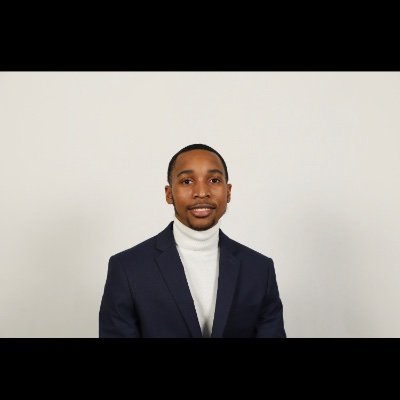

Math. Money. Machines.

@MathMoneyMach

Interested in math, personal finance, engineering. Might write about it some time.

Potrebbero piacerti

I just published The Earnings Engine: Power Your Journey To FI link.medium.com/jF8kenT4Wub

If you are 50% of the way to your FI number, you're actually much closer time wise due to the effects of compounding! Stay motivated, you're closer than you think!

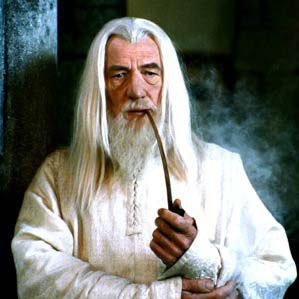

Going to use this anytime someone tells me they don't invest because the market is too risky and they don't trust it. Great analogy!

One of the better career advices: Get a full-time job that still providers you with enough time to work on your side hustle Then, slowly but surely transition from your 9-5 to your business

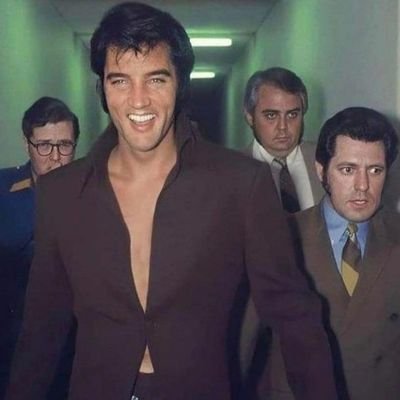

5 years from now so many of you are gonna wish you kept investing. Bear markets = Opportunities. It's just not obvious until well after the fact. Let's put things into perspective... The S&P 500 is up nearly 2,817% since 1982. Despite ALL of the past economic chaos:

You know what's riskier than investing in the stock market? Not investing in the stock market.

The slowest way to get rich is by trying to get rich quick

When do you think is the optimal time to start gifting children money?

Index funds are the best recommendation for the majority looking to reach financial freedom early. Not everyone wants to start a business or manage real estate. Not everyone is ok with taking on large amounts of debt. It may not be the fastest way, but it is the surest way.

If you've read more than a handful of personal finance books, you probably don't need to read any more. There are only so many variations on the advice to live below your means and invest the rest. How about don't buy the new book and invest that amount instead?

Why so much talk about what is and is not a flex on Twitter recently? Why do you even have to flex? Be happy with where you're at and where you're going. Be happy for those around you as well for whatever stage they are at in their journey.

You can pay off your mortgage and still invest in the stock market. Get peace of mind and upside. Any yield is better than no yield.

While a family home might not be a cash flow producing asset, it is a productive asset. What it produces is priceless. Memories.

If you're working towards financial independence, don't forget to celebrate the milestones along the way. It's a long road. Stop and enjoy the view every once in a while.

While everyone is replaceable, not everyone can be immediately replaced. Make it costly to replace you and you'll be the one with the leverage.

Everyone can invest and receive dividends. Everyone should also realize that those dividends are generated by people working and creating value. Dividends aren't passive income. Someone / something is producing value to provide you a dividend.

Emergency fund are like shocks on a car. Too little and you feel every bump too much and you lose performance.

Risk vs. reward is a spectrum. A #Powerball ticket can be looked at as an investment. Quickest way to get rich. Also probably the least likely way to get rich too.

People hoping to get rich by teaching other people how to get rich while complaining about the rich.

Loans aren't good or bad. They're just loans. It's how it's used that matters.

If a world war 3 possibility, 40-year high inflation, record interest rate raises, and massive quantitative tightening can’t break the S&P 500 Maybe nothing can.

United States Tendenze

- 1. #WorldSeries 139K posts

- 2. #SNME 74.1K posts

- 3. Ohtani 59.6K posts

- 4. Blue Jays 80.6K posts

- 5. Hugh Freeze 2,181 posts

- 6. Auburn 8,516 posts

- 7. Gimenez 14.8K posts

- 8. Bo Bichette 23.2K posts

- 9. Jesse Love 3,127 posts

- 10. Mateer 2,570 posts

- 11. Jordan Marshall 1,300 posts

- 12. Zilisch 4,847 posts

- 13. Max Scherzer 12.8K posts

- 14. Shohei 41.9K posts

- 15. Wrobleski 6,667 posts

- 16. Toronto 50.3K posts

- 17. Purdue 4,274 posts

- 18. CM Punk 25.9K posts

- 19. #UFCVegas110 14.8K posts

- 20. Vlad 8,549 posts

Something went wrong.

Something went wrong.