DVB

@DeepValueBagga

$8M NW | fatFIRE | Peter Lynch 2.0. Long term investor 90%, trade 10%, chasing deep value baggers. Short fiat, long btc. e/acc

The man, the legend, Peter Lynch, the greatest fund manager and investor of all time, appeared in a rare public interview yesterday. This weekend, I'm watching and absorbing it! I'll be mostly off X. You should bookmark and watch it too! Highly recommended. Let me know your…

1/776th the size of El Salvador's Bitcoin Fund. $btc $eth

Mike is serious! $btc to run up soon...

I just got off a 20 minute call with THE guy who runs the most important OTC desk. He says at the current pace they will be completely out of Bitcoin to sell within 2 hours of futures opening tomorrow unless the price goes to $126,000-$129,000 (his estimate). Things getting wild.

You believe Paypal price will go up therefore you must do buy backs now. I believe the price will go sideway, you don't need to rush doing buybacks. 1. A low debt, large cash base like $AAPL growing revenue. Very good. 2. High debt, slow growth $PYPL. Bad. I think it's…

You're welcome! For the record, I'm not calling bearish on $hims either. It is a quality company with too many headwinds including sector (pharma) headwinds. I worry whole sector will be priced down due to the risks. Conserving cash and looking for better risks/rewards.

I'm betting that boner pills will be available for cheap on TrumpRx. Sold off $HIMS. Really though, when the government is squeezing margin on the pharma sector, it's hard to be bullish.

Last post on $PYPL i swear. > Some commenters are justifying "good debt", "structures", DVB: you don't know the structures...fagoozi stuff. 1. Listen, you have $400m finance expense on a $4bil net income. That means 10% if your income goes to bank, not to your shareholder.…

I researched into $PYPL again to see if i missed anything. - Growing net income were used to buy back shares - Paypal paid $1B tax in the last twelve months - Paypal maintains $10B debt - Paid interest expense of $412M+ Ok, that is utterly incompetence. a) Why not pay down…

Paypal stock analysis from a business operator who processed millions of dollars through $pypl and Paypal also cranked up rates on him without notice. Cc: @acce

Absolutely and horribly managed. Quite possibly worse financials than our federal government has. I’ve always run my company debt free. But then we also have products and inventory. Paypal has ZERO inventory to collateralize their debt. So what is even collateralizing their…

We're having too much fun! 😂

I'm literally at the house from the meme, how did you retire our family? It's so exquisitely beautiful.

Anyone feels like they don't have enough $iren today? I do. Nfa/no fomo

Great to see. Congrats! I share research and insights for purpose of my own investments. And i share it for free, for all.

Hit 100k invested today at the age of 22 this was my biggest goal when I stated investing about a year ago. Big shoutout to some of the goat twitter guys that got me started @TJTheWheelDeal @amitisinvesting @DeepValueBagger @optionscjp along with a a lot of others ❤️ onto 1 mil!

Great to see. Congrats! I share research and insights for purpose of my own investments. And i share it for free, for all. $iren

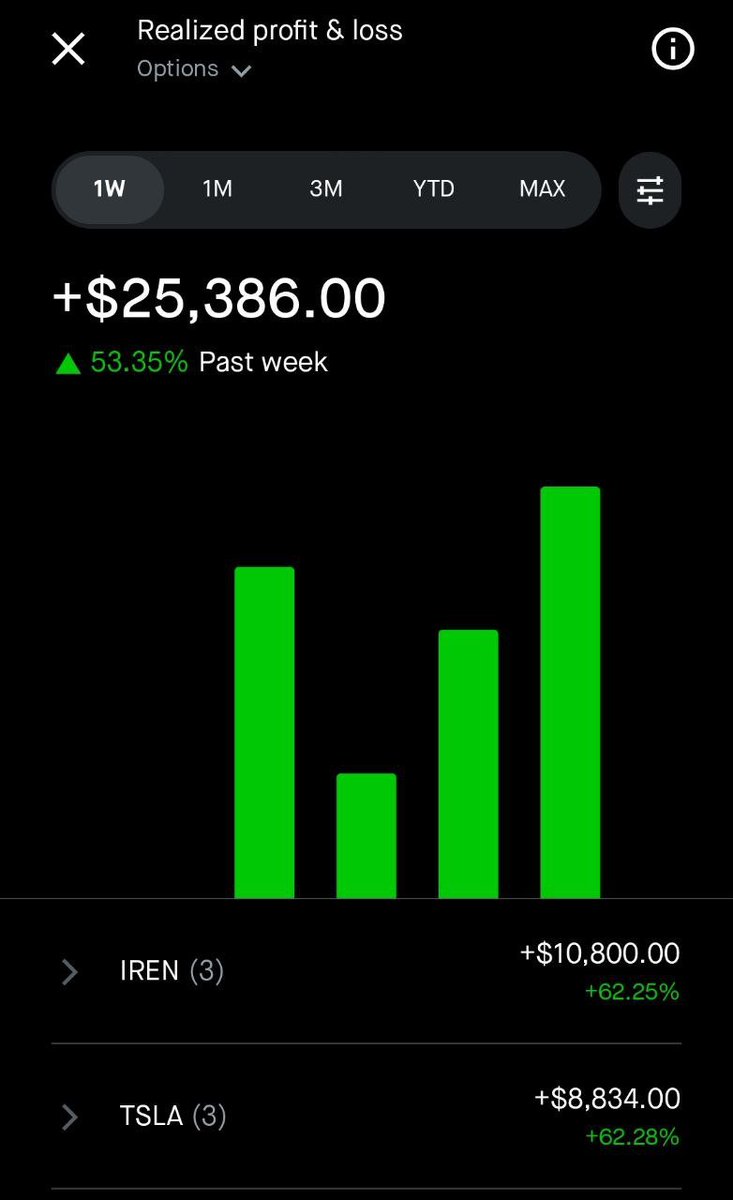

Closed $25K option profit this week. I'm already done for this week and loaded for next week, targeting $27K premium. Opened $TSLA CC $560 Oct 31. Still waiting for $HOOD to premium to come down. Lots of $IREN $TSLA CSP.

I'm biased toward option selling. High win rate. Targeting $20k per week. All profits this week on csp, considering CC now.

Let's compare $TSLA vs $PYPL financials 1. TSLA pay slightly more taxes as $PYPL, that's really sad for Paypal given the differences in company sizes. 2. TSLA debt is only $10B out of $20B bonds (earning interest) + $16B cash / ratio of 1:4 debt to cash, where as Paypal is…

I researched into $PYPL again to see if i missed anything. - Growing net income were used to buy back shares - Paypal paid $1B tax in the last twelve months - Paypal maintains $10B debt - Paid interest expense of $412M+ Ok, that is utterly incompetence. a) Why not pay down…

I researched into $PYPL again to see if i missed anything. - Growing net income were used to buy back shares - Paypal paid $1B tax in the last twelve months - Paypal maintains $10B debt - Paid interest expense of $412M+ Ok, that is utterly incompetence. a) Why not pay down…

$PYPL Few people know this. Many people will dismiss it. Most will ignore it.👇

You probably think why the board of director of suits, and CEO can't be this stupid....well no board of director ever got fired for buying back shares.. betting $1b-$6b business --- yeah, no one is risking their neck for it.

@paradisemint as business owner you would understand my argument....

Paying down debt also decreases the tax bill.

United States Trends

- 1. Good Sunday 46.1K posts

- 2. Discussing Web3 N/A

- 3. #sundayvibes 4,084 posts

- 4. Auburn 47.1K posts

- 5. MACROHARD 8,168 posts

- 6. Wordle 1,576 X N/A

- 7. Gilligan 6,626 posts

- 8. #SEVENTEEN_NEW_IN_TACOMA 39.2K posts

- 9. Brewers 66.8K posts

- 10. #MakeOffer 20.5K posts

- 11. QUICK TRADE 2,166 posts

- 12. Kirby 24.8K posts

- 13. #SVT_TOUR_NEW_ 31.1K posts

- 14. FDV 5min 2,196 posts

- 15. Utah 25.3K posts

- 16. Holy War 2,000 posts

- 17. #SVT_WORLDTOUR 28.4K posts

- 18. Dissidia 7,267 posts

- 19. Whale - Buy 1,817 posts

- 20. Boots 51.1K posts

Something went wrong.

Something went wrong.