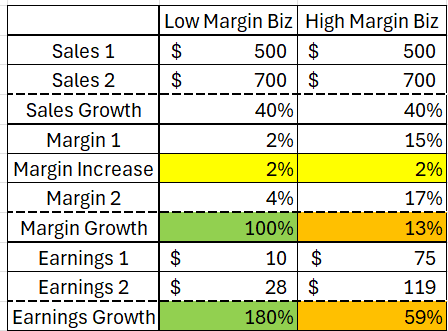

Absolutely true. There’s nothing like getting into a stock in the early innings of a margin expansion cycle. Not only does it create a long runway for multibagger returns, but you don’t need much of an increase in revenue to produce strong EPS growth. A top 5 set up.

The impact of margin growth on low mgn businesses, including an example to illustrate. A 2% increase in mgn on a low margin biz drives earnings growth significantly higher than the same increase on a high mgn business (same sales growth). And the market loves earnings growth.😉

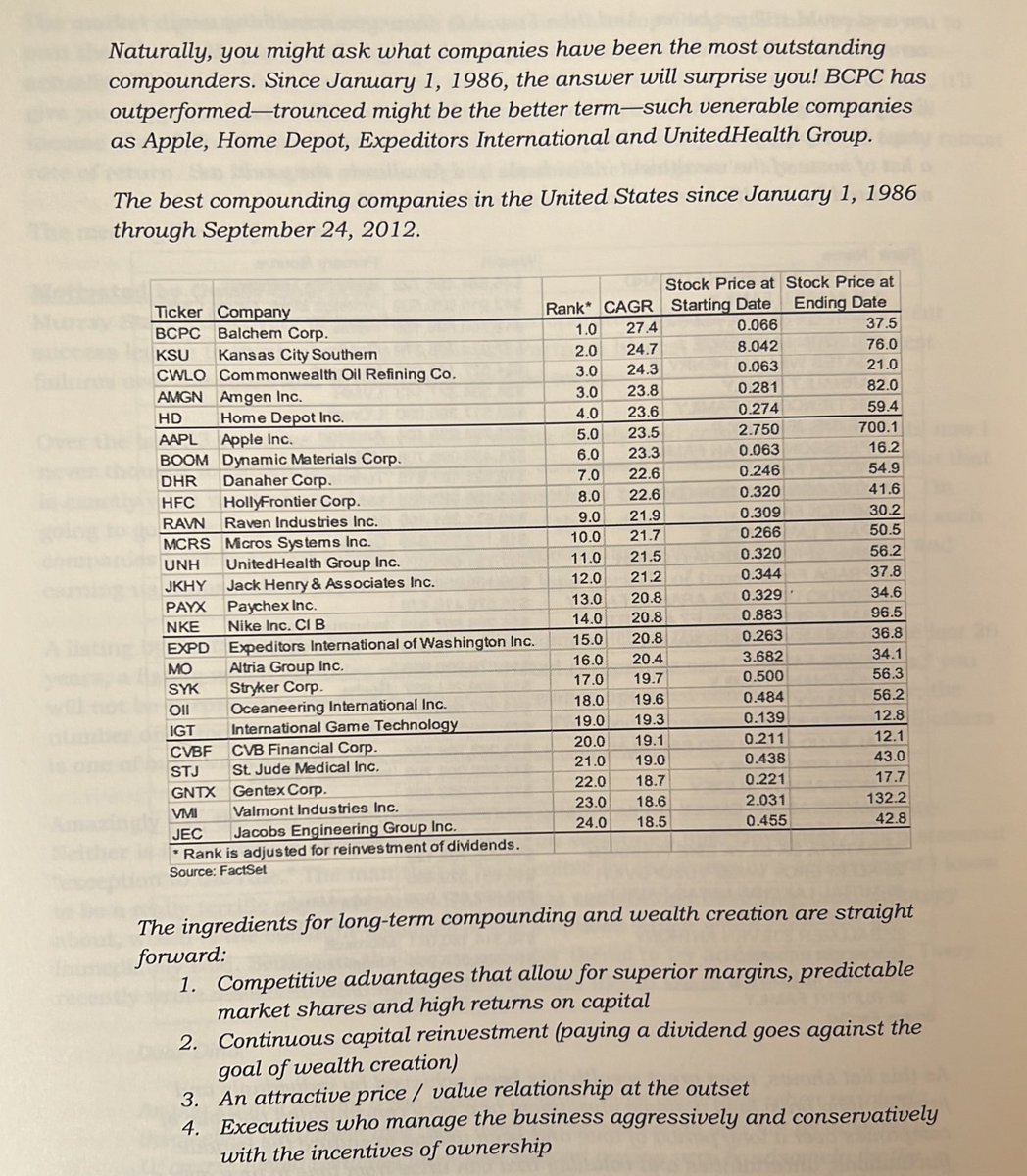

“Paying a dividend goes against the goal of wealth creation”.

Extract from Santa Monica Partners Shareholder Letters

Warren Buffett during market volatility.

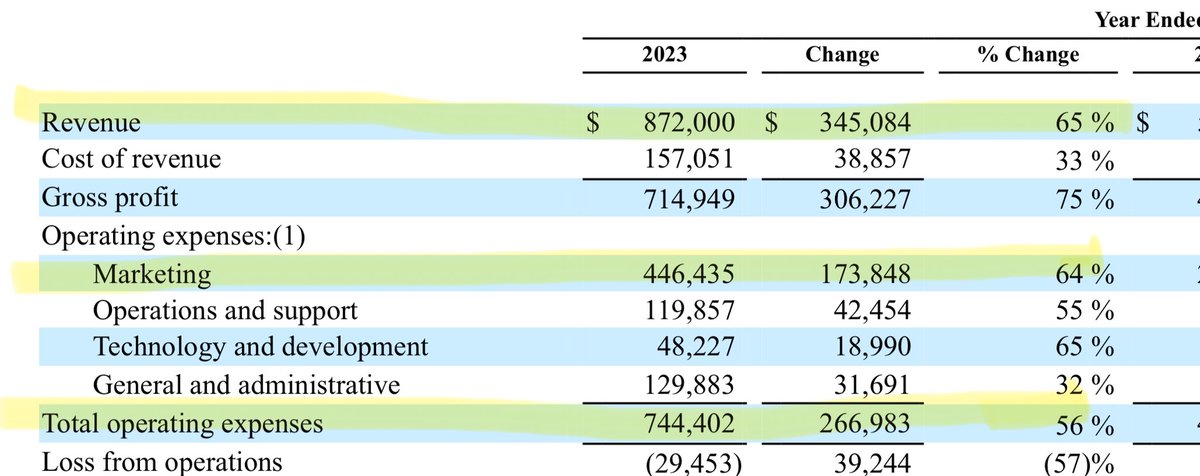

That’s not surprising at all. However, this growth comes at a high cost. For every percent of increased revenue, they must increase their CAC/ad spending by the same amount (see pic). And since their ad spending is over 50% of their revenue, it is a burden. Also, as I have…

Warren Buffett and Nebraska Furniture Mart's Rose Blumkin An interesting look back in history from 1983 for those interested:

On Digging Deeper in Investing Most "investors" are able to perfectly understand surface level information. Revenue, earnings, assets and liabilities etc. Beyond that, unless one has a passion for investing, the level of competency falls off and really doesn't delve any deeper.…

Pre-Tax Profit Margin The pre-tax profit margin is the profit after subtracting cost of goods sold, operating expenses, and interest. As the name implies, it is the profit before paying taxes. The formula is: Pre-Tax Profit= Earnings before taxes/Revenue Let’s say a business…

Coffee thoughts on AI I’m likely out of my intellectual scope here, but here’s a brief, unsophisticated chatter about AI: I think it’s very difficult to map out a long-term impact, so I’m not going to try. If AI is able to improve upon itself without human intervention at a…

What the F*ck is Sector Investing? Investing a percentage of your money into materials, and another into health care, and another into energy, and another into utilities, and another into industrials and another into so on and so on is nonsense. This idea that you have to…

If Only We Could In the investment world, most of us are limited to public companies, and we've become accustomed to this. But sometimes it can be fun to fantasize about the businesses we could buy if we could. There are some sensational private companies that I would…

Crypto-Crappo I only buy investments that generate cash. Businesses generate cash, at least the ones I buy ;). Stocks, being small ownership positions in businesses, meet my criteria. If something generates cash, you can come to a conclusion on it's intrinsic value, which in…

Theft. The action or crime of stealing: Immoral But is it immoral in investing? Probably not. There is no ego shame or plagiarism in following another investor into the same stock. In fact, it is an excellent way to find a golden opportunity. If you come across a thesis from…

Warren Buffett on Coca-Cola Let me add a lesson from history: Coke went public in 1919 at $40 per share. By the end of 1920 the market, coldly reevaluating Coke's future prospects, had battered the stock down by more than 50%, to $19.50. At yearend 1993, that single share,…

Don't Abuse the Stock Market The stock market gives lots of advantages for those who view it rationally. The ability to jump from one business to another is a useful tool that should be used only to correct a mistake made on the analysis of a business. Here's Warren Buffett:…

Return on Capital Employed (ROCE) Employed Capital is the total amount of money a company uses to operate and acquire profits, including debt used. The formula for ROCE is: =Operating Income/(Total Assets-Current Liabilities) Let’s assume a business has $8,500,000 in…

Forex is not Investing The Forex community is large. Disregarding any Multi-level marketing that's going on, let's objectively think about Forex. Foreign-Exchange trading speculates on short-term (and long-term!), pricing power between one currency to another. Think the U.S.…

United States 趨勢

- 1. #ALLOCATION 224K posts

- 2. #JUPITER 224K posts

- 3. The BIGGЕST 462K posts

- 4. #GMMTVxTPDA2025 592K posts

- 5. #GivingTuesday 9,001 posts

- 6. Good Tuesday 28.5K posts

- 7. rUSD N/A

- 8. Kanata 24.5K posts

- 9. #AreYouSure2 53.7K posts

- 10. JOSSGAWIN AT TPDA2025 86.5K posts

- 11. JIMMYSEA TPDA AWARD 2025 62.9K posts

- 12. Snow Day 7,716 posts

- 13. Dart 39.3K posts

- 14. Costco 29.4K posts

- 15. Lakers 49.5K posts

- 16. Bron 26.8K posts

- 17. Penny 23.3K posts

- 18. Hololive 16.4K posts

- 19. Pentagon 56.8K posts

- 20. Dillon Brooks 8,231 posts

Something went wrong.

Something went wrong.