Deep in the suburbs of Dallas

@DemSign

Turning Texas Blue. Go @KamalaHarris #Resistance #BlueWave #TXDem 🥥💙☮️🇵🇸🇮🇱 Free🇺🇦

Thanks to Senate Republicans, 17 million people will lose their health care. Thanks to Senate Republicans, rural hospitals will close. Thanks to Senate Republicans, three million Americans, including veterans and seniors, will lose food assistance. Thanks to Senate…

I will put it simply- they are stealing funds!

Donald Trump just Barbra Streisand Effect-ed himself into a national conversation about (1) whether he has lied about his links to Epstein, (2) whether he has raped kids, (3) what role his lawyers have in this story, (4) whether Bondi is withholding the Epstein Files to save him.

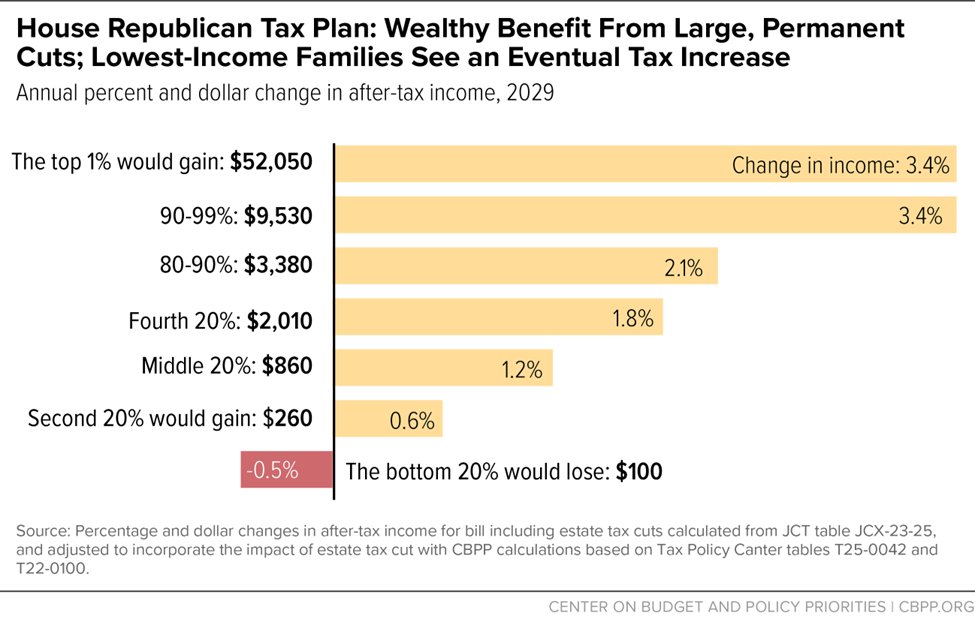

Right now we're caught up in how much they cut Medicaid, who's holding out for more cuts, who voted no, what happened in committee, when they'll put it on the floor, what's happening with SALT, etc. But after Republicans pass this, tax distribution is going to enter the chat.

And most importantly, you can rephrase that sentence thusly with ad backup that will win a factcheck: "Rob Bresnahan voted to give himself and other millionaires tax cuts while cutting Medicaid and raising taxes for working Pennsylvanians."

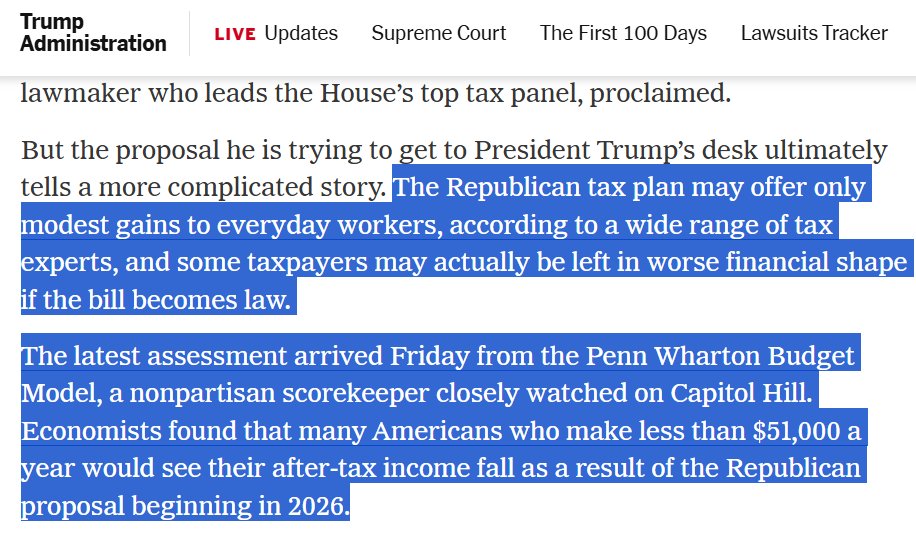

"Republicans will give working class people tax hikes and cut their health care while lowering taxes for billionaires" is a sentence that is entirely backed up by Congress' designated, nonpartisan scorekeeper. Republicans ARE raising taxes on working class people

The *distributional* effects of the tax cut have been largely overlooked because Medicaid and SNAP deservedly got the spotlight, while SALT and R negotiations on toplines occupied Hill reporters. And some outlets are covering this (including those linked). But that being said-

It's extremely important to note that these distributional effects DO NOT include the effects of Medicaid cuts, SNAP cuts, energy tax credit elimination, or tariffs -- all of which will factor into voters' assessments of Trump and the Republican majority, and of this bill.

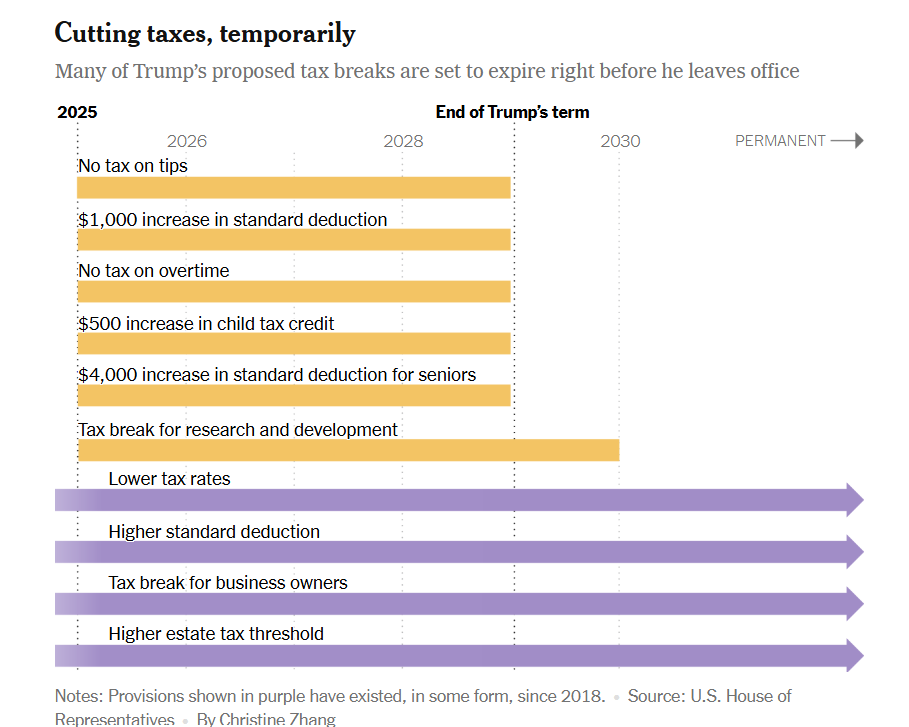

Why? It's largely because 1) Republicans eliminated tax credits that help pay for health coverage 2) R's set tips, seniors, and overtime provisions to expire in 2029 (the year Trump leaves office), while making permanent cuts for corporations / the wealthy nytimes.com/2025/05/14/us/…

JCT is not alone in this finding. @TonyRomm reports, "a wide range of tax experts" including the Penn-Wharton model found "many Americans who make less than $51,000 a year would see their after-tax income fall as a result of the Republican proposal" nytimes.com/2025/05/16/us/…

This isn't a nit-picky point based on a technicality or an asterisk. It isn't analysis from a far left group, the White House sent these tables out and posted them on their website. They're still there: whitehouse.gov/articles/2025/… These tables say working people get a tax hike

BUT HERE IS THE THING Per JCT, Congress' official scorekeeper, the bottom 20% of households - tens of millions of Americans - will see a TAX INCREASE beginning in 2029. Republicans are cutting taxes for billionaires AND RAISING TAXES ON WORKING PEOPLE x.com/Brendan_Duke/s…

The bill is even more regressive when you look at 2029 when tax cuts for families expire & tax increases resulting from cuts to ACA premium tax credits grow larger.

In fact, once you incorporate the effects of the estate tax - a tax that will cost $212 BILLION and literally only benefits a small number of estates worth a minimum of $14 million - the benefits are massively skewed towards the wealthy in tax year 2027: x.com/Brendan_Duke/s…

New @CenterOnBudget analysis of the draft GOP tax plan released yesterday: Unsurprisingly, it provides enormous tax cuts for the wealthy—including an average annual $65k cut for the top 1%—while doing little for low- and moderate-income families in 2027 (and even less by 2029).

The distribution tables will show who ACTUALLY benefits, who gets cuts and how much, under the Republican tax bill. You won't be surprised, since this is what happened in 2017 and we've been saying it ever since, that the money mostly goes to rich people:

Remember- Trump ran on promises to eliminate taxes on Social Security, tips, overtime, it likely helped him win. He also seemingly endorsed closing the carried interest loophole (which benefits hedge fund managers) and even raising the top rates. Working class stuff, in theory.

"Distribution tables" is wonky but this is a simple thing- it tells you who gets money from the Republicans' bill, and how much. The winners and losers, if you will. Some time later, those distribution tables arrived- well into the markup. They are here: jct.gov/getattachment/…

After opening remarks, this markup begins with technical questions to the Chief of Staff of the Joint Committee on Taxation, Tom Barthold, about the bill. An hour in, the top Dem on tax, @RepThompson asked Tom Barthold: where are our distribution tables x.com/cady_stanton/s…

JCT Chief of Staff Tom Barthold tells W&M member Mike Thompson he expects JCT to release distribution tables on the updated tax bill soon, estimates within "90 minutes."

Ways & Means Republicans released stub bill text Friday, then full text Monday afternoon. This gave Congress' nonpartisan tax scorekeeper, the Joint Committee on Taxation, little time to score the bill in time for the markup. JCT is our source for numbers on what the bill does.

One of the most significant moments of the 2026 cycle likely happened Tuesday night during the Ways and Means markup of the tax portion of Republicans' reconciliation bill. It got no attention at the time and little since, but it is wildly important. Here's what happened--

United States Trends

- 1. Derrick Henry 35,2 B posts

- 2. Packers 64,4 B posts

- 3. #AEWWorldsEnd 62,2 B posts

- 4. Malik Willis 24 B posts

- 5. Ravens 56,5 B posts

- 6. #massbylerpsychosis 2.464 posts

- 7. #GoAvsGo 1.103 posts

- 8. #netflixreleasethevolume2files 137 B posts

- 9. NFC North 21,2 B posts

- 10. Houston 49,5 B posts

- 11. Museum Mile 1.865 posts

- 12. Green Bay 12,9 B posts

- 13. Giannis 16 B posts

- 14. #DanDaDan 3.930 posts

- 15. Josh Jacobs 3.388 posts

- 16. Huntley 10,9 B posts

- 17. Frank Wilson N/A

- 18. Chicago Bears 13,4 B posts

- 19. Moxley 12,5 B posts

- 20. Willie Fritz N/A

Something went wrong.

Something went wrong.