Lightbeam.fi

@Lightbeamfi

Wealth management for Web3 & beyond.

You might like

Today we're launching LegalPromptGuide.com, the most in-depth guide on effective AI / ChatGPT prompt engineering specifically for paralegals, attorneys, researchers and other legal professionals. legalpromptguide.com

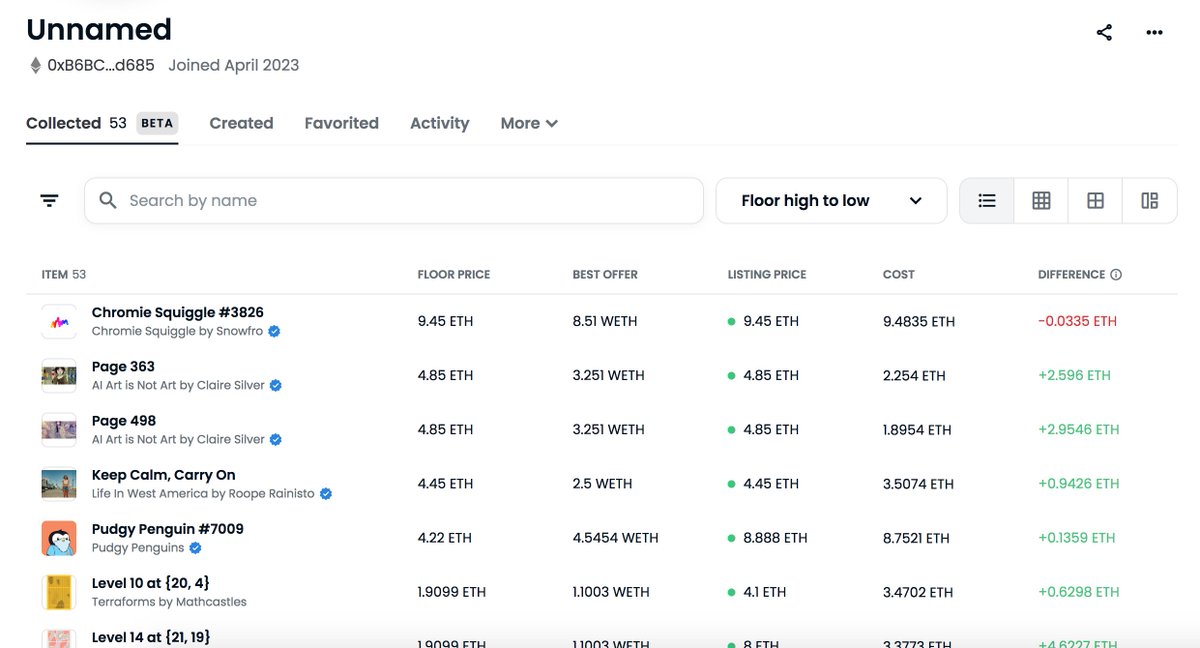

I got hacked. Almost certainly exploit via MetaMask with weak security. I'd been meaning to upgrade -- heart sank when I got alert (from my own site) that my NFTs listed on OpenSea.

🧵1/3 In 4 weeks I've sent out 131 @DocSend links to VCs/angels which points to the @Crypto_I3 pitch deck. The 3rd slide contains a @loom link to our product demo. Ask me how many times the video has been viewed...?!?!

What happens to your fort in the case of a flood, fire, etc.?! Hopefully you bought coverage from @Crypto_I3 😉

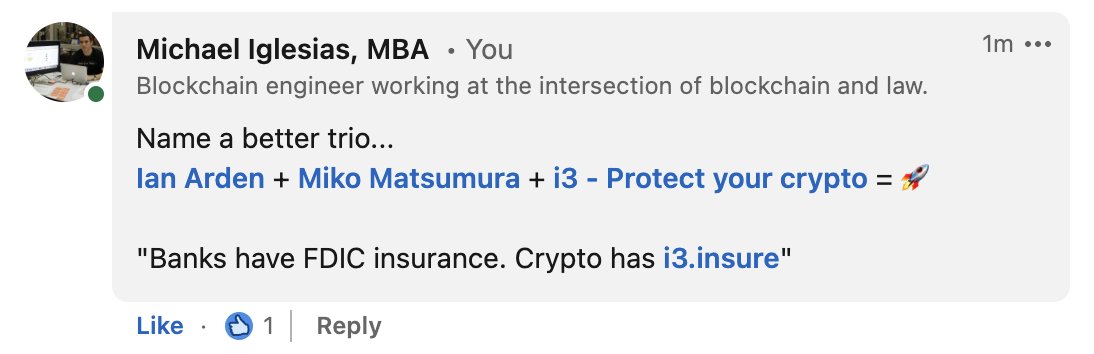

I can't help myself. I'm out of control 😂... The drive for success is just too strong 💪

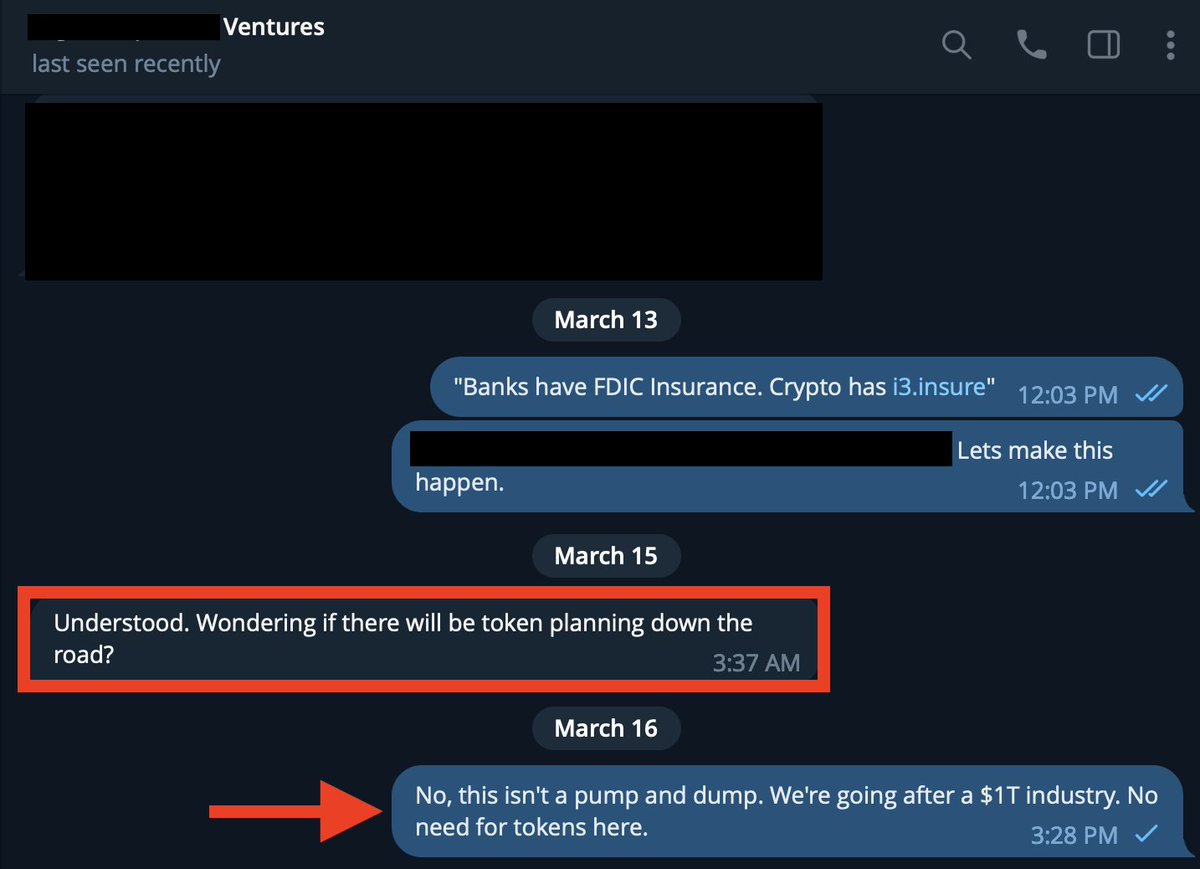

Since some of y'all don't believe some of the messages I send to VCs 🤣

🧵1/2 So did one VC fund with proper due diligence + risk mgmt. review SVB's 10K published on Feb. 23rd to uncover their incredibly poor money management practices...?! Crazy to think that one person (analyst) could have possibly triggered this entire sh*t show lol

Speaking the truth… “Warren Buffett loves insurance. Berkshire Hathaway made $164B from float last year. Lucky for us he hates crypto. i3.insure will print money just Berkshire Hathaway. Doubtful any of your other portfolio companies will do the same.”

@USTreasury OFAC's SDN list does *NOT* include any addresses on @solana (nor many other chains). Find it highly unlikely that nefarious actors are only transacting on a handful of L1s. We need better regulatory guidance, tools, and collaboration with our government. #Web3

We also need a robust insurance industry to develop around digital assets.

Tell me on-chain insurance for digital assets isn’t going to be a massive industry, and I’ll reply by telling you you’re an idiot.

The float is critical to Berkshire’s business. Basically, it’s money that Berkshire takes in as insurance premiums. The company can make interest from that money until it has to pay out insurance claims. In 2022, the firm’s float increased from $147 billion to $164 billion.

The float is critical to Berkshire’s business. Basically, it’s money that Berkshire takes in as insurance premiums. The company can make interest from that money until it has to pay out insurance claims. In 2022, the firm’s float increased from $147 billion to $164 billion.

We’re excited to be building alongside @coinbase and @Crypto_I3 to bring the consumer protections badly needed in crypto! 🔵

🔵 I'll be deploying the world's first on-chain coverage protocol on @BuildOnBase after I go shred with the @mtndao crew 🏂⛷️❄️🔵

The only way crypto reaches mass adoption is with a robust insurance industry protecting against the abundance of risk currently plaguing the industry. It's just common sense. #crypto #web3

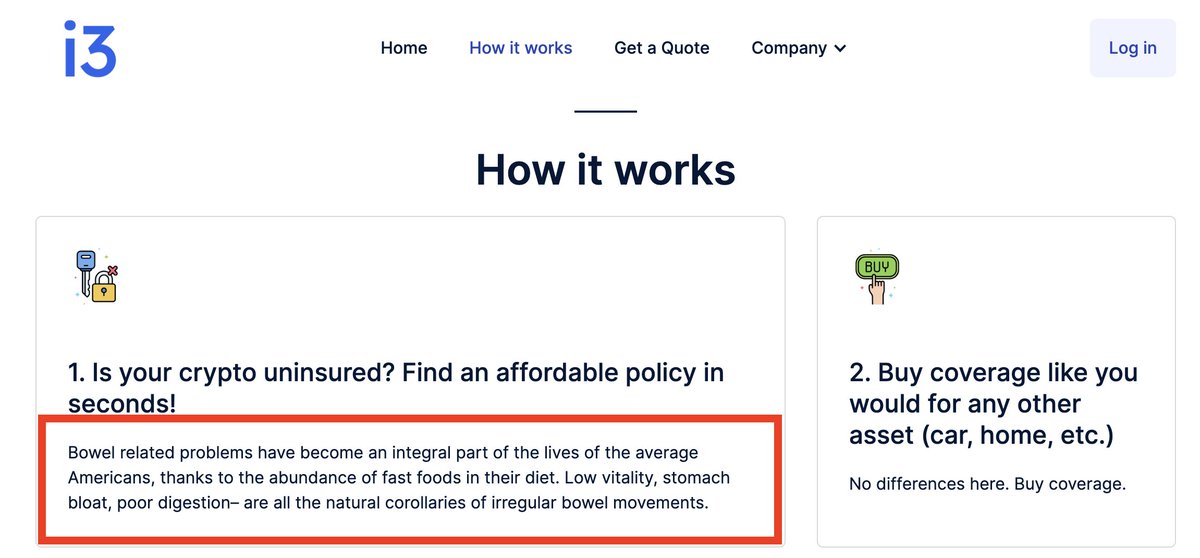

Losing your crypto 💰 also causes irregular bowel movements 💩 @Crypto_I3 #crypto #walletsecurity

United States Trends

- 1. harry styles N/A

- 2. The PENGU N/A

- 3. #PMSSEATGEEKPUNCHAHT N/A

- 4. Insurrection Act N/A

- 5. FINALLY DID IT N/A

- 6. #BLACKWHALE N/A

- 7. The Jupiter N/A

- 8. Karoline Leavitt N/A

- 9. Kuminga N/A

- 10. Lara Croft N/A

- 11. #BTS_ARIRANG N/A

- 12. Kiss All The Time N/A

- 13. InfoFi N/A

- 14. Arrest Tim Walz N/A

- 15. Franz N/A

- 16. Casa Blanca N/A

- 17. Sophie Turner N/A

- 18. Willi Castro N/A

- 19. Mahmoud Khalil N/A

- 20. GRRM N/A

You might like

Something went wrong.

Something went wrong.