Frank Taber

@Ionewolvesfrank

Private investor. Focused on micro-caps & overlooked stocks. No tweets are financial advice.

You might like

🧵In 2002, Michael Burry wrote a thesis on Value Investors Club for a Mexican poultry producer $IBA In this thread, I'll summarise his write-up. Over the next 5 years the stock price was up ~260%. If we include dividends, the IRR for the 5 years was ~32%. 1/7

8/ if you’re interested in learning more about the booked that helped shape a young Warren Buffett’s business mind, here is a PDF of the entire book. dl.rasabourse.com/%5BF.C._Minake…

7/ Mostly though the book is business motivation, with valuable quotes like "If you have the urge to go into business or to lay the foundation for a future business by capitalizing your spare time, delay no longer. If you wait for conditions, they may leave you in the lurch."

6/ The book also covers the concept of investing in an enormous market that you understand well, mentioning cigarette humidors, tailored suits and greeting cards. This is a principal that Buffett certainly adopted.

5/ "I would create these compound interest tables to figure out how to have a weighing machine for every person in the world. I pictured everybody in the country weighing themselves 10 times a day, and me just sitting there like the John D. Rockefeller of weighing machines”

4/ Buffett was particularly interested in a chapter about pennyweight scales. "I sat and calculated how much it would cost to buy the first weighing machine, and then how long it would take for the profit of that one to buy another one”

3/ Other stories in the book tell of people who have made money by starting their own consulting businesses, and even selling pet rocks (which was a popular fad in the 1970s). The author also shares the founding story of JCPenney as well discussing the stock market.

2/ One woman in the book started a business selling homemade pies to local restaurants and eventually turned it into a successful catering business. Another man became rich by flipping real estate. He bought and fixed abandoned houses.

1/ "One Thousand Ways to Make $1,000" is a classic book on personal finance, first published in 1936 by author Francis Minaker. The book is filled with inspiring stories of people who have successfully made money using a variety of creative strategies.

🧵 The book that Warren Buffett memorised as a child. "Very early, probably when I was seven or so, I took this book out of the Benson Library called 'One Thousand Ways to Make $1,000’. I pretty much memorised it” - Warren Buffett Here’s a synopsis of the book ⬇️

I’ve always wanted to dabble in a basket of 5-10 net-nets. Willing to size it appropriately so that if it’s a bit of a drag on the portfolio I could live with it. Comment any interesting net-nets below, or even any Twitter or Substack accounts to follow.

Since Buffett has made Japan the hot topic, here are some of the best accounts for Japanese equities. @AltayCapital @siegelist1 @Fritz844 @puppyeh1 (sometimes) @Japan_too_cheap @JapanDeepValue1 is a new account that seems great, with only 175 followers, let’s triple that.

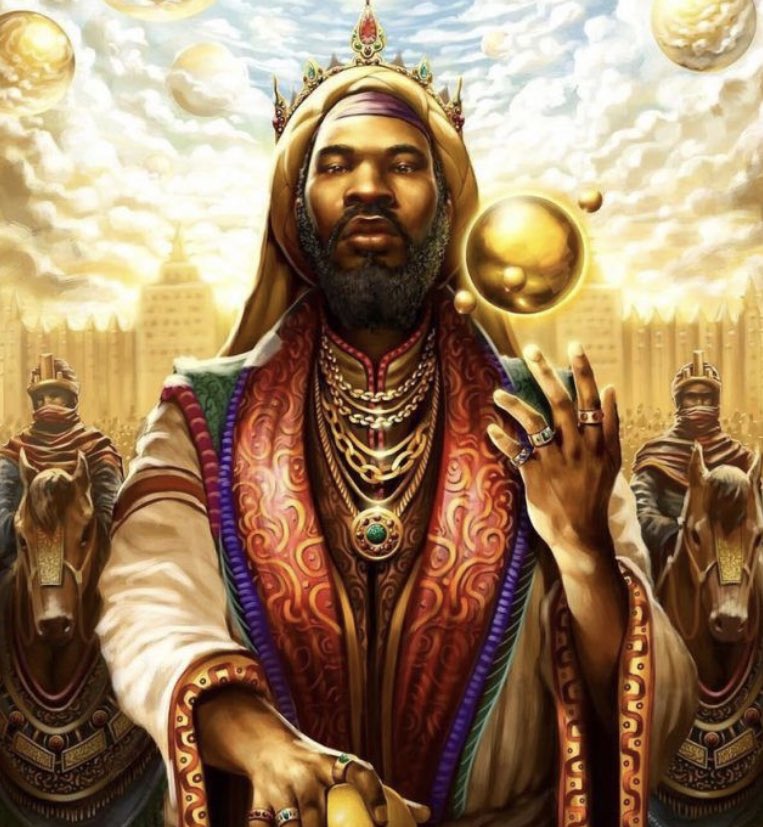

7/ According to the British Museum, the land in which Mansa Musa ruled accounted for about half of the gold in the ‘Old World’. All of it belonged to King Mansa Musa, and allowed him to become the richest man to ever live.

6/ The kingdom stretched for >3000km, from the Atlantic Ocean all the way to modern-day Niger, taking in parts of what are now Senegal, Mauritania, Mali, Burkina Faso, Niger, The Gambia, Guinea-Bissau, Guinea and Ivory Coast. Most of which was rich in gold and salt.

5/ Musa's wealth was also a result of his wise management of resources. He invested heavily in education, building mosques, and expanding the empire's infrastructure. His rule was characterized by stability and prosperity, and his people benefited greatly from his wealth.

4/ Musa's wealth was also fueled by his pilgrimage to Mecca, in 1324. He traveled with a massive caravan of over 60,000 people and carried a vast amount of gold with him. Musa distributed so much gold along the way that he caused inflation in the regions he passed through.

3/ Mansa Musa was the king of the Mali Empire, one of the wealthiest empires in Africa during the 14th century. The empire was rich in gold, salt and other commodities, and Mansa Musa controlled the trade in the region.

2/ To put it into perspective, Bernard Arnault, the world's richest man, has a net worth of $223 billion, while Elon Musk's net worth is $185 billion. Mansa Musa's wealth would have been about equal to these two combined.

🧵Mansa Musa: The Richest Man in History Mansa Musa, also known as Musa I of Mali, is widely considered the wealthiest person in history. His net worth (adjusted for inflation) was estimated at $400 billion, which dwarfs the wealth of the world's current richest men. ⬇️

What investment approach / fintwit group will have the best returns over the next 5 years?

United States Trends

- 1. Under Armour 7,330 posts

- 2. Megyn Kelly 39.4K posts

- 3. Blue Origin 11.5K posts

- 4. Nike 27.1K posts

- 5. New Glenn 11.9K posts

- 6. Curry Brand 6,066 posts

- 7. Senator Fetterman 22.5K posts

- 8. Brainiac 9,483 posts

- 9. Vine 39K posts

- 10. Operación Lanza del Sur 7,559 posts

- 11. Operation Southern Spear 6,906 posts

- 12. #2025CaracasWordExpo 16K posts

- 13. CarPlay 4,790 posts

- 14. #drwfirstgoal N/A

- 15. Matt Gaetz 19.6K posts

- 16. Eric Swalwell 35K posts

- 17. Thursday Night Football 2,608 posts

- 18. Coach Beam N/A

- 19. World Cup 111K posts

- 20. Suriname 1,325 posts

Something went wrong.

Something went wrong.