Lance Roberts (PRIVATE)

@LanciRoberts

Chief Strategist http://RIAAdvisors.com, Host: Reallnvestment Show, Editor http://realinvestmentadvice.com, PM for http://SimpleVisor.com Newsletter Signup: https://t

Could Changes To The SLR End The Bond Bear? open.substack.com/pub/lancerober…

In Lincoln, UK today visiting my oldest son. Went to Lincoln castle, and prison, which legend states was guarded by a dragon.

Daily Market Trading Update: July 1, 2025 open.substack.com/pub/lancerober…

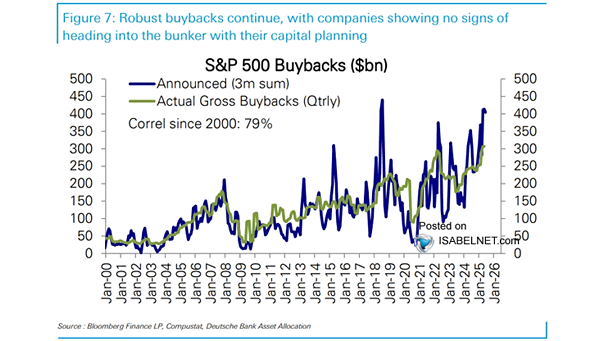

There seems to be nothing to stop the rise of #buybacks which will exceed $1 trillion this year. SURE, that's $1 trillion that could have gone to creating jobs, increasing wages, or M&A....BUT why do that we can boost asset prices to fund #executive #compensation. After all,…

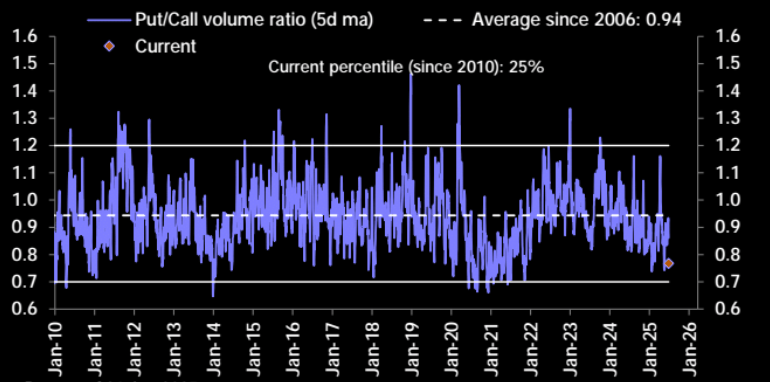

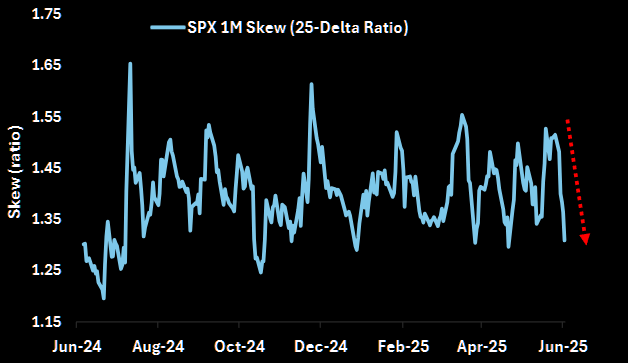

Given that literally NO ONE is buying downside #risk protection, #SKEW has absolutely crashed over the last few weeks. (Generally, this is a good time to buy some cheap protection for portfolios.) @themarketear

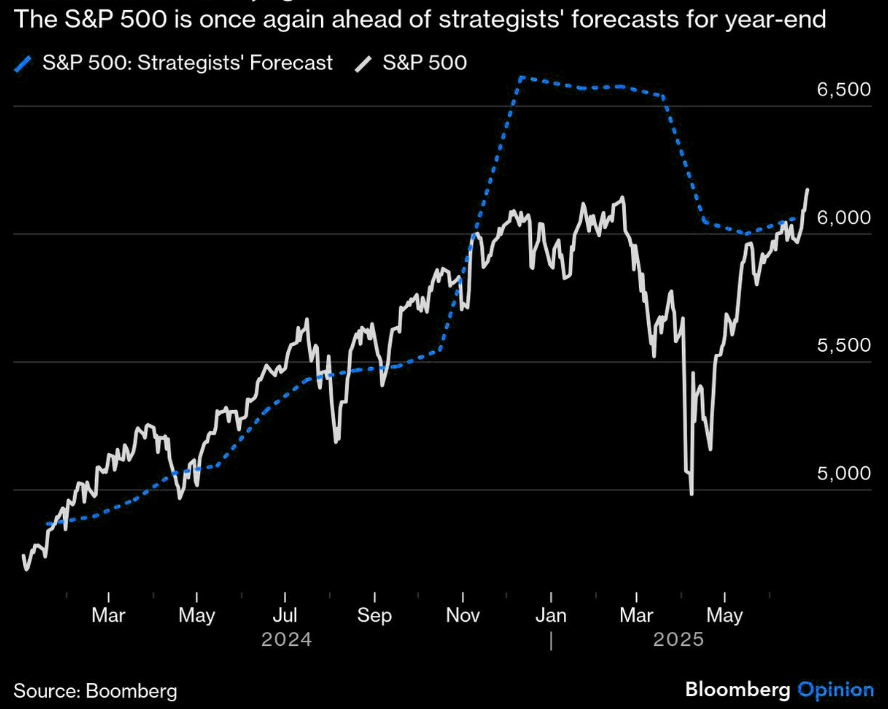

With the #market trading above the average #WallStreet target, we could see a rush to adjust those targets as the market rises further. As noted by #Nomura: "...the latest projection for VC projected buying in the case of an average 50bps SPX daily move over the next 1m =…

I don't like analogs because they never work out exactly the same, but the post-pandemic and current #QQQ rallies are tracking pretty darn close, with consolidated #equity positioning still underweight it looks like this #rally may have some more legs to it.

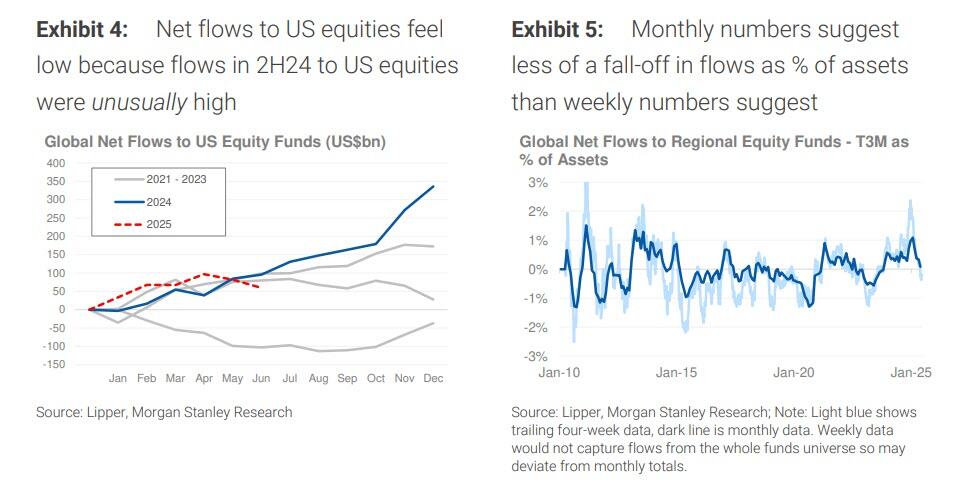

One of the great narratives of late has been that #investors are fleeing #US #assets. Weekly data suggests this is hardly in the case in both #stocks and #bonds where net #fund flows remain positive just at a slower pace than 2024

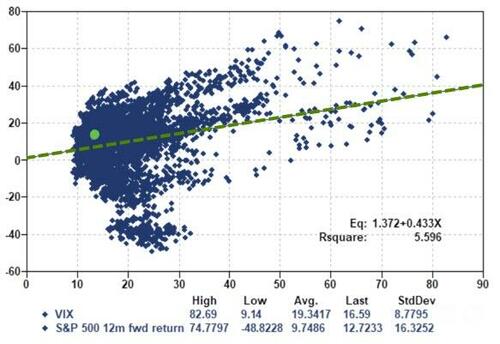

What people often forget about #volatility spikes is that they "reset the table" on markets and improve forward returns on a 12-month basis. Fear creates dislocations and better entry points. But its hard to buy low.

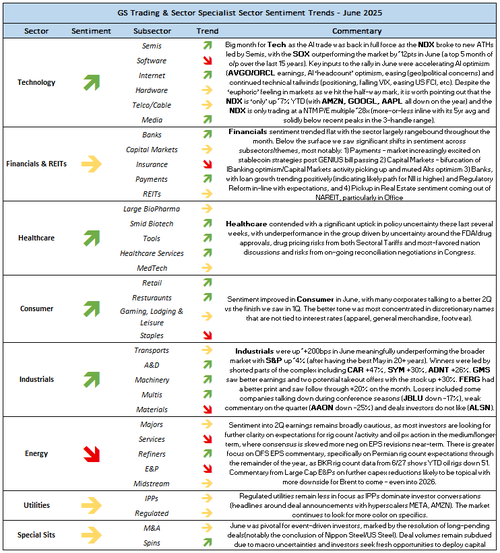

This is a good #QuickTake from $GS on #sentiment, #flows and positioning.

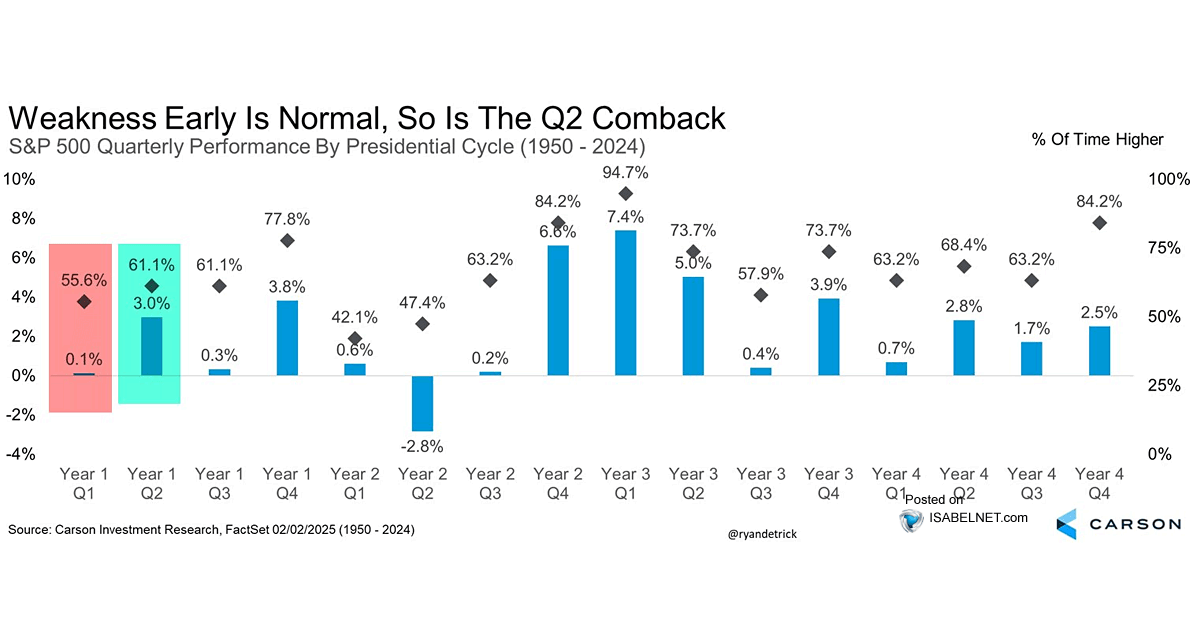

While Q2 was volatile, it offered some gains for #investors. However, Q3 tends to be weaker for returns during Presidential #election years. @CarsonResearch @ISABELNET_SA

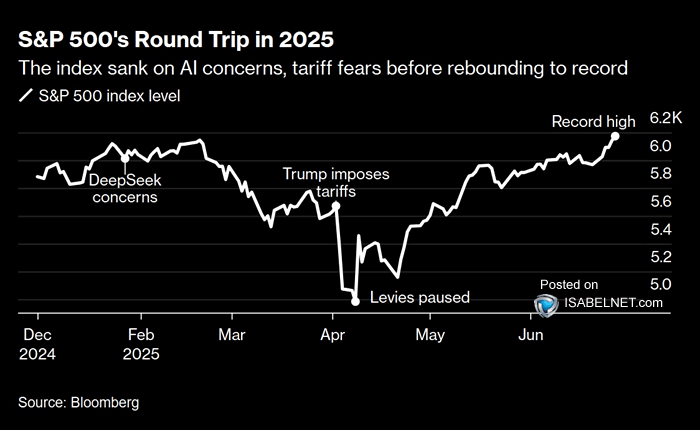

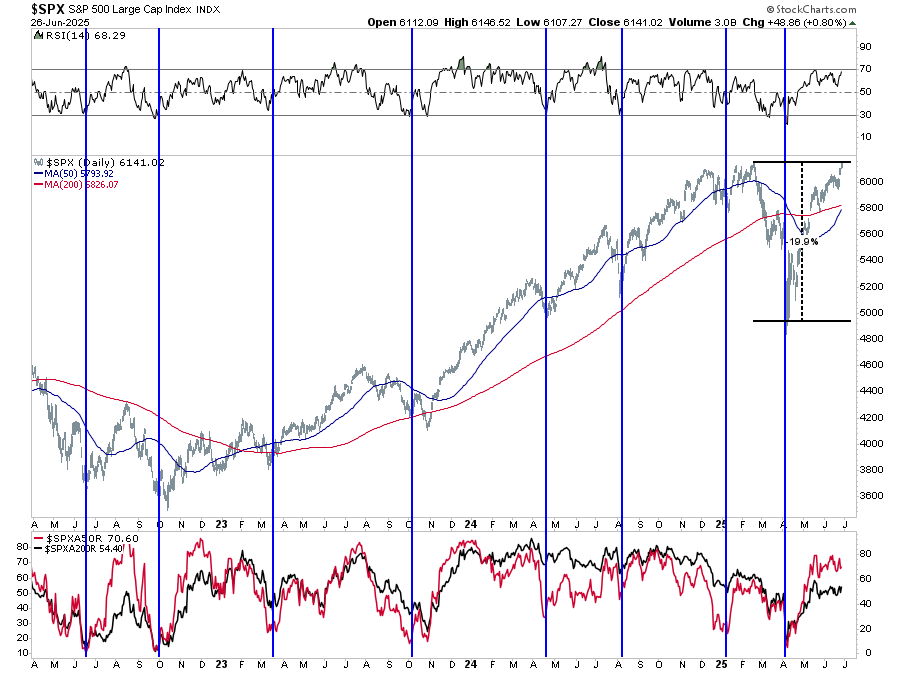

Conerns from #Deepseek to #Tariffs are now just a distant memory as #stocks crank out new highs. But with #markets heading back into more exuberant levels, a #risk of short-term pullback increases. h/t @ISABELNET_SA

Daily Market Trading Update: June 30, 2025 open.substack.com/pub/lancerober…

The #BullBearReport is out. This week, we discuss the death of another #narrative as markets hit all-time highs. What to do now if you missed the rally, and a technical review of the #markets. (Let us know what you think of the new format.) open.substack.com/pub/lancerober…

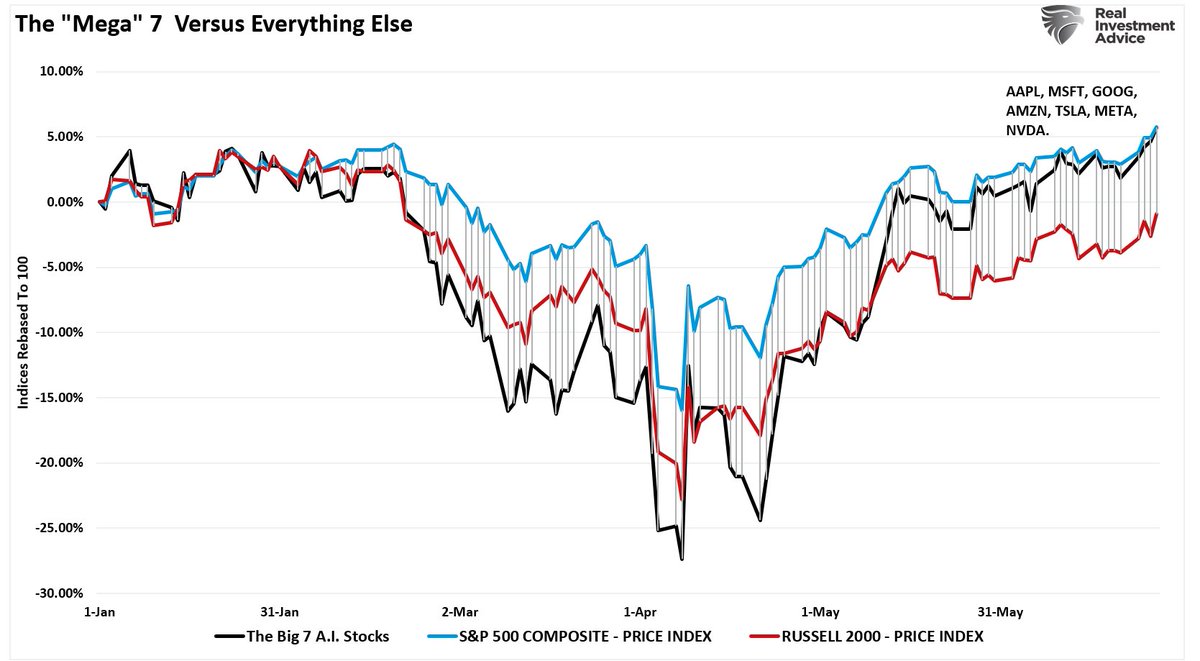

While the S&P will likely hit all-time highs today, the #Nasdaq has already accomplished that feat. The rally has left many #bears scrambling as their #narratives continue to get decimated: - WWIII, Debt, Deficits, Tariffs, Inflation, etc., all failed to bring markets down. -…

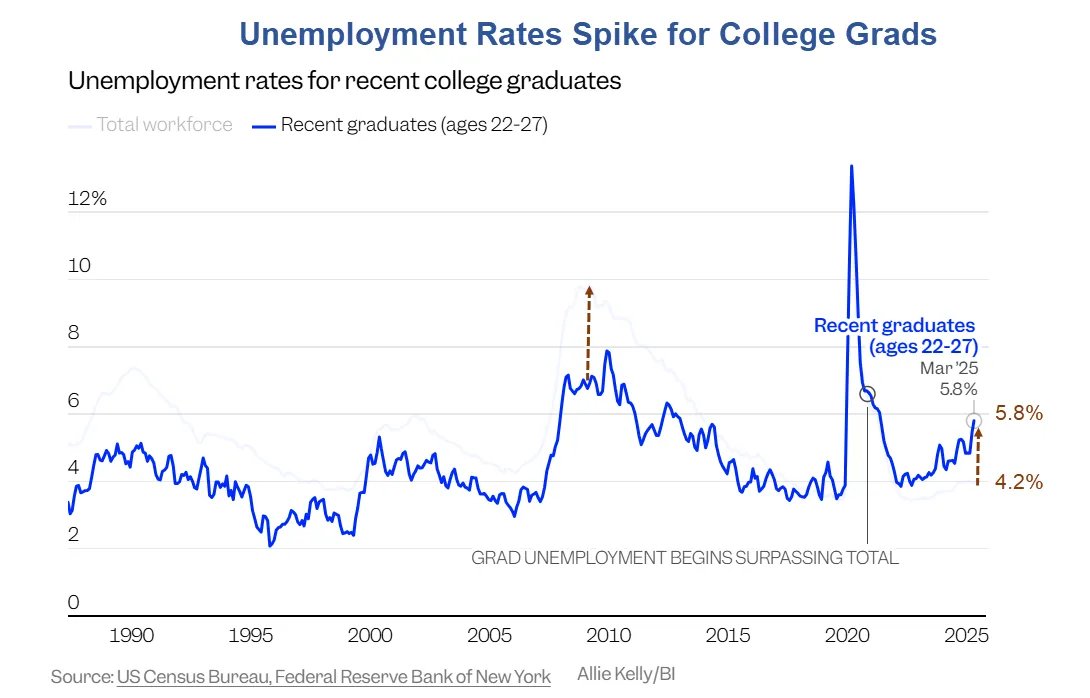

Interesting post by #MishShedlock discussing the rising #unemployment rate of #college #grads with nearly 6-million on track to have #wages garnished to repay #student #loan debt. mishtalk.com/economics/six-…

While the #market has recovered the March/April decline, the number of stocks trading above their 200-DMA remains fairly weak. However, on a #bullish note we are coming off very deep oversold breadth conditions which tends to bode well for further gains.

Yesterday, the S&P 500 closed right at all-time highs. The #market desperately wants to set new highs and with future pointing higher this morning, such looks to be the case today with few "headline worries" to weigh on traders as we start wrapping up the month and quarter.

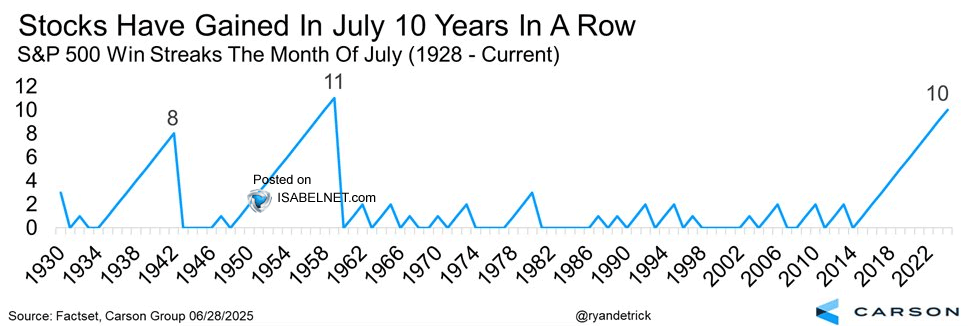

For 10 straight years, the S&P 500 has gained in #July—an impressive record. Historically, July is the best month for #stocks in post-election years. Another gain this July would tie the longest winning streak for the month in history. h/t @ISABELNET_SA

Today's #macroview digs into the #Fed's curret view of holding rates steady while #economic data continues to weaken. Is the fear of its #transistory mistiming affecting its view of the data. open.substack.com/pub/lancerober…

United States الاتجاهات

- 1. Thanksgiving 2.44M posts

- 2. Packers 66.2K posts

- 3. Packers 66.2K posts

- 4. Dan Campbell 7,346 posts

- 5. #GoPackGo 11.1K posts

- 6. Wicks 11.4K posts

- 7. Malik Davis 1,517 posts

- 8. Jordan Love 17.1K posts

- 9. Micah Parsons 12.3K posts

- 10. Goff 11.4K posts

- 11. Kenneth Murray N/A

- 12. #ChiefsKingdom 4,157 posts

- 13. Tony Romo N/A

- 14. McDuffie 3,002 posts

- 15. Jack White 9,859 posts

- 16. Kelce 12.2K posts

- 17. #KCvsDAL 3,633 posts

- 18. Watson 16.1K posts

- 19. Turkey 312K posts

- 20. Caleb Wilson 1,288 posts

Something went wrong.

Something went wrong.