MetricsDAO

@MetricsDAO

The community for onchain data analysts.

Tal vez te guste

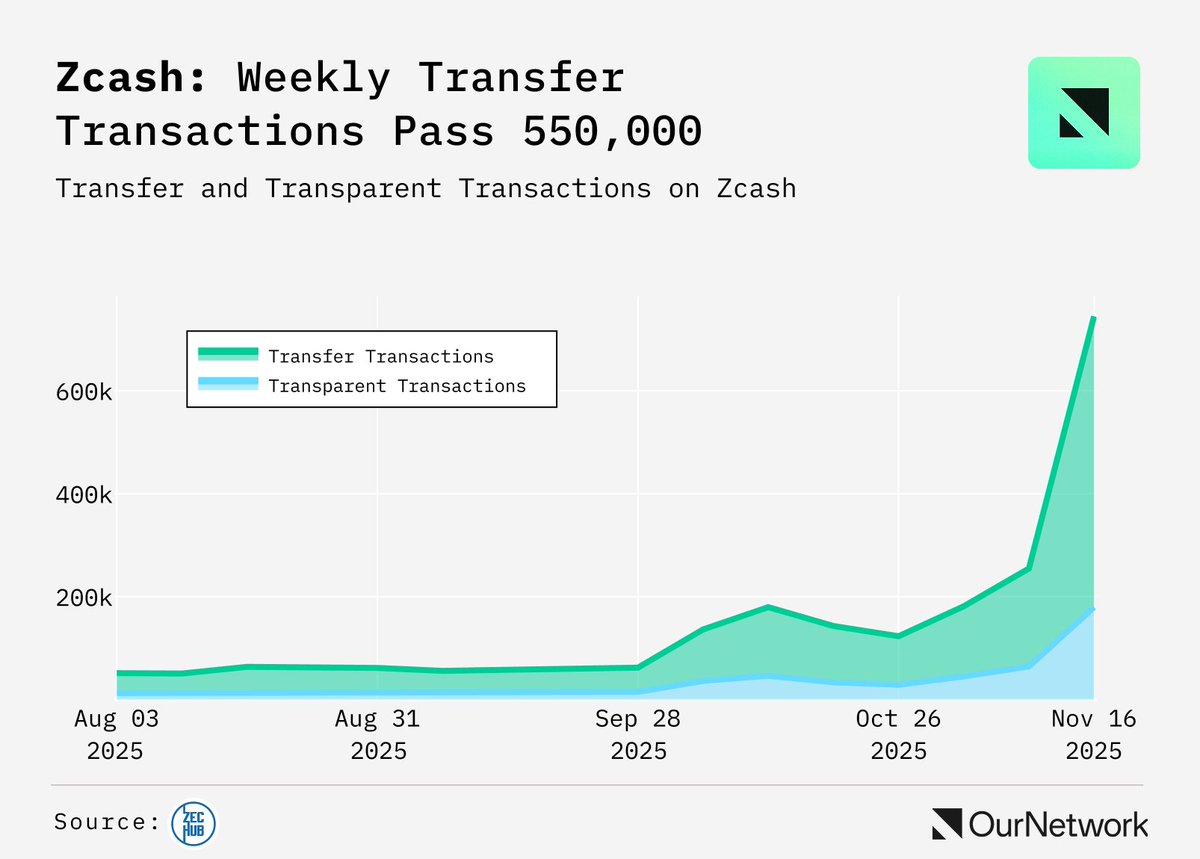

$ZEC just posted its strongest week of 2025: transfer transactions jumped 197% week-over-week to an all-time high of 565,000. Read more on @Zcash from @surfquery → ournetwork.xyz/p/on-379-priva… Data via @ZecHub

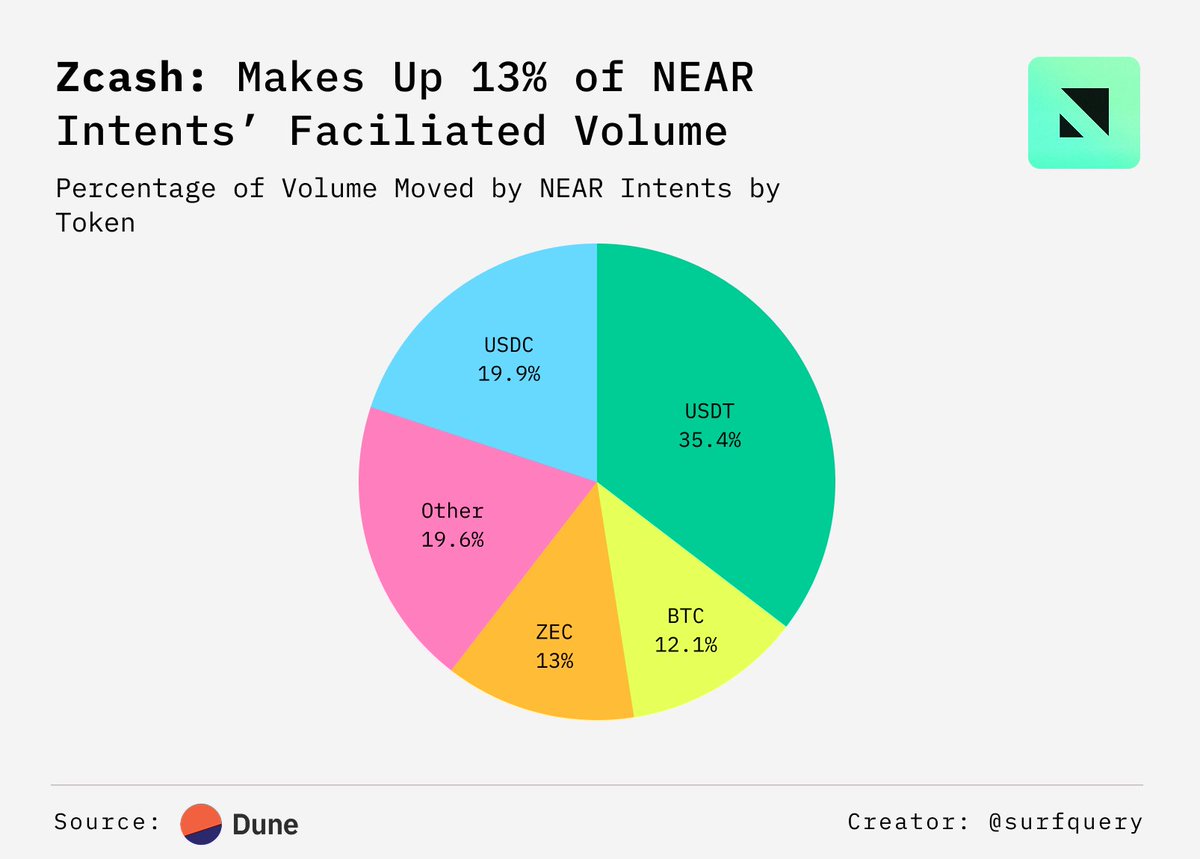

Since September, $ZEC ranks third among tokens in terms of NEAR Intent volume with $587M (13%). Get more alpha on @Zcash from @surfquery in our latest issue ➡️ ournetwork.xyz/p/on-379-priva… Data via @Dune

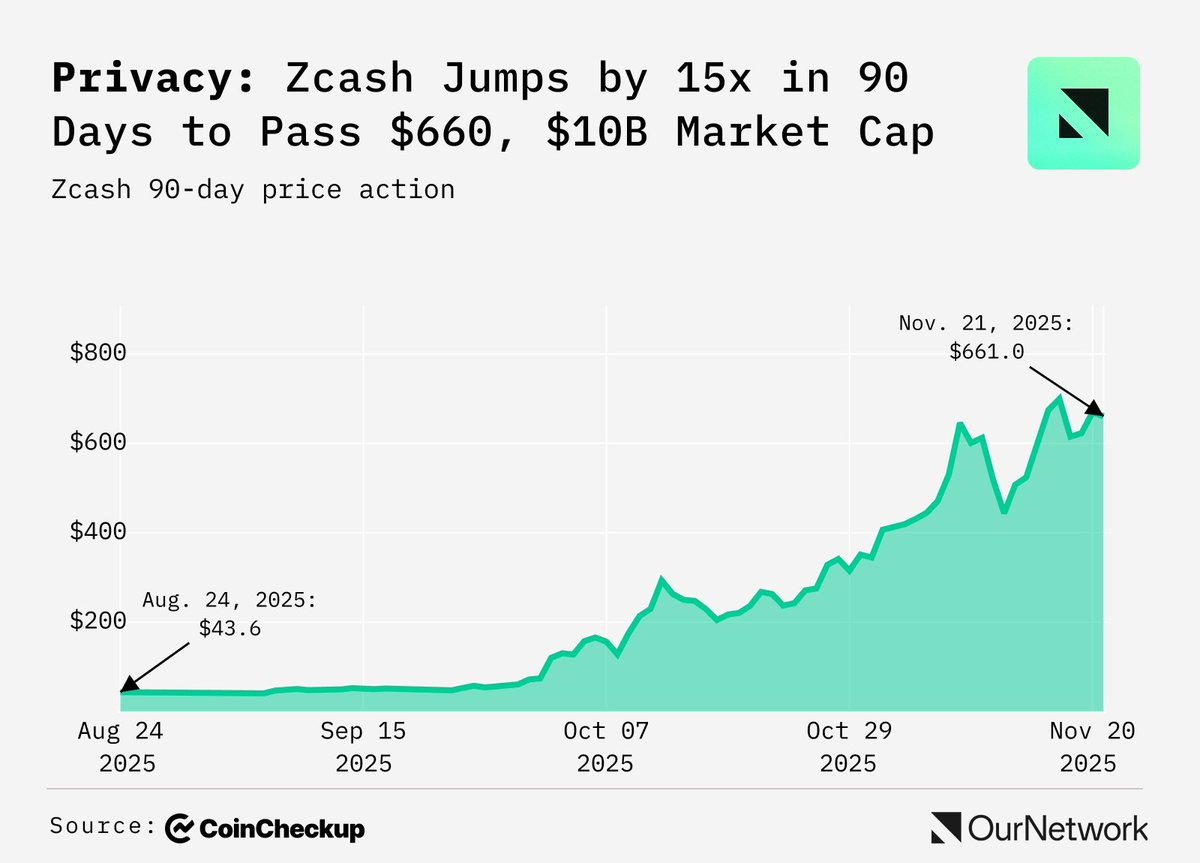

The privacy sector was pushed into the spotlight with the rise of @Zcash ($ZEC), launched in 2016, and since jumped 15x in the past 90 days to become a top 20 crypto asset. Check out @ournetwork__ for coverage on the privacy sector as a whole⏬⏬⏬ ournetwork.xyz/p/on-379-priva…

1/ Over the past year, crypto Digital Asset Treasuries (DATs) have doubled their digital asset holdings and now sit on ~$100B of crypto on their balance sheets. Let’s dive into their current state

JUST IN: Oracles 📊 | ON-376 🔷 @chainlink | @queriesdata ♦️ @redstone_defi | @weronikow 🔵 #chaosoracles | @chaoslabs ournetwork.xyz/p/on-376-oracl…

1/ @NEARProtocol enabled a Zcash→Solana bridge called the Zolana Bridge. Let’s dive into ZEC activity on @solana since launch.

1/ Programmable privacy is moving from niche add-on to core infra. Institutions need rails that are private-by-default yet provably compliant via selective disclosure. Our new landscape report maps the tech, tradeoffs, and where adoption is happening - unlocked by @Zcash.

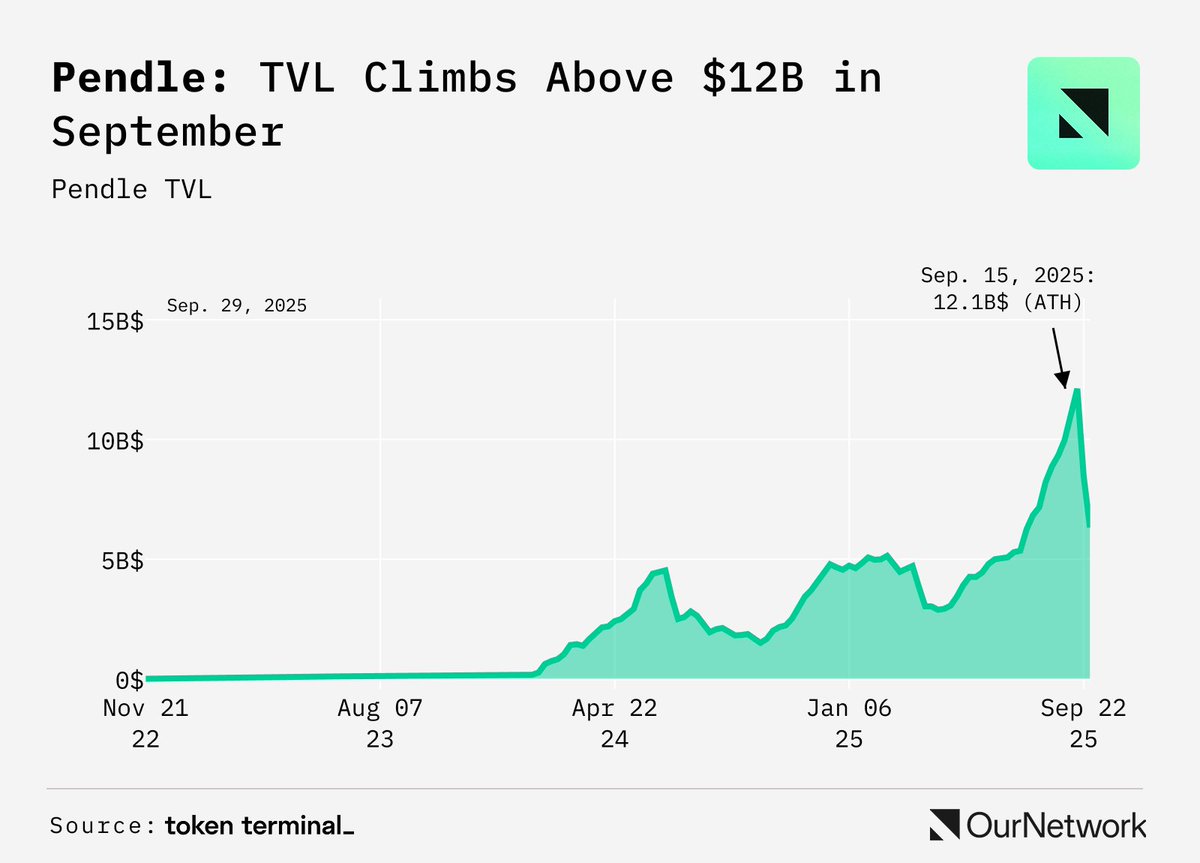

By late September 2025, TVL on @pendle_fi climbed above $12B. Then, the large $USDe September 2025 series matured, pushing TVL back down to about $6.3B. Get a full deep dive from @real_obbwd: ournetwork.xyz/p/on-372-yield… Data via @tokenterminal

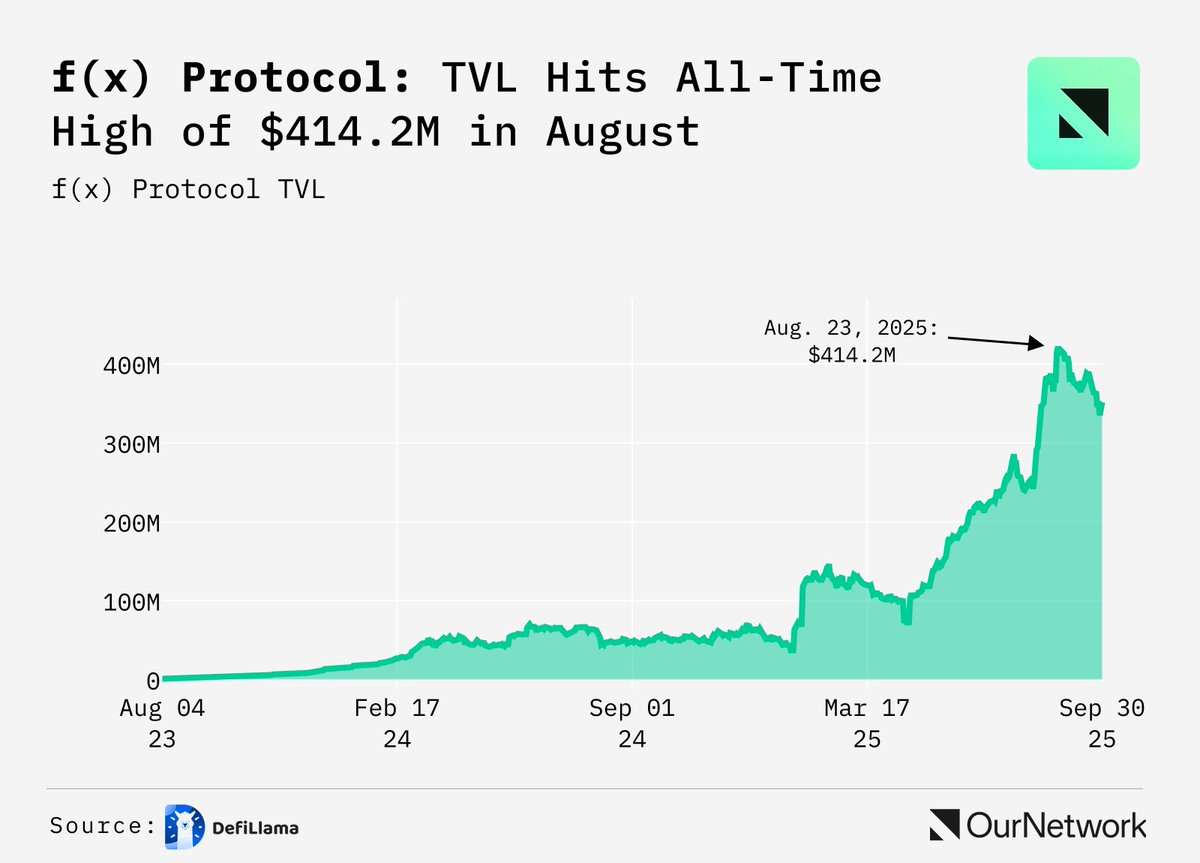

.@protocol_fx TVL is up over 10x in 2025 due to leverage positions which don’t charge funding fees & offer liquidation protection. Read more from @kmets_ 👉ournetwork.xyz/p/on-372-yield… Data via @DefiLlama

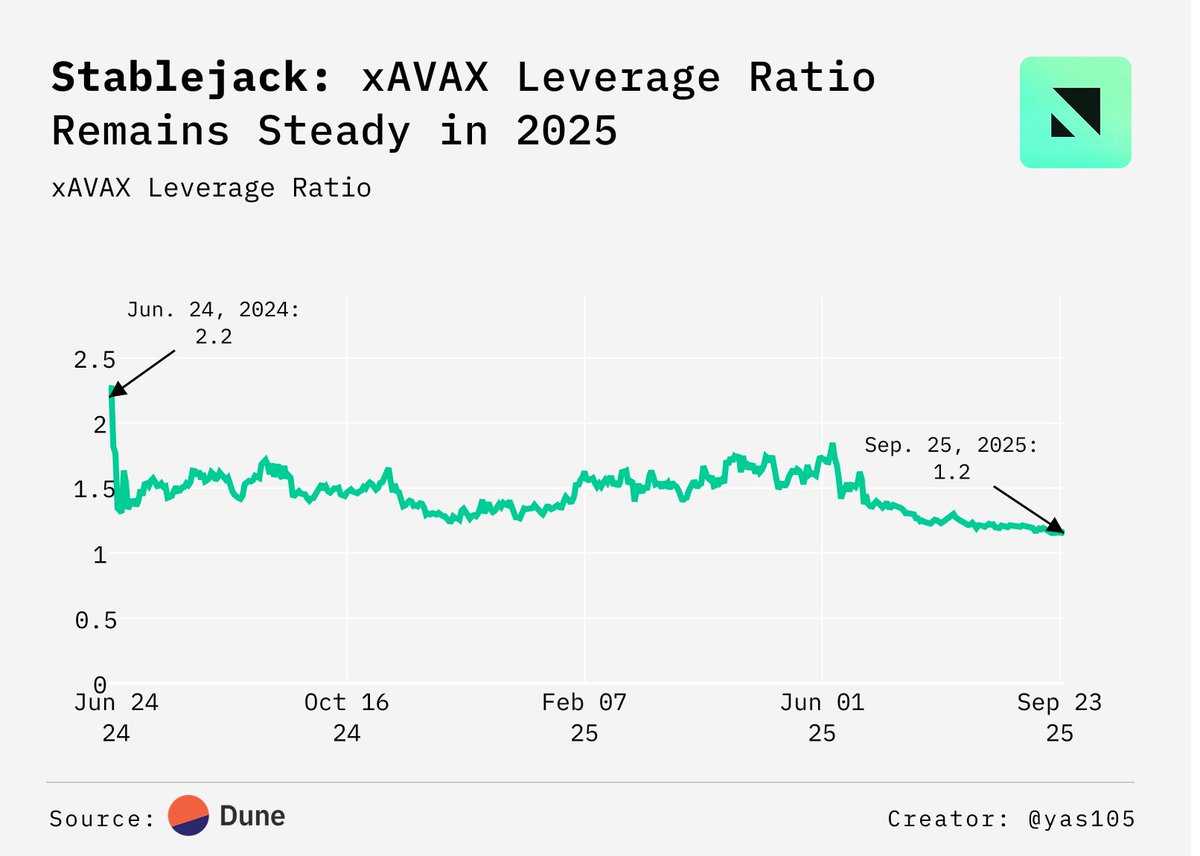

The xAVAX leverage market (~$6.8M TVL) backed by $aUSD (~$1.3M) keeps leverage in a stable 1.2x–1.8x band without liquidation risk. Read more on @StableJack_xyz from @Haj1379 in our Yield issue: ournetwork.xyz/p/on-372-yield… Data via @Dune

1/ @Collector_Crypt has been continuously growing its activity since the CARDS token launch. Let’s look at app usage and where activity is heading.

1/ @UmbraPrivacy has its @MetaDAOProject ICO going live today. Let’s dive into what this project plans is and their tokenomics.

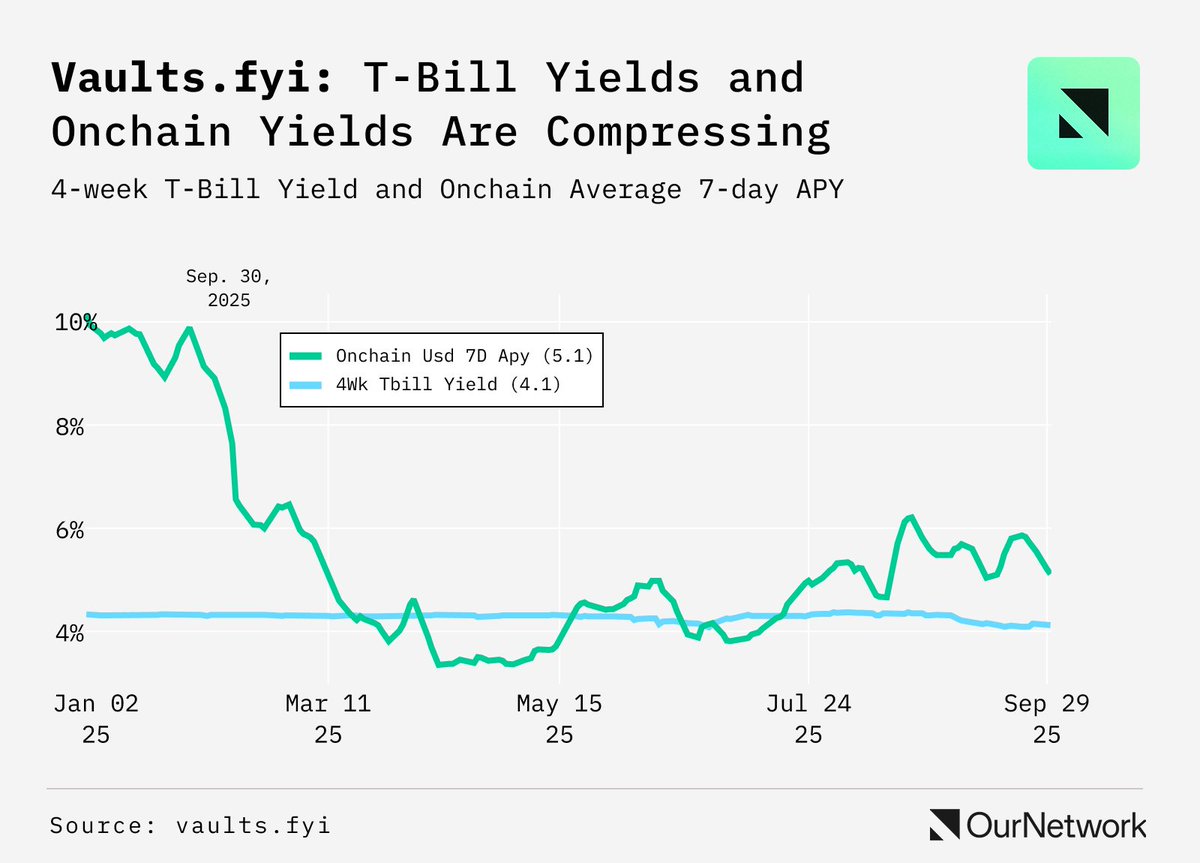

Insight from @0x7477: “Onchain rates started 2025 at a premium over T-bills, this spread compressed & briefly turned negative, signaling a maturing market where the ‘crypto-native’ risk premium has diminished, with onchain yields now stabilizing at ~100 bps above T-bills."

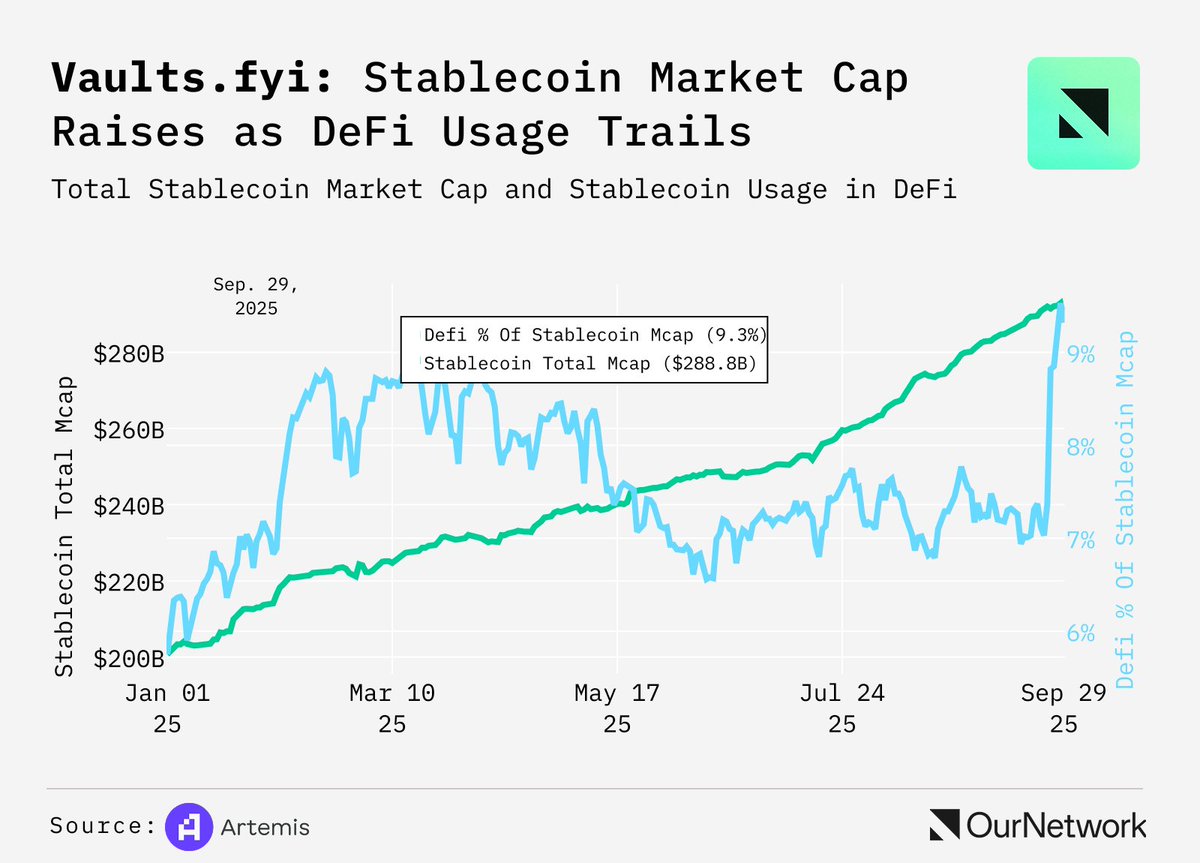

The total market cap of stables has grown throughout 2025, steadily climbing towards $300 billion. Despite this massive and growing pool of onchain liquidity, less than 10% of stablecoins are currently engaged in DeFi protocols to earn yield. Get a full sector update on yields…

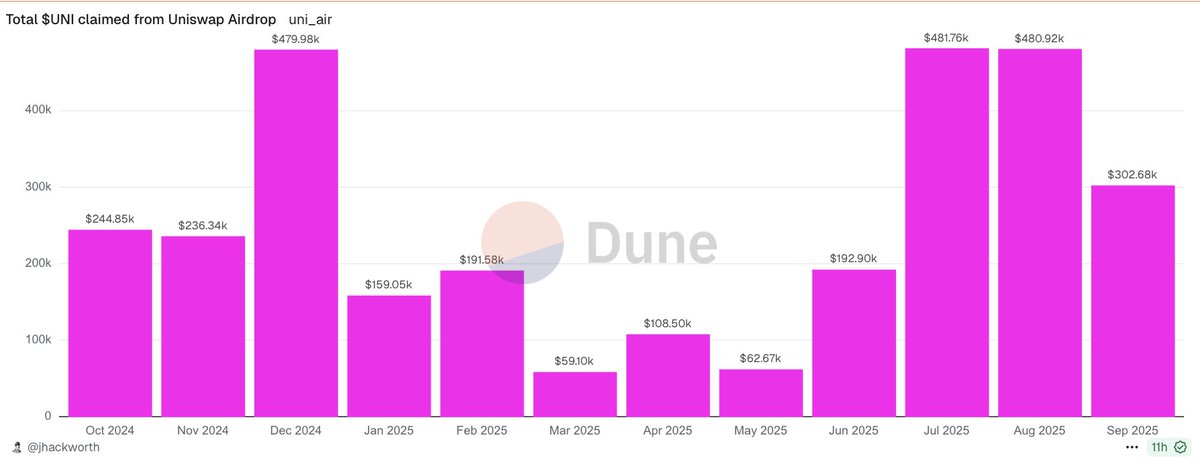

After 5 years, people are still claiming the Uniswap airdrop! Over $300k of $UNI has been claimed this month alone by 54 addresses

BonkFun (and Heaven and other competitors) make Pump a better project - even if they can't unseat it. I firmly think competition is good for the launchpad space. Took a closer look at BonkFun specifically in the latest issue of @ournetwork__ :

In July, @bonk_fun was the launchpad of choice for an average of 55% (and a daily max of 75%) of deployed tokens on @Solana. Get full coverage from @queriesdata: ournetwork.xyz/p/on-371-launc… Data via @Dune

1/ USDF is @Aster_DEX's native stablecoin. Holders earn airdrop points for holding the token. Lets dive into the metrics of this token.

United States Tendencias

- 1. #StrangerThings5 263K posts

- 2. Thanksgiving 688K posts

- 3. BYERS 60.9K posts

- 4. robin 95.9K posts

- 5. Reed Sheppard 6,253 posts

- 6. Afghan 297K posts

- 7. holly 66K posts

- 8. Dustin 89.2K posts

- 9. Podz 4,757 posts

- 10. Vecna 61.7K posts

- 11. Jonathan 75.7K posts

- 12. hopper 16.4K posts

- 13. Erica 18.2K posts

- 14. National Guard 672K posts

- 15. Lucas 84K posts

- 16. noah schnapp 9,095 posts

- 17. Nancy 69.1K posts

- 18. derek 19.9K posts

- 19. Joyce 33.3K posts

- 20. mike wheeler 9,732 posts

Tal vez te guste

-

Dune | DuneCon 🇦🇷

Dune | DuneCon 🇦🇷

@Dune -

Kofi

Kofi

@0xKofi -

Primo Data

Primo Data

@primo_data -

hildobby

hildobby

@hildobby -

Richard Chen

Richard Chen

@richardchen39 -

Darren Lau

Darren Lau

@Darrenlautf -

Fire Eyes 🔥_🔥

Fire Eyes 🔥_🔥

@fireeyesgov -

ilemi

ilemi

@andrewhong5297 -

Bitcoin Stylist

Bitcoin Stylist

@bitcoinstylist -

jackie | agaperste

jackie | agaperste

@agaperste -

Crypto Quotes & News🚀

Crypto Quotes & News🚀

@TwoKiloGlobal -

OurNetwork 🔎

OurNetwork 🔎

@ournetwork__ -

Flipside 📈🤖

Flipside 📈🤖

@flipsidecrypto -

chuxin 🔴✨

chuxin 🔴✨

@chuxin_h -

Data Wolf 🐺

Data Wolf 🐺

@0xDataWolf

Something went wrong.

Something went wrong.