Danny Marques | The Investing Informant

@Invst_Informqnt

Helping build world's 1st Bitcoin IR firm @OGAdvisors | Research @Finblueprint | | @VillanovaU '16

$ASTS - AST Spacemobile $42B market cap and only generated $14.7M in revenue last quarter. One of the largest fundamental discrepancies in the market right now. Reason? Market has extremely high expectations for space tech and $ASTS ability to effectively monetize partnerships…

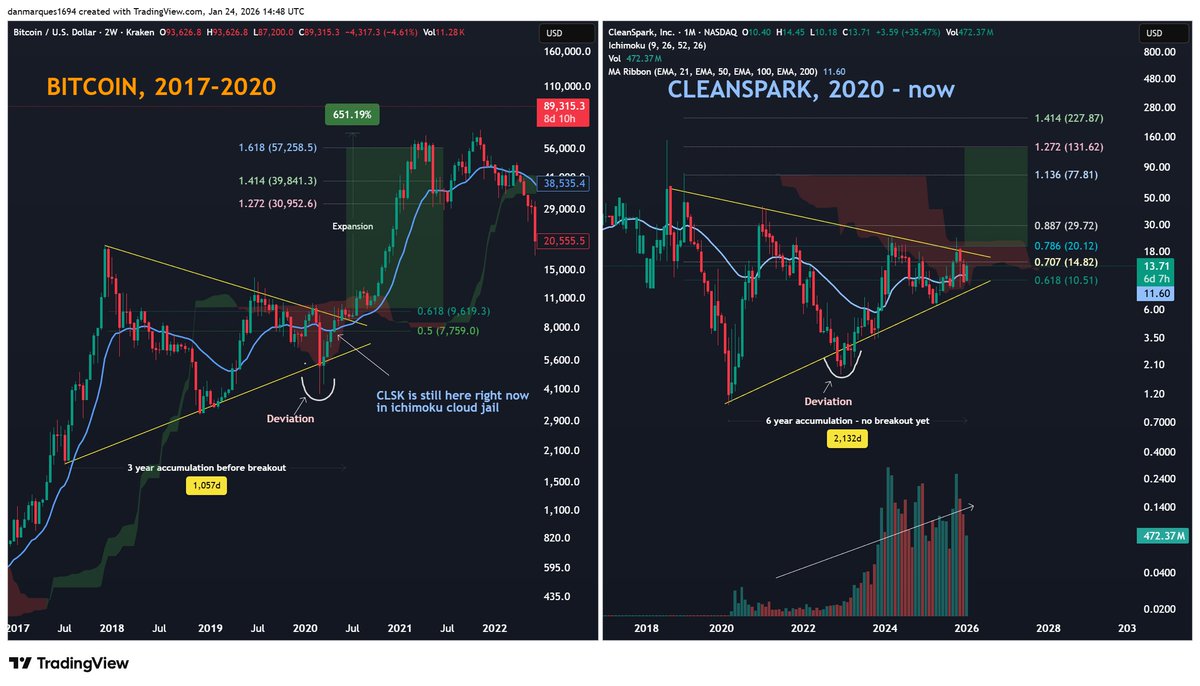

Bitcoin $BTC spent 3 yrs in accumulation from 2017 - 2020 capped by a massive symmetrical triangle pattern that culminated in a fakeout, followed by re-absorption into the range and then a HTF breakout, which signaled the start of a parabolic expansion phase. Now look at…

@cantonmeow @matthughes13 @Fibonacci_TA @chad_ventures @StonkChris @CrypticTrades_ @Freedom_By_40 @AlemzadehC @bitcoindata21

Cleanspark $CLSK is one of my largest holdings second to Bitcoin $BTC. As hard as it is to believe, it's never entered an expansion phase since 2020. Everything that's happened last few years is just consolidation within this triangle and the energy compression yet to be…

Bitcoin $BTC is not going lower and I'll prove it by cross-referencing what I see across other assets like the below: $MSTR / $BTC pair Ethereum $ETH Coinbase $COIN Ripple $XRP Cleanspark $CLSK Russell 2000 $IWM 🧵

@cantonmeow @Fibonacci_TA @matthughes13 @chad_ventures @StonkChris @CrypticTrades_ @Freedom_By_40 @AlemzadehC The only other TA 🐐you should be following

Would love a re-post on the thread if you guys don't mind whoring me out!

Cleanspark $CLSK is one of my largest holdings second to Bitcoin $BTC. The reason behind this is in this chart It's never entered an expansion since 2020. Hard to believe it but everything that's happened last few years is just consolidation within this triangle and the energy…

$IWM breaking out to ATHs is the early tell and confirmation of a risk-on environment aka liquidity rotating into small caps and that expansion is just starting

For those expecting Bitcoin $BTC to still head to $70k or whatever lower price target you have and crypto to “enter a bear” This is why your predictions make 0 sense $MSTR and $COIN are arguably the purest proxies for BTC / $ETH, both of which are nearing the end of their…

$IWM is at ATH entering price discovery while Bitcoin $BTC hasn't even joined the party. Yet. Study the liquidity cycles. The risk-on environment we've recently entered will beget an expansionary phase that will last longer than many are expecting

$IWM is at ATH entering price discovery while Bitcoin $BTC hasn't even joined the party. Yet. Study the liquidity cycles. The risk-on environment we've recently entered will beget an expansionary phase that will last longer than many are expecting

@cantonmeow @Micro2Macr0 @CredibleCrypto @TheProfInvestor @Fibonacci_TA @matthughes13 @chad_ventures @StonkChris

I haven't felt this bullish on Bitcoin $BTC, high beta equities and frankly other crypto proxies in a very long time $IWM (small cap ETF) and $ARKG $XBI (biotech etfs) are all tells that we're still early stages of an exuberant risk-on market Too many are focused on day to day…

FYI when I say "while that still may play out" it means yea anything can happen, but you don't sit sidelined waiting for a bear market if you're a long-term investor Cost of missing out > waiting for a "good entry"

I love how everyone on my timeline is a Japanese bond expert again....

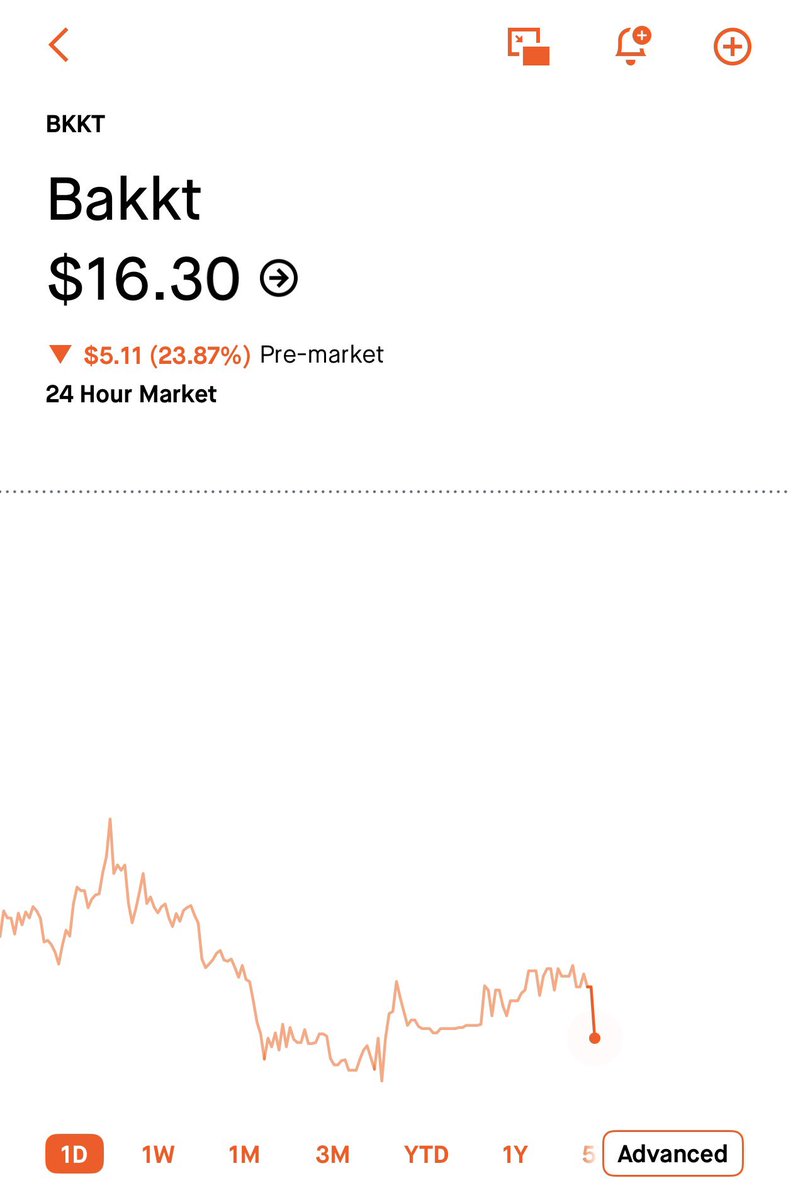

This a short-sighted take on Bakkt $BKKT that also shows a lack of understanding how growth companies operate The ATM is an optionality instrument and a very cheap and cost-effective source of capital that gives a firm flexibility in terms of when they're raising capital and at…

$BKKT is down -23.87% premarket after a new $300M ATM dilution. In my opinion, this is one of the worst companies in the entire market. I feel sorry for people who followed a certain influencer at $45 since retail portfolios are now wiped over 64%. There’s an endless cycle…

i think they could.. i’m saying they should NYSE doesn’t need tokenization to enable 24/7. they could just keep their servers running instead of turning off at 4 “it’s not real tokenization unless it comes with self-custody and defi, otherwise it’s just sparkling tradfi”

Next deep dive will be on Gemini $GEMI - IPO’d in September at $28, down -62% since IPO - 24th largest exchange by trading volume - Launched Bitcoin $BTC credit card now used by 100k+ users - obtained license for prediction markets - Launched in 2014, been thru multiple crypto…

Let me know in comments if you guys would like to see more fundamental deep dives like the ones below on Galaxy Digital $GLXY? I’d also have a section that looks at my perspective on the technical analysis as you rarely see them paired together as if price action doesn’t matter

I want to thank all the geopolitical analysts and economists on X who have become experts on the matters of Greenland and tariffs overnight and currently attribute the volatility in Bitcoin to these very matters Your alpha will always be appreciated 🙏

United States Trends

- 1. Czechia N/A

- 2. Mitch Marner N/A

- 3. Ash Wednesday N/A

- 4. #bucciovertimechallenge N/A

- 5. Kristen Bell N/A

- 6. Amy Rose N/A

- 7. Lent N/A

- 8. Nick Suzuki N/A

- 9. Crosby N/A

- 10. Ted Lieu N/A

- 11. Necas N/A

- 12. #TrumpAffordabilityChaos N/A

- 13. Anthony Gordon N/A

- 14. Binnington N/A

- 15. Gudas N/A

- 16. Ondrej Palat N/A

- 17. Leafs N/A

- 18. Qarabag N/A

- 19. Newcastle N/A

- 20. Diego Garcia N/A

Something went wrong.

Something went wrong.