Tobias

@Greenbackdd

PM, Acquirers Funds® http://acquirersfunds.com. Author, Soldier of Fortune (http://amzn.to/3KM4BGj) and Acquirer's Multiple (http://amzn.to/2ij8q4U).

Junky small caps (Russell 2000) went parabolic against profitable small caps (S&P 600) this year (see chart). That looks to be breaking down now. Profitable small caps (S&P 600) are much cheaper than junky small caps (Russell 2000). Profitable small caps are trading between the…

The chart plots forward P/E ratios (price / next-12-month expected earnings) for two US small-cap indexes from 2002–2025: Russell 2000 (red): Broader, includes many unprofitable companies S&P 600 Small Cap (blue): Profitability-screened, higher quality Current readings (Oct…

The audiobook of Soldier of Fortune: Warren Buffett, Sun Tzu and the Ancient Art of Risk-Taking is now available: amzn.to/47J0XV8

"I said, 'The S&P 500's earnings per share are down since December 2021.'"

S&P 500 Earnings Per Share. 12-month real earnings per share — inflation adjusted, constant September, 2025 dollars. Peak was 230.52 in December 2021.

The chart plots forward P/E ratios (price / next-12-month expected earnings) for two US small-cap indexes from 2002–2025: Russell 2000 (red): Broader, includes many unprofitable companies S&P 600 Small Cap (blue): Profitability-screened, higher quality Current readings (Oct…

Is the 10Y-3M Treasury spread inversion normalizing?

$MSTR (-6%) vs $BTC (+35%) over the last 12 months.

This chart tracks the "Magnificent 7" $GOOG, $AMZN, $AAPL, $META, $MSFT, $NVDA, and $TSLA dominance of the S&P 500. Market Cap Share 33.3% Forward Earnings Share 23.8% Forward Revenue Share 12.4% The wide gap between market cap and earnings suggests these companies trade at…

These companies deserve to trade at a premium. They generate about 24% of S&P 500 earnings while only producing 12% of revenues, demonstrating exceptional profit margins and operational efficiency compared to other index constituents.

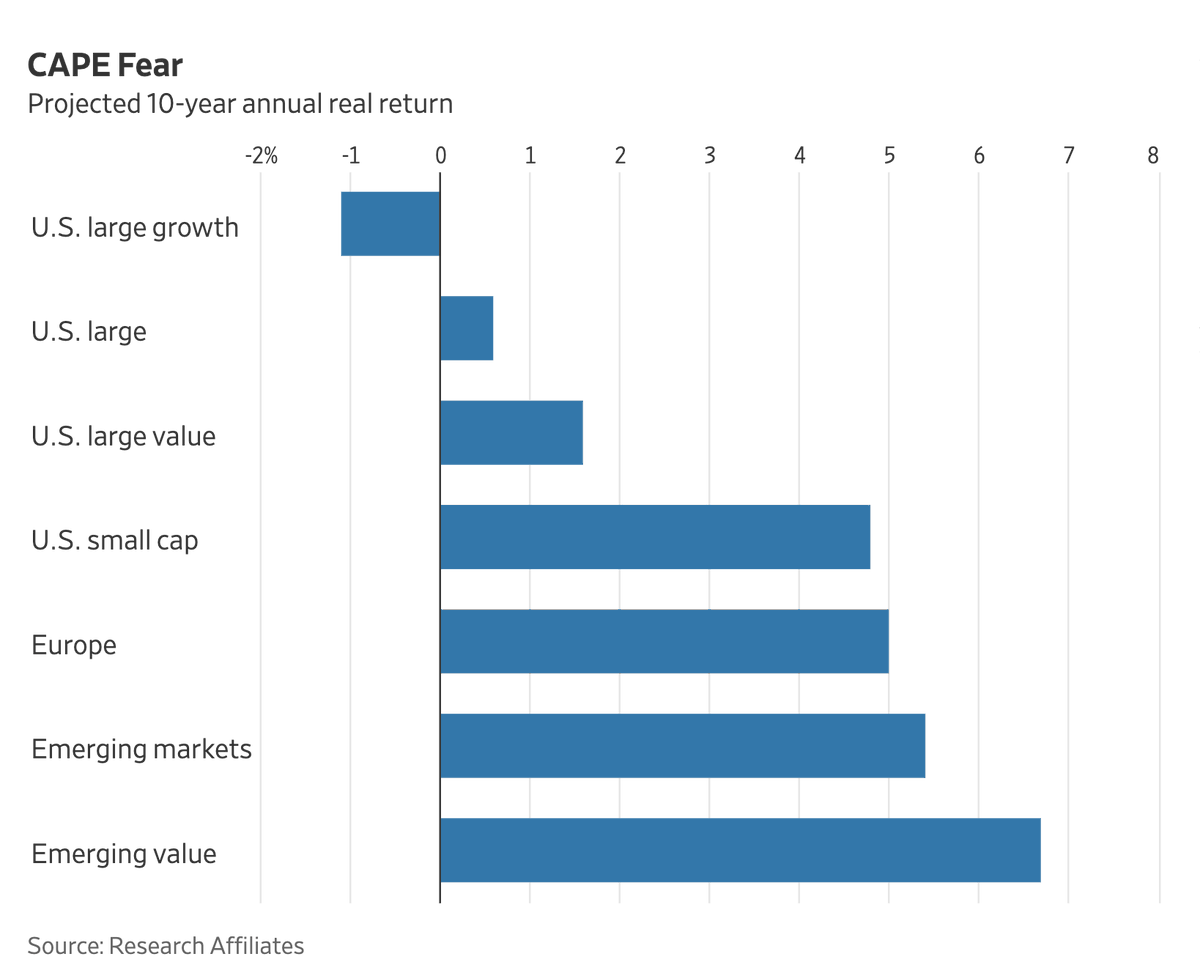

Incredible set-up for deep value contrarians.

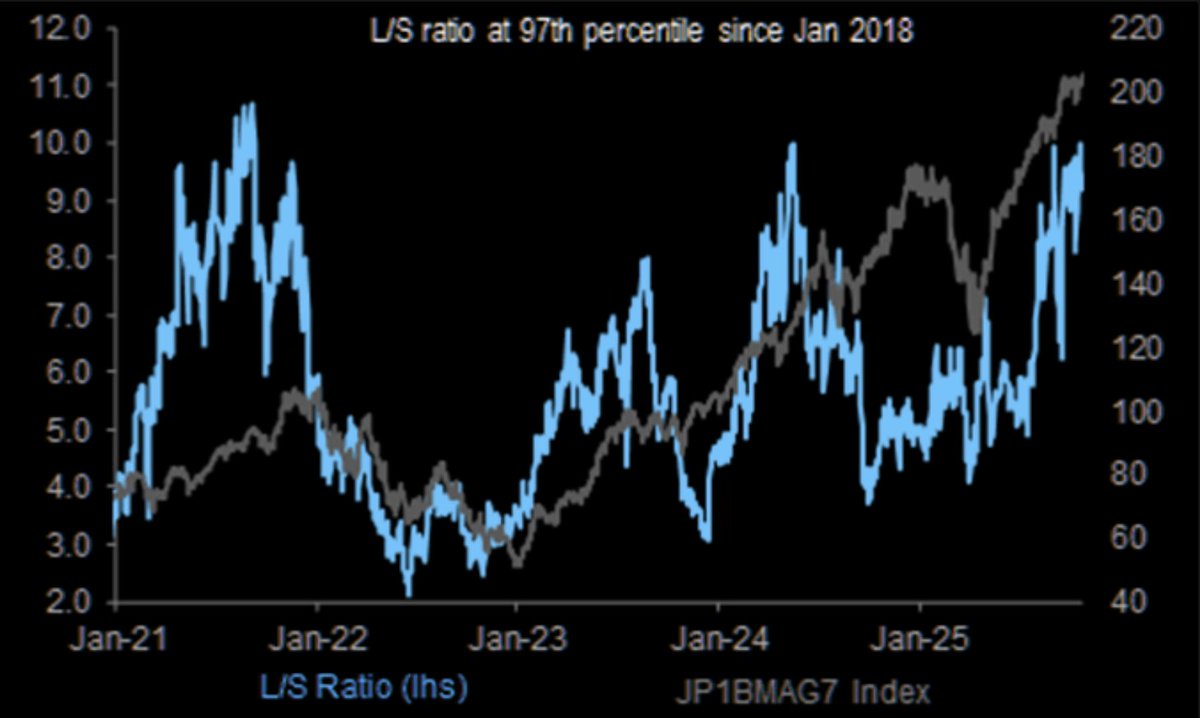

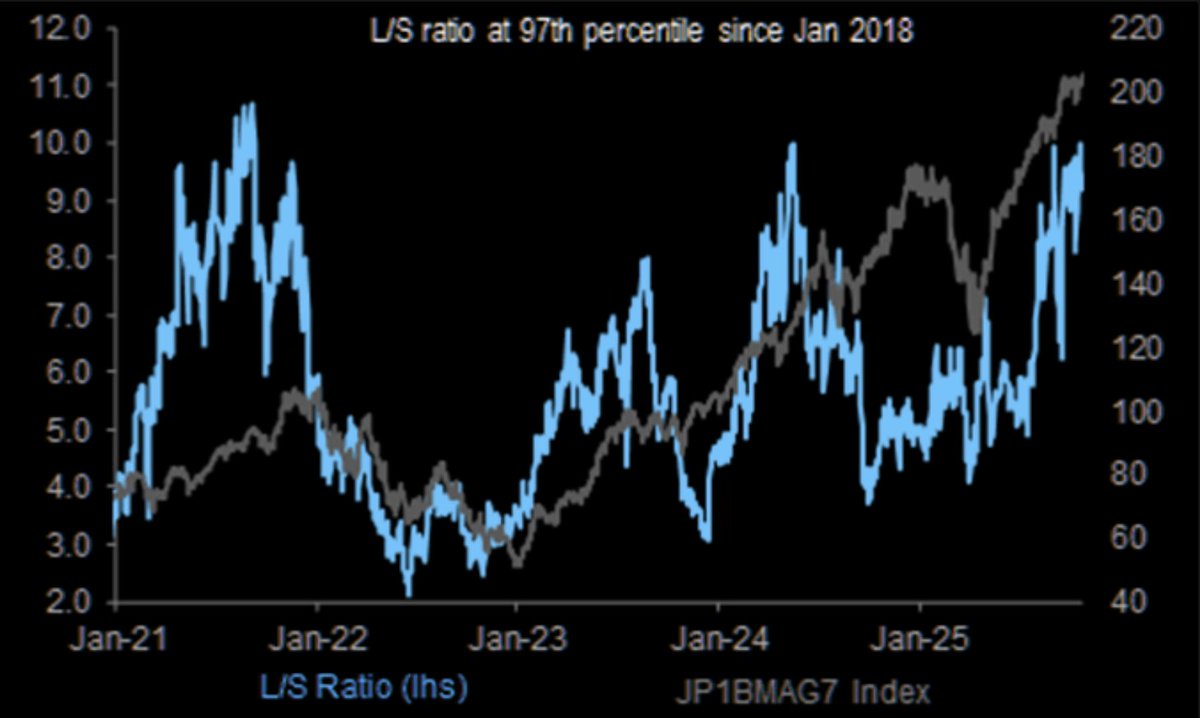

Conclusions in brief: Fundamental hedge funds have embraced high-beta stocks… …With good price charts, fast growth rates, and above- market valuations

garbitrage /ˈɡɑːrbɪtrɑːʒ/ noun Definition: The investment practice of seeking mispriced opportunities among neglected, unfashionable, or “garbage” stocks, companies dismissed by the market but trading below intrinsic value. A tongue-in-cheek blend of garbage and arbitrage,…

Hard to believe, I know, but the biggest stocks have tended to be a worse bet than the rest of the market. It hasn't been true since 2015. The same thing happened in to the late 1990s. A bone-crunching 15-year bear market followed for the biggest.

S&P 500 Earnings Per Share. 12-month real earnings per share — inflation adjusted, constant September, 2025 dollars. Peak was 230.52 in December 2021.

Tiptoe through the SMID cap tulips.

Small Caps: Expensive, over-levered & unprofitable. (Bullish)

Investor and author @bogumil_nyc joins @farnamjake1 and me on Value: After Hours LIVE TODAY at 1.30pm E / 10.30am P / 5.30pm UTC / 3.30am AEST Watch it on the Acquirers Podcast channel: youtube.com/channel/UCJ27F……………

youtube.com

YouTube

Bogumil Baranowski on Freedom, Mindfulness, Patience, and the Art of...

T.I.N.A. to Mag7

Hedge funds are very bullish on Mag7 stocks. Complete shift after being underweight.

Hedge funds are very bullish on Mag7 stocks. Complete shift after being underweight.

"The cyclically adjusted version first proposed by Warren Buffett’s mentor Benjamin Graham ... popularized by Nobel Prize-winning economist Robert Shiller looks back at 10 years of earnings and adjusts them for inflation to cover an entire business cycle. It recently broke above…

United States 趨勢

- 1. Peggy 27.6K posts

- 2. Zeraora 9,577 posts

- 3. Berseria 2,966 posts

- 4. #FaithFreedomNigeria 1,443 posts

- 5. Luxray 1,609 posts

- 6. Dearborn 337K posts

- 7. Cory Mills 20.6K posts

- 8. Good Wednesday 34.7K posts

- 9. #wednesdaymotivation 7,279 posts

- 10. #Wednesdayvibe 2,487 posts

- 11. Hump Day 17.6K posts

- 12. Xillia 2 N/A

- 13. #MissUniverse 26.4K posts

- 14. Tom Steyer N/A

- 15. International Men's Day 66K posts

- 16. Sonic 06 1,361 posts

- 17. $NVDA 40.5K posts

- 18. Happy Hump 11.5K posts

- 19. #LosVolvieronAEngañar 1,999 posts

- 20. Jessica Tisch N/A

Something went wrong.

Something went wrong.