MunicipalBondLagrange@Opacity

@Euler__Lagrange

Working on building zkTLS infra/products. A ruthless empiricist, Co-founder/CEO @OpacityNetwork.

You might like

The Chinese economy would crash if real estate within it crashes. Chinese financial markets don’t have the same depth as the American markets. No mortgage backed securities or insurance/swaps. If you made a chinese real estate catastrophe bond, you could get a lot of Chinese…

Is there a DePin in here @DAnconia_Crypto ?

🇺🇸🇻🇪 NEW: Reuters reveals the US is rebuilding the former Roosevelt Roads naval base in Puerto Rico and upgrading airfields in Puerto Rico and St. Croix as potential staging grounds near Venezuela. The buildup is the largest since 1994. 🧵👇🏻 1/5

Keep your mouth shut kiddo

@EulerLagrange out here fixing crypto and the internet quietly but i can’t say how just yet and it’s driving me nuts

@EulerLagrange out here fixing crypto and the internet quietly but i can’t say how just yet and it’s driving me nuts

NASA wants to nuke an asteroid before it hits the moon. Idk why but im excited

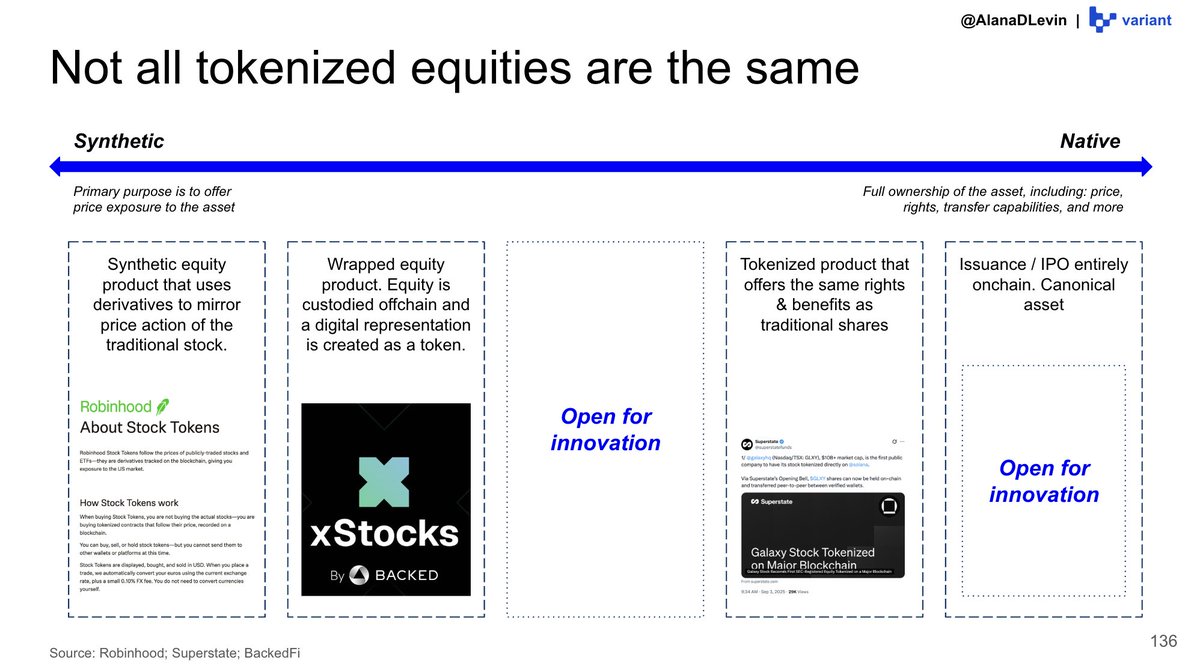

For how much it’s talked about there is surprisingly little commentary on why they don’t really exist for the US market. The existing ones that explicitly for US usually trade at lower to market value bc of low liquidity. And don’t support the DeFi bells and whistles

The term “tokenized securities” gets thrown around a lot, but it doesn’t always mean the same thing. Securities can make their way onchain in many different forms and flavors. @AlanaDLevin maps out the spectrum from purely synthetic to crypto-native in this must-read report 🔥👇

About 30% of the S&P500 is tied up in companies with crazy AI valuations. a AI-bubble hedged S&P500 RWA would be a banger.

it should be easier to get 10x leverage on AAA bonds that build hospitals than it is to get 10x leverage on memecoins

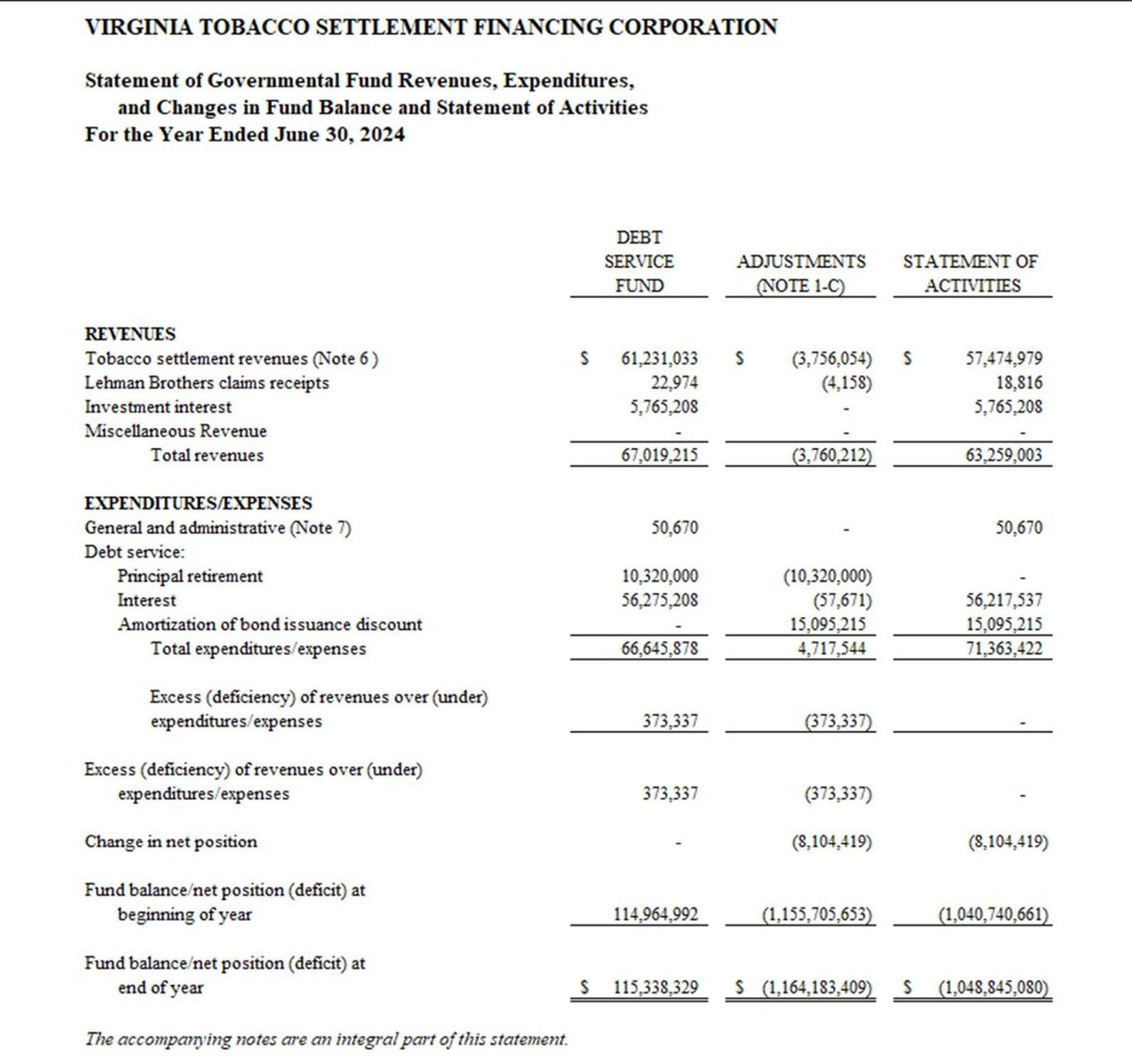

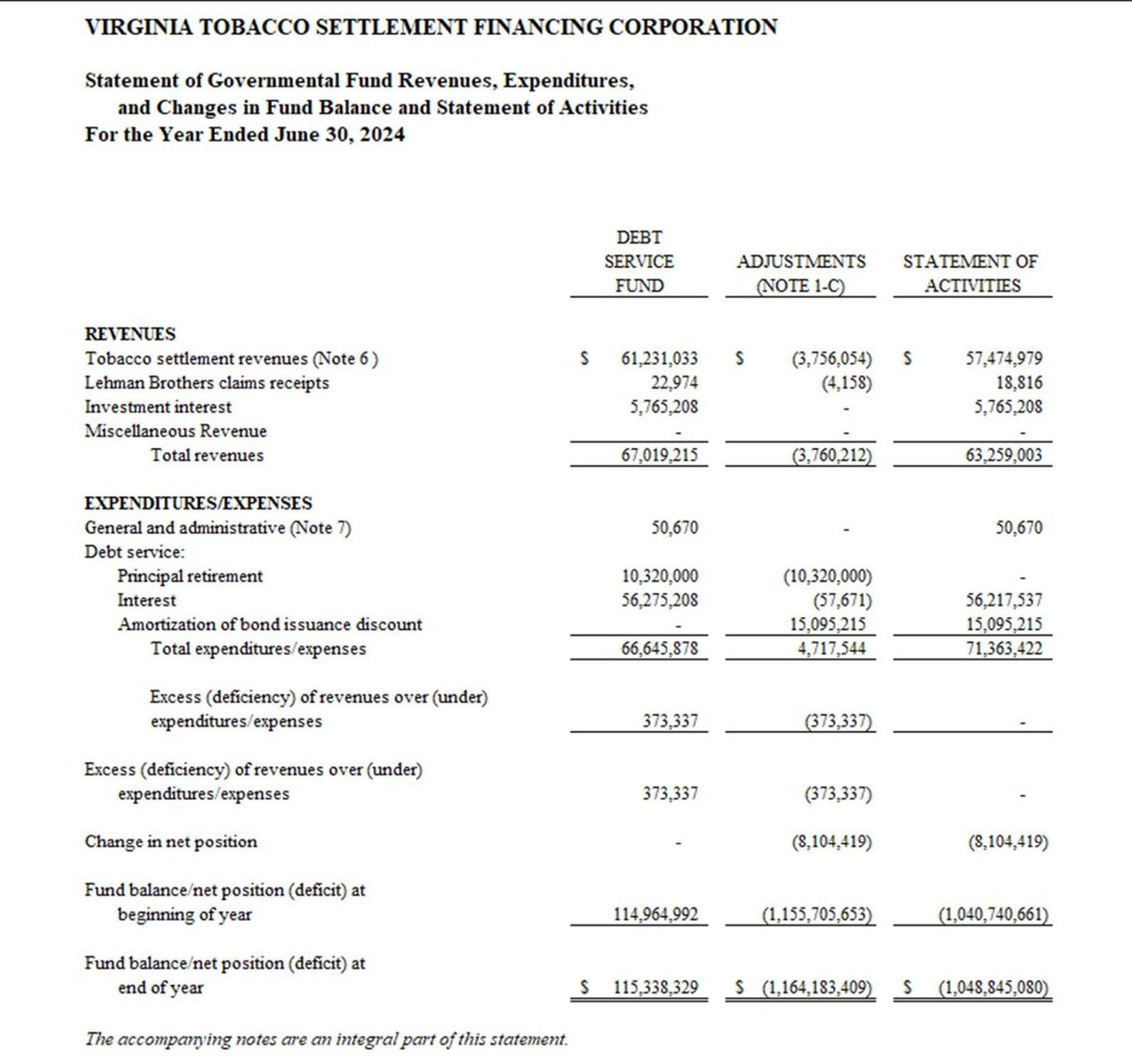

Virginia has a $1.1B fund solely for borrowing against guaranteed settlement money big Tobacco companies legally have to pay annually for lying to congress about cigs causing cancer. Bonds backed by this income are AAA rated and pay 8.5%, with tax advantages too

People criticize the 50 year mortgage for the wrong reason. Yes you pay more interest over the term, but you can always refinance the term/rate later. The time value of money could win with an optimistic outlook. The real problem is that we would end up where we started.…

The treasury department can make triple A muni-bonds Genius compliant. 👀 @SecScottBessent

A municipal bonds backed stablecoin, instead of a treasury bonds backed stablecoin would be the world's first peaceful fiat currency.

A municipal bonds backed stablecoin, instead of a treasury bonds backed stablecoin would be the world's first peaceful fiat currency.

Virginia has a $1.1B fund solely for borrowing against guaranteed settlement money big Tobacco companies legally have to pay annually for lying to congress about cigs causing cancer. Bonds backed by this income are AAA rated and pay 8.5%, with tax advantages too

Shout out to @ArynChadha

1st, lame not to @ me 2nd, there’s a reason Uni decided to launch the fee switch now. “Less regulatory hostility” means “yes this clearly was illegal back before crypto purchased the WH” 3rd, call is coming from inside the house; I’m paraphrasing the original defi post QT’d

The data sovereignty enthusiasts are having a great time right now, join us. Valuable independent of market sentiment on highly volatile digital assets.

Tracking current timeline sentiment: - Growing number of folks saying we topped, cycle is over - More and more folks saying "buy back in 9-12mo at $60-70k" (approx last cycle's ATH, with similar drawdown period to historical cycles) - Increased levels of doom posting - Very…

🫡

“I wasn’t the fastest guy in the world. I wouldn’t have done well in an Olympiad or a math contest. But I like to ponder. And pondering things, just sort of thinking about it and thinking about it, turns out to be a pretty good approach.’ – Jim Simons

United States Trends

- 1. Thanksgiving 724K posts

- 2. #StrangerThings5 289K posts

- 3. BYERS 68.1K posts

- 4. robin 103K posts

- 5. Afghan 323K posts

- 6. Dustin 67.9K posts

- 7. Holly 69.6K posts

- 8. Reed Sheppard 6,865 posts

- 9. Vecna 67.4K posts

- 10. #DareYouToDeath 64.9K posts

- 11. Jonathan 75.6K posts

- 12. Podz 5,177 posts

- 13. hopper 17.2K posts

- 14. mike wheeler 10.6K posts

- 15. derek 21.3K posts

- 16. Lucas 86K posts

- 17. noah schnapp 9,386 posts

- 18. Nancy 70.6K posts

- 19. Erica 19.5K posts

- 20. Tini 10.8K posts

Something went wrong.

Something went wrong.