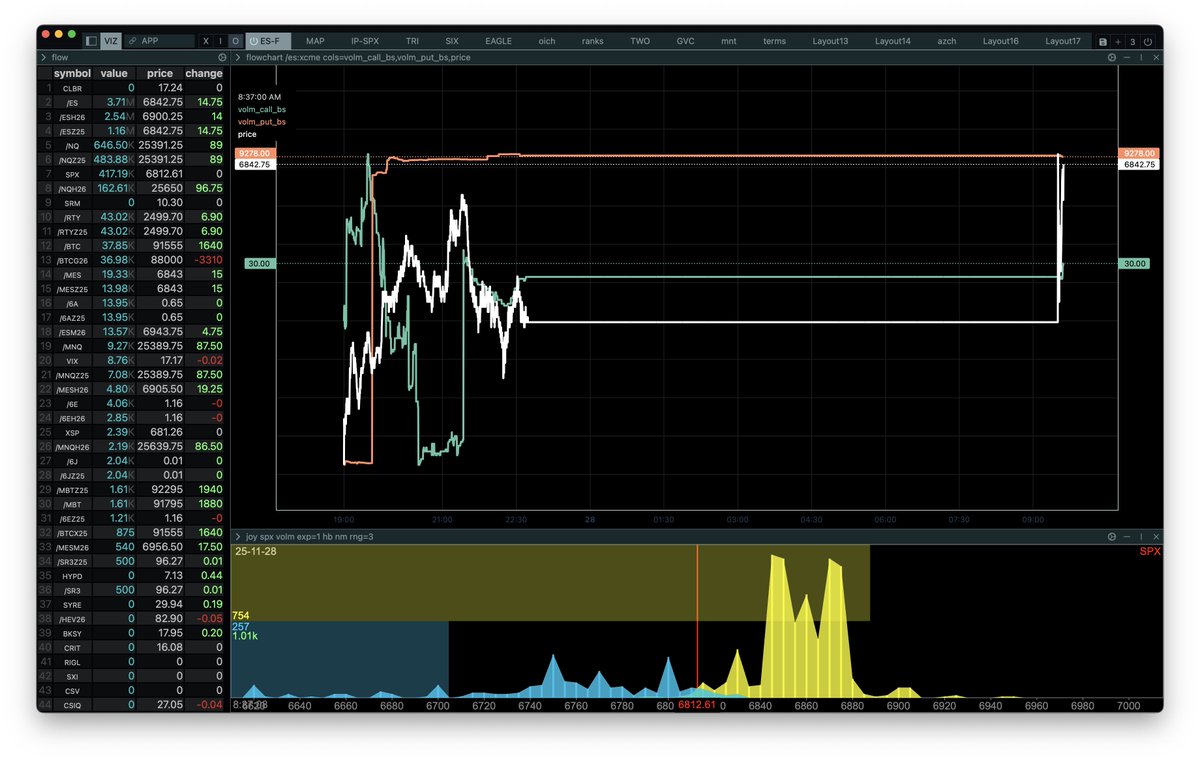

![Yam_Trades's tweet image. $SPX

Market Data from @ConvexValue

-Term structure remains low but has increased since Friday

-Gamma surface shows ~ 6720 for cumulative flip as of Friday morning's run.

-Overnight PM straddle is~ 33 points giving us an ON straddle range of [6816, 6882]

-Current straddle as of…](https://pbs.twimg.com/media/G7FcgaMa4AA54OK.jpg)

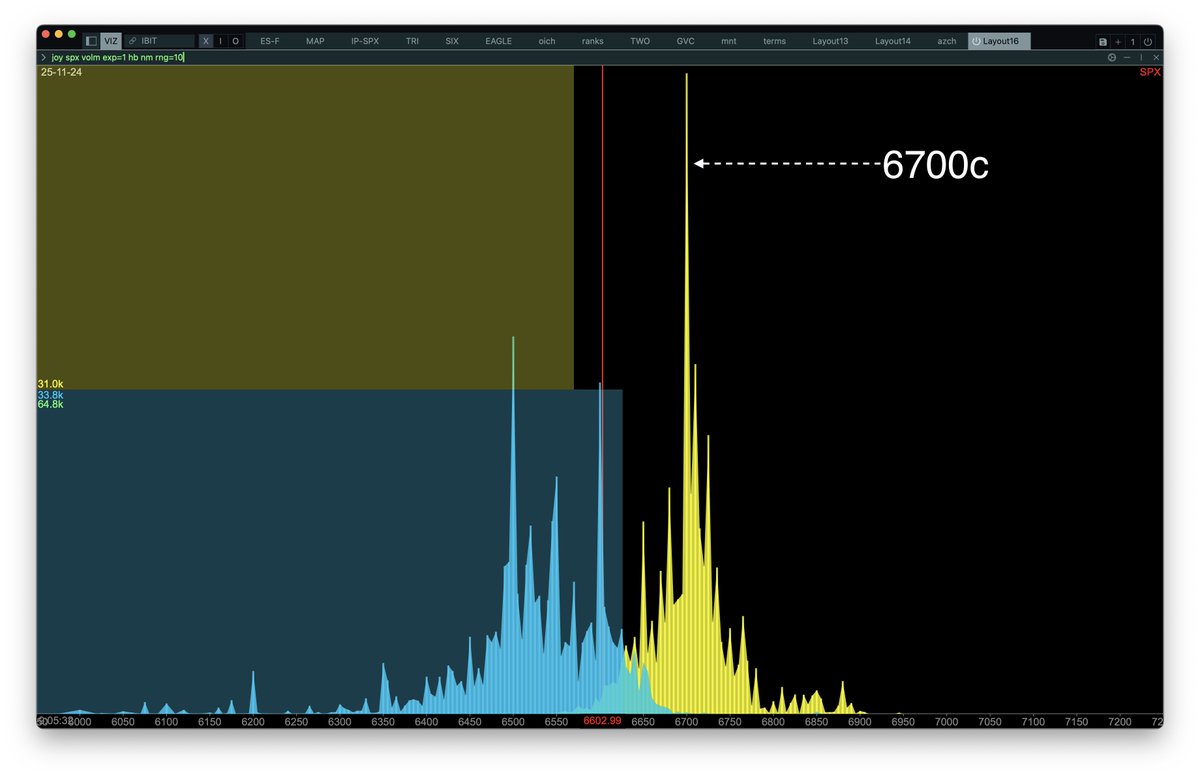

$SPX 0dte overnight volume: Strike 6850 Calls Command: joy spx volm exp=1 hb nm rng=10

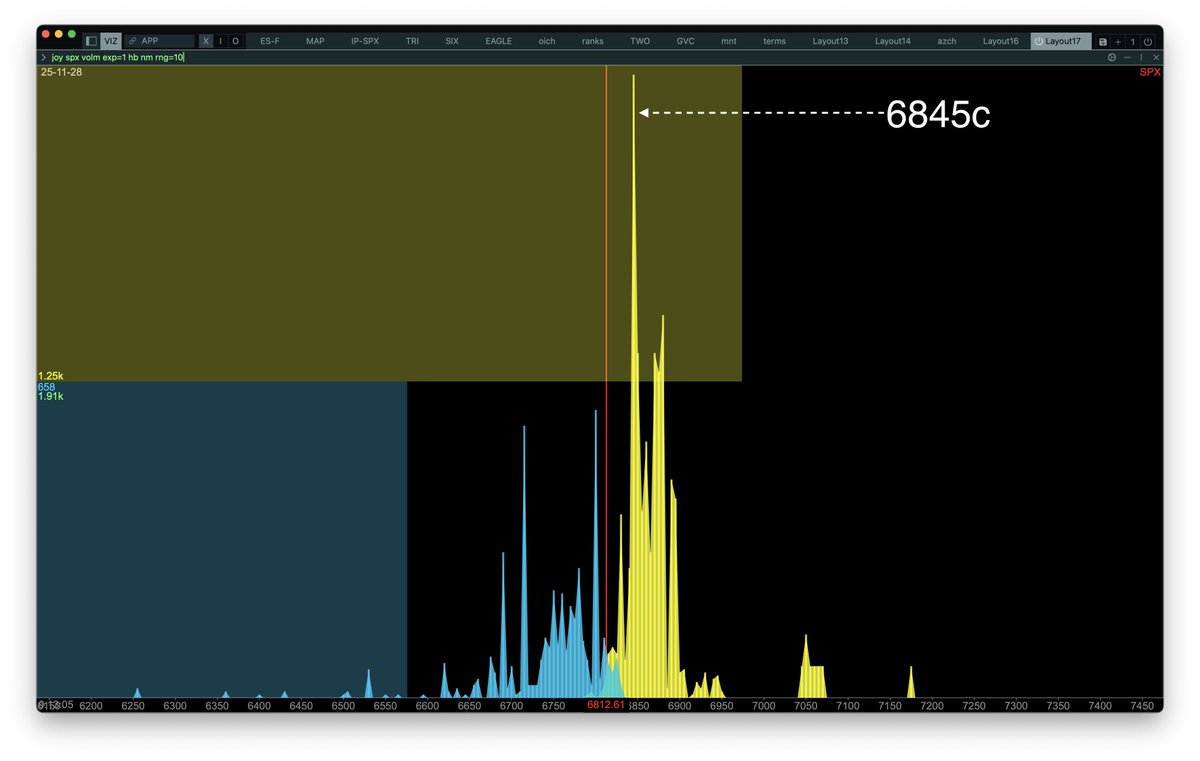

$SPX 0dte overnight volume: 6845 Calls Command: joy spx volm exp=1 hb nm rng=10

$SPX Market Data from @ConvexValue -Term structure remains low but has increased since Friday -Gamma surface shows ~ 6720 for cumulative flip as of Friday morning's run. -Overnight PM straddle is~ 33 points giving us an ON straddle range of [6816, 6882] -Current straddle as of…

![Yam_Trades's tweet image. $SPX

Market Data from @ConvexValue

-Term structure remains low but has increased since Friday

-Gamma surface shows ~ 6720 for cumulative flip as of Friday morning's run.

-Overnight PM straddle is~ 33 points giving us an ON straddle range of [6816, 6882]

-Current straddle as of…](https://pbs.twimg.com/media/G7FcS9Zb0AAeTQc.jpg)

![Yam_Trades's tweet image. $SPX

Market Data from @ConvexValue

-Term structure remains low but has increased since Friday

-Gamma surface shows ~ 6720 for cumulative flip as of Friday morning's run.

-Overnight PM straddle is~ 33 points giving us an ON straddle range of [6816, 6882]

-Current straddle as of…](https://pbs.twimg.com/media/G7FcUfrbwAASEy-.jpg)

![Yam_Trades's tweet image. $SPX

Market Data from @ConvexValue

-Term structure remains low but has increased since Friday

-Gamma surface shows ~ 6720 for cumulative flip as of Friday morning's run.

-Overnight PM straddle is~ 33 points giving us an ON straddle range of [6816, 6882]

-Current straddle as of…](https://pbs.twimg.com/media/G7FcXiFaUAAIejk.jpg)

![Yam_Trades's tweet image. $SPX

Market Data from @ConvexValue

-Term structure remains low but has increased since Friday

-Gamma surface shows ~ 6720 for cumulative flip as of Friday morning's run.

-Overnight PM straddle is~ 33 points giving us an ON straddle range of [6816, 6882]

-Current straddle as of…](https://pbs.twimg.com/media/G7FcgaMa4AA54OK.jpg)

$ES_F -40 ⚠️ Not the best futures opening. > put buying up (orange line) > call buying down (green line) > price down (white line) Command: flowchart /es:xcme cols=volm_call_bs,volm_put_bs,price

$ES_F is back! And its green +15! Almost complete blackout overnight. Command: flowchart /es:xcme cols=volm_call_bs,volm_put_bs,price

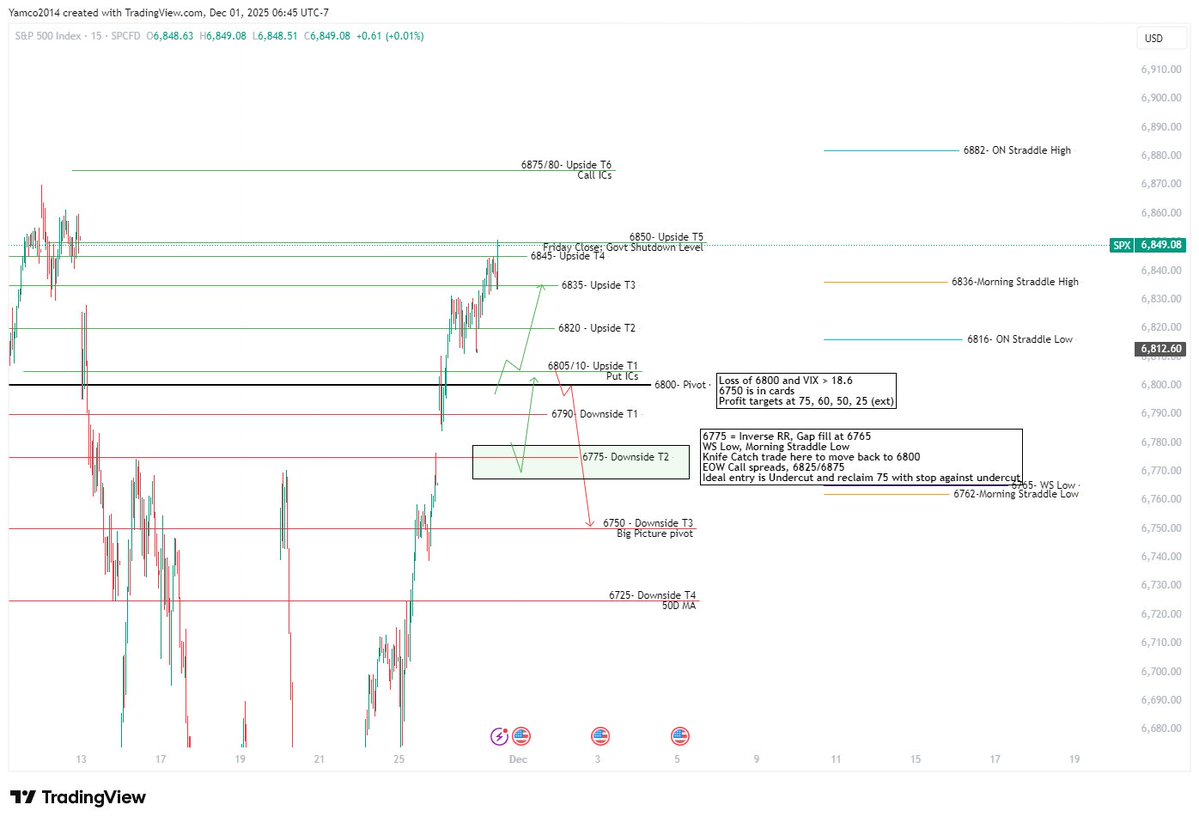

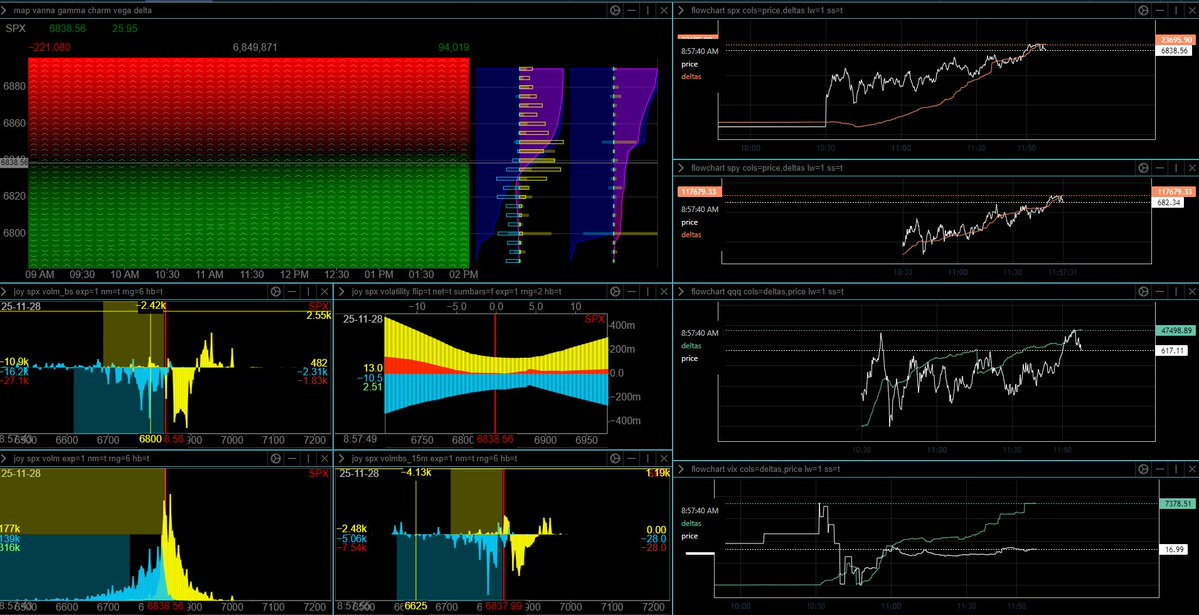

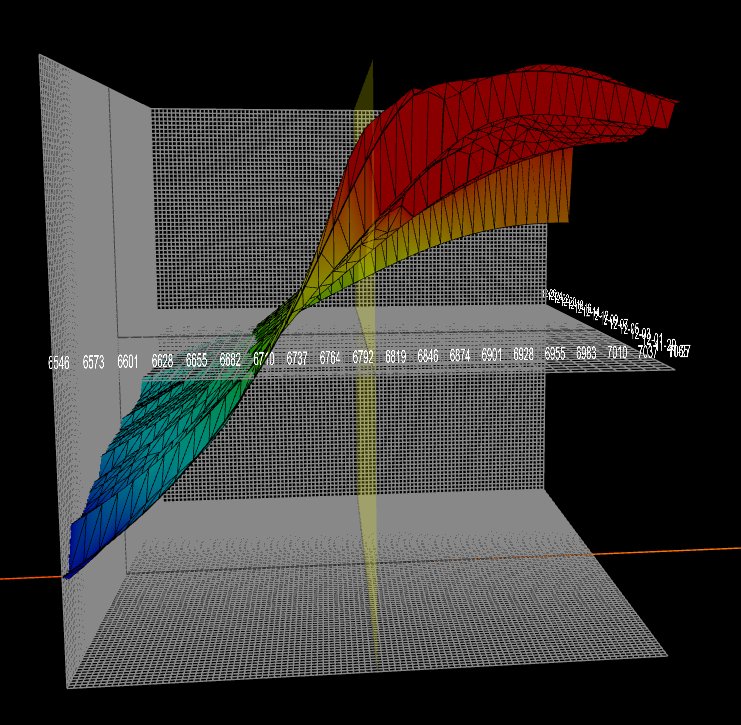

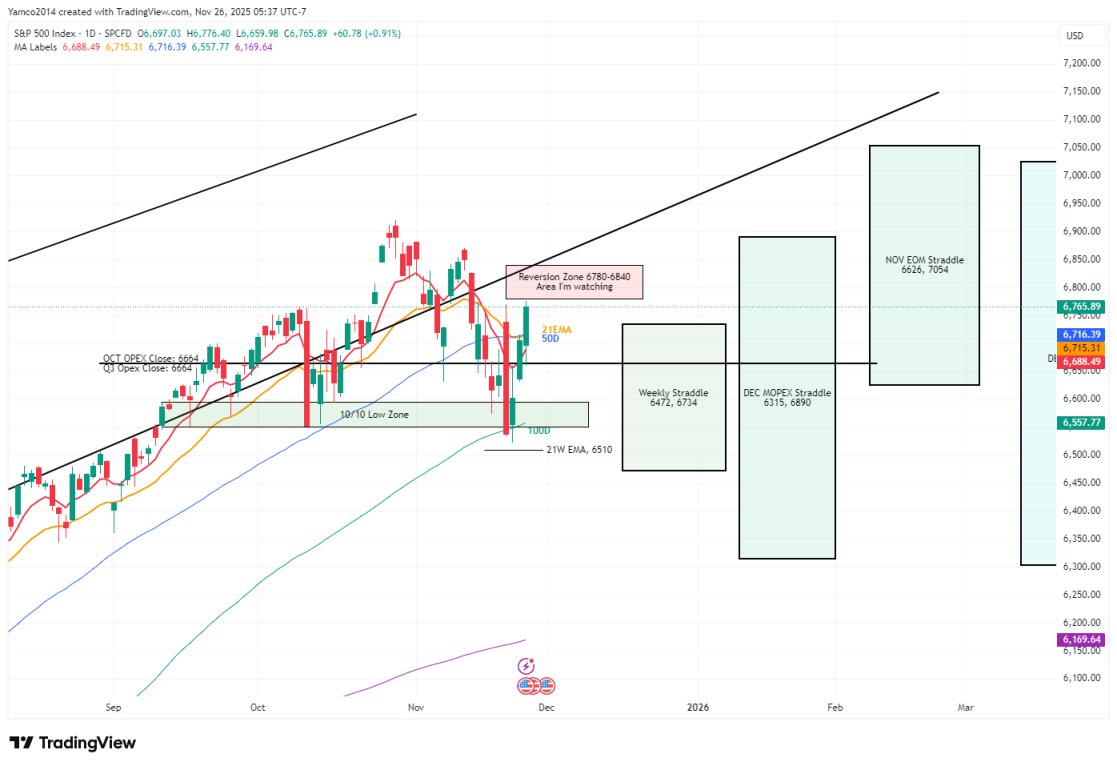

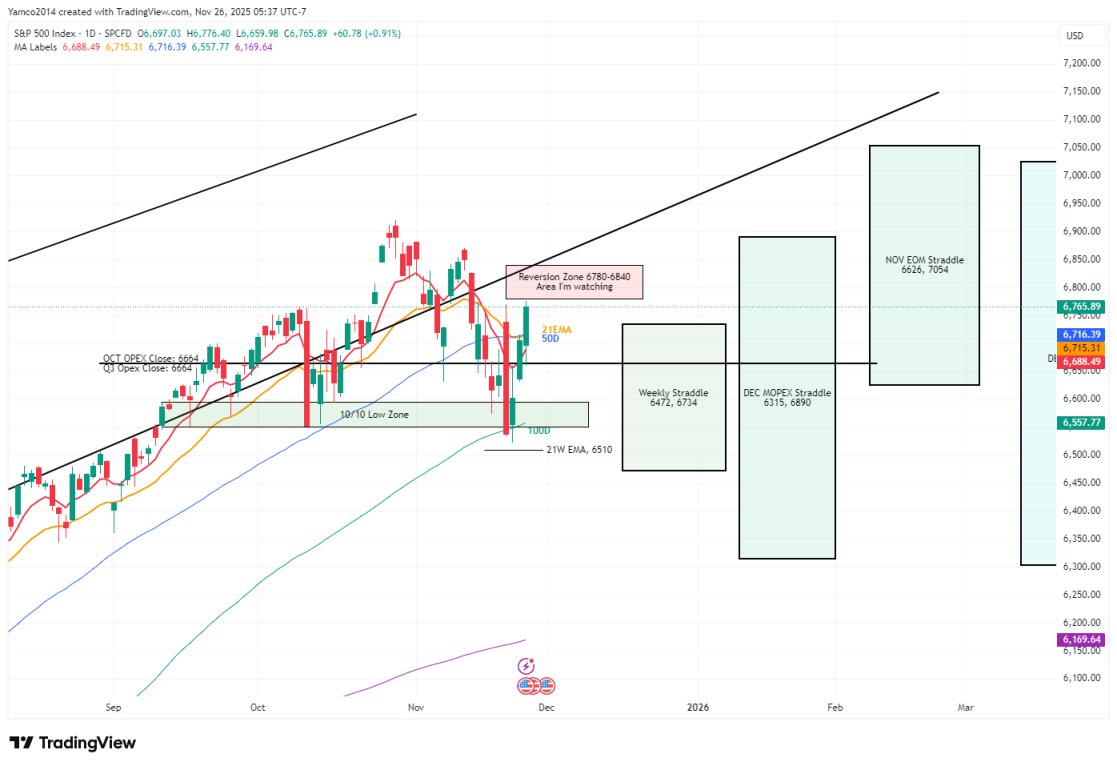

$SPX Week Ahead is out yamtrades.substack.com/p/positioning-… Market data from @ConvexValue Net positioning data from @OptionsDepth Straddle Weekly Straddle Range: 84 pt straddle implies a weekly range of [6765, 6933] Much smaller than the past few weeks Gamma Surface As of Friday’s open,…

![Yam_Trades's tweet image. $SPX

Week Ahead is out

yamtrades.substack.com/p/positioning-…

Market data from @ConvexValue

Net positioning data from @OptionsDepth

Straddle

Weekly Straddle Range: 84 pt straddle implies a weekly range of [6765, 6933]

Much smaller than the past few weeks

Gamma Surface

As of Friday’s open,…](https://pbs.twimg.com/media/G67qfeJaUAAQsz_.jpg)

![Yam_Trades's tweet image. $SPX

Week Ahead is out

yamtrades.substack.com/p/positioning-…

Market data from @ConvexValue

Net positioning data from @OptionsDepth

Straddle

Weekly Straddle Range: 84 pt straddle implies a weekly range of [6765, 6933]

Much smaller than the past few weeks

Gamma Surface

As of Friday’s open,…](https://pbs.twimg.com/media/G67qnELbkAAGLMl.png)

![Yam_Trades's tweet image. $SPX

Week Ahead is out

yamtrades.substack.com/p/positioning-…

Market data from @ConvexValue

Net positioning data from @OptionsDepth

Straddle

Weekly Straddle Range: 84 pt straddle implies a weekly range of [6765, 6933]

Much smaller than the past few weeks

Gamma Surface

As of Friday’s open,…](https://pbs.twimg.com/media/G67qt7MaAAAQqvp.jpg)

![Yam_Trades's tweet image. $SPX

Week Ahead is out

yamtrades.substack.com/p/positioning-…

Market data from @ConvexValue

Net positioning data from @OptionsDepth

Straddle

Weekly Straddle Range: 84 pt straddle implies a weekly range of [6765, 6933]

Much smaller than the past few weeks

Gamma Surface

As of Friday’s open,…](https://pbs.twimg.com/media/G67rCT0bkAM2Uq6.png)

Top 20 by Volume of Call Buys (command below) $SPY $NVDA $TSLA $QQQ $SLV $INTC $META $SPX $MSTR $AAPL $GOOGL $IBIT $IWM $AMZN $COIN $GME $MSFT $BMNR $MARA $AMD Command: flow cols=value,price,change,volm_call_buy,volm_put_buy orderby=volm_call_buy limit=20

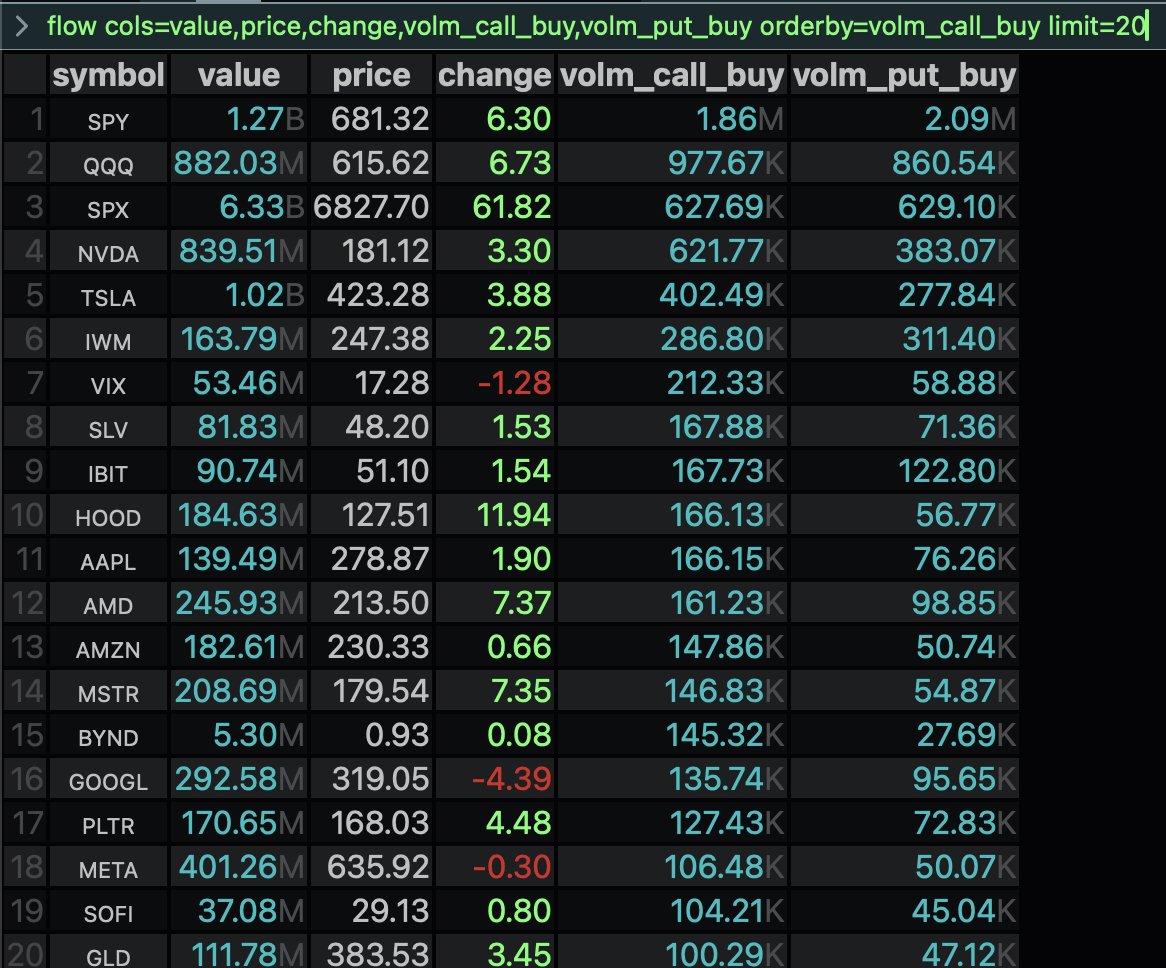

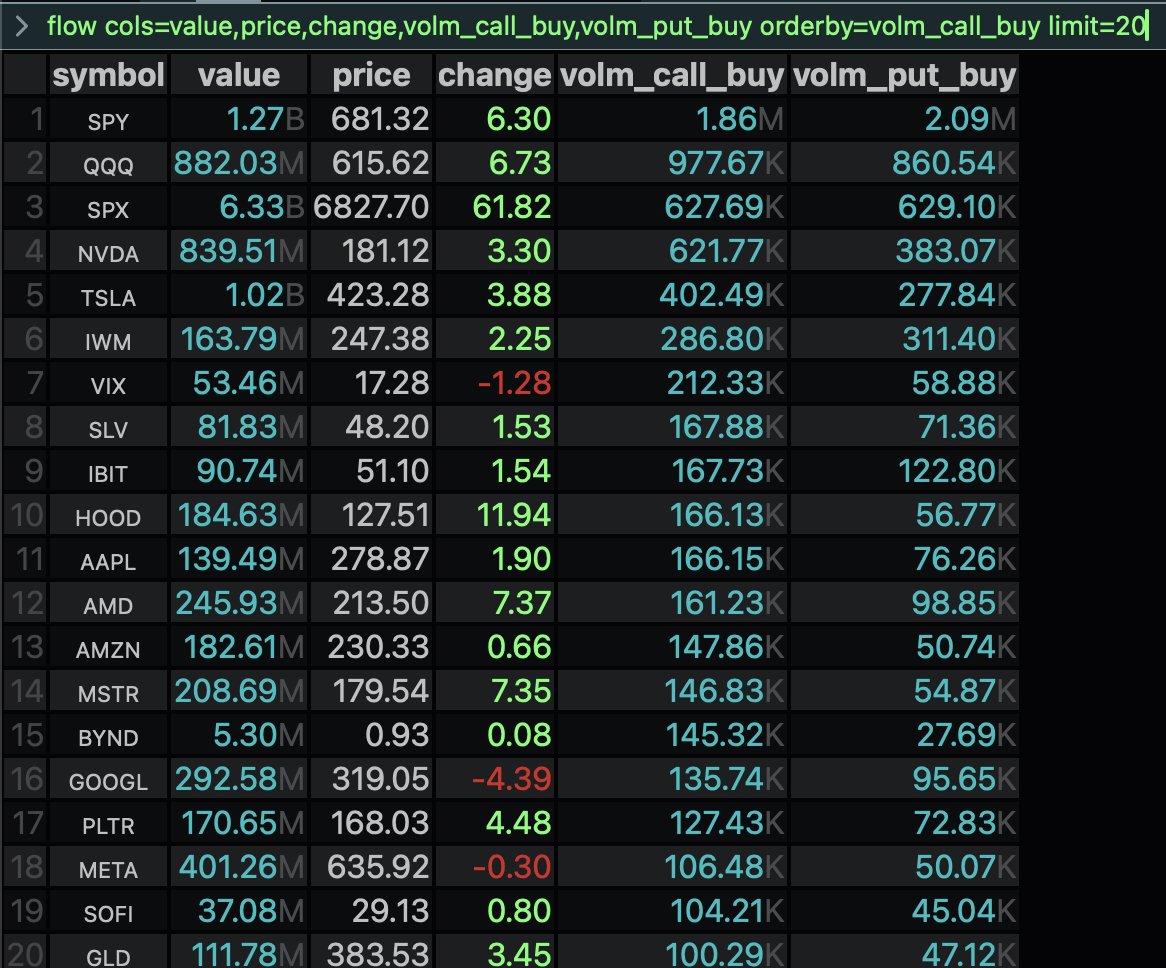

Top 20 by Volume of Call Buys (command below) $SPY $QQQ $SPX $NVDA $TSLA $IWM $VIX $SLV $IBIT $HOOD $AAPL $AMD $AMZN $MSTR $BYND $GOOGL $PLTR $META $SOFI $GLD Command: flow cols=value,price,change,volm_call_buy,volm_put_buy orderby=volm_call_buy limit=20

$SPX How I saw the day from my note below. 0DTE from @OptionsDepth -IC has taken a break from getting punched in RTY and is back in SPX today. -Wonder if they lose with a green monthly close.... - moonshot but would be interesting to see NOV with a massive wick New gamma…

$SPX Even lower volume today with half day on Black Friday, EOM flows last 30 minutes - that's the volume time period. Market Data from @ConvexValue -Term structure remains low -Gamma surface shows ~ 6700 for cumulative flip and peak around 6850 into much higher (relatively…

$SPX 0dte overnight volume: 6845 Calls Command: joy spx volm exp=1 hb nm rng=10

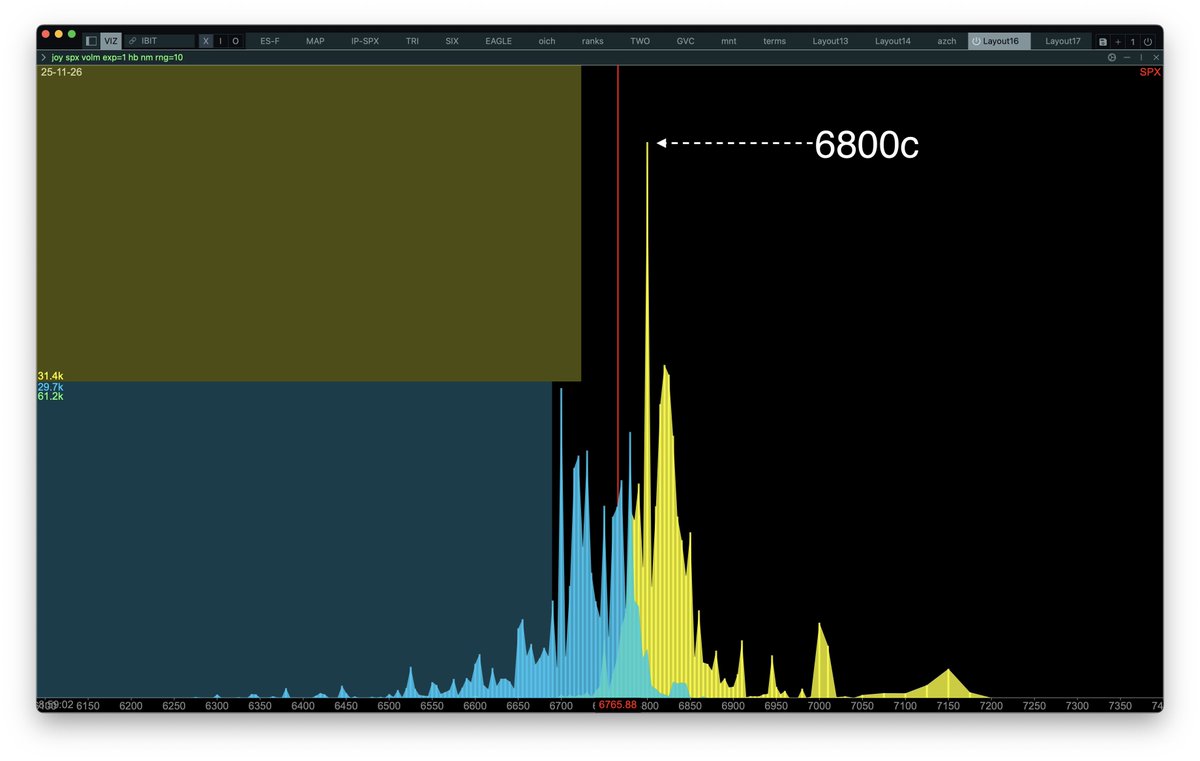

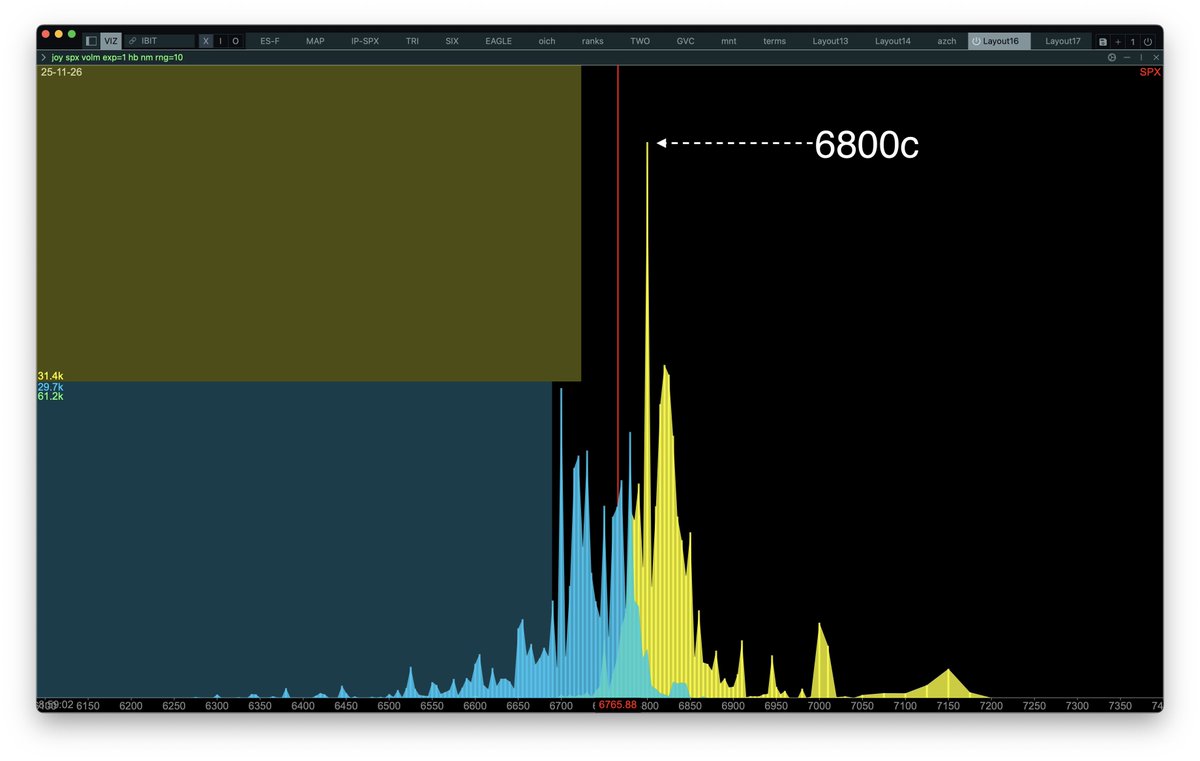

$SPX 0dte overnight volume: 6800 Calls 🥳 6800 back in the game. Note how in the quoted post just recently we were in 6700. Command: joy spx volm exp=1 hb nm rng=10

$ES_F is back! And its green +15! Almost complete blackout overnight. Command: flowchart /es:xcme cols=volm_call_bs,volm_put_bs,price

$ES_F +8 Overnight rally, just now dipped along with a spike in put buying. Command: flowchart /es:xcme cols=volm_call_bs,volm_put_bs,price

$SPX Even lower volume today with half day on Black Friday, EOM flows last 30 minutes - that's the volume time period. Market Data from @ConvexValue -Term structure remains low -Gamma surface shows ~ 6700 for cumulative flip and peak around 6850 into much higher (relatively…

This has been affecting $ES_F all night btw.

Happy Thanksgiving! I am thankful for all of you! I wish you and your loved ones the best!

Top 20 by Volume of Call Buys (command below) $SPY $QQQ $SPX $NVDA $TSLA $IWM $VIX $SLV $IBIT $HOOD $AAPL $AMD $AMZN $MSTR $BYND $GOOGL $PLTR $META $SOFI $GLD Command: flow cols=value,price,change,volm_call_buy,volm_put_buy orderby=volm_call_buy limit=20

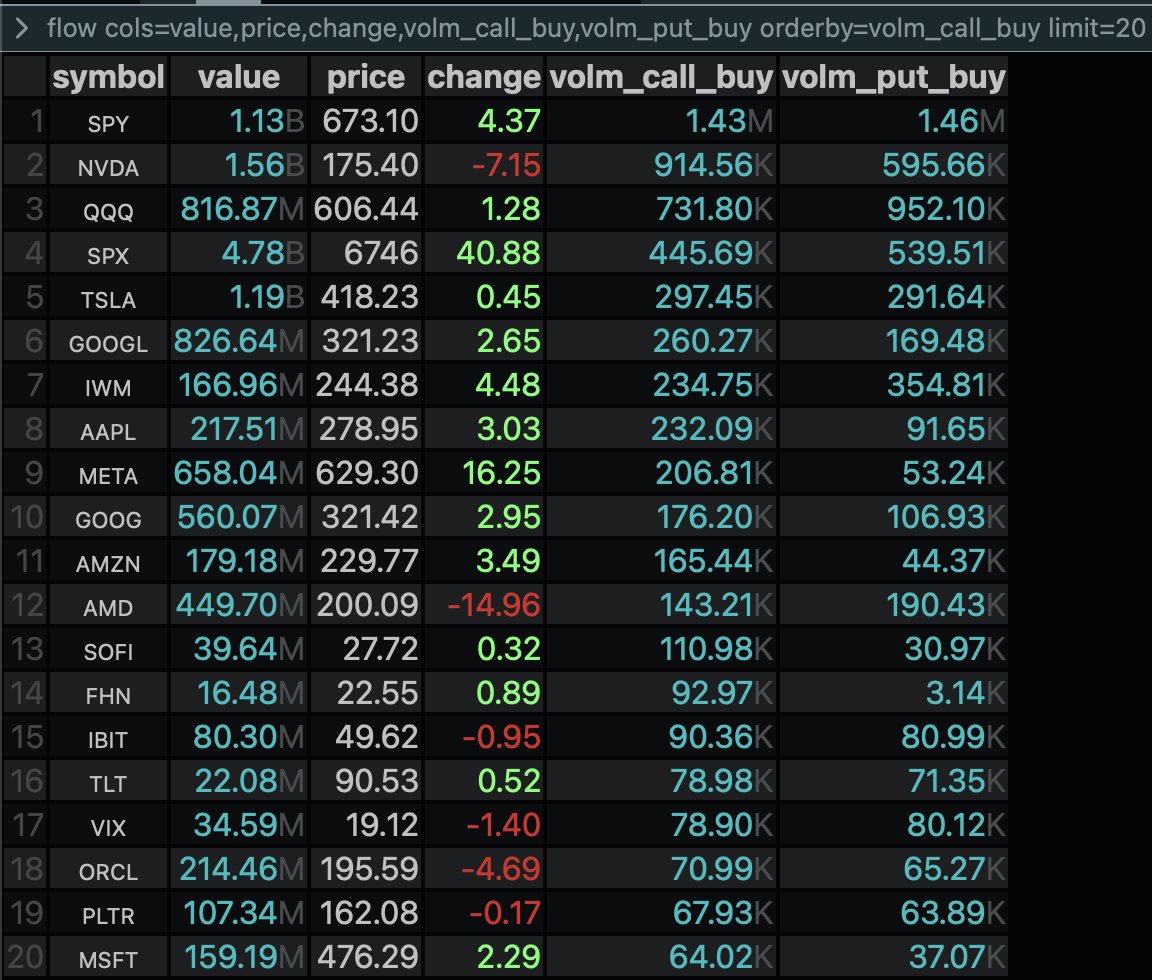

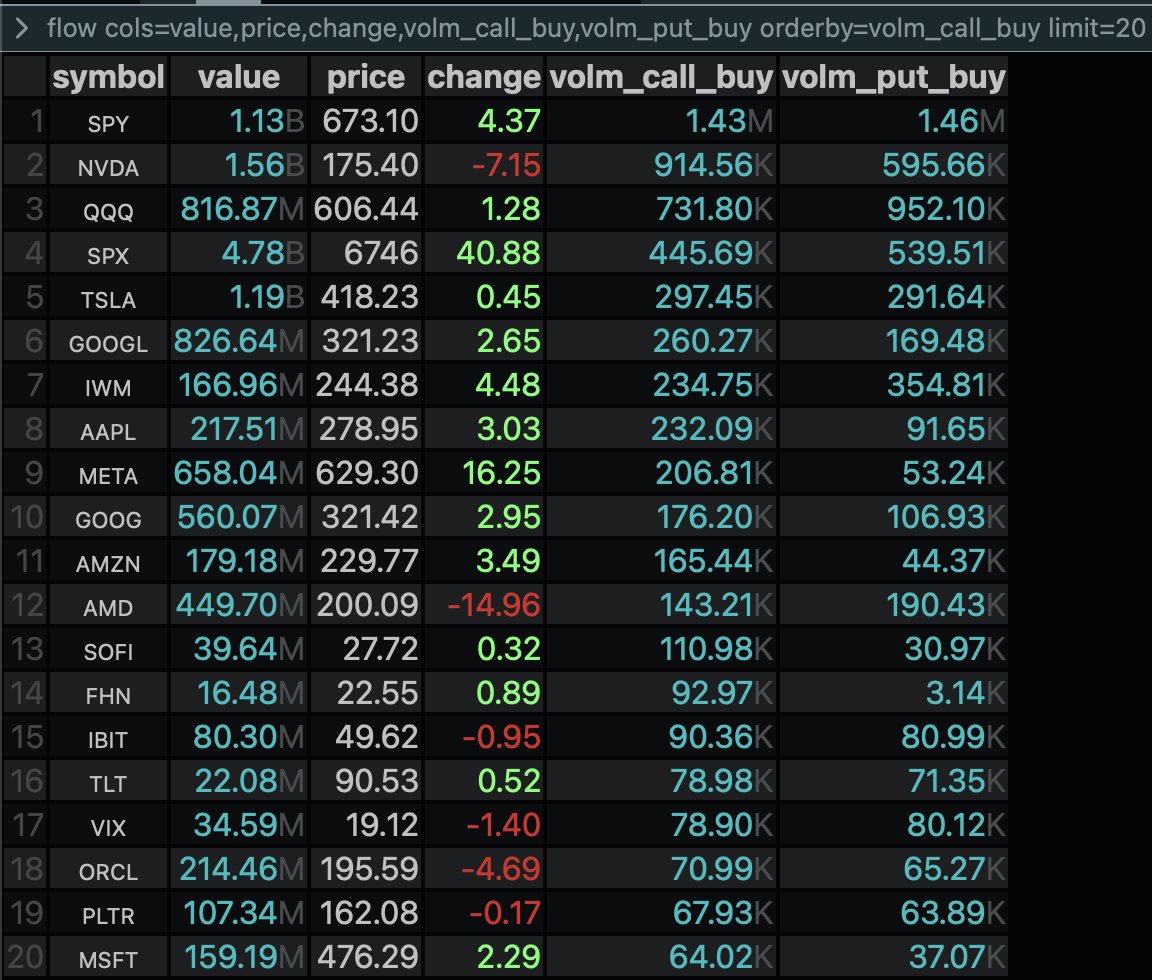

Top 20 by Volume of Call Buys: (command below) $SPY $NVDA $QQQ $SPX $TSLA $GOOGL $IWM $AAPL $META $GOOG $AMZN $AMD $SOFI $FHN $IBIT $TLT $VIX $ORCL $PLTR $MSFT Command: flow cols=value,price,change,volm_call_buy,volm_put_buy orderby=volm_call_buy limit=20

$SPX Mid-Morning Update - Went to lunch this AM and missed the first 90 minutes or so. How I typed up my morning note Gamma surface from @ConvexValue -Peak gamma vic 20/25 - I think that's it on the day if we even go that high Net positioning from @OptionsDepth -If you want…

$SPX Even lower volume today Market Data from @ConvexValue -Future volatility expectations (Term Structure) has collapsed again. -In Premarket, We're on a steep gamma surface with EOM and well above cumulative gamma flip -Overnight PM straddle is~ 34 points giving us an ON…

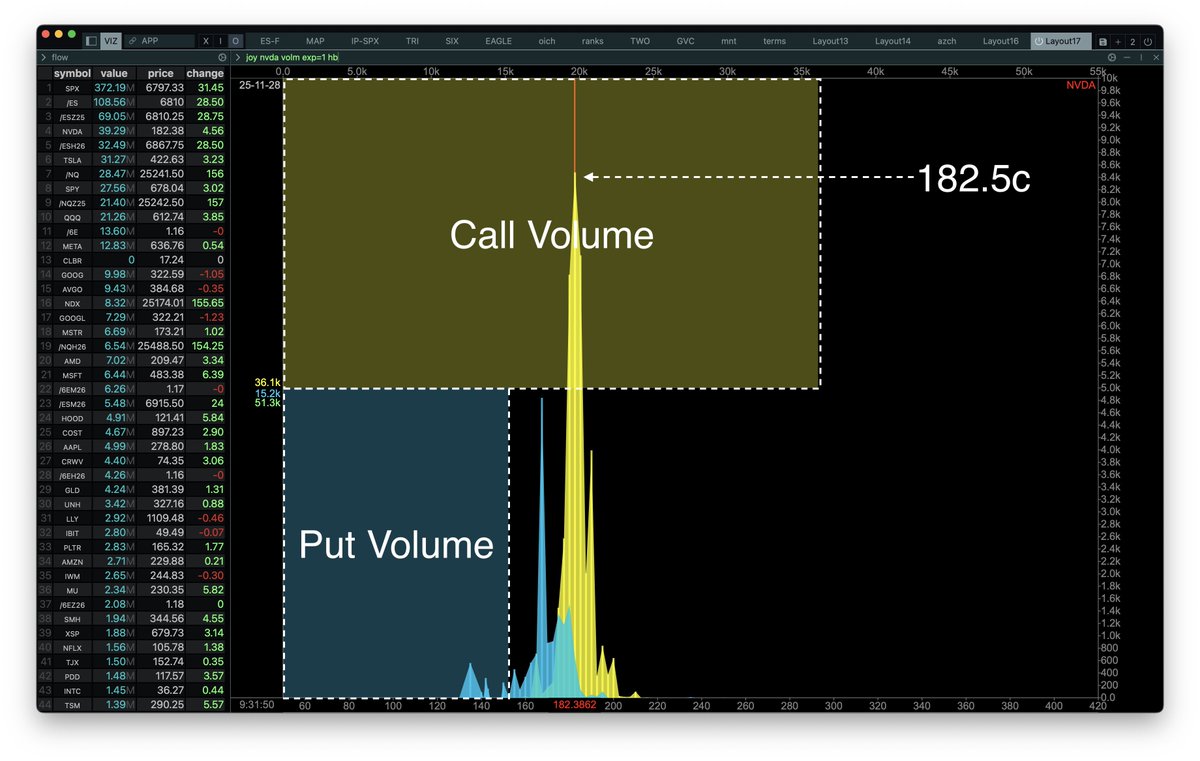

$NVDA - strong volume at the open (highest single-stock) Here 11/28 expiration. > 2x calls than puts > Top volume at 182.5 calls (but 185 rising rapidly) Command: joy nvda volm exp=1 hb

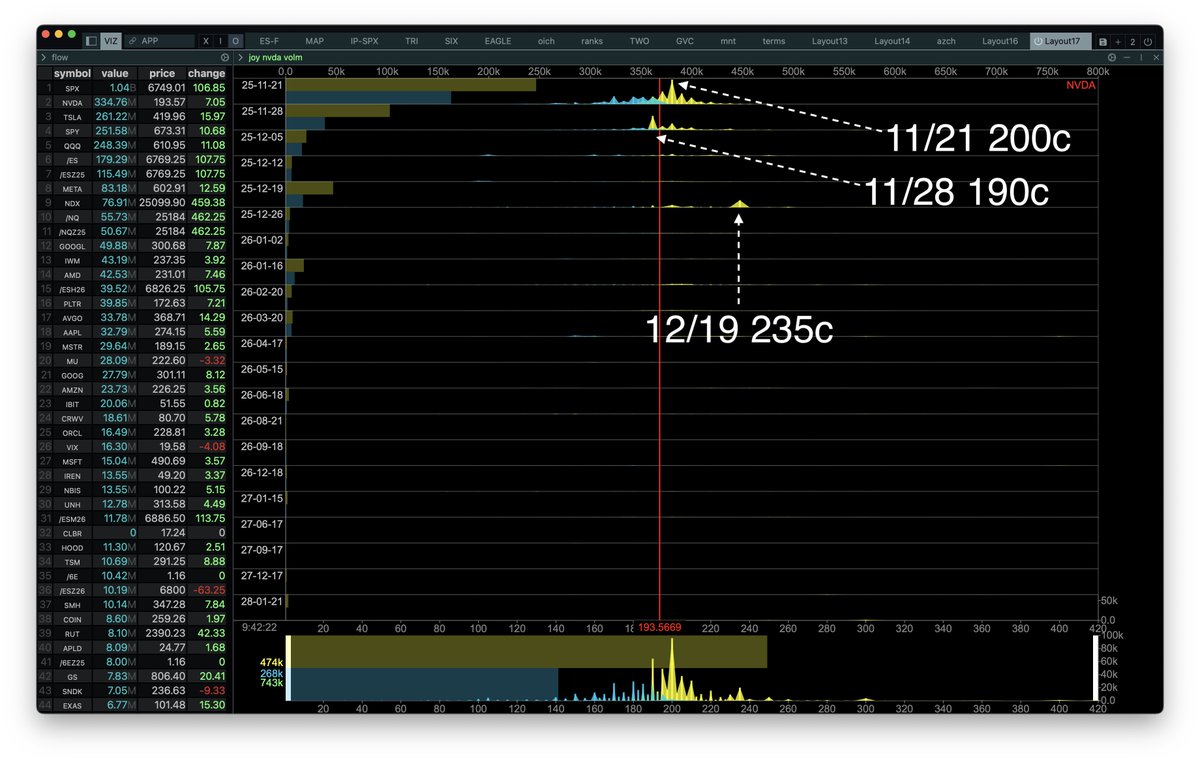

$NVDA volume 11/21 strike 200 calls (otm) 11/28 strike 190 calls (itm) 12/19 strike 235 calls (otm) Command: joy NVDA volm

$SPX 0dte overnight volume: 6800 Calls 🥳 6800 back in the game. Note how in the quoted post just recently we were in 6700. Command: joy spx volm exp=1 hb nm rng=10

$SPX 0dte overnight volume: 6700 Calls 🏆 Command: joy spx volm exp=1 hb nm rng=10

$SPX Even lower volume today Market Data from @ConvexValue -Future volatility expectations (Term Structure) has collapsed again. -In Premarket, We're on a steep gamma surface with EOM and well above cumulative gamma flip -Overnight PM straddle is~ 34 points giving us an ON…

$ES_F +8 Overnight rally, just now dipped along with a spike in put buying. Command: flowchart /es:xcme cols=volm_call_bs,volm_put_bs,price

$ES_F -2 Recovering from an overnight dip. Net call buying (green) rising in the past hour. Command: flowchart /es:xcme cols=volm_call_bs,volm_put_bs,price

Top 20 by Volume of Call Buys: (command below) $SPY $NVDA $QQQ $SPX $TSLA $GOOGL $IWM $AAPL $META $GOOG $AMZN $AMD $SOFI $FHN $IBIT $TLT $VIX $ORCL $PLTR $MSFT Command: flow cols=value,price,change,volm_call_buy,volm_put_buy orderby=volm_call_buy limit=20

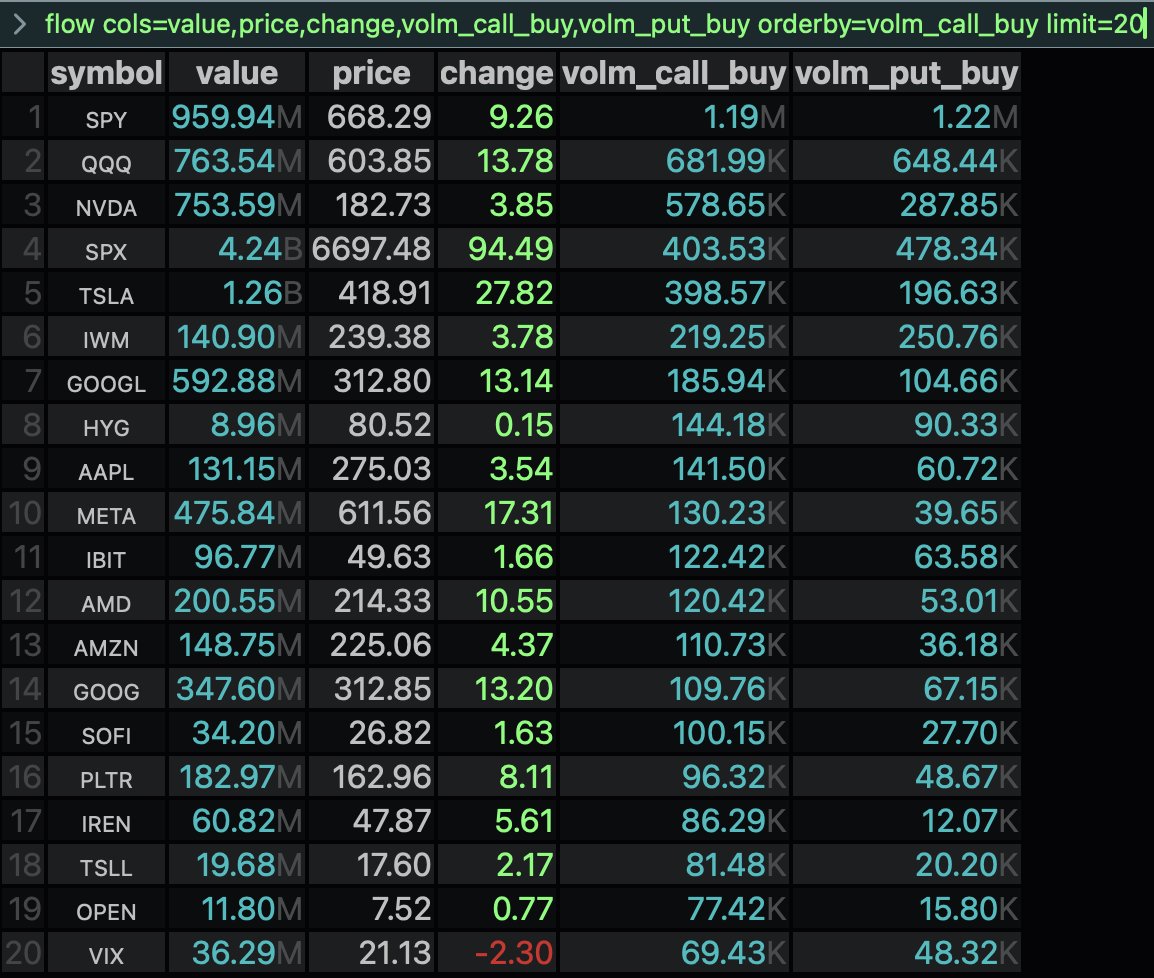

Top 20 by Volume of Call Buys: (Command below) $SPY $QQQ $NVDA $SPX $TSLA $IWM $GOOGL $HYG $AAPL $META $IBIT $AMD $AMZN $GOOG $SOFI $PLTR $IREN $TSLL $OPEN $VIX Command: flow cols=value,price,change,volm_call_buy,volm_put_buy orderby=volm_call_buy limit=20

United States Trends

- 1. #ALLOCATION 209K posts

- 2. The BIGGЕST 447K posts

- 3. #JUPITER 209K posts

- 4. #GMMTVxTPDA2025 541K posts

- 5. Good Tuesday 27.5K posts

- 6. #GivingTuesday 8,692 posts

- 7. Kanata 23.7K posts

- 8. rUSD N/A

- 9. #AreYouSure2 50.6K posts

- 10. JOSSGAWIN AT TPDA2025 78.3K posts

- 11. JIMMYSEA TPDA AWARD 2025 57.6K posts

- 12. Snow Day 7,497 posts

- 13. Dart 38.8K posts

- 14. Lakers 49.2K posts

- 15. Costco 28.8K posts

- 16. Bron 26.5K posts

- 17. Hololive 16.1K posts

- 18. Pentagon 55.5K posts

- 19. Penny 22.9K posts

- 20. Dillon Brooks 8,102 posts

You might like

-

Kris Sidial🇺🇸

Kris Sidial🇺🇸

@Ksidiii -

SpotGamma

SpotGamma

@spotgamma -

Trading Volatility

Trading Volatility

@TradeVolatility -

Cem Karsan 🥐

@jam_croissant -

HangukQuant

HangukQuant

@HangukQuant -

Kris

Kris

@KrisAbdelmessih -

Jay Soloff

Jay Soloff

@jsoloff -

cephalopod

cephalopod

@macrocephalopod -

Scott

Scott

@VolatilityWiz -

SqueezeMetrics

SqueezeMetrics

@SqueezeMetrics -

Hari P. Krishnan

Hari P. Krishnan

@HariPKrishnan2 -

Double Chin Capital

Double Chin Capital

@OffTheRunTrades -

ConvexityMaven

ConvexityMaven

@ConvexityMaven -

Corey Hoffstein 🏴☠️

Corey Hoffstein 🏴☠️

@choffstein -

Jason C. Buck 🪳🏴☠️

Jason C. Buck 🪳🏴☠️

@jasoncbuck

Something went wrong.

Something went wrong.