TheAnalyst

@German_Analyst

Commodity Analyst (Gas, Coal, Carbon & Power) for a German Energy Supplier

You might like

What excites and worries LNG exporters in 2026 reuters.com/markets/commod…

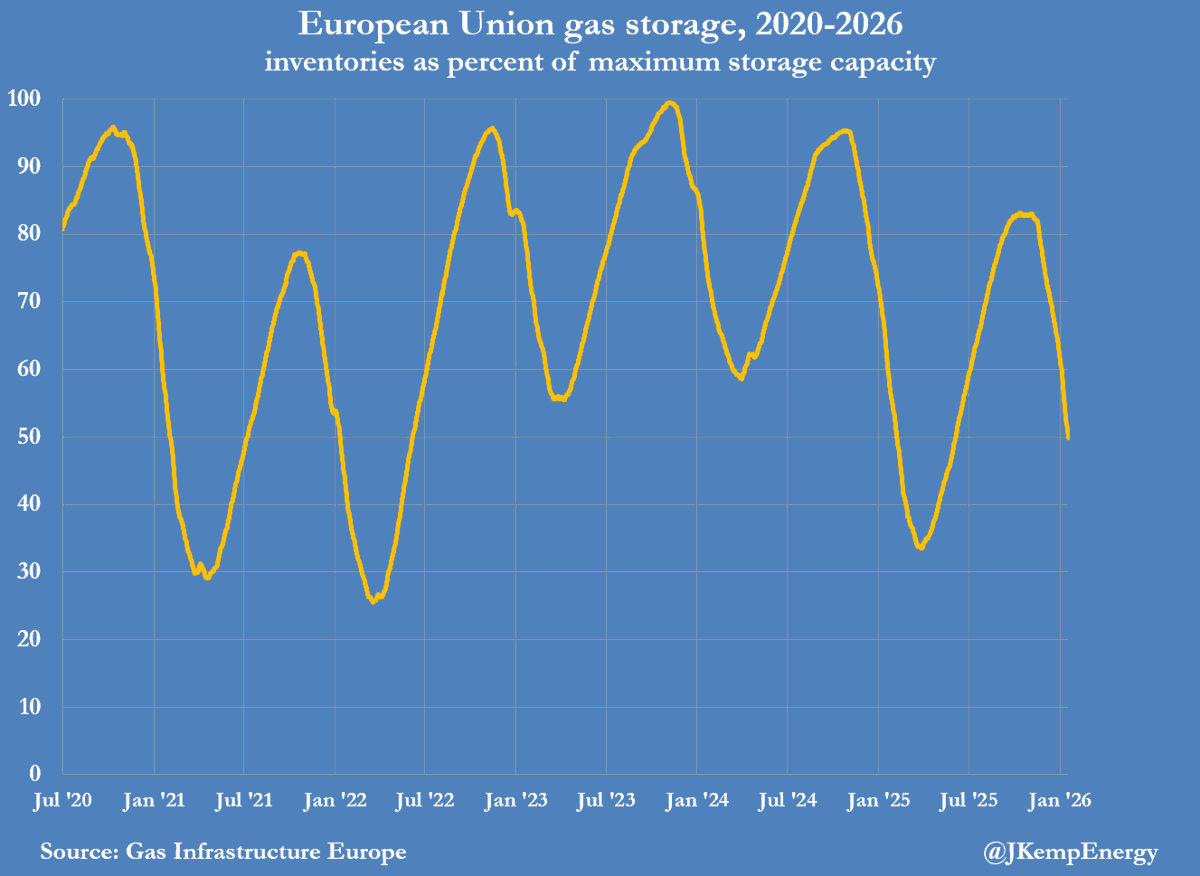

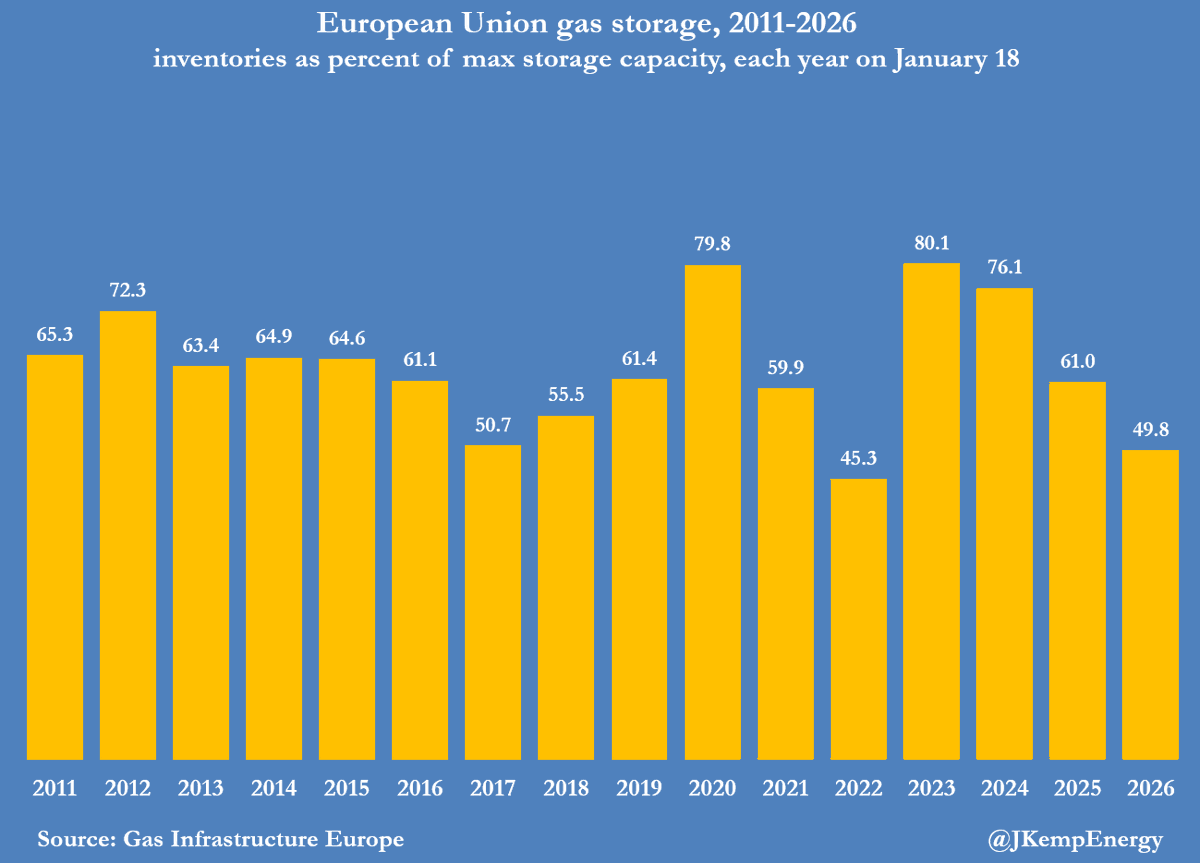

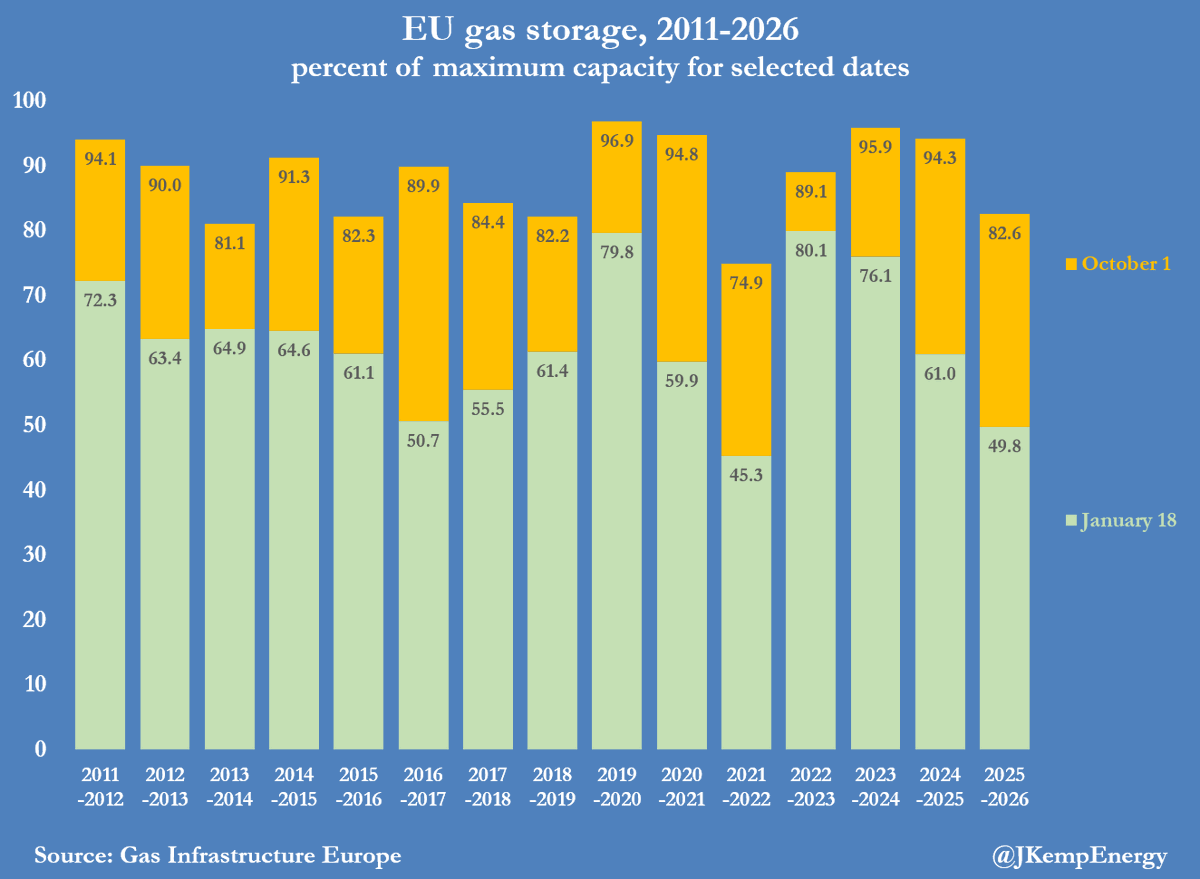

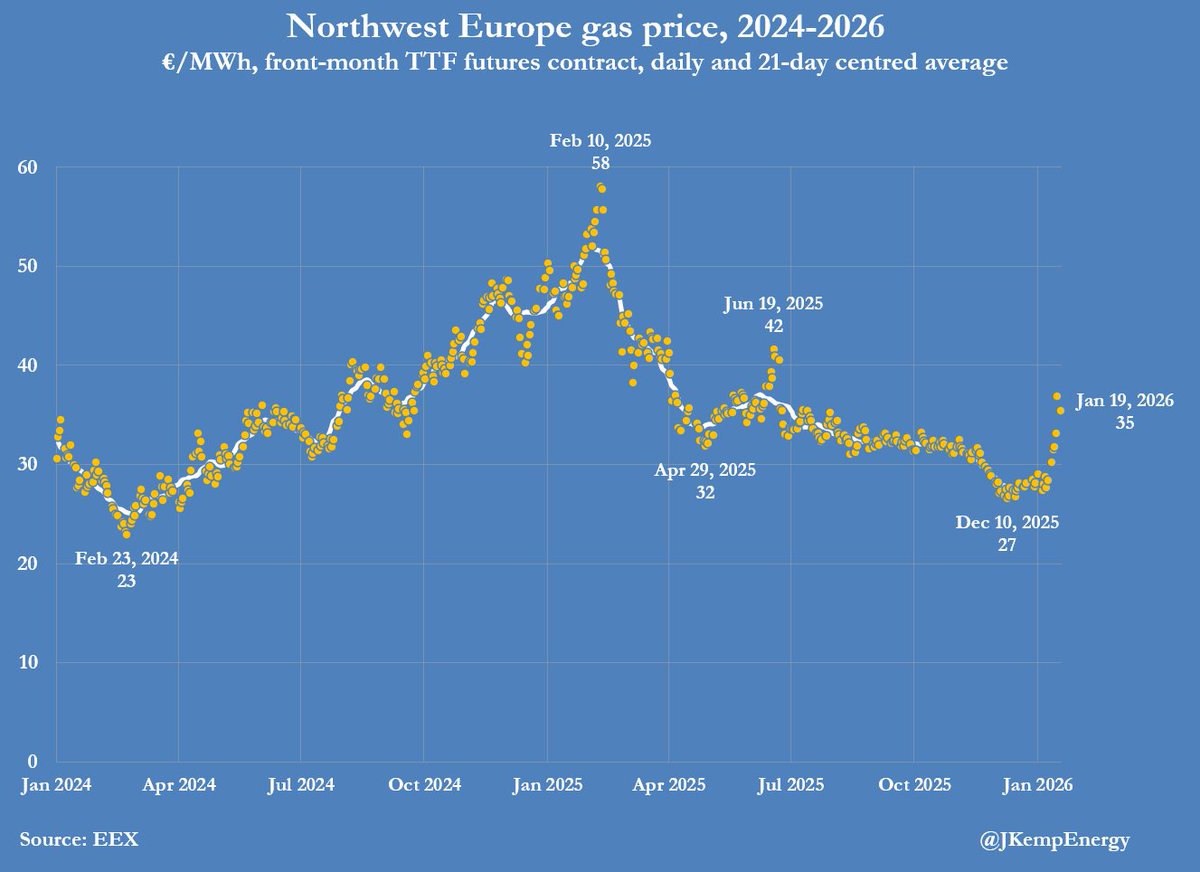

EUROPE’s underground gas storage is emptying faster than normal this winter, and the rapid drawdown has finally started to push up prices. With the winter heating season just half-way through, storage sites are less than 50% full on average down from almost 83% when winter…

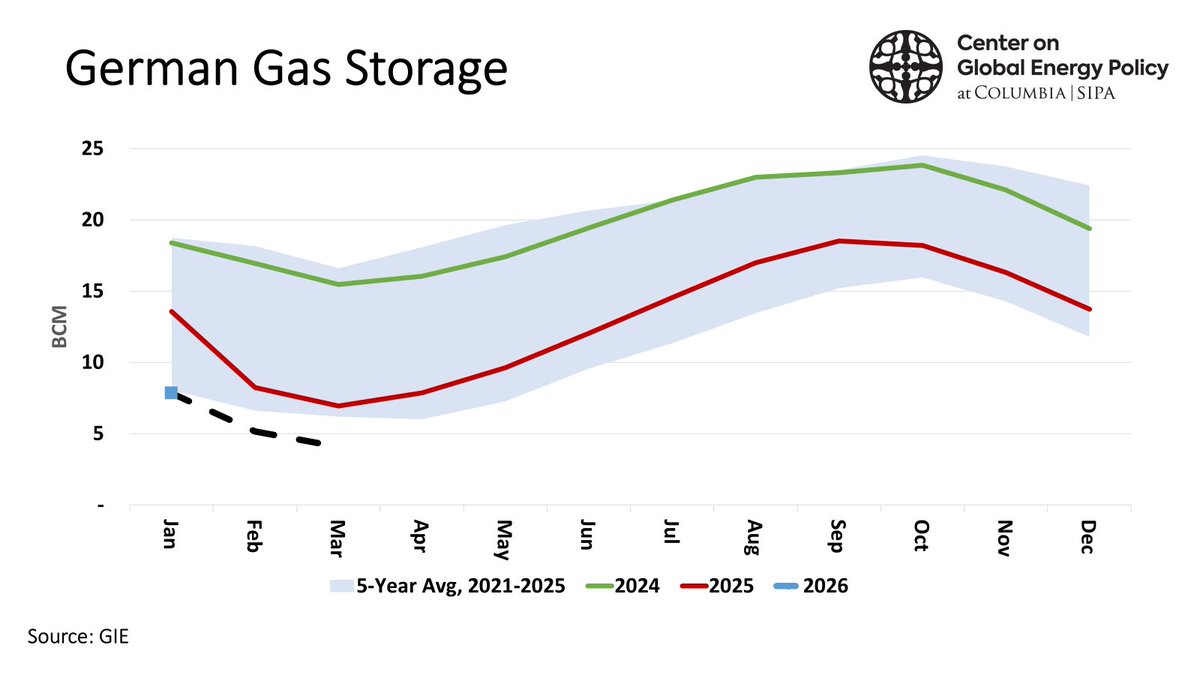

Assuming average draws in Feb./Mar., Germany will be scraping by as it begins injection season with around 4 bcm left in the tank. The last time it was this low was 2018, which led to 17 Bcm of injections. This year it will need 18 Bcm just to reach 90% capacity. @ColumbiaUEnergy

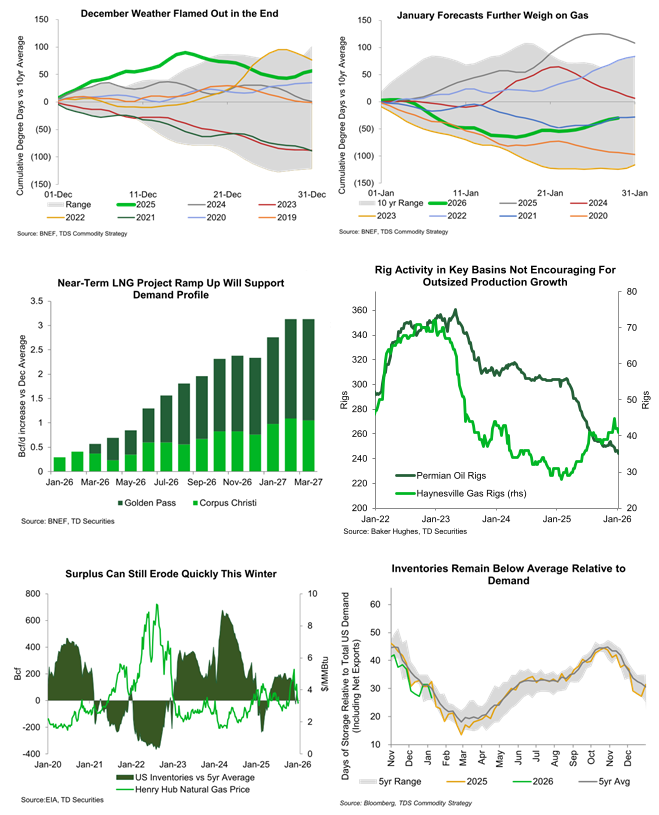

Its happening US NATURAL GAS SURGES 24% AS FORECASTS SHOW ARCTIC BLAST

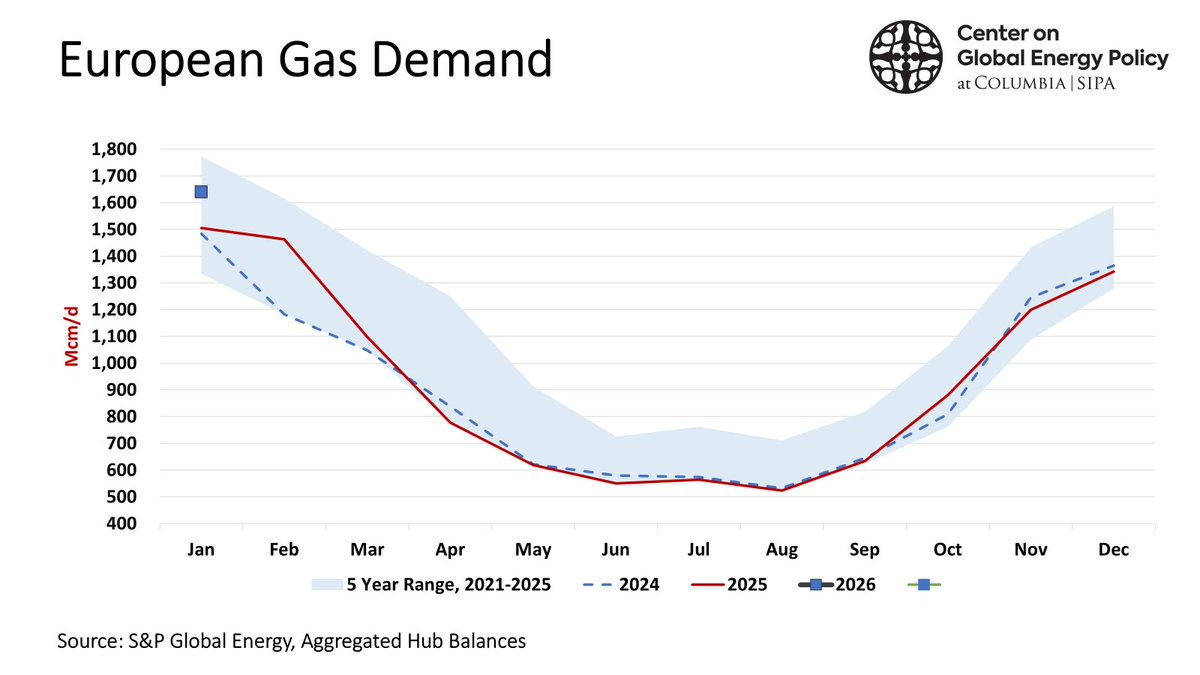

Extremely cold weather in Europe definitely has raised demand in January, although not to 5 year highs given losses elsewhere in industry. Europe will continue to draw more storage and import more LNG to balance. Another cold snap looms in late January. @ColumbiaUEnergy

A fortunate truth for US LNG producers that will eventually face competition from a group of buyers willing and able to absorb a higher bearable price for gas. US LNG’s profitability is predicated on low Henry Hub prices. Data centers are more indifferent. @ColumbiaUEnergy #ONGT

The Trump administration wants gas to power the AI boom instead of renewable energy. But the time it takes to build a gas plant has increased to five years. bloomberg.com/news/articles/…

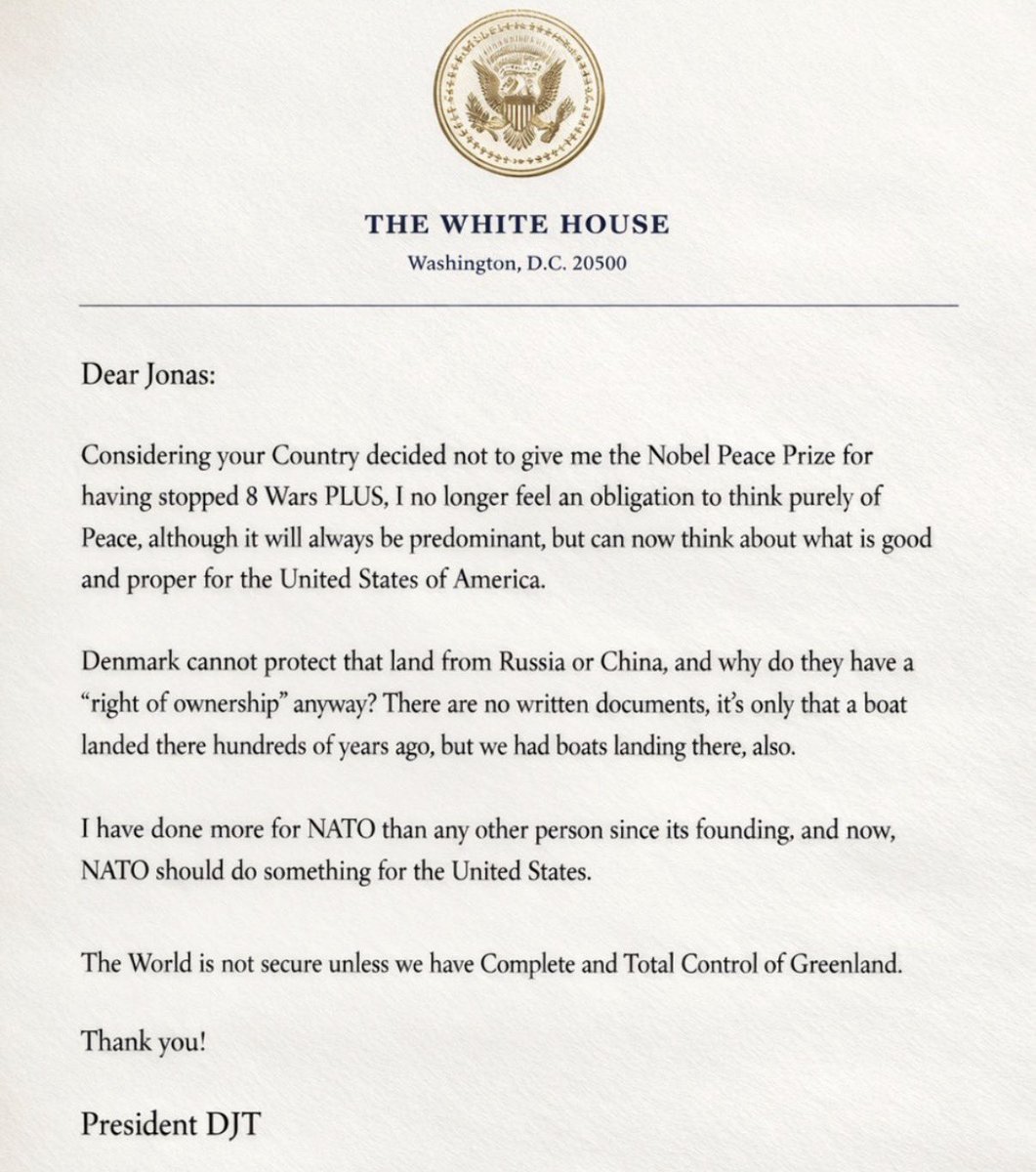

PRESIDENT TRUMP’S FULL LETTER TO NORWAY: “I no longer feel an obligation to think purely of peace… but can now think about what is good and proper for the USA.” Trump is doubling down on Greenland. Step #6 of our tariff playbook is beginning.

EU Spent €7.2 Billion On Russian LNG in 2025, Maximizing Imports Before 2027 Ban highnorthnews.com/en/eu-spent-eu…

European gas prices fall over 8% 📉📉📉 🇺🇸 Market sentiment shifted after Trump's Europe tariff threat, new weather forecast showed less cold 📈 Prices rallied 30% last week (largest weekly increase since 2023) on the back of cold outlook, falling inventories

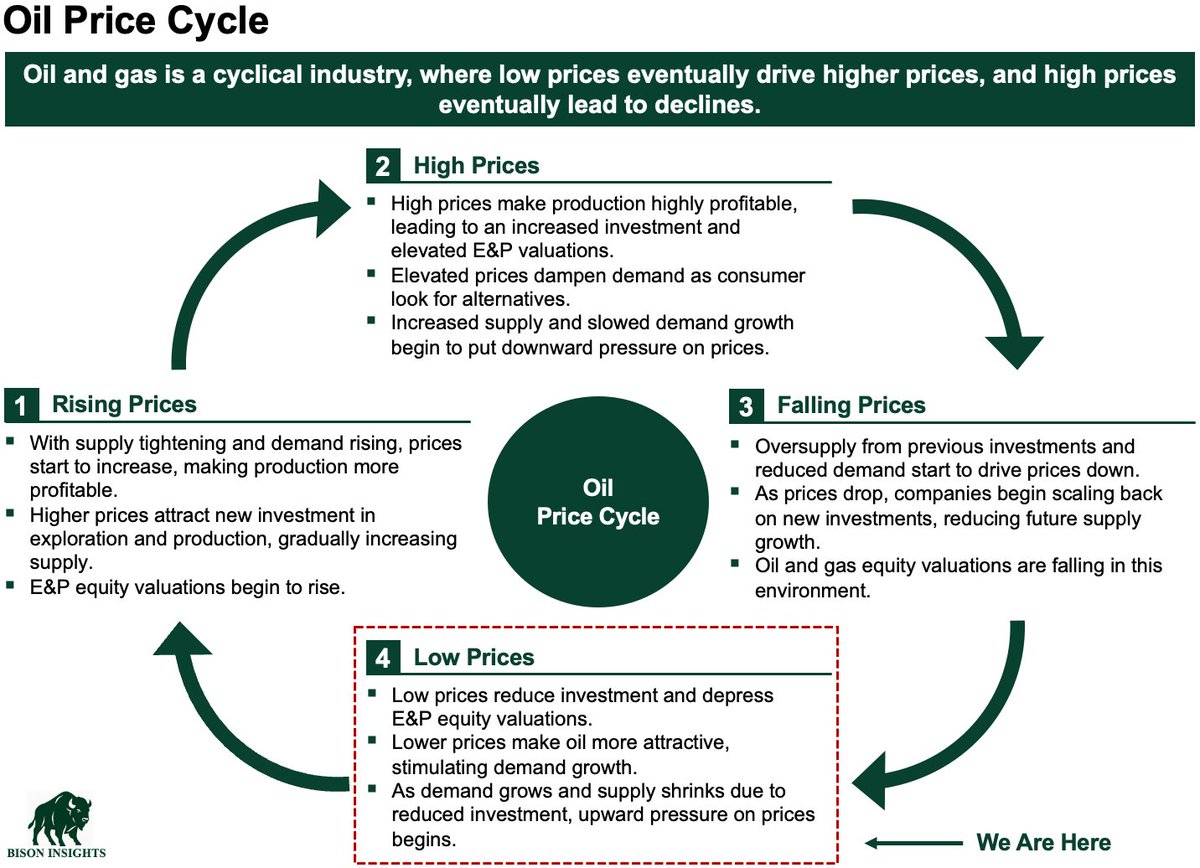

« Today, oil prices are low, investment is falling, and the sector is deeply underowned. Those conditions have historically marked the beginning, not the end, of periods of outperformance for oil equities »

The next 48 hours are critical: With the EU's "emergency meeting" scheduled for tomorrow, we are now on step #4 of our tariff playbook We expect the EU to take an aggressive, but open approach. They will threaten to cancel the EU-US trade deal, while encouraging President Trump…

Indonesia's coal exports are off to a sluggish start in 2026, with trader sources reporting restrained mine availability curbed by policy changes and uncertainties... More: sxcoal.com/vixzuZ #CoalExport #Indonesia

Texas LNG project fully subscribed following binding agreement with RWE bairdmaritime.com/shipping/tanke…

Winter is not over yet, and neither is the bullish gas thesis. Normal weather forecasted for February (🤞) + 3Bcf/d of incremental LNG demand + proven US discipline... $4USD marginal cost of supply = 13%-16% FCF yields in US gas stocks.

Given Qatar skipped autumn maintenance last year….would be a perfect storm if they choose to do even a partial maintenance when Europe is in peak panic mode….. might actually help Qatar when it comes to the spat with EU. Plus they have a ton of spot cargoes that need to find…

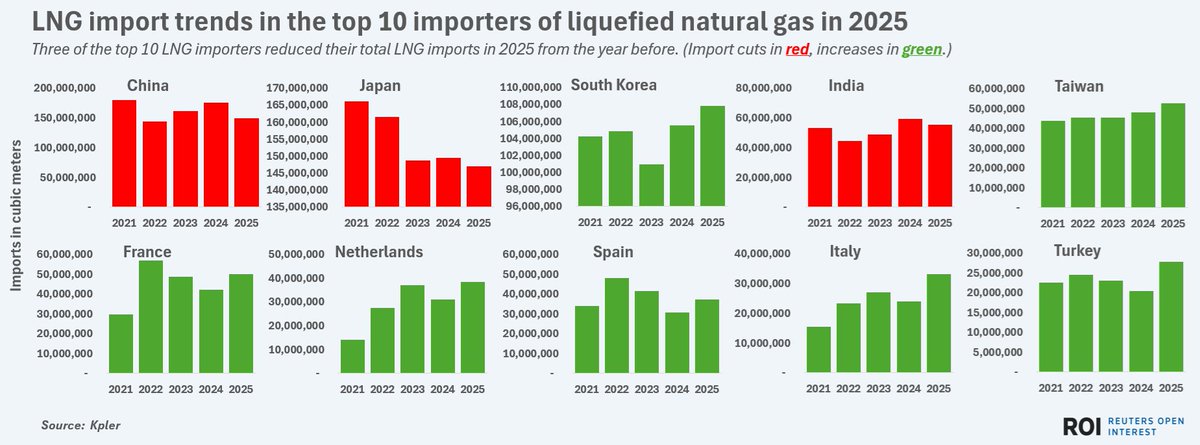

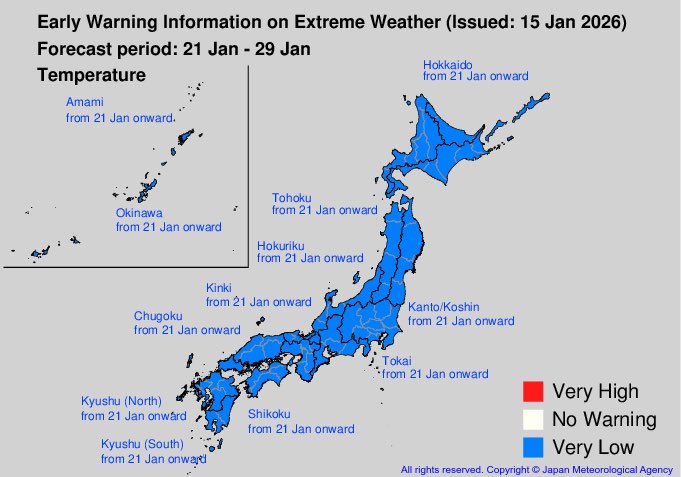

🇯🇵 While the situation is expected to be less severe in Japan, the country’s meteorological agency has issued a nationwide warning cautioning against very low temperatures from Jan. 21 onward 🚢 China and Japan are the world’s biggest LNG buyers bloomberg.com/news/articles/…

🚨 JKM–TTF (Mar26) spread widens towards Ras Laffan breakeven JKM–TTF has shifted from -$0.100 (9 Jan ’26) to around -$0.800 today (15 Jan ’26), reflecting stronger #TTF vs stagnant #JKM pricing. With the spread widening fast, the key question is: does JKM–TTF (Mar26) reach the…

Egypt imported 9.01 Mt of LNG in 2025, equivalent to 129 cargoes, with 90.9% of this from the US. In 2026, Egypt will import a total of 11.14 million mt, a 26.3% increase from the previous year. The question, will Egypt import more or less than 160 cargoes?

China's thermal coal market showed mixed signals. Prices of domestic coal at N ports softened slightly on weak buying interest, while imported coal remained firm due to supply constraints in key regions like Indonesia. More: sxcoal.com/tylQPG #ThermalCoal #CoalPrice

United States Trends

- 1. Speedway N/A

- 2. Iceland N/A

- 3. TACO N/A

- 4. Davos N/A

- 5. Fredo N/A

- 6. #SongwritersHallOfFame N/A

- 7. Keon N/A

- 8. Ubisoft N/A

- 9. Pedri N/A

- 10. Josh Doan N/A

- 11. Gavin N/A

- 12. Al Gore N/A

- 13. Art of the Deal N/A

- 14. Fermin N/A

- 15. Jeanie N/A

- 16. Pafos N/A

- 17. Ted Cruz N/A

- 18. Switzerland N/A

- 19. Rutte N/A

- 20. Newscum N/A

Something went wrong.

Something went wrong.