Rajjobalia10

@Jobalia_Decodes

Entrepreneur & AI Enthusiast | Building next-gen AI search | CIO @rivesagroup | Finance, Stocks & AI Research

You might like

⚠️Recent US job cuts are MASSIVE: Amazon is cutting up to 30,000 jobs. UPS has cut 48,00 so far in 2025. GM laid off 200, and Target is cutting 1,800. Nestlé is slashing ~16,000 globally over 2 years. Meanwhile, the S&P 500 is trading at all-time highs, up +17% YTD.

🔴Central banks are cutting rates as if there is a RECESSION: Central banks have cut rates 312 TIMES over the last 24 months, the fastest pace since 2010. This century, only the GREAT FINANCIAL CRISIS saw more rate reductions in a 2-year period, at 313. What is happening?

India’s Q2 FY2020 Growth Signals Sectoral Challenges Recent data reveals GVA growth slowing to 4.3% and GDP at 4.5%. Key industrial segments—manufacturing, mining, quarrying, and construction—have shown contraction, while services have moderated except for public…

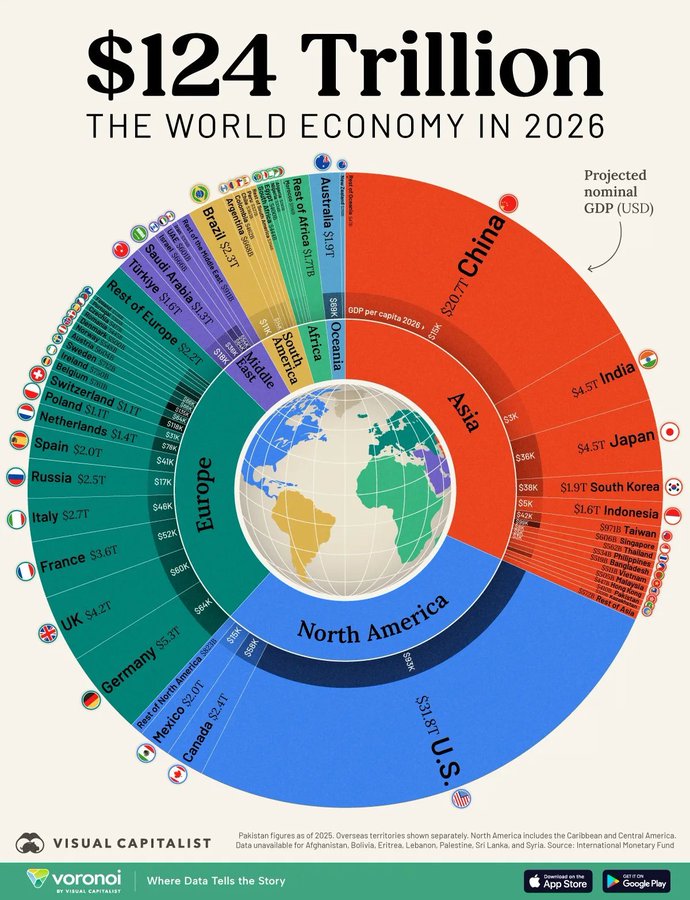

$124 Trillion: The World Economy in 2026 Global economic output is projected to reach an unprecedented $124 trillion by 2026. Key Highlights: The United States, China, and Europe will continue to dominate in nominal GDP. Major economies across Asia, North America, and Europe…

Stocks when consumer sentiment is low:

Gold now accounts for over 20% of global central bank reserves, the highest share we've seen in nearly three decades.

Here’s how the price of Gold has changed since 2000 Gold price: 2000 - $260 2005 - $425 2010 - $1,250 2015 - $1,150 2020- $1,500 2025 - $4,200+

⚠️WHERE ARE WE NOW? $SPY $QQQ

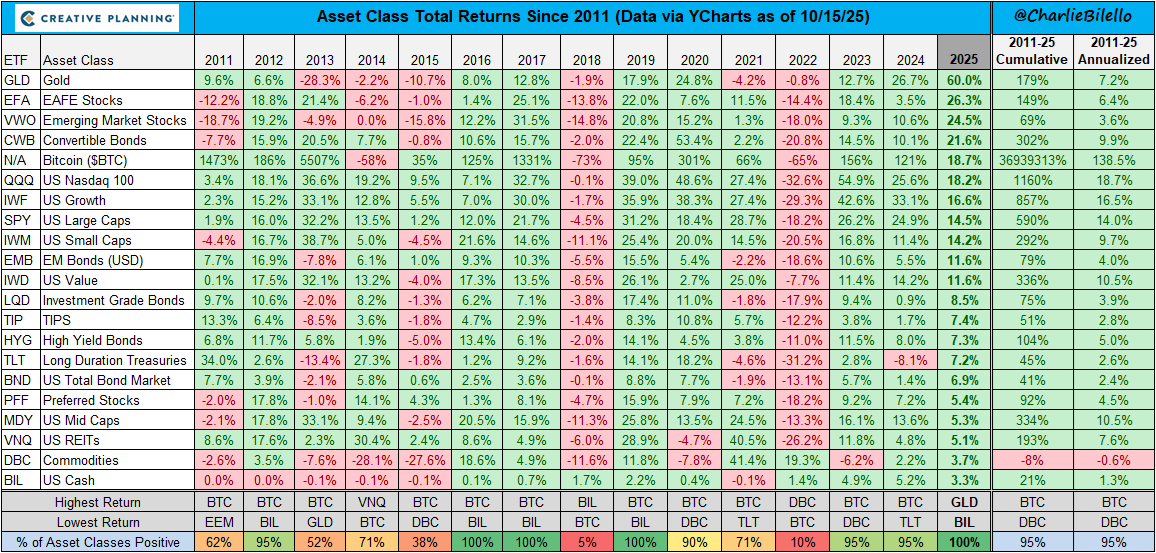

Every major asset class is in the green so far this year, the first time we've seen that since 2019. It's rare for the Fed to ease monetary policy into rising inflation and a melt-up in the equity/credit markets. And investors absolutely love it. Video: youtube.com/watch?v=6xICRo…

Market Minute — 15 Oct 2025 (Indian Markets)

Flows / Anomaly: Record DII inflows in CY25 (~₹6T) continue to offset cumulative FPI selling (~₹2.03T), helping rallies sustain even as foreign flows remain uneven

M&A & Margins / Corporate tape: No marquee deals. Stock-specific flow included HDFC AMC (1:1 bonus) headlines and Tata Communications Q2 profit down ~19% YoY; market focus remains on Q2 margin commentary in IT/financials. Business Standard

News: Rupee rallied to a near 1-month high after RBI dollar sales via state banks before market open, improving risk tone; global backdrop aided by a softer USD. Reuters+1

Quant: Leadership from PSU banks and realty; midcaps outperformed while smallcaps lagged (Nifty Midcap100 +1.11%, Smallcap100 −0.82%). India VIX subdued. The Economic Times+1

Broad: Sensex 82,605.43 (+0.70%); Nifty 25,323.55 (+0.71%) — firm close with both benchmarks finishing in the green. The Times of India

Quarterly Results (Q2FY26): #ADOR Rev 281cr vs 251cr vs 269cr PAT 25cr vs -3.9cr vs 6.7cr #SUMMITSEC Rev 119cr vs 27cr vs 106cr PAT 90cr vs 20cr vs 75cr #TIPSMUSIC Rev 89cr vs 88cr vs 80cr PAT 53cr vs 45cr vs 48cr Good no.s

United States Trends

- 1. Good Monday 23.8K posts

- 2. #ITZY_TUNNELVISION 33.2K posts

- 3. Steelers 53.6K posts

- 4. Rudy Giuliani 13.7K posts

- 5. Mr. 4 4,764 posts

- 6. #MondayMotivation 29.2K posts

- 7. Happy Birthday Marines 3,259 posts

- 8. Resign 115K posts

- 9. Chargers 38.7K posts

- 10. Schumer 236K posts

- 11. #Talus_Labs N/A

- 12. Tomlin 8,424 posts

- 13. 8 Democrats 10.7K posts

- 14. Rodgers 21.6K posts

- 15. Tim Kaine 23.4K posts

- 16. Sonix 1,462 posts

- 17. Happy 250th 1,413 posts

- 18. Voltaire 9,394 posts

- 19. Angus King 19.3K posts

- 20. #BoltUp 3,142 posts

Something went wrong.

Something went wrong.