The average silver stacker owns ~10 ounces. Stack 100x that and you’re literally top 0.1%. I love math. 🤑

Silver looks primed for a nice Santa Clause rallye!

2024's global silver production was 1268x this bar:

World’s Largest Silver Bar unveiled at the 2025 Dubai Precious Metals Conference (DPMC) at Atlantis, The Palm. Weighing exactly 1971 kgs, and manufactured by SAM Precious Metals, the silver bar commemorates the founding of the UAE in 1971, and creates a Guinness Wold Record.

💡The average decline across the largest 10 stock market crashes was -45.6%. Average length was 18 months. How bad and long next time?

Socialism noun (ˈsoʊ.ʃəl.ɪ.zəm) The belief that equality is best achieved by making everyone equally miserable, except the rulers.

There are 4 billion ounces of silver available above ground. (Ted Butler estimates) That leaves 0.5 ounces for every human on earth.

Potential Gold Revaluation Prices - A Thread Overview: Moderate: $3,000 - $5,000 Significant Devaluation: $7,500 - $10,000 Global Economic Reset: $15,000 - $30,000 Hyperinflation: $20,000 - $50,000 Economic Collapse: $50,000 - $100,000 Max Supply Backing: $100,000+ Let's dive…

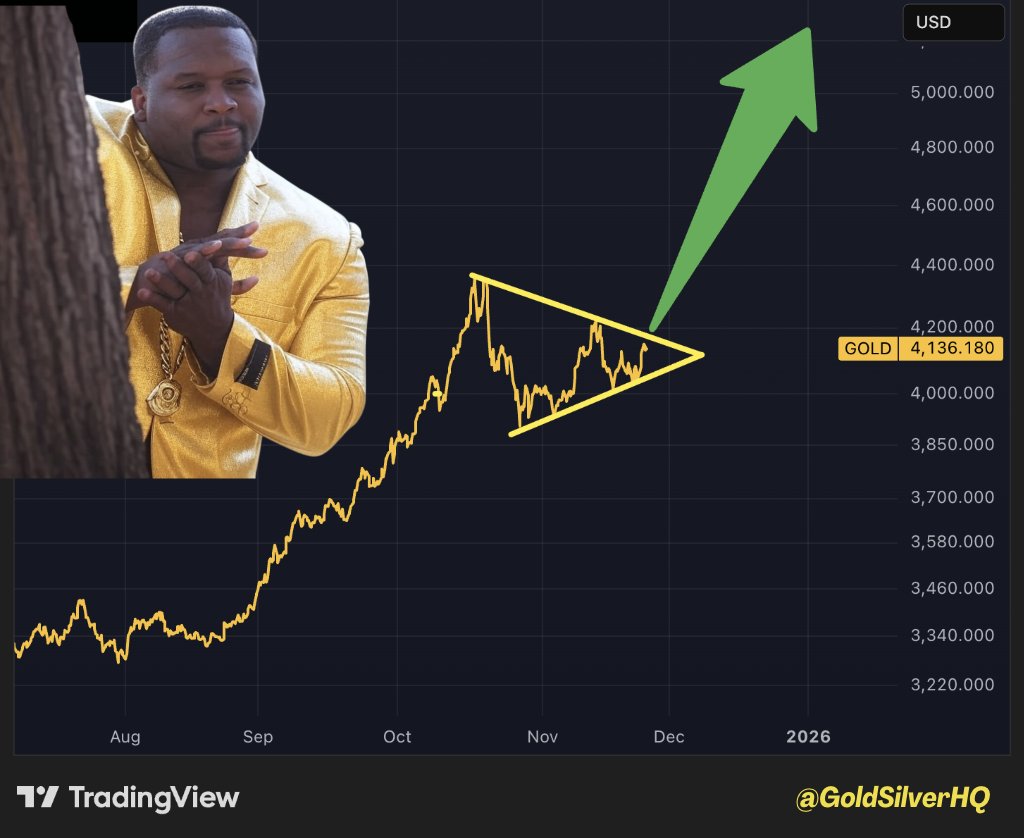

2026 Gold Price Predictions by Banks: 1. J.P. Morgan Private Bank – $5,300 2. JPMorgan / Goldman Sachs – $5,055 3. Bank of America – $5,000 4. HSBC / Société Générale – $5,000 5. Goldman Sachs – $4,900 6. UBS – $4,900 7. Morgan Stanley – $4,500

For more context: Last year's global silver demand was 36000 tonnes. = 1 Mexico.

Top Countries by In-Ground Silver Reserves (2025): 1.🇵🇪 Peru: 140,000 tonnes 2.🇦🇺 Australia: 94,000 tonnes 3.🇷🇺 Russia: 92,000 tonnes 4.🇨🇳 China: 70,000 tonnes 5.🇵🇱 Poland: 61,000 tonnes 6.🇲🇽 Mexico: 37,000 tonnes 7.🇨🇱 Chile: 26,000 tonnes 8.🇺🇸 United States: 23,000 tonnes 9.🇧🇴…

If your silver weighs more than your dog, congrats – you’re probably a top 1% stacker.

💰 BRICS countries share of global GDP: 1995: 16.9% 2000: 18.5% 2005: 21.2% 2010: 25.1% 2015: 30.4% 2020: 31.5% 2025: 37.3% (projected, expanded BRICS)

👀 More eyes on the metals. 👍

Tucker Carlson Is Joining the Gold Rush with New Precious-Metals Company Battalion Metals - WSJ wsj.com/finance/commod…

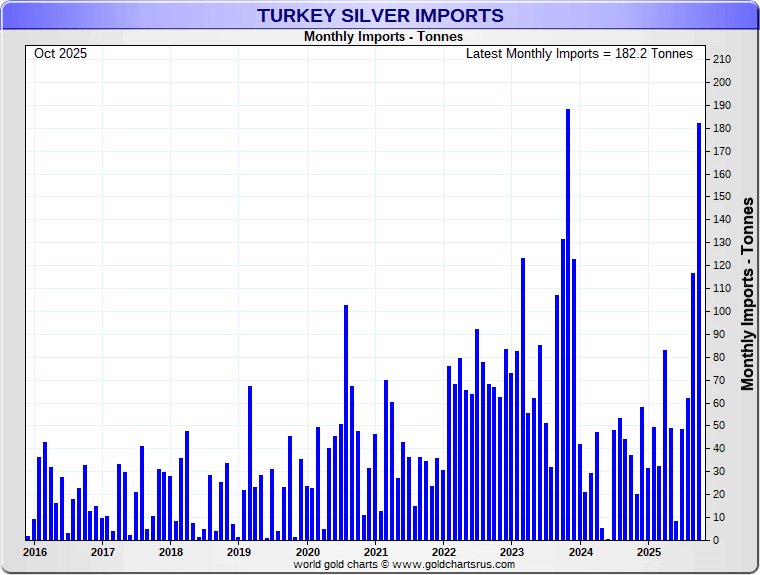

🇹🇷Turkey keeps stacking BIGLY.🥈

Turkey's 2nd largest $Silver import month ever +5.86 million oz in Oct 2025 alone for the Turks, in this tight world silver market is worth noting:

📉 10 largest U.S. stock market crashes: 1. 1929–1932 (Great Depression): 🔻86.2% 2. 2007–2009 (Global Financial Crisis): 🔻56.8% 3. 1937–1938 (Fed Tightening): 🔻54.5% 4. 2000–2002 (Dot-Com Bust): 🔻49.1% 5. 1973–1974 (Oil Crisis/Stagflation): 🔻48.2% 6. 1968–1970 (Growth Stock…

👀Billionaire Eric Sprott's largest positions: 1. Hycroft Mining: ~$259M 2. Discovery Silver: ~$252M 3. Americas Gold and Silver: ~$191M 4. Jaguar Mining: ~$193M 5. Freegold Ventures.: ~$161M 6. New Found Gold: ~$131M 7. Andean Precious Metals: ~$106M 8. Erdene…

The things is: The "New Paradigm!" will be real if (when) we go back to a gold standard. That's why this is a not typical gold bull run that ends with a crash, but a sustainable monetary reset.

Top Countries by In-Ground Silver Reserves (2025): 1.🇵🇪 Peru: 140,000 tonnes 2.🇦🇺 Australia: 94,000 tonnes 3.🇷🇺 Russia: 92,000 tonnes 4.🇨🇳 China: 70,000 tonnes 5.🇵🇱 Poland: 61,000 tonnes 6.🇲🇽 Mexico: 37,000 tonnes 7.🇨🇱 Chile: 26,000 tonnes 8.🇺🇸 United States: 23,000 tonnes 9.🇧🇴…

🤔Where are gold & silver?

United States トレンド

- 1. The BONK 87,9 B posts

- 2. #LingOrmHNYatICONSIAM 444 B posts

- 3. Good Tuesday 31,1 B posts

- 4. FINALLY DID IT 327 B posts

- 5. Chao Phraya 5.664 posts

- 6. Whale - Buy 1.676 posts

- 7. The 4D 14,5 B posts

- 8. #tuesdayvibe 1.803 posts

- 9. Taco Tuesday 8.822 posts

- 10. 10m TXs N/A

- 11. Chip Kelly N/A

- 12. 5m TXs N/A

- 13. The Jito 63,1 B posts

- 14. Tuesday of 2025 7.580 posts

- 15. QUICK TRADE 1.547 posts

- 16. Smart Money - Buy 2.428 posts

- 17. AI - $DUCKY N/A

- 18. JIANKUI HE N/A

- 19. Bangkok 72,2 B posts

- 20. Yemen 67,3 B posts

Something went wrong.

Something went wrong.