Option Alpha

@OptionAlpha

We're on a mission to give pro trading tools to everyone and launched the industry's first bot trading platform for stocks and options.

You might like

Using Gamma Exposure to Scalp SPX Intraday: youtu.be/XQQIH3qkn2M

youtube.com

YouTube

Using Gamma Exposure to Scalp SPX Intraday

This week on the podcast, we're joined by very special guest Lex from @tradier! We chat all things Gamma & Gamma Exposure (GEX): Watch or listen to the show here: optionalpha.com/podcast/gamma-…

Defined-risk vs. undefined-risk options positions. Lesson number 1: Trade defined risk positions. Example attached. Lesson number 2: See lesson number 1. #TrumpTariffs #StockMarketNews #optiontrading

Mic check 1-2. The Option Alpha Podcast is officially back!!! New energy. Same mission. Helping traders level up their game — one episode at a time. 🎧 👉 optionalpha.com/podcast/reboot… #OptionsTrading #OptionAlphaPodcast

Our 1st live event is planned next month in NYC! Chat with the team, learn with hands-on bot building, and network with other OA members. Only a few spots left. Grab your spot now: optionalpha.com/live

Looking forward to joining the Inside Investing podcast with @TDBank_US to break down credit spread strategy, risk, automation, and everything in between. Don’t miss it 👇 🎧 Register to join live here: event.on24.com/wcc/r/4863743/… #OptionsTrading #CreditSpreads #Investing

Profit targets are always fun to test, particularly for 0DTE strategies. Today, I tested 5 different profit targets to see if taking profits early improved the strategy. Then, I turned 1 bot on LIVE: youtu.be/2mqsHo_Idu4

youtube.com

YouTube

I Backtested 5 Different 0DTE Profit Targets & Turned 1 New Bot Live

New "Tales of the Tape" podcast! What are common hurdles retail traders face when automating their strategies? How is managing a portfolio of options like raising a family? Find out in Episode 2 feat. @kirkduplessis, founder of @OptionAlpha. Watch/listen on the below…

If you're new to options trading and have a smaller account, I created a 55-min guide on how I would start with a $3,000 portfolio for free here: hubs.li/Q03gqgVW0 Plus, you can clone my $3k bot template and use it to help start your first bot here: hubs.li/Q03gqjYK0

youtube.com

YouTube

Start Trading Options with $3,000

We just released a new in-depth video on Technical Analysis for Beginners: youtu.be/hAfZhYPn9I4 It covers key indicators like the SMA, RSI, MACD, and then shows how you can automate technical strategies with multiple examples. Hope it helps! Enjoy!

youtube.com

YouTube

Technical Analysis for Beginners (Ultimate Guide w/ Examples)

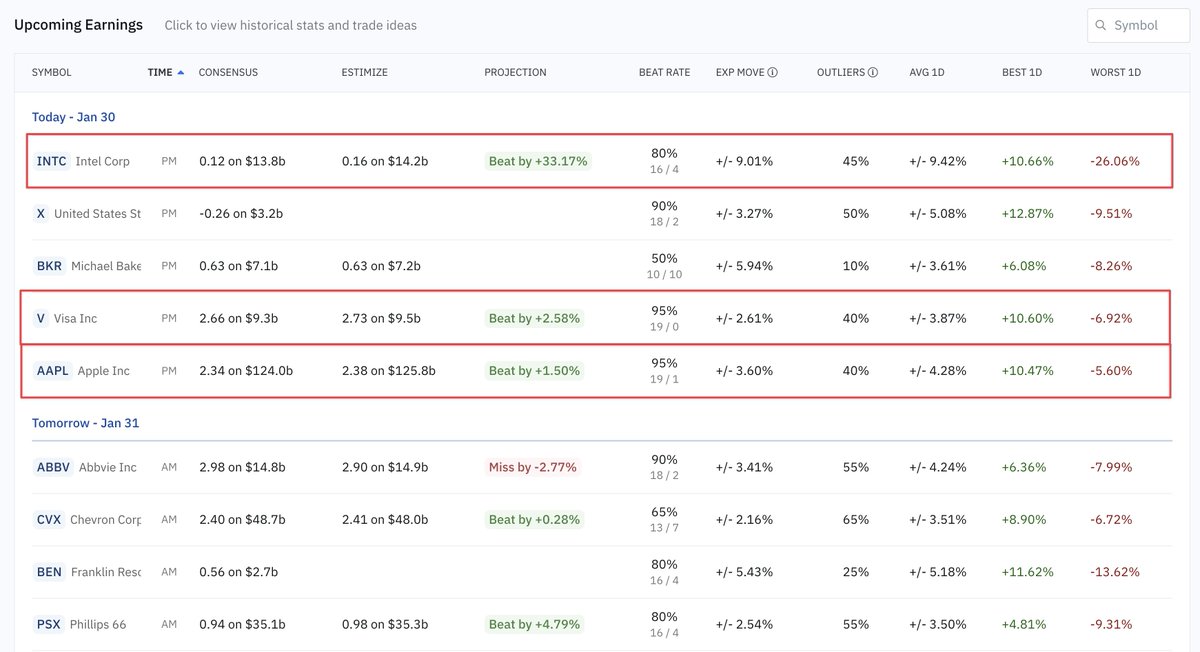

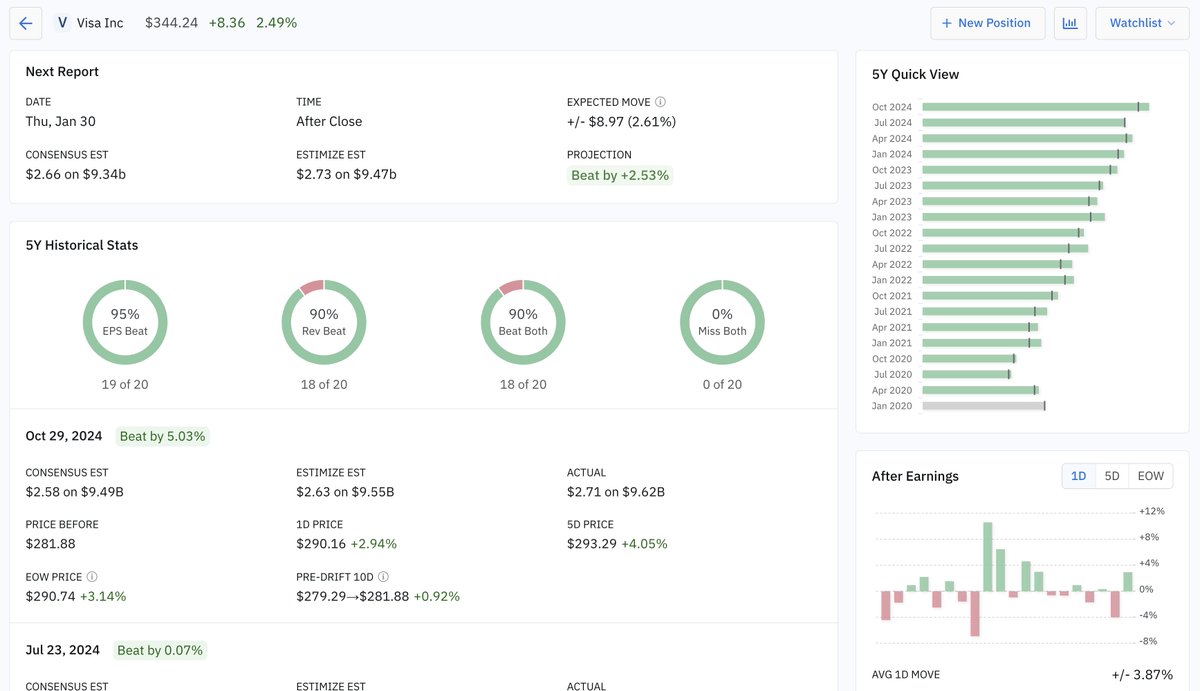

$AAPL $INTC $V all report earnings after the close. Combined, they have an average beat rate of over 85%. See more earnings stats and expected moves here: app.optionalpha.com/earnings

If you're new to options trading and unsure what Debit vs. Credit spreads are, this video is your ultimate guide. Inside, I walk through multiple live examples of each and show you how I find trade ideas for both types of spreads: youtube.com/watch?v=rVak0W…

youtube.com

YouTube

Debit vs. Credit Spreads (Ultimate Guide w/ Live Examples)

$NVDA down 17%+, near the session lows of the day. All this volatility means there's an opportunity for option sellers here if you can keep your position size small. Here are some scans to kick-start the ideas: app.optionalpha.com/tradeideas?cre…

This video explores the concept of slippage. It explains what slippage is, why it is important for options trading, how to screen and filter for liquidity, and shows backtested strategies that include slippage and its impact on performance: youtu.be/MR0HyD5f2xA

youtube.com

YouTube

What is Slippage + 4 Backtested Examples of Winning vs. Losing...

Today our team is getting together to review all the feedback (both good and bad) on how we can help our traders this year. It’s an important step and one we take seriously as we plan 2025 for you all!

United States Trends

- 1. Sesko N/A

- 2. West Ham N/A

- 3. Palmer N/A

- 4. Amad N/A

- 5. Leeds N/A

- 6. Caicedo N/A

- 7. Alaska N/A

- 8. #WHUMUN N/A

- 9. Laila Edwards N/A

- 10. Manchester United N/A

- 11. Murkowski N/A

- 12. Nancy Guthrie N/A

- 13. Baby Keem N/A

- 14. Man U N/A

- 15. Noah Kahan N/A

- 16. Dalot N/A

- 17. Thomas Frank N/A

- 18. Nest N/A

- 19. Shaw N/A

- 20. Courtney Love N/A

You might like

-

OIC

OIC

@Options_Edu -

Edgewonk

Edgewonk

@edgewonk -

Chat With Traders

Chat With Traders

@chatwithtraders -

Colibri Trader (a.k.a. Atanas)

Colibri Trader (a.k.a. Atanas)

@priceinaction -

tastytrade

tastytrade

@tastytrade -

Gavin | Options Trading IQ

Gavin | Options Trading IQ

@OptiontradinIQ -

NYC Trader

NYC Trader

@szaman -

Better System Trader

Better System Trader

@bettersystrader -

Schwab Trading

Schwab Trading

@SchwabTrading -

tastylive

tastylive

@tastyliveshow -

Simpler Trading

Simpler Trading

@simplertrading -

Trade Alert

Trade Alert

@OptionAlert -

TraderFlorida

TraderFlorida

@TraderFlorida -

John F. Carter

John F. Carter

@johnfcarter -

CMT Association

CMT Association

@CMTAssociation

Something went wrong.

Something went wrong.