Parallax Financial Research

@ParallaxFR

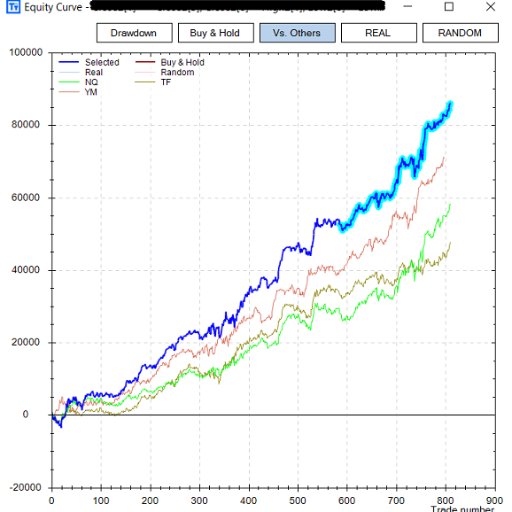

Neural Network Solutions for Professional Money Managers

You might like

The QQQ and IWL ETFs have weekly scale ExtremeHurst Top Extension signals here. Extensions mark the abrupt end of trends and are followed by flat or retracing prices. Signal duration scales to the elapsed signal build time. In this case they expire next April.

The Nikkei 225 has a weekly scale top here. Expect a retracement period to last through Feb. All our tools including ExtremeHurst are available by subscription on either Bloomberg or TradeStation. pfr.com

Parallax built a stock valuation algo in 1990 using traditional AI . Since then we've tracked the total market cap of the top 1000 US stocks using our model versus the actual cap. The degree of over valuation has now reached 1999 levels. (available in the Bloomberg app store)

GOOG has a weekly scale top that will be active through mid-December.

There are a number of technology ETFs showing daily scale tops tonight. Expect a retracement period into the first or second week of Oct. Our tools are available by subscription on Bloomberg or TradeStation.

Further checking showed top indications are far worse than first thought. I just discovered the IYF, IYG, Russell 1k and 3k are also top extended through the 3rd week in July. Expect a rough patch near term. Subscribe to our tools from the Bloomberg app store (APPS)

We noted a daily scale ExtremeHurst Top Extension in the IVV iShares Core S&P 500 ETF. Expect a retracement period lasting through July 21st.

The S&P 500 cash half day chart (195 minutes) nailed the bottom. Will it nail a top is to be determined. Expect a flat to down period for the next week.

United States Trends

- 1. #CashAppGreen N/A

- 2. hayley 15K posts

- 3. #FanCashDropPromotion 2,858 posts

- 4. Rondo 2,310 posts

- 5. Wale 42.3K posts

- 6. Summer Walker 32.1K posts

- 7. Bubba 15.9K posts

- 8. #FridayVibes 6,528 posts

- 9. #FursuitFriday 13.1K posts

- 10. Bill Clinton 82.2K posts

- 11. Bart Scott N/A

- 12. Reid Hoffman 24.1K posts

- 13. Hunter Biden 11.8K posts

- 14. Thomas Crooks 50.9K posts

- 15. #LCxCODSweepstakes N/A

- 16. Good Friday 67.2K posts

- 17. Ticketmaster 8,610 posts

- 18. Jaylon Johnson N/A

- 19. Saylor 53.9K posts

- 20. SINGSA LATAI EP3 165K posts

You might like

-

Dean Christians, CMT

Dean Christians, CMT

@DeanChristians -

Quantifiable Edges

Quantifiable Edges

@QuantifiablEdgs -

Build Alpha

Build Alpha

@buildalpha -

Variant Perception

Variant Perception

@VrntPerception -

Marcos López de Prado

Marcos López de Prado

@lopezdeprado -

Andrew Thrasher, CMT

Andrew Thrasher, CMT

@AndrewThrasher -

Brrr Infinity Capital

Brrr Infinity Capital

@InterestRateArb -

SPYderman

SPYderman

@alsabogal -

HFTAlert

HFTAlert

@HFTAlert -

The Leuthold Group

The Leuthold Group

@LeutholdGroup -

Saeed

Saeed

@saeedamenfx -

𝐏𝐢𝐧𝐞𝐜𝐨𝐧𝐞 𝐌𝐚𝐜𝐫𝐨

𝐏𝐢𝐧𝐞𝐜𝐨𝐧𝐞 𝐌𝐚𝐜𝐫𝐨

@pineconemacro -

Bill Luby

Bill Luby

@VIXandMore -

Pat Hennessy, CMT

Pat Hennessy, CMT

@pat_hennessy -

BA

BA

@ChiTownBA

Something went wrong.

Something went wrong.