You might like

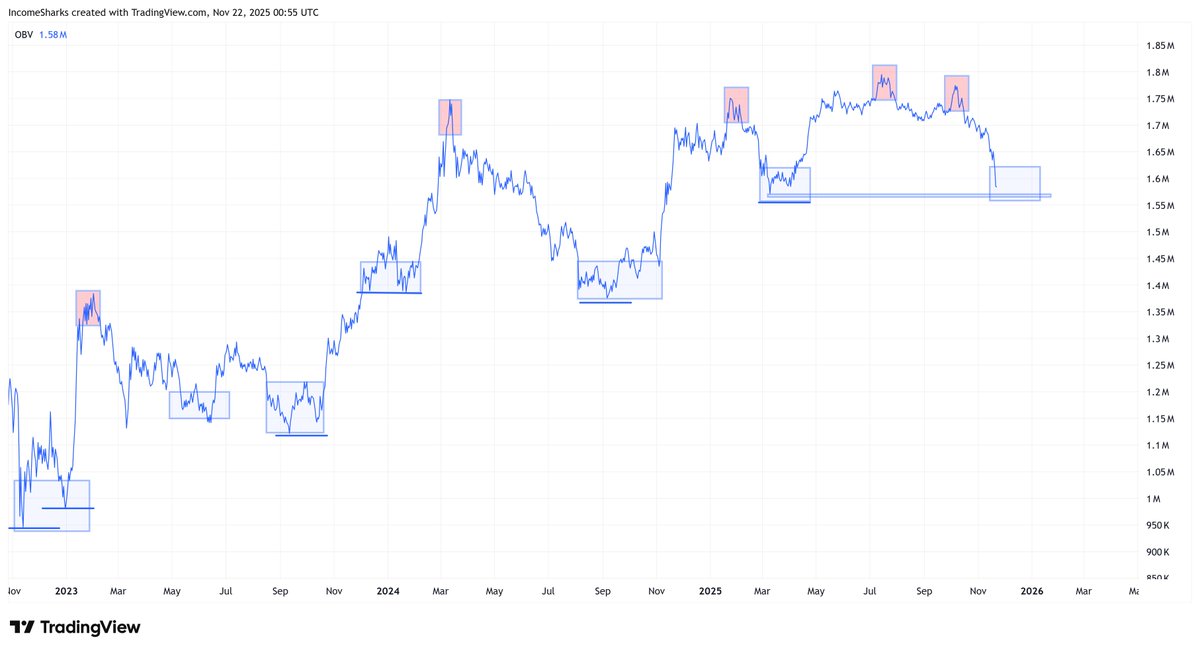

$BTC - This shouldn't bother long term holders but will terrify those overleveraged or impatient.

$BTC - Squiggles playing out perfectly so far. We got the relief bounce that gets people to FOMO buy and now the pull back which gets them to panic sell before forming the actual bottom that even the bulls won't want to buy.

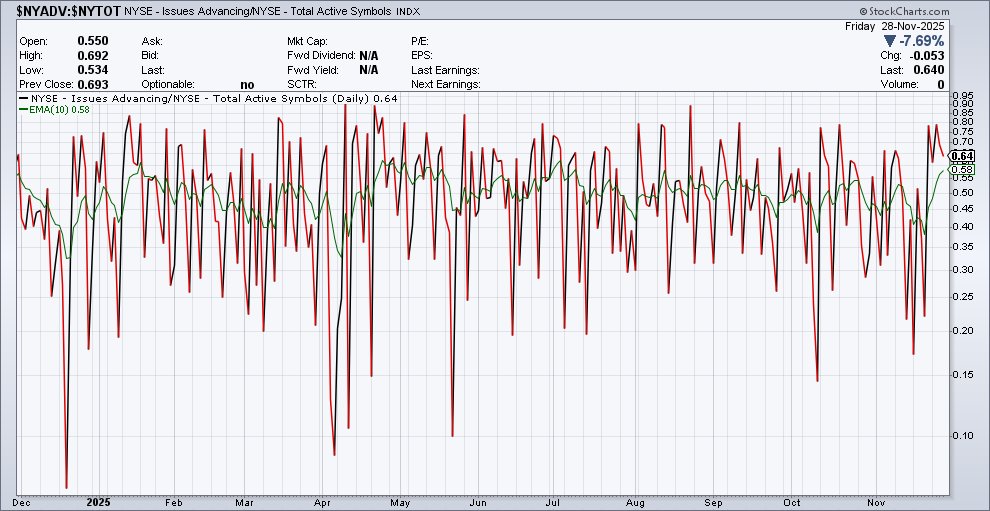

**Sunday Morning Thoughts for the First Week of December** Please read, and bookmark. I once again issue a warning for the first week of December, as I did in November. We witnessed the first two weeks of November marked by the rampant surge of the $VIX, the proliferation of…

THE CHART THAT SHOULD TERRIFY EVERY PORTFOLIO MANAGER ON EARTH Japan’s 10 Year Government Bond Yield just hit 1.84%. The highest since April 2008. Up 11.19% in a single session. You need to understand what this means. For three decades, Japan was the anchor. Zero rates.…

BREAKING: Japan's 10Y Government Bond Yield surges to 1.84%, its highest level since April 2008. This chart is concerning to say the least.

Sunday night futures open and immediately Japanese bond yields spike higher. How this impacts Yen carry (liquidity): Left — USD/JPY Right — Bitcoin

Over $2.8B traded right at $177 on $NVDA into Friday’s close. Huge level, trade was at the ASK $SPY $QQQ

BANK OF AMERICA SEES 5 TAILWINDS FOR U.S. ECONOMY IN 2026 Bank of America expects 2026 U.S. growth of 2.4%, supported by Five key tailwinds: 1. OBBBA stimulus: Adds 0.3–0.4pp to GDP via consumer and capex support. 2. Fed cuts: Lagged effects likely to boost activity in 2H26. 3.…

Experts sound the alarm as electricity prices surge across the US: 'It's sort of like the new price of eggs' #MacroEdge

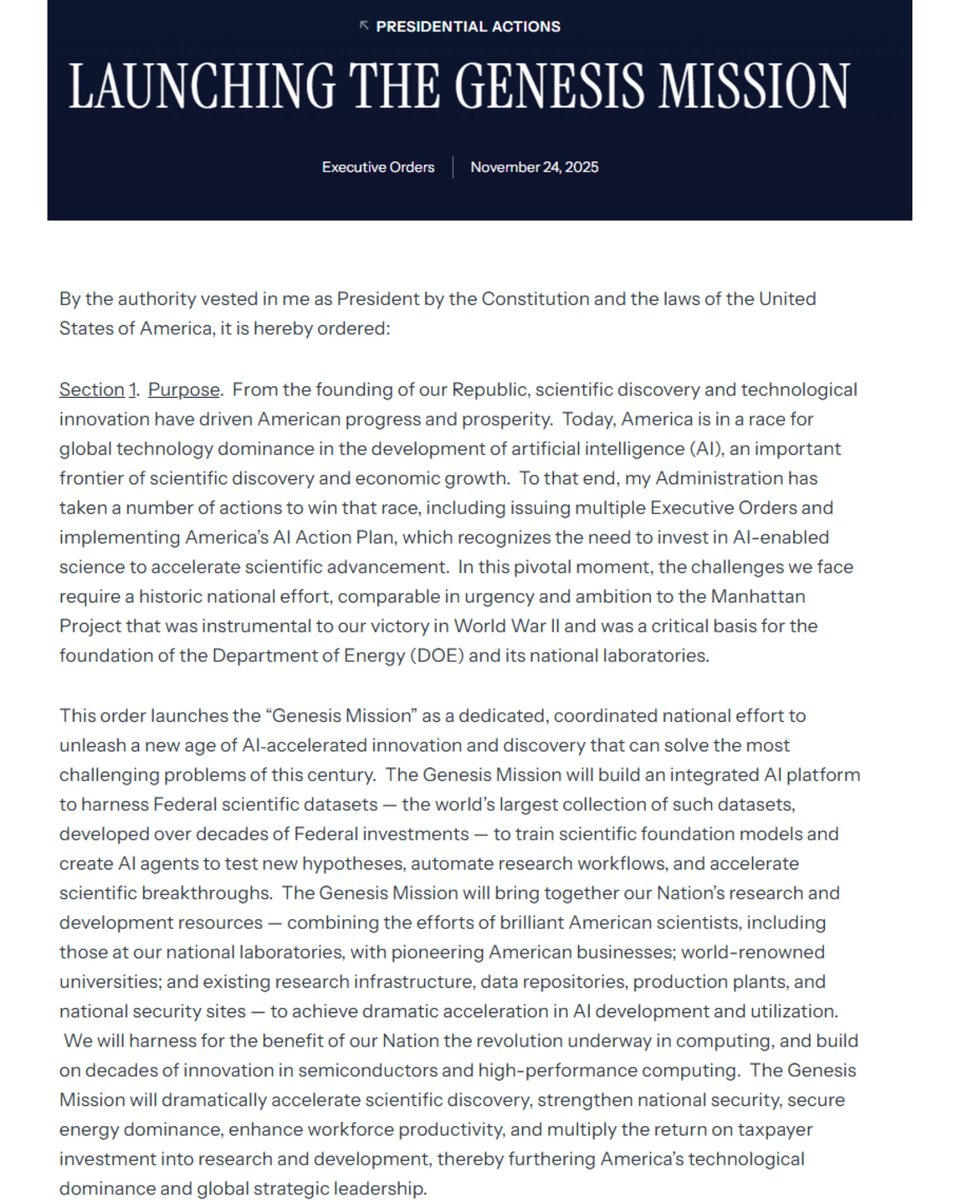

🚨 JUST IN: In a huge move, President Trump signs executive order launching a national Artificial Intelligence initiative, modeled after the MANHATTAN PROJECT in terms of its ambition Trump has launched the "Genesis Mission," a coordinated effort to surge AI "innovation and…

*PRESIDENT TRUMP SIGNS 'GENESIS MISSION' EXECUTIVE ORDER, CALLING FOR THE NATION TO MAKE A COORDINATED EFFORT TO DOMINATE THE AI INDUSTRY, COMPARING IT TO THE MANHATTAN PROJECT Full text of the executive order below: By the authority vested in me as President by the…

People don't get it This is national security and functionally an arms race If you think the government is going to let Mag7 default, you're cooked

BREAKING: Amazon, $AMZN, to invest up to $50 billion to expand AI and supercomputing infrastructure for US government agencies

$ASTS we are seeing lots of confluence on the latest low. Hit the uptrend from May 2024. Retraced to the 61.8% fib level from 2025's low which is also the 52 week low. Found support at the largest volume shelf in this cluster similar to the June low. Also filled a gap from 9/30…

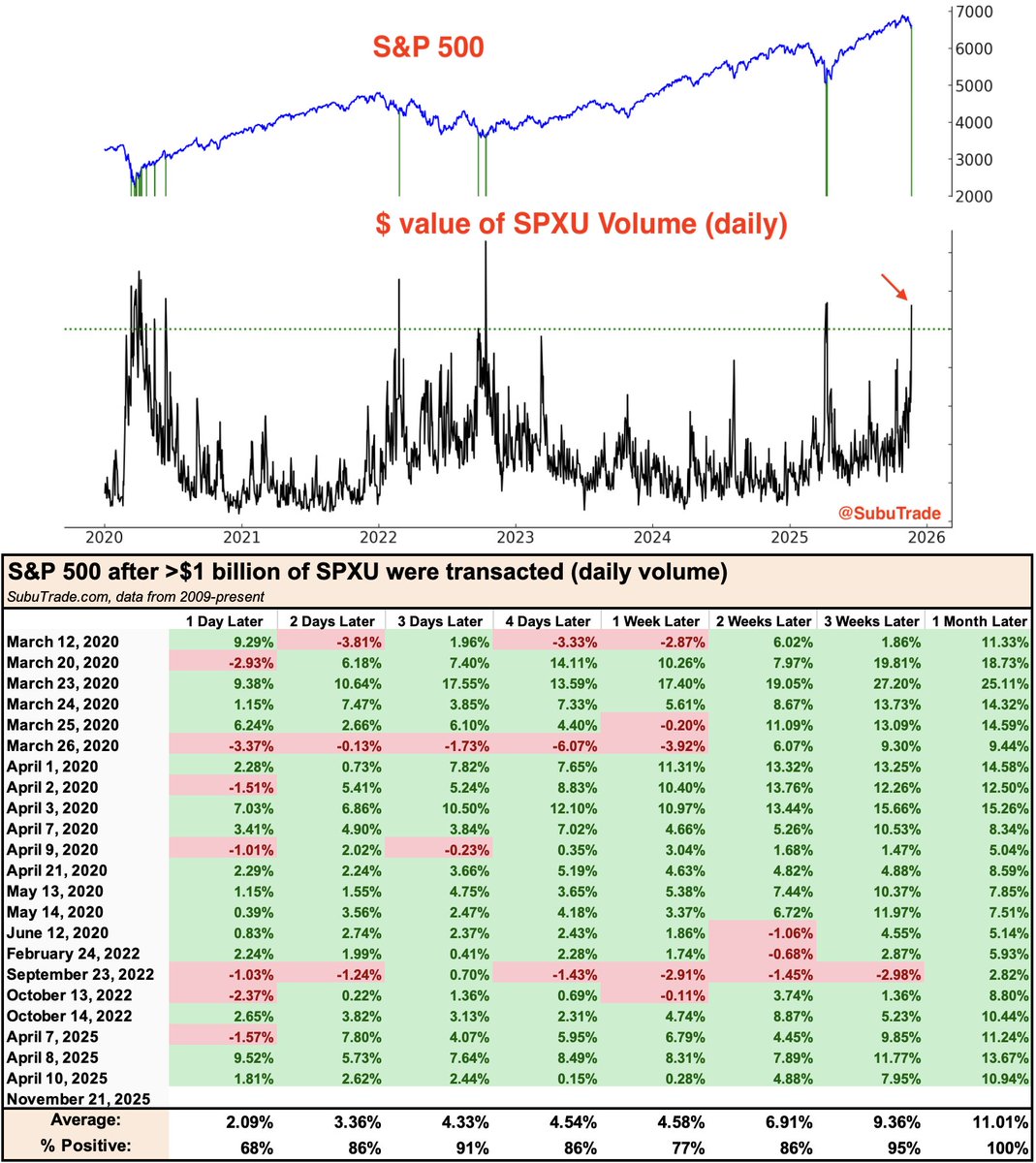

Huge bets against $SPX? On Friday, more than $1 billion of $SPXU were transacted. (SPXU is -3x short S&P 500 ETF) Past spikes marked major bottoms: 1. COVID bottom 2. 2022 bear market's first wave bottom 3. October 2022 (bear market bottom) 4. April 2025 (Liberation Day…

🚨BREAKING NEWS: White House rumored to be supportive of extending ACA subsidies for 2 years. $UNH $ELV $CI $CVS $HUM $MOH $OSCR $SPY $CNC

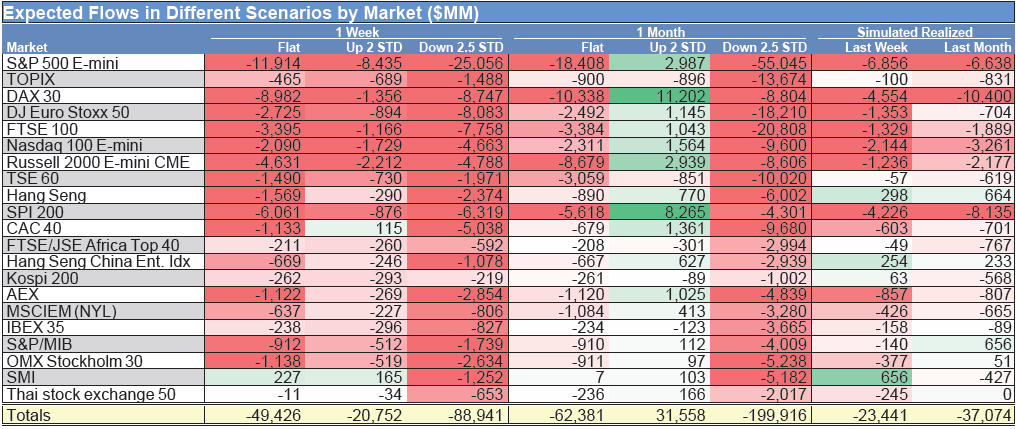

CTA LEVELS - BIG RISK HERE FOR US EQUITY FUTURES Over 1 week, with market: flat = $18.6B TO SELL up = $12.4B TO SELL down = $34.5B TO SELL Over 1 month, with market: flat = $29.4B TO SELL up = $7.5B TO BUY down = $73.3B TO SELL KEY LEVELS (SPX) ST 6710 MT 6458 LT 6021

$BTC Cartwheel Concept. 1) Note the recent 3 compression episodes of 30% from 2024 to today 2) The first one took the longest, look at the compression angle, the current is fastest and should provide the highest snapback. 3) I depict at the bottom how this increasing compression…

$BMNR Let’s do some math. No way around the fact this has been a brutal selloff. Based on the 384.07 million shares outstanding (as of November 20, 2025), the current stock price of $26.00 is now almost exactly aligned with the Net Asset Value per share $25.31 based on 3.6mm…

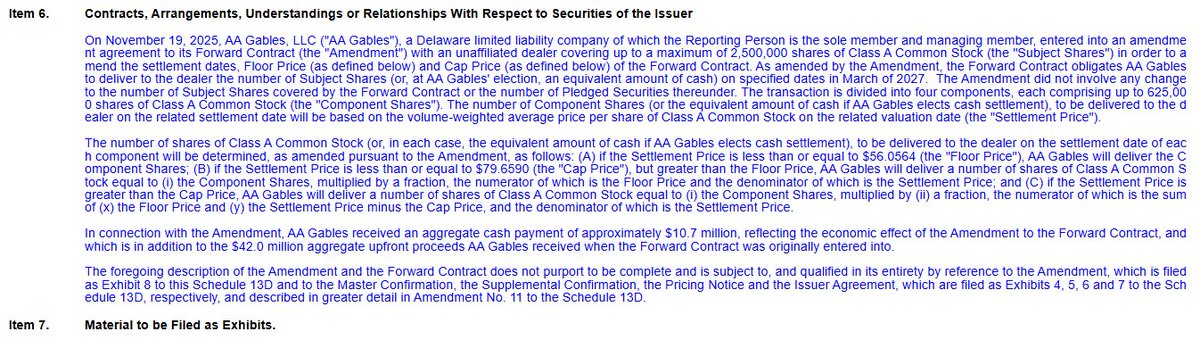

$ASTS Here’s another nugget, the new forward agreement has a floor price of $56.0564 and a cap price of $79.659. The last agreement Abel had, had a floor price of $17.50 and a cap price of $34.50. That agreement was put together Nov 20, 2024. The stock never traded below…

As I predicted this trade/flow was Abel rolling his $ASTS collar. Moved it to $56-$80 for March 2027. Implying, that he has no plans to sell anymore before March 2027. He is a true owner, takes no salary, no share compensation & has only used 2.5m shares (3% holdings) to get…

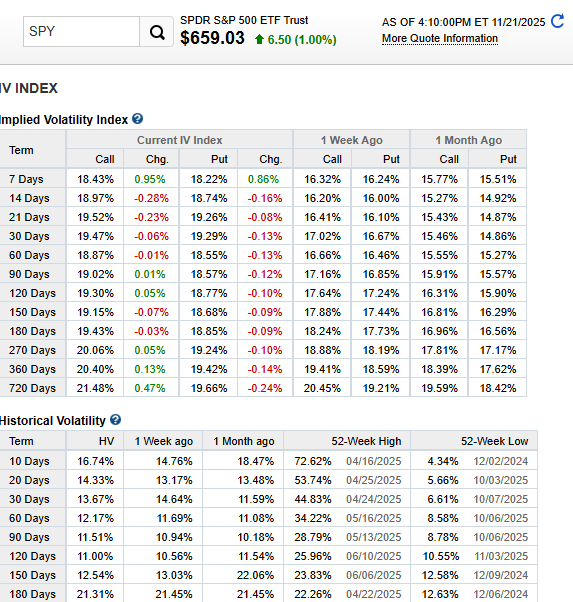

$SPY 1️⃣ Put/Call Ratio = 1.45 (Bearish) This is high. But key: $SPY today closed +1.00% (green day) → High put/call on an up day = hedges, not bearish conviction → Dealers short gamma absorbing flows → Forced hedging, not directional shorts This exact setup usually…

$BTC - Let's say it bottomed today. You could not only get this entry again in the future, you probably have 2 months of chop to follow. FOMO is the reason you didn't take profits higher up and it's the reason you are rushing to stand in front of a moving train.

$BTC - Tops are where you need to be quick and move fast. Bottoms are where you can sit back, grab some popcorn, and sleep on it. Yet some how there was no sense of urgency near the top but everyone is super urgent trying to time this bottom. It's completely backwards.

United States Trends

- 1. #ALLOCATION 215K posts

- 2. The BIGGЕST 453K posts

- 3. #JUPITER 213K posts

- 4. #GMMTVxTPDA2025 557K posts

- 5. Good Tuesday 27.9K posts

- 6. #GivingTuesday 8,770 posts

- 7. Kanata 23.9K posts

- 8. rUSD N/A

- 9. #AreYouSure2 52K posts

- 10. JOSSGAWIN AT TPDA2025 80.8K posts

- 11. JIMMYSEA TPDA AWARD 2025 60K posts

- 12. Snow Day 7,558 posts

- 13. Dart 38.9K posts

- 14. Lakers 49.2K posts

- 15. Costco 29K posts

- 16. Bron 26.6K posts

- 17. Hololive 16.2K posts

- 18. Pentagon 56K posts

- 19. Penny 23.1K posts

- 20. Dillon Brooks 8,144 posts

You might like

-

JOEEM05

JOEEM05

@joeem05 -

Corry Wang

Corry Wang

@corry_wang -

الشايعة مشري

الشايعة مشري

@echaiaa -

Don Durrett - goldstockdata.com

Don Durrett - goldstockdata.com

@DonDurrett -

Homeward Harrison

Homeward Harrison

@IGOSODAMNHAM -

Brian Beamish

Brian Beamish

@CRInvestor -

Ilya Kazakov

Ilya Kazakov

@ilyakazakov -

Jason C. Buck 🪳🏴☠️

Jason C. Buck 🪳🏴☠️

@jasoncbuck -

Darren 🦃🙏

Darren 🦃🙏

@ReformedTrader -

HY6

HY6

@highyield6 -

Chris Jordan

Chris Jordan

@ChrisJordan55 -

Cam Hui, CFA

Cam Hui, CFA

@HumbleStudent -

IV

IV

@iv_technicals -

Dr Arvind Virmani (Phd)

Dr Arvind Virmani (Phd)

@dravirmani -

U.S. Global Investors

U.S. Global Investors

@USFunds

Something went wrong.

Something went wrong.