Demon X

@DataOrganised

Charts, Chaos, and Crypto Conviction | Learn while I trade

Some of the best traders I have followed for over the years mostly had hit rate lower than 50%, it was actually way uncommon to see someone objectively successful with a high win rate This didn't make sense to me at the time but after a few thousand trades taken and a few…

Losing is a normal part of any profitable trading system Those losses are not failures or problems with your strategy. Rather they are the foundation for the wins Assume a trader with a 40% win rate that has a verified track record of profitability over time The 60% of his…

1. Open Gemini / ChatGPT 2. Upload your image 3. Prompt Boys : A high-resolution black and white portrait of a man wearing a sharp black turtleneck with minimal classic accessories, styled hair neatly swept back. He stands confidently in a minimal studio setting, positioned…

1. Open Gemini / ChatGPT 2. Upload your image 3. Prompt: Shirt : Black-and-white fine art studio portrait of the uploaded person, seated with both hands resting naturally in front, relaxed and composed. Slightly messy hair softly framing the face, natural smooth skin tones,…

There’s a lot of quant vs retail takes in my feed right now so I’ll weigh in as someone who runs a desk with both. What the “retail trading has -EV so don’t bother” argument misses is that if you applied it consistently you’d shut down most ambitious pursuits. Startups.…

Try this: > Delete everything off your charts. > Write out a plan. > Turn off socials. > Don’t turn it on until done trading. > Wake up. Go through routine. Prep yourself. > Take trade if it shows, otherwise do nothing. > Journal trades you took & those you missed. > Review at…

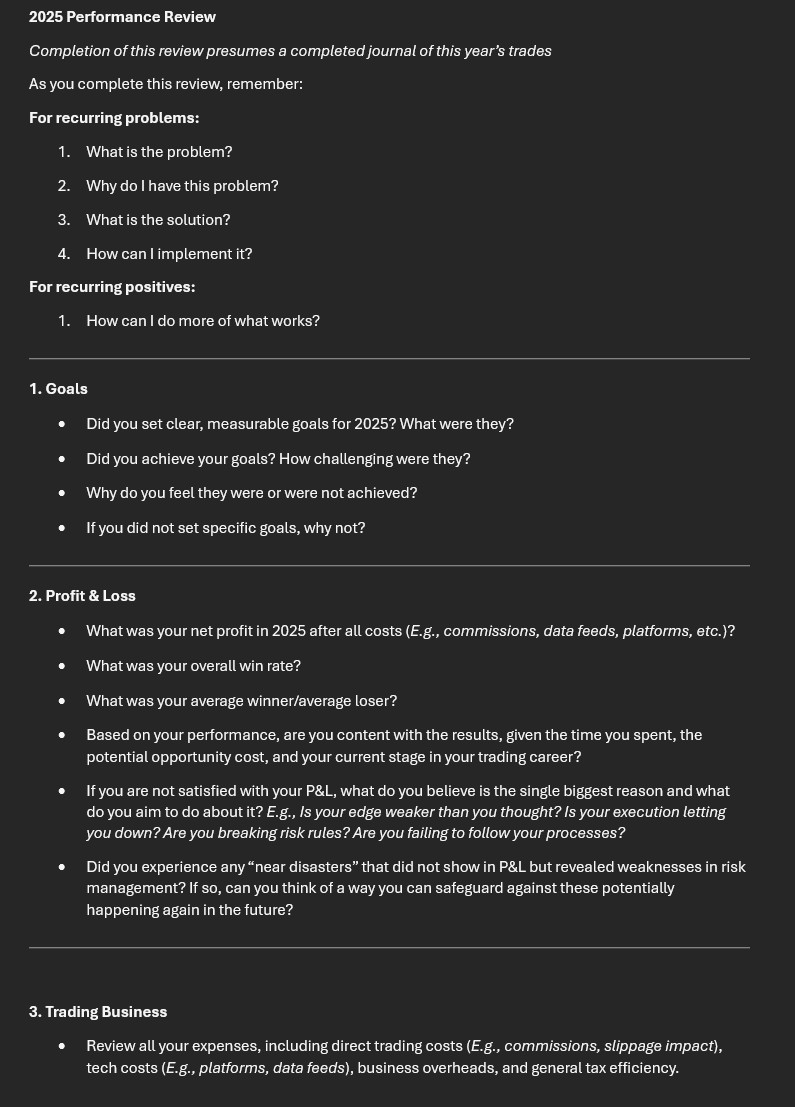

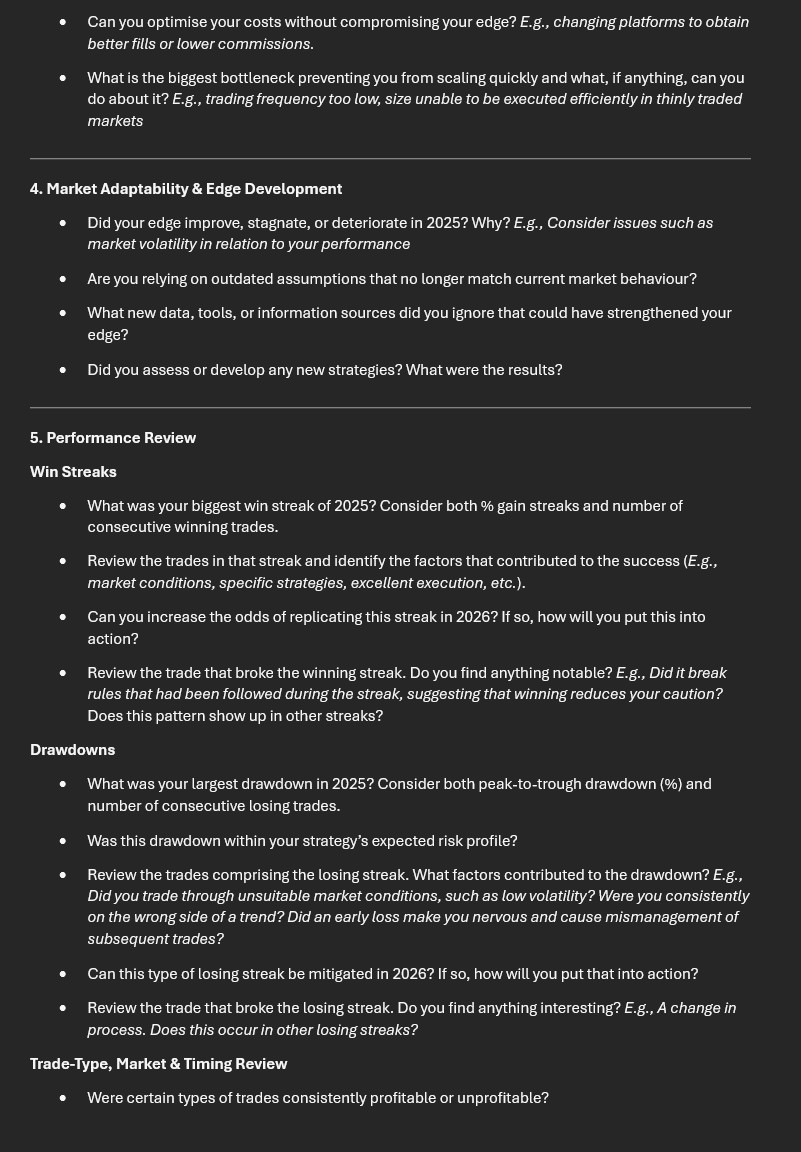

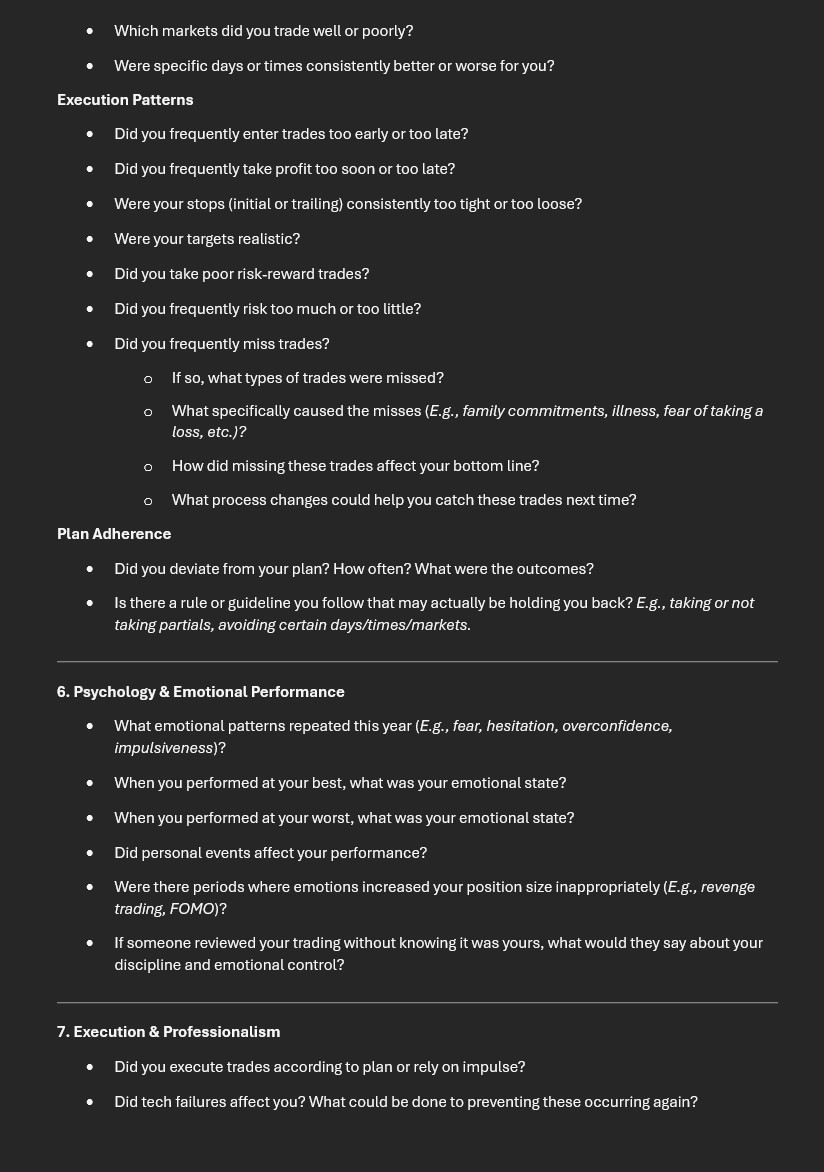

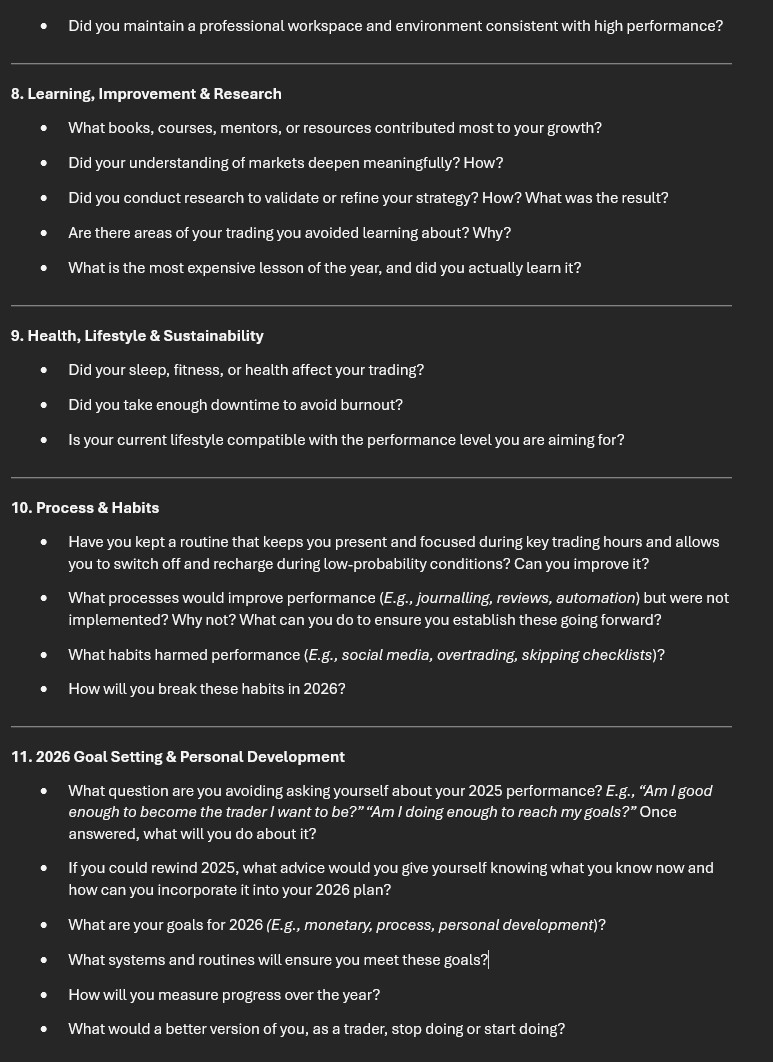

A traders year-end review comes down to three questions: What worked well? What didn’t? What's next? Here is a structured 2025 Trading Performance Review for a deep dive into key issues including: edge decay, execution, psychology and more. PDF: drive.google.com/file/d/1QPdnGS…

Learning how price moves and where opportunities lie is one thing. Training your mind to stay calm and execute fearlessly in every situation is another entirely. You need both skills to make it in this business.

Emas 20/50 on daily/h4 timeframe are quite good measure for me when it comes to defining such trend shifts. Very simple in nature but gets the job done

One of the easiest ways to improve your trading is to reach out randomly to other traders and start collaborating. The best traders I know collaborate with each other, not compete.

Remind yourself you’re always one step away from being a cunt and not one step away from being something special

I feel like more context is needed here because I know many professional traders who “work an area” e.g. they’re bid 50, 48 and 46 with stops for all at 40. By the very nature of this, any fill after the first is “adding to a loser”. The differentiator is the reasoning for…

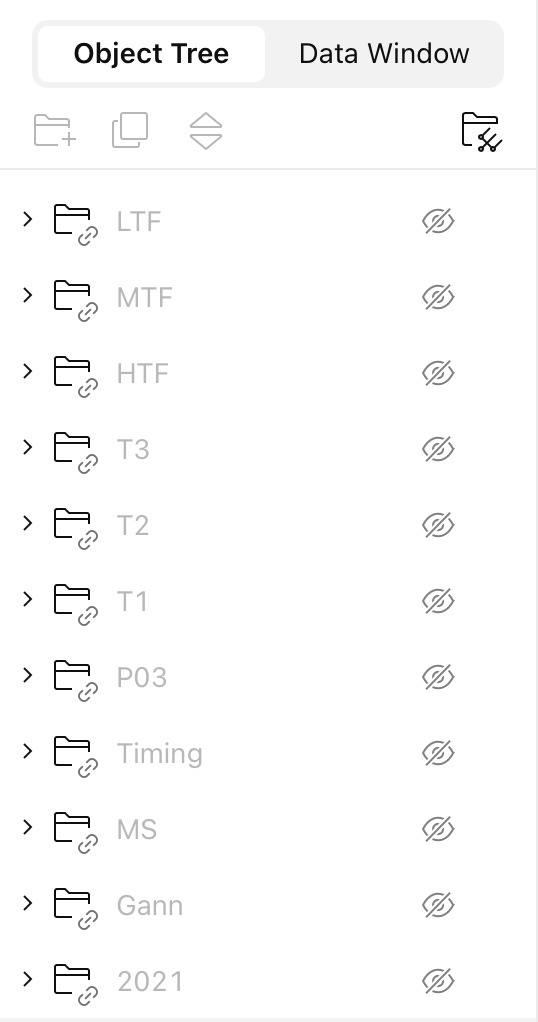

One simple way to improve your trading: organize your charts. TradingView already gives you the tools. Most people just don’t use them. Use the folder system: • Higher time frame analysis → HTF folder • Mid time frame context → MTF folder • Lower time frame execution →…

STOP TELLING CHATGPT “ACT AS AN EXPERT STOCK MARKET TRADER”. Bad prompt = Bad result. Use these prompts instead and see the magic:

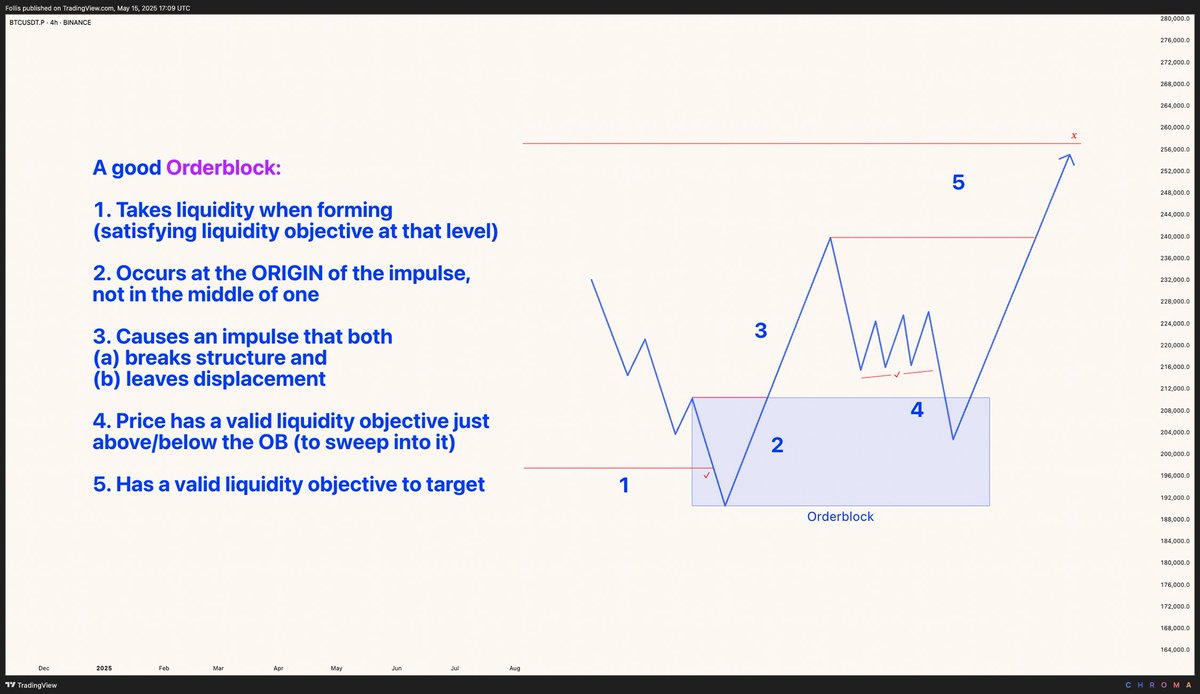

Orderblocks 📝 One of the questions I get asked the most — what makes a good, valid, high probability orderblock? Annotations on the chart Let me know if you like this kind of educational content and I'll do more 🤝 $BTC

WATCH YOU SHOULD DO IN MID DAY: Before Market Opens 6:00 AM – 8:00 AM Review economic calendar. Identify potentially high-impact events scheduled for the day. Scalping when the breakout happens. 8:00 AM – 8:30 AM Review trading plan. Refresh your memory of entry and exit rules,…

This trading routine can give you the extra edge in trading. Not a new setup Not a new indicator Just a structured daily process A thread

Indicators Basics Model: 1. MACD —-Buy/ Sell Signal 2.RSI—Overbought/ Oversold 3.Bollinger Bands—Volatility levels 4.9EMA—Short term Trend 5.21 EMA —Entry/ Exit points 6.50 EMA—Place Stop loss 7.200EMA—Long term Trend 8.AVWAP—Intraday Breakouts 9.ADX—Strength of the Trend…

Portfolio Seperation 📚 One thing I can recommend everyone is to have clear seperated sections within your overall portfolio. I'm just listing what works for me, and makes me perform best in the long run. Here's how I set it up: 1. Long term focussed section. Consisting of…

Find Your Trading Style 1️⃣ Scalping 1m → 15m Hold: Sec–Min 2️⃣ Day Trading 15m–5m → 4H–1H Hold: Min–Hours 3️⃣ Swing Trading 4H → 1W Hold: Days–Weeks 4️⃣ Position Trading 1D → 1M Hold: Weeks–Months 5️⃣ Trend Trading 4H–1D → 1W–1M Hold: While trend lasts 6️⃣ Breakout Trading…

United States Trends

- 1. Christmas 3.59M posts

- 2. Santa 1.33M posts

- 3. Feliz Navidad 697K posts

- 4. Hawaii 17.2K posts

- 5. Dan Fouts N/A

- 6. #AEWDynamite 12.1K posts

- 7. Merry Xmas 253K posts

- 8. #ShowSVPTheTree N/A

- 9. Drew Brees N/A

- 10. Rudolph 28.8K posts

- 11. Marty Supreme 15K posts

- 12. Home Alone 34.8K posts

- 13. Radical Left Scum 14.1K posts

- 14. Stan Humphries N/A

- 15. Wonderful Life 13K posts

- 16. Groq 6,684 posts

- 17. Clove 1,980 posts

- 18. Phil Donahue N/A

- 19. Ray Lewis 1,084 posts

- 20. Xmas Eve 159K posts

Something went wrong.

Something went wrong.