Courtney Berman

@MrsBerman

Mother of dragons and Cadbury egg lover 😍

You might like

Drawing from data from Case-Shiller’s 20-City Home Price Index, Curinos takes a look at the link between soaring prices, spiking taxes and the hazards that may be in store for many homeowners. hubs.ly/Q01ZtTPP0 #lendingmarket #housingmarket #debt #propertytaxes #DTI

Last month, Curinos was pleased to welcome executives from 15 financial institutions to its Retail Deposit Optimizer Client Forum in New York. We've distilled the forum's presentations, observations and give-and-take dialog into five timely themes: hubs.li/Q01Zrk920

Marketers are under pressure like never before to both drive franchise growth and cut costs. tinyurl.com/yc2dws6w #financialmarketer #financialmarketing #banking #marketingROI

Curinos explores the game-changing shift toward virtual payment solutions in the corporate world. Discover how businesses are embracing the ease and efficiency of virtual payments for transactions. hubs.li/Q01YtrBN0 #BusinessPayments #VirtualPayments #DigitalTransformation

With today’s challenges to #profitability, cultivating relationships with customers and prospects is as important as ever. That’s why virtually every article in this issue of the Curinos Review is tied to the topic. hubs.li/Q01W6_2Q0 #curinosreview #margins #expenses

What is the lifespan of your deposits and how will that affect your profitability? Listen as Greg Muenzen, director of treasury and balance sheet management, talks about the value of assessing deposit life. Access podcast: hubs.li/Q01tCc3s0

This Month in Commercial Banking looks #risingrates and factors determining whether #commercial bankers pass those on to clients, the new commercial dashboard and TM-lite bundles for #smallbusinesses. bit.ly/3udO2bE #commercialbanking #treasurymanagement

While banks are communicating data-informed product and action suggestions, there's much more to content personalization for today's consumer. Sarah Welch covers this and more with @JimMarous on the Banking Transformed podcast. bit.ly/3qw4fGU

Our Senior Research Analyst, Gina DeCorla, discusses how cobranded #creditcards - that generate #rewards & typically have no annual fee - have opportunity to grow given the pandemic & #inflation landscape in @plasticpayments' @AmerBanker article below: bit.ly/3reIcF6

americanbanker.com

Barclays issuing private-label cards to reach more retailers

The new product will help Barclays' U.S. bank reach customers who may not want — or qualify for — its cobranded cards. It's part of a strategy to reach more consumers after card balances declined...

The traditional business model of #overdraft has been upended. How should financial institutions respond? With even more banks announcing policy changes since our December study, Curinos examines what goes into a successful solution. bit.ly/3ueZljV

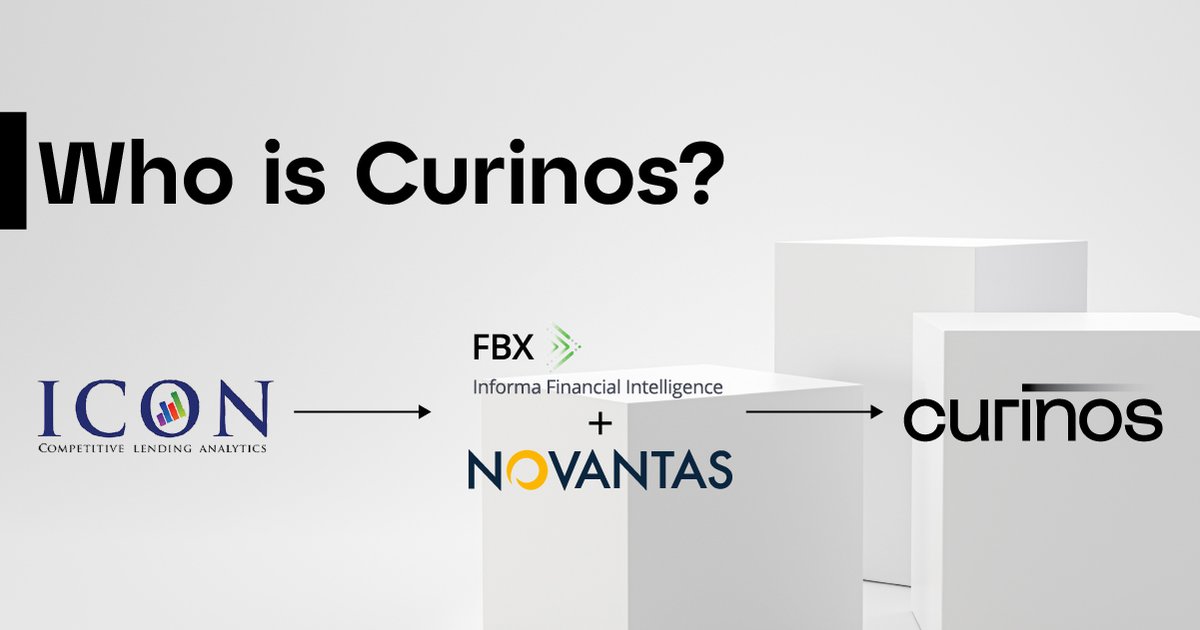

How did we get to where we are today? See how LendersBenchmark became part of the Curinos suite of solutions to help customers Navigate Today and Anticipate Tomorrow. bit.ly/3okb3X0

Curinos' own Brad Resnick & Adam Stockton were quoted in @cguillot's @FinancialBrand article below, discussing how rising #interestrates are impacting #banking and ways in which #banks & #creditunions can prepare now to better serve their clients: bit.ly/3ovOJJW

#Innovation in products and customer engagement are driving change across the consumer lending landscape. Join Curinos' Yvan De Munck, Suraya Randawa, and Ken Flaherty as they analyze trends and discuss where the market is headed in the coming year. bit.ly/3GCnqDK

Curinos' Head of Product & Market Strategy, Rutger van Faassen, discusses banking technology & how #banks should invest in new tech focused on #financialplanning & points of #purchase in @_carterpape_'s @AmerBanker article below: bit.ly/3Jw4DfB

americanbanker.com

FDIC researchers say tech-savvy banks outperformed on PPP loans

Banks that rank high on a Fintech Similarity Score made the most government-backed small-business loans outside their local area, a study found.

Reintroducing our timely Perspective series, Curinos experts weigh in on the latest news from the Federal Open Market Committee and preparations for a future rise in rates. bit.ly/3KPlOda #fed #fomc #rates #risingrates

Curious about Curinos? Learn how #Curinos got its name. Listen to the full podcast: bit.ly/3FYxO9B

Gina DeCorla, senior research analyst at Curinos, shares how a lot of #consumers will expect customization to start happening automatically with #creditcard #rewards in @plasticpayments & @johnhadams’s @AmerBanker article. Read more here: bit.ly/3qJR3gH

americanbanker.com

NFTs, rewards, buy now/pay later: Front lines of payments in 2022

Card networks are poised to connect to nonfungible tokens, issuers are revamping rewards, and regulators are taking greater interest in installment loans. These developments and more bear watching in...

Rutger van Faassen, Innovation & New Markets Industry leader shares his insights with @YizhuEvy’s @SPGMarketIntel around the continuing trend of #fintechs acquiring #banks, specifically how it is smarter to partner or acquire. Read the full article here: bit.ly/3G126IK

Our recent #data shows December 2021 #mortgagerate lock volume was down 40% year-over-year, while funded volume decreased 25% year-over-year and 6% month-over-month in Katie Jensen’s @NatlMortgagePro article. Read more here: bit.ly/3Fcznja

United States Trends

- 1. The JUP 101K posts

- 2. FINALLY DID IT 148K posts

- 3. Christmas 1.91M posts

- 4. The PENGU 46.8K posts

- 5. #StrangerThings5 335K posts

- 6. #NightOfTheSamurai 2,374 posts

- 7. Kwanzaa 60.2K posts

- 8. Utah 37.7K posts

- 9. Nigeria 503K posts

- 10. Vecna 154K posts

- 11. Marty Supreme 29.3K posts

- 12. Boxing Day 748K posts

- 13. $luna 1,738 posts

- 14. Kyle Whittingham 24.7K posts

- 15. Dustin 142K posts

- 16. #SmackDown 29.2K posts

- 17. Good Saturday 20.5K posts

- 18. Minnesota 595K posts

- 19. Jokic 42.5K posts

- 20. Jesus 434K posts

Something went wrong.

Something went wrong.