You might like

It’s Saturday morning! You all know what that means… Make sure you taste the goodness of the biscuit today and everyday.

Interesting in Gas This Week - Shell indicates in analyst update that LNG-Canada Ph2 FID anticipated before YE'26. Thats a when, no longer an if! - Fed 32 major project list for rapid advancement anticipated to include new oil pipeline to pacific, power from BC to Yukon, LNG-C…

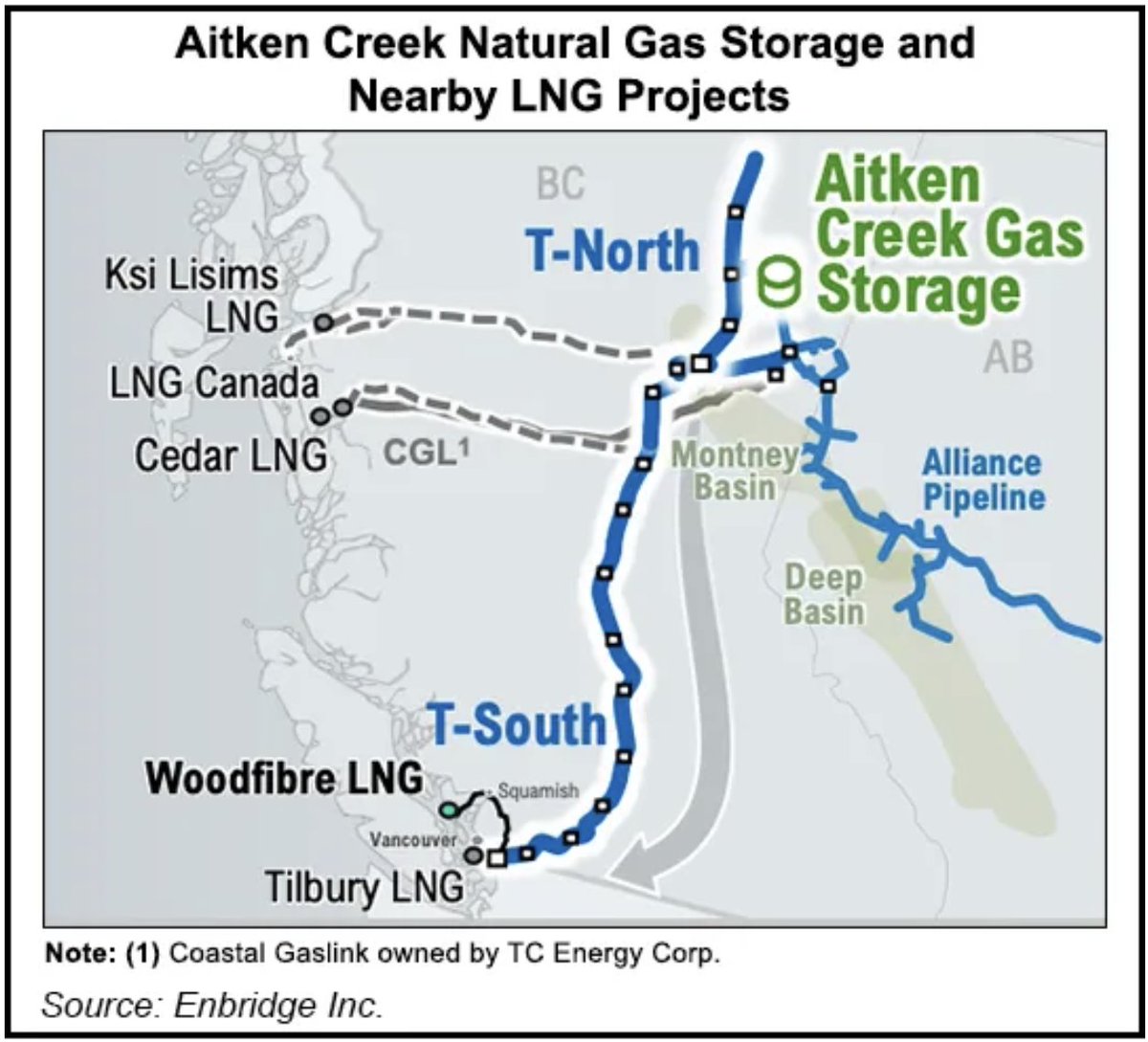

#Enbridge is going ahead with a $300-million expansion of the Aitken Creek #naturalgas storage facility, 120 km northeast of Fort St. John: ow.ly/emjq50WATIl @energeticcity

To be fair, another great energy company $CNQ, got a 67% RoR since 2022 (+$7.4125 in dividends), while $TOU got 55% (+19.47 in dividends), so total returns were $CNQ 96% amd $TOU 103% - for buy and hold, pretty similar returns - for most, playing vol is a mugs game. Own quality

Catching my eye in gas this week: - LNG Canada first shipment away, more cargos en route - CAL26/27/28+ AECO / St2 took a 30-50c step back this week in absense of any real fundamental news. Shoulder tap at a fund? Or a big Canadian gas transaction needing a PDP hedge. Would poll…

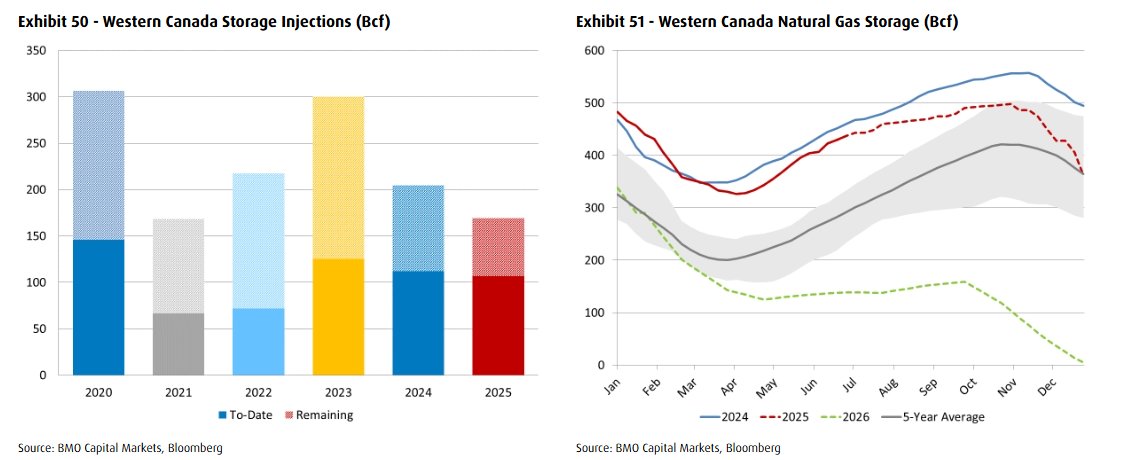

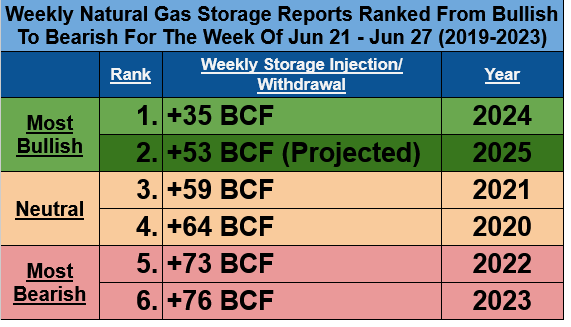

For today’s EIA #Natgas Storage Report for June 21-27, I’m projecting a +53 BCF injection, 7 BCF bullish vs the 5-yr avg & the 2ndsmallest for the week in the last 5 yrs after last year’s +35. This will be a closely-watched Report to assess for supply/demand imbalance tightening.

U.S. shale has peaked. Demand is stronger than expected. Inventories are balanced. Yet oil trades near crisis-era levels—both in real terms and vs. gold. For RIAs: this may be a rare opportunity hiding in plain sight. Read: hubs.li/Q03vCZMj0 #RIA #oil #energy #markets

Oil demand growth to continue, no peak in sight, #OPEC Secretary General says #oott reuters.com/business/energ…

Canadian energy stocks are starting to move. 🇨🇦🛢️ Multi-year bases. Rising momentum. Insider buying. We broke it all down — including the setups flagged early by our scanner. 👀🛰️ $CNQ.TO $HWX.TO $NVA.TO $SU.TO $TOU.TO $TPZ.TO $TVE.TO See the charts👇setyourstop.com/canadian-energ…

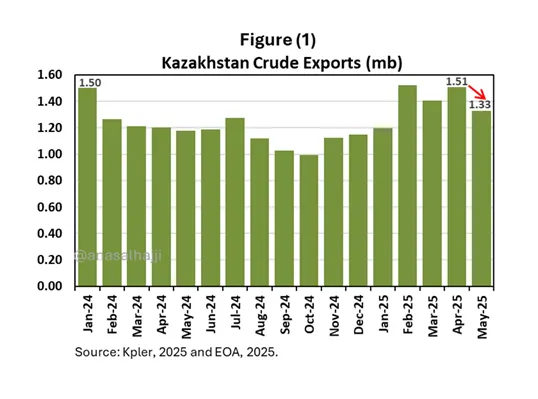

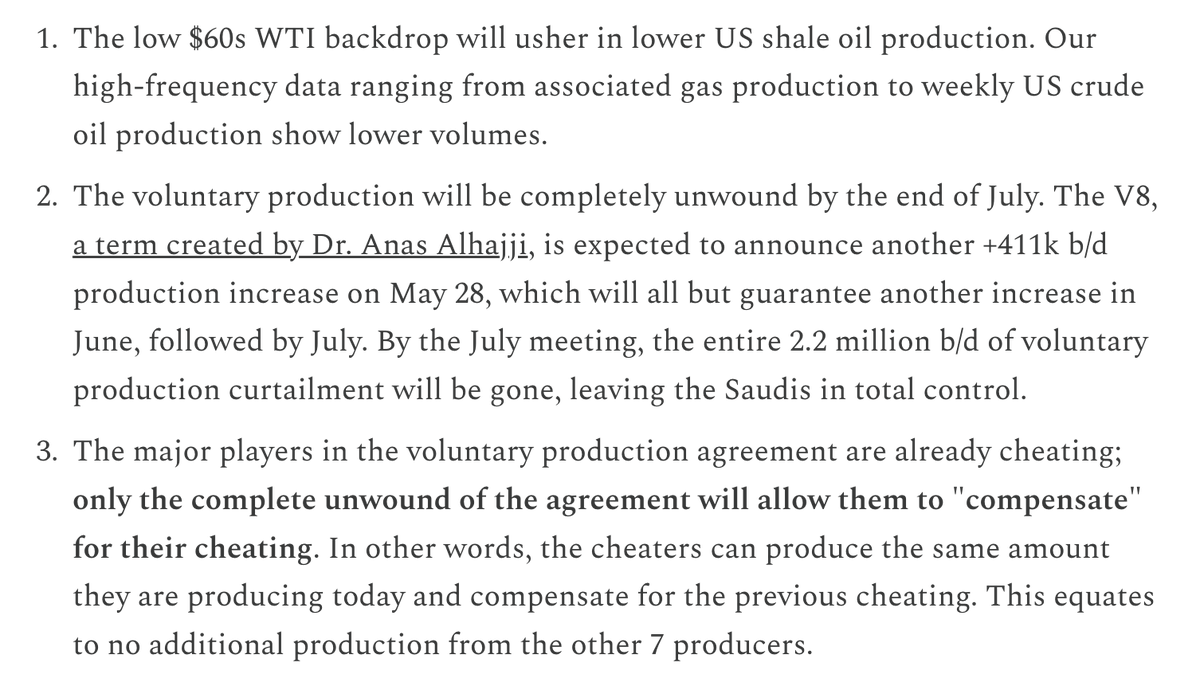

The oil bears got wrong on multiple fronts! Daily Energy Report open.substack.com/pub/afalhajji/…

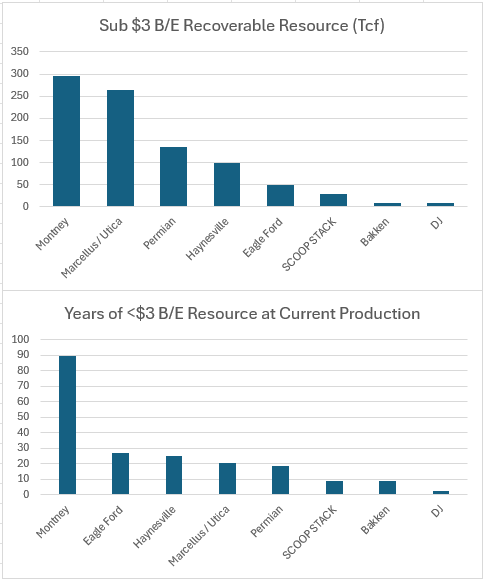

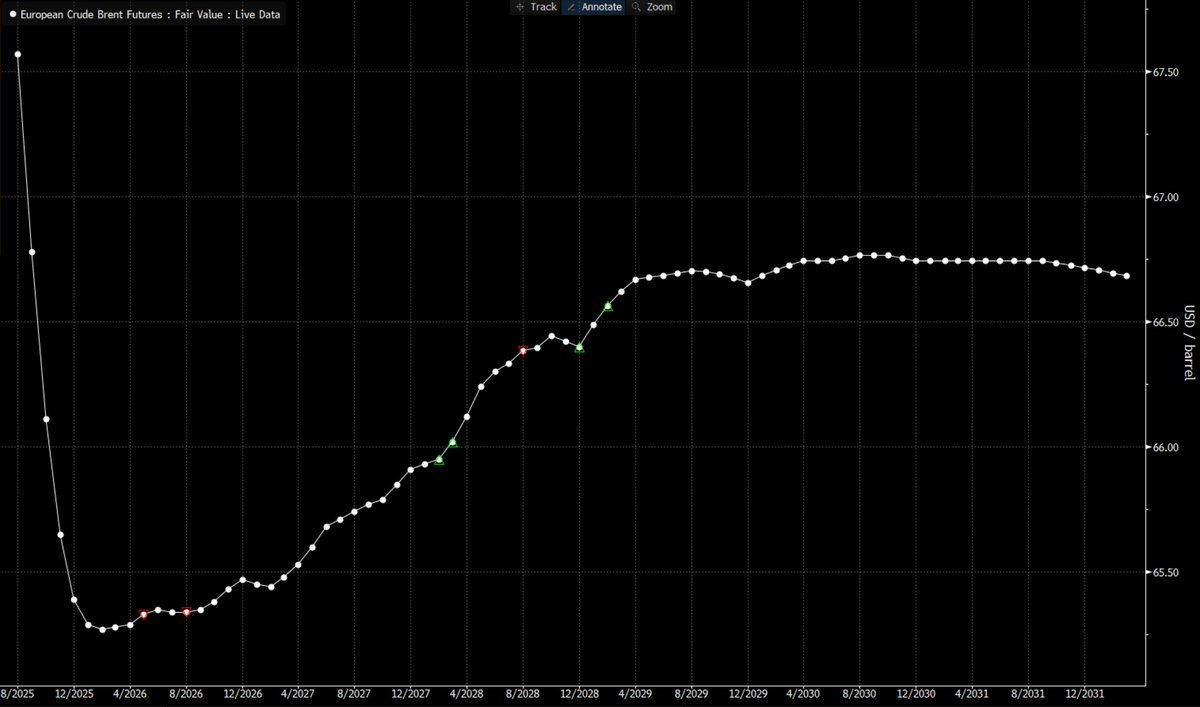

Imagine being a ShaleBro and just plugging away drilling your best inventory into the front end of this curve. Market screaming longer term shortage and near term oversupply. DUC OR DROP

Crude curve is getting EVEN WEIRDER. Front two months now trading at a premium to the rest of the curve, even though the bulk of the curve remains in contango. But that front-end backwardation continues to spread, now backwardated out 6 months through January 2026.

⭕️No shale oil companies out there lose money at $65 WTI. ⭕️The question is about "adequate" investment to maintain production.

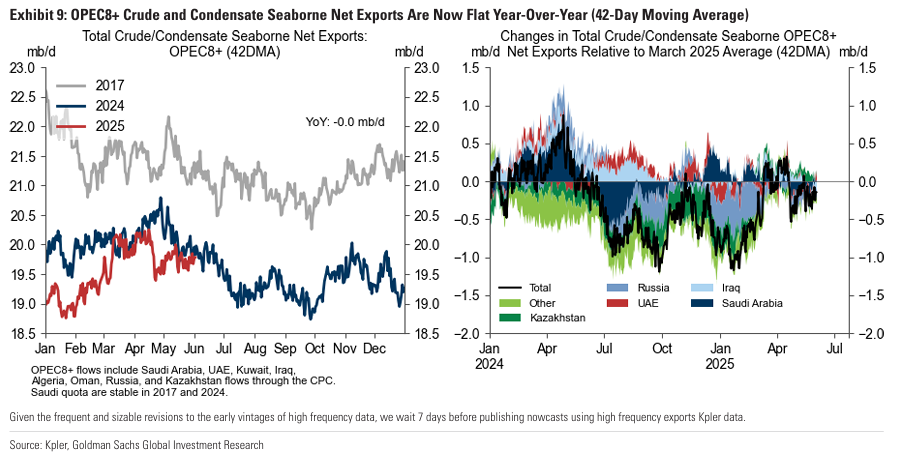

If you're still expecting OPEC+ production to flood the oil market this summer, you're going to have to put those hopes to rest. #oott #com

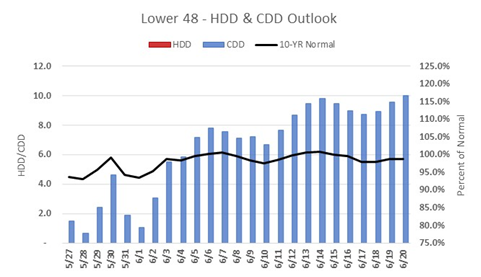

In gas this week: - Last week of cool weather (and big injections) with summer heat on the doorstep and trending higher than normal for the balance of June - LNG Canada scheduled to receive its first vessel for loading on June 29th (coming from Malaysia) - CAL26 NYMEX finishes…

Everything you need to know about $TOU.TO Tourmaline Oil under 10 min, Canada’s largest Natural Gas producer, link first comment 👇🫡🪒

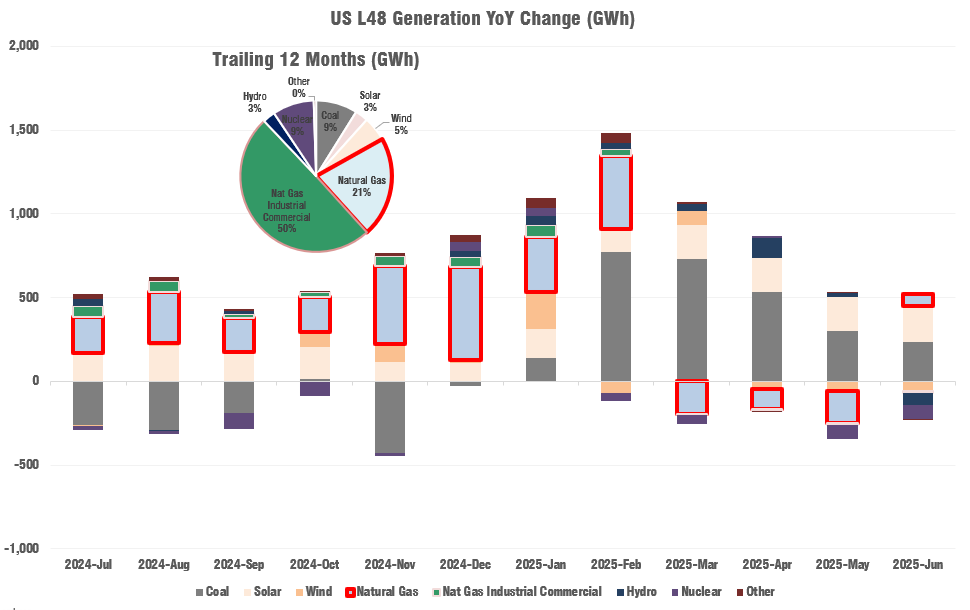

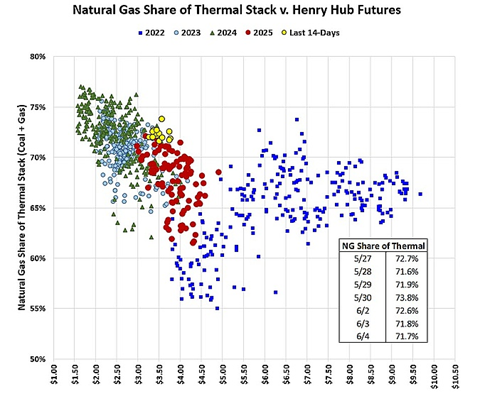

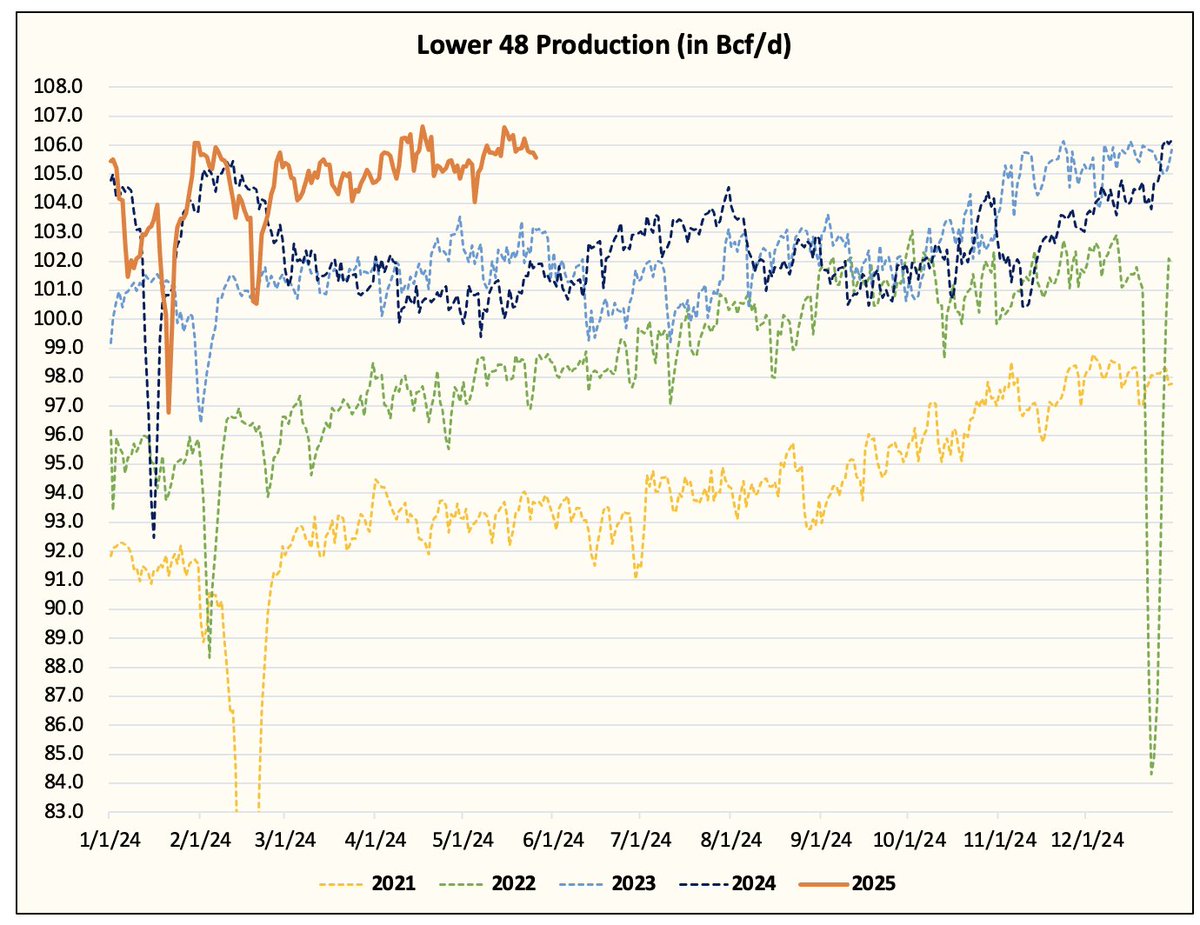

Following the brief spike we saw in Lower 48 natural gas production last weekend, production is tapering off, as expected, back to the ~105.5 Bcf/d range. More weakness in US shale oil production will continue, which will be a tailwind for natural gas.

(WCTW) Total Control The Saudis have total control of the global oil market... for now. hfir.com/p/wctw-total-c…

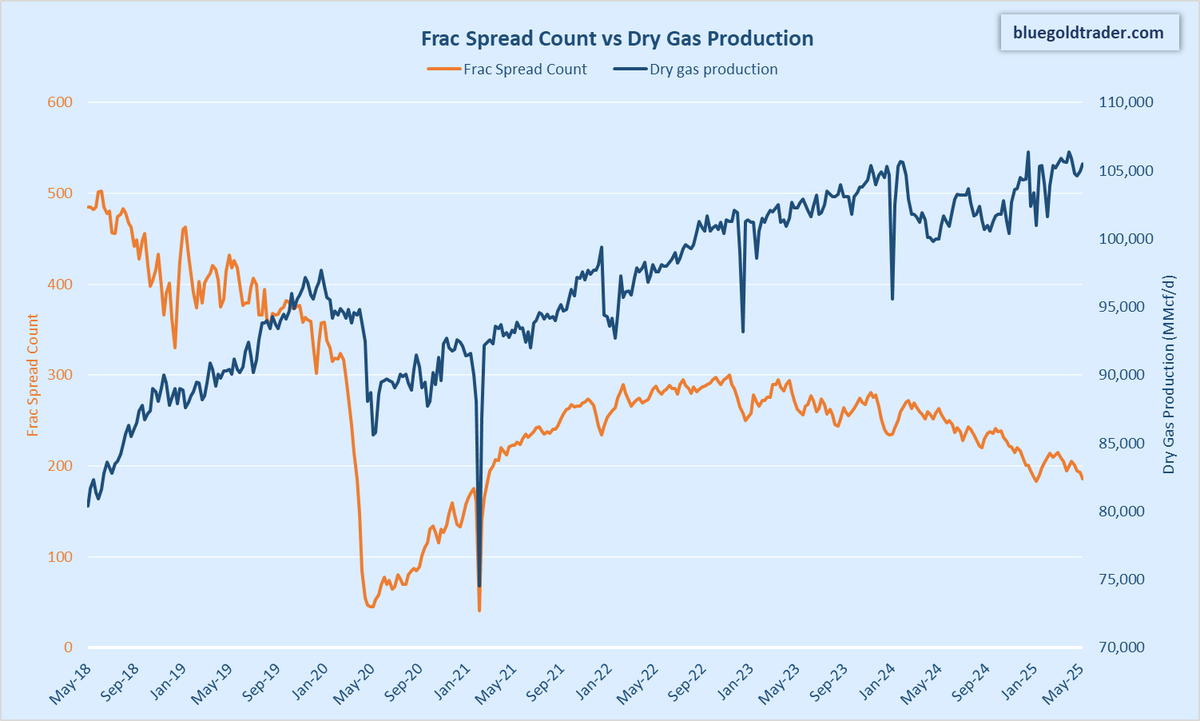

U.S. frac spread count keeps falling, U.S. dry #natgas production keeps rising. This cannot continue for very long.

Fantastic summary of $CNQ.TO. The best quote as quality evidence of this name: "Raised our dividend in 2020 while others cut". Stay tuned for what $CNQ get up to next. #OilSands #LNG #NaturalGas bnnbloomberg.ca/markets/2025/0…

United States Trends

- 1. Joe Brady N/A

- 2. Aaron Glenn N/A

- 3. Holocaust N/A

- 4. Daboll N/A

- 5. Philip Glass N/A

- 6. Babich N/A

- 7. Engstrand N/A

- 8. #ValentinoSpeculaMundi N/A

- 9. #Olandria N/A

- 10. #DaredevilBornAgain N/A

- 11. Doomsday Clock N/A

- 12. Jimmy Kimmel N/A

- 13. Juan Crow N/A

- 14. Cam Ward N/A

- 15. Vindman N/A

- 16. Taxation N/A

- 17. Aaron Judge N/A

- 18. Kennedy Center N/A

- 19. Megyn N/A

- 20. Rick Rizzs N/A

Something went wrong.

Something went wrong.