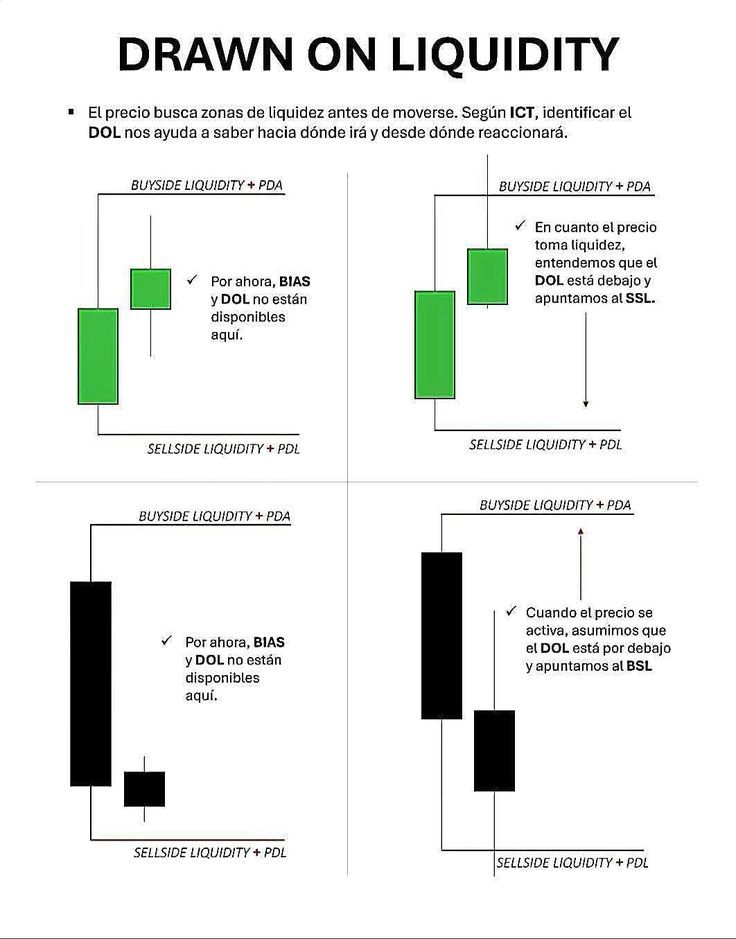

Once htf liquidity is raided watch the brk in the ltf aligned. Is that it? I think so

ICT’s 09:30 Model for Indices: - A liquidity grab 9:30AM - A shift in market structure - Entry off a FVG in Premium/Discount. Join Tel; t.me/ictgirlreal

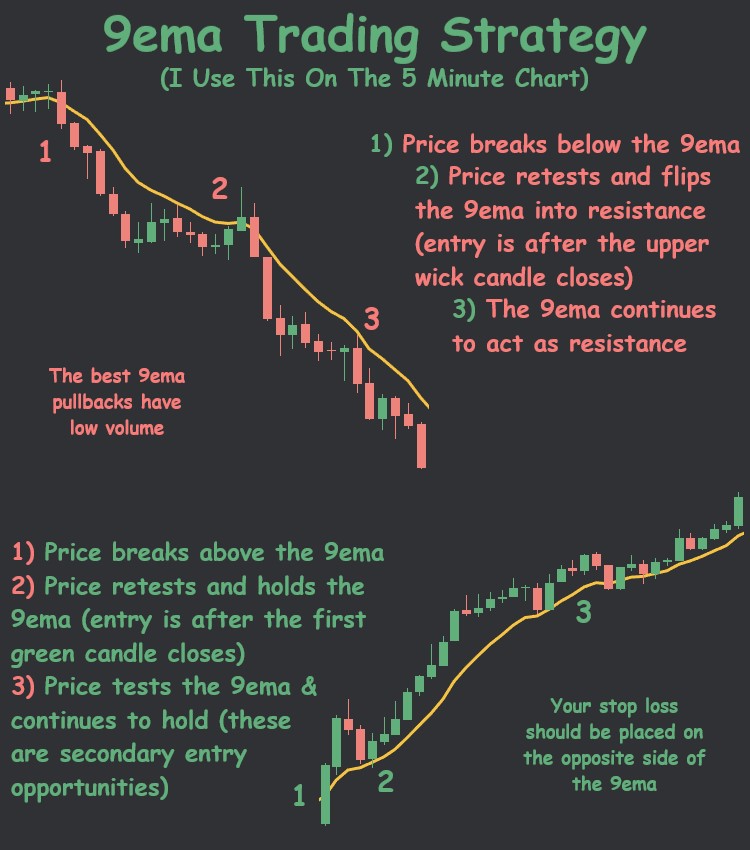

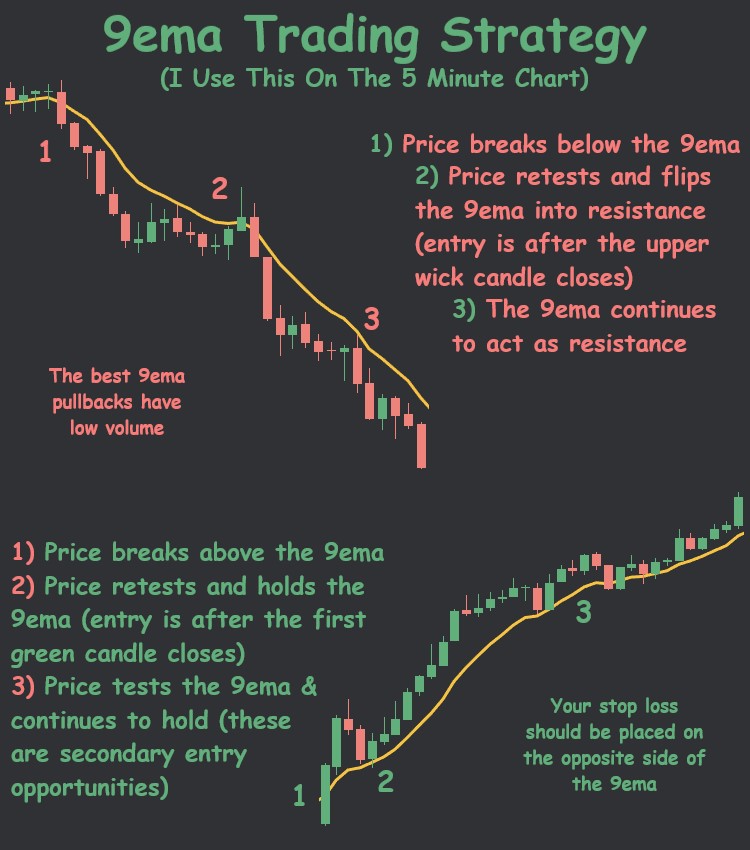

Trending market = use the 9ema Keep an eye out for these setups this week

4 SCREENERS YOU NEED TO TRY OUT🔥🔥🔥 1) Accumulation 2) Buy Ugly 3) Dividend 4) Momentum

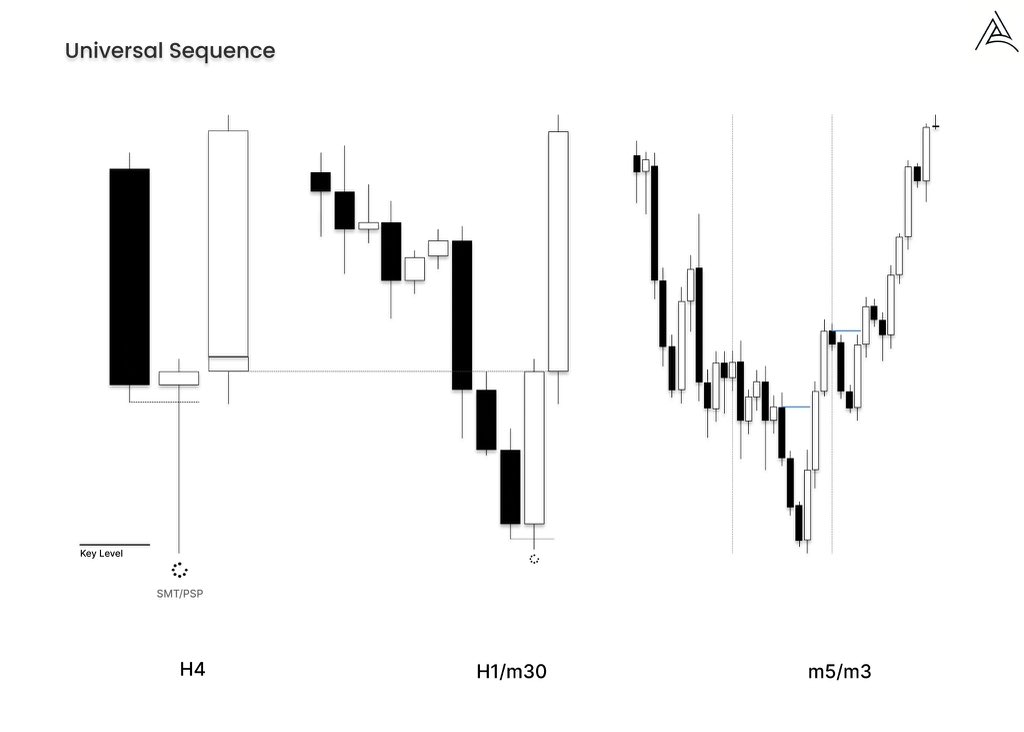

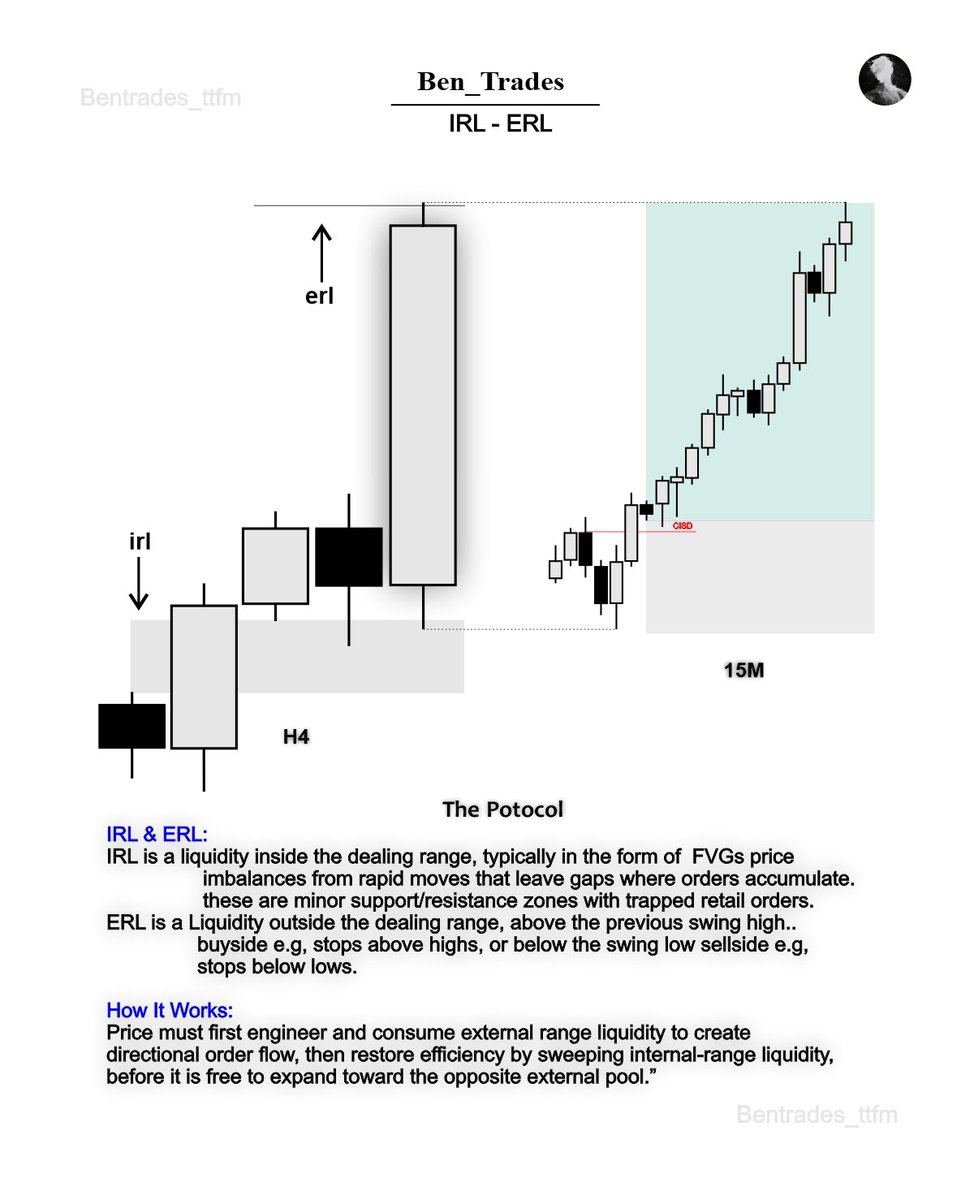

This Simple Strategy Can Make You Multiple Funded 4H IRL ♻️ ERL 15M CISD FVG Credit @Bentrades_ttfm

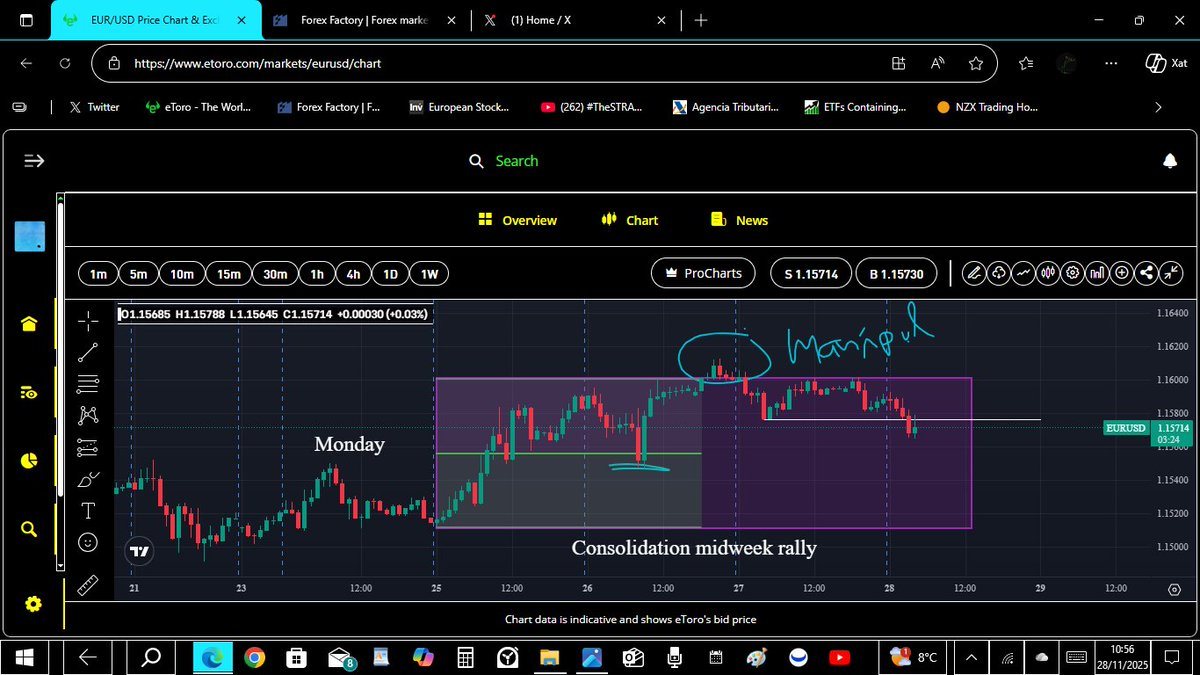

Do you know what is a Market Makers Sell Model? It's happening right now on Eurusd

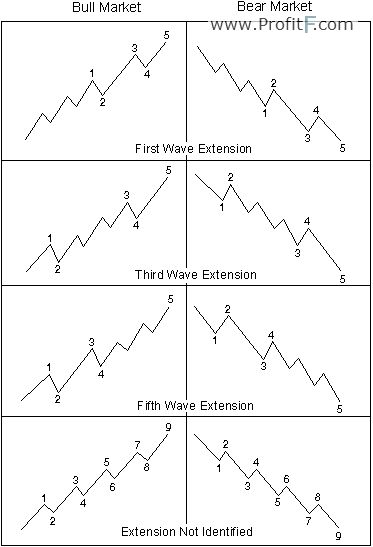

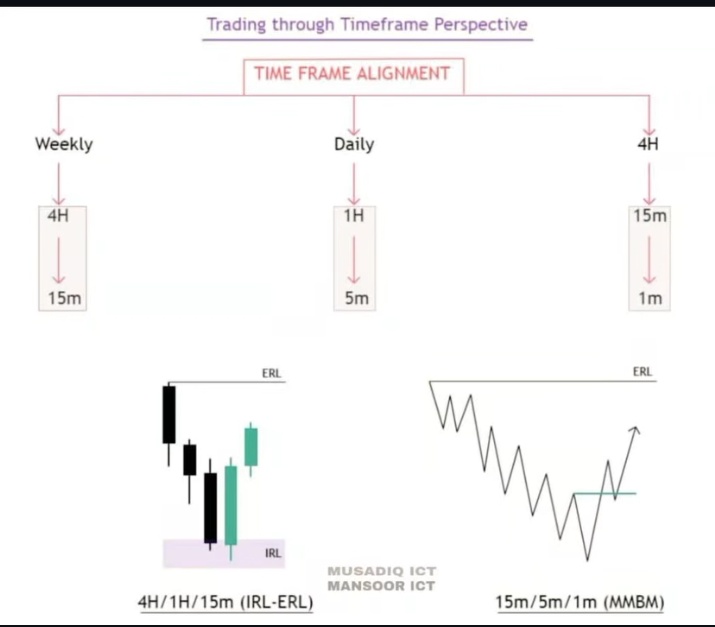

We always start top-down: Weekly, Daily... but as intraday traders, our real edge is in 4H and below: 4H gives us directional bias 15M reveals MMXM setups The game is simple: Find valid setups from 4H/15M or 1H structure Execute on 5M or 1M MMXM Target the ERL (LRLR) -…

Did not play out. London should have manipulated asia highs or pdh and it didn't, so the sell day ended up as a reversal one. Too bad. 😡😡😡😡

Midweek rally bear profile for euro this week. Question is: Thknsgiving bank holiday in US today. Will ny open volatility be enough to take ssl?

$XAUUSD 1D played out just as anticipated. My attention is now on the ATH level…👀

As long as the daily candle doesn’t close below 100% of the FVG, my overall bias on $XAUUSD remains bullish. Let the price prove itself 👀

HOW TO FIND THE MOST RECENT INSIDER TRADES🔥 & HOW TO FIND THE LARGEST INSIDER TRADES💰

Master oderblock full PDF ••FOLLOW ME ••LIKE,REPOST •COMMENT [OB] I will send you the full PDF guide

![Magic__trader_'s tweet image. Master oderblock full PDF

••FOLLOW ME

••LIKE,REPOST

•COMMENT [OB] I will send you the full PDF guide](https://pbs.twimg.com/media/G6hz49CWUAApCUL.jpg)

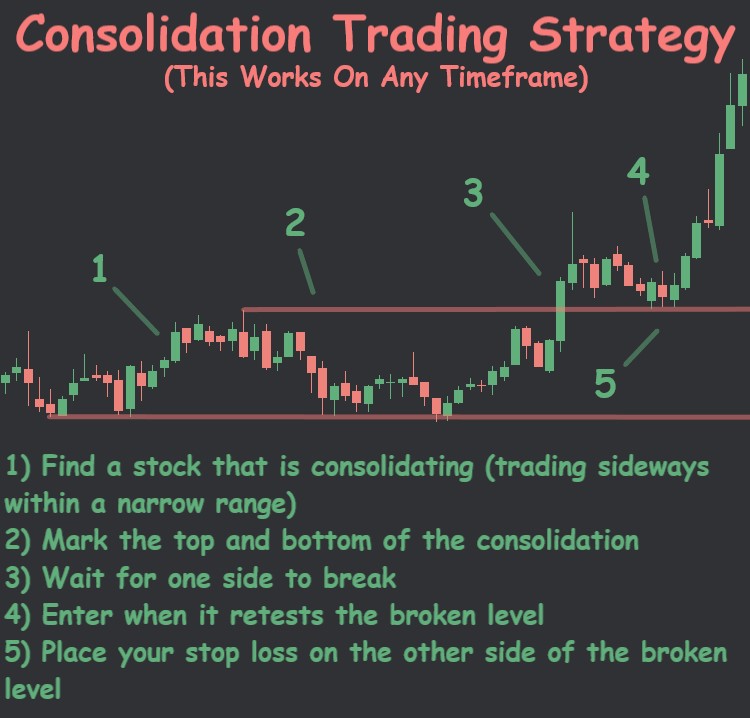

3 SIMPLE TRADING STRATEGIES EVERY TRADER SHOULD KNOW📈📈 1) The 9ema 2) Consolidation 3) Trendline Breakout

United States 趨勢

- 1. #WWERaw 54.4K posts

- 2. Giants 66.7K posts

- 3. Giants 66.7K posts

- 4. Patriots 96.5K posts

- 5. Drake Maye 16.9K posts

- 6. Dart 28.3K posts

- 7. Diaz 33.1K posts

- 8. Gunther 11.6K posts

- 9. Devin Williams 5,785 posts

- 10. Younghoe Koo 4,239 posts

- 11. Abdul Carter 8,023 posts

- 12. Mets 16.3K posts

- 13. Marcus Jones 5,491 posts

- 14. LA Knight 11.7K posts

- 15. #RawOnNetflix 1,777 posts

- 16. Theo Johnson 1,864 posts

- 17. Kyle Williams 3,818 posts

- 18. Joe Schoen 1,865 posts

- 19. #NYGvsNE 1,751 posts

- 20. Kafka 6,809 posts

Something went wrong.

Something went wrong.