おすすめツイート

I was also impacted by the @WSJ layoffs. I was laid off after mat leave for some extra salt in the wound. All the working moms out there know that this is a worst nightmare scenario. I’d love any help from former colleagues, friends, social media connection, etc.! 🙏

Some of the best tech reporters + editors out there were laid off from @wsj yesterday. When I say these folks are not only incredibly knowledgeable but also kind and a joy to work with, I mean it. If you’re hiring, don’t miss the chance to snatch them up. I can help make…

just learned about recency bias and its my favorite thing ever

"Money and the Momentous Decision to Retire." Readers weigh in on financial issues they're concerned about when they think about retiring - as reflected in the blogs they are reading: crr.bc.edu/money-and-the-… #retire #financial #socialsecurity #401k #Babyboomers #boomers #aging

Perfect timing. Very excited to dig into @kylascan's new book, out today! Get it here: amzn.to/3XinBR1

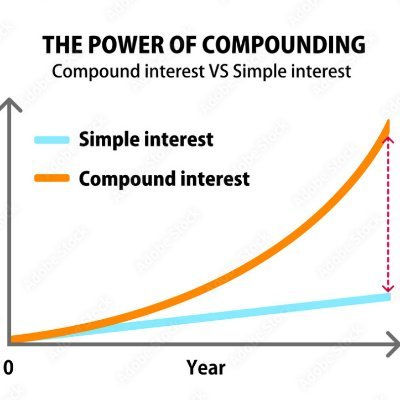

Fine: You screwed up and you're in trouble. Avoid repeating the mistake. Fee: A cost of admission that's worth paying to get something worthwhile in return. Market volatility is a fee, not a fine.

This applies to a lot more than just art. There’s almost always more money to be made in selling the thing than doing it yourself.

Some of the best tech reporters + editors out there were laid off from @wsj yesterday. When I say these folks are not only incredibly knowledgeable but also kind and a joy to work with, I mean it. If you’re hiring, don’t miss the chance to snatch them up. I can help make…

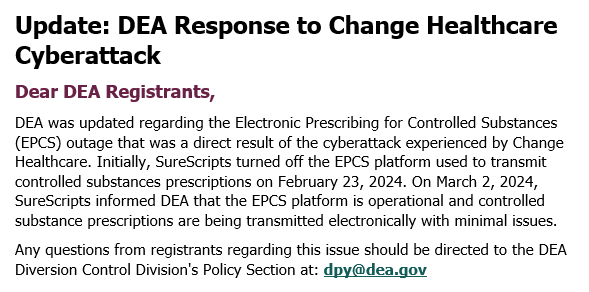

Total digitization of medication subscribing is a complex adaptive system waiting for a downfall. There is no resiliency built into how medications are dispersed. People, always keep extras of your important medications. Would love to see a story on this @KFFHealthNews

New Blog Post - How to Find the Right Financial Advisor For You! This is one of the more comprehensive resources for understanding how to find a financial advisor. Hat tip to @michaelkitces for providing a framework on laying out the industry history. quietwealth.com/insights/finan…

“People assume that a good financial plan has to be complicated. I think there’s room to talk about simplifying it.” – @christine_benz Why is that idea so hard for us to get our heads around? buff.ly/3sIKQWM

Periodic reminder that I was able to cut down my hospital bill SUBSTANTIALLY by asking if there was a discount for paying within 30 days. There was. I can't remember if I saved 1/4 or 1/3, but it was a lot. I am forever grateful to the person who passed on this info to me.

What can happen if you deposit a fraudulent check? - The bad guys would have your bank account information and signature. - The scammer will ask for some money to be returned. That money will be gone forever. -Other payments could bounce when the bank subtracts the money. (END)…

Everyone knows the standard 3-6 months of emergency fund advice. When advising clients on how much cash to keep, I tailor it to how risky the household's income is. - Dual income ➡️3-6 months - Single income➡️ 6-9 months - Entrepreneur ➡️6-12 months

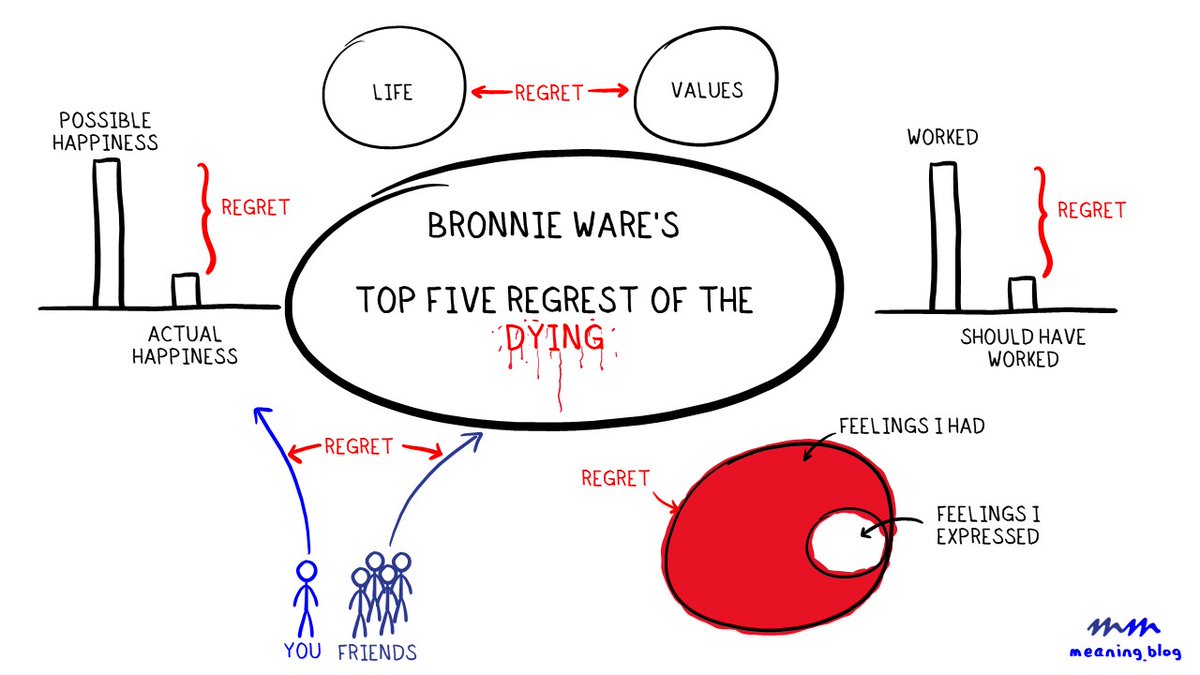

Bronnie Ware's top five regrets of the dying: 1. I lived a life that was expected of me. 2. I worked too much. 3. I didn't express myself. 4. I lost touch with my friends. 5. I didn't allow myself to be happy. You still have time. meaning.blog/life #life #money #meaning

There are so many benefits to working "in" retirement. Socialization, better financial stability, better health. Most of our clients choose to do this - of course, only doing work they love. @barronsonline barrons.com/articles/worki…

Sobering but important message of what we have to be mindful we may lose at retirement: - Income <duh> - Identity - Purpose - Structure - Community - Relevance - Power Many can be replaced in retirement, but only if you're intentional w/ a plan to do so? humbledollar.com/2023/08/what-w…

5 tips to enhance your returns in the stock market: 1. Stop 2. Looking 3. At 4. Your 5. Investments Use automation to invest and go spend time doing things you love.

.@SocialSecurity's Office of #Retirement and #Disability Policy has released an annual chartbook that highlights statistics on the most important aspects of the Social Security and Supplemental Security Income programs. Read the publication here: bit.ly/3EAMzR3 #SSI

I LOVE my aftertax 401(k)! Heavy savers, you're missing out if you're not badgering your employer to add this feature, along with automatic in-plan conversions. It's a wonderful, easy way to get way more $ into the Roth column. morningstar.com/personal-finan…

morningstar.com

Should You Make Aftertax 401(k) Contributions?

In-plan conversions are a no-brainer for heavy savers who have access to them.

Fascinating!

The more you bullshit, the more likely you are to fall for other people's bullshit. Data: those who exaggerate their expertise to impress others are more vulnerable to misinformation. When people speak without concern for the truth, they can't be trusted to recognize the truth.

5 Retirement Blind Spots By comparing pre-retiree EXPECTATIONS vs. post-retiree EXPERIENCES, the following 5 Blind Spots have been identified in a new study: 1) You'll miss more than just your paycheck from work (think friends, sense of identity, purpose, etc.) Read on...

United States トレンド

- 1. Texans 88,7 B posts

- 2. Aaron Rodgers 37,9 B posts

- 3. Tomlin 32 B posts

- 4. DeepNodeAI 66,4 B posts

- 5. CJ Stroud 19,4 B posts

- 6. Arthur Smith 5.750 posts

- 7. #HereWeGo 21,1 B posts

- 8. Christian Kirk 4.096 posts

- 9. #HOUvsPIT 3.854 posts

- 10. #HTownMade 4.891 posts

- 11. Will Anderson 4.131 posts

- 12. Nico Collins 3.163 posts

- 13. Jonnu Smith 2.979 posts

- 14. TJ Watt 2.864 posts

- 15. Woody Marks 2.602 posts

- 16. Muth 1.564 posts

- 17. Sheldon Rankins 1.873 posts

- 18. Marvin Lewis N/A

- 19. DK Metcalf 3.197 posts

- 20. Echols 2.128 posts

Something went wrong.

Something went wrong.