Quant

@quantnetwork

The infrastructure of money. Building on #Overledger? Follow @OverledgerDev.

You might like

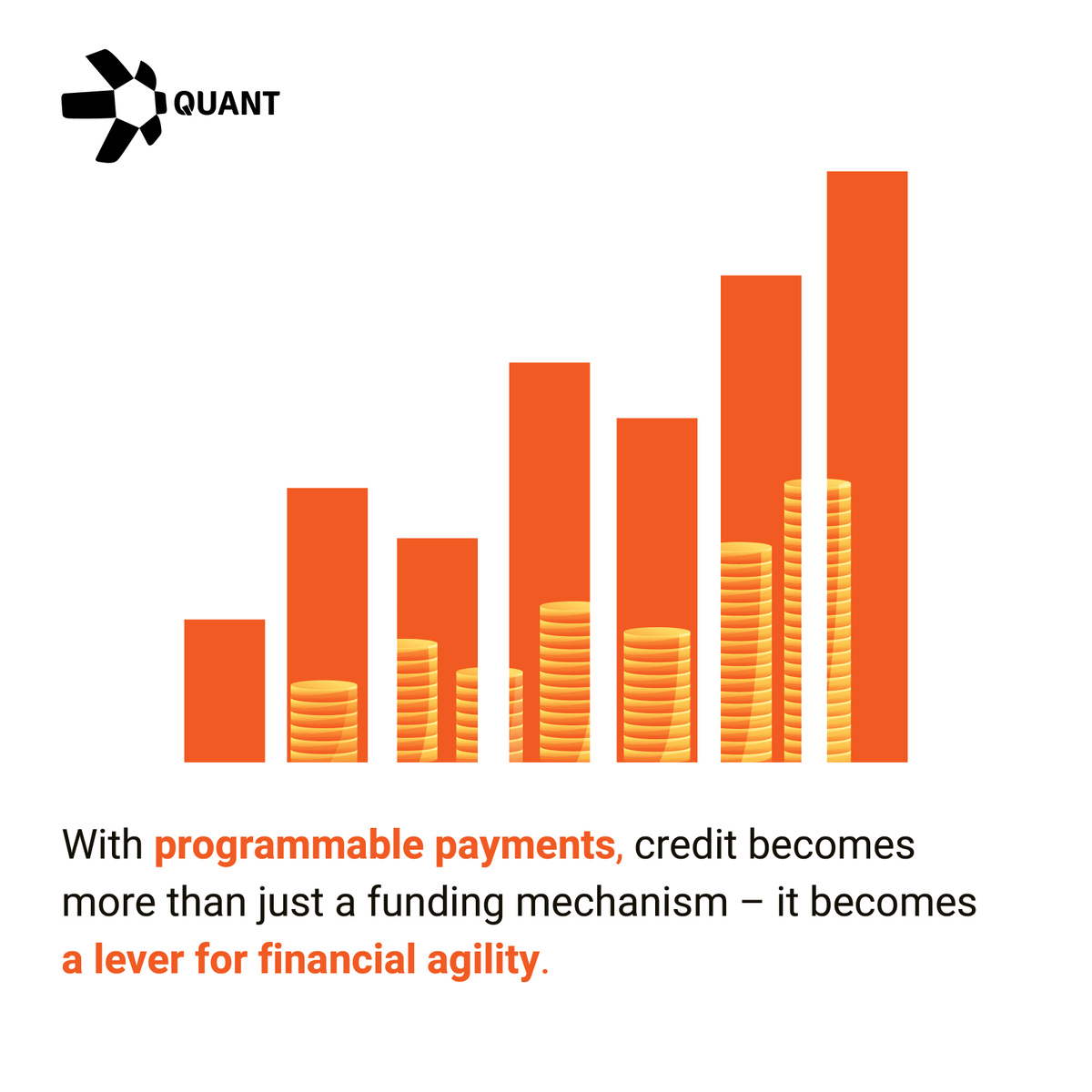

Did you know over a third of businesses face potential closure without access to vital funding? Yet traditional #credit forces rigid monthly repayments, regardless of #cashflow reality. With #QuantFlow, businesses can automate #repayments based on actual performance. Example:…

As #tokenisedassets scale, #posttrade infrastructure remains fragmented. QuantNet orchestrates assets & money across #distributedledgers + traditional systems, no infrastructure replacement, no custody risk. The future of post-trade is programmable: eu1.hubs.ly/H0pLklM0

Programmable #treasuryautomation embeds rules into #financialworkflows, enabling dynamic responses to balance thresholds, forecasts & market changes - learn how in this article: eu1.hubs.ly/H0pKTVw0

On Tuesday 21 October, industry leaders from across financial services came together for the fifth edition of @InnFin Finance FinTech as a Force for Good Forum in London. In a panel titled: “Capital Markets: The Road to Digitalisation,” our Founder and CEO, @gverdian, joined…

Settlement fragmentation is the hidden bottleneck in #tokenisedbanking. While #tokenisedassets are processing trillions in monthly trades, the cash side remains stuck, trapped by incompatible #paymentrails that don't communicate. The result? Higher settlement failures, manual…

Today at @InnFin 'FinTech as a Force for Good Forum' event, our Founder and CEO, @gverdian, joined a panel titled: 'Capital Markets: The Road To Digitalisation', to discuss how the digitalisation of #capitalmarkets is a pivotal step in strengthening the UK’s global leadership in…

Consensus on today’s Capital Markets panel at FinTech in a Changing World that we’re reaching an inflection point in tokenisation as demand increases #FFFG25 @LSEGplc @PeelHunt @quantnetwork @fnality @BlackRock_UK @HoganLovellsFIS

Last month, @UKFtweets announced the launch of a collaborative industry pilot project to deliver the first UK live transactions of #tokenisedsterlingdeposits (GBTD). On Monday 6 October, UK Finance convened major banking institutions to unveil the next phase of the UK’s #GBTD…

Are you ready for @InnFin 'FinTech as a Force for Good Forum' event next week? Our Founder and CEO, @gverdian, will be joining a panel titled: 'Capital Markets: The Road To Digitalisation', to discuss how the digitalisation of #capitalmarkets is a pivotal step in strengthening…

@gverdian, Founder and CEO of @quant_network shares key insights on DLT standards and interoperability in this @isostandards - International Organization for Standardization WG7 TC307 interview by ismael arribas(@kunfud) , Standards Advisor at #LNET. 💡 Learn about ISO’s role…

United States Trends

- 1. #WWERaw 54.6K posts

- 2. Purdy 24.1K posts

- 3. Panthers 31.8K posts

- 4. 49ers 32.5K posts

- 5. Mac Jones 4,539 posts

- 6. Penta 8,548 posts

- 7. Canales 11.7K posts

- 8. Gunther 13.2K posts

- 9. #KeepPounding 4,925 posts

- 10. Jaycee Horn 2,469 posts

- 11. #FTTB 4,558 posts

- 12. Niners 4,691 posts

- 13. #RawOnNetflix 2,012 posts

- 14. Melo 17.9K posts

- 15. Ji'Ayir Brown N/A

- 16. #CARvsSF 1,140 posts

- 17. Rico Dowdle 1,381 posts

- 18. Mark Kelly 166K posts

- 19. McMillan 2,376 posts

- 20. Kittle 3,310 posts

You might like

-

THORChain

THORChain

@THORChain -

Hedera

Hedera

@hedera -

Gilbert Verdian

Gilbert Verdian

@gverdian -

Ripple

Ripple

@Ripple -

Arweave Ecosystem

Arweave Ecosystem

@ArweaveEco -

Zilliqa

Zilliqa

@zilliqa -

Digital Pound Foundation

Digital Pound Foundation

@digitalpoundfdn -

VECTOR SPACE BIOSCIENCES - Accelerating Discovery

VECTOR SPACE BIOSCIENCES - Accelerating Discovery

@VectorSpaceBio -

eCash

eCash

@eCash -

Brad Garlinghouse

Brad Garlinghouse

@bgarlinghouse -

Greg Lunt

Greg Lunt

@GregLuntX -

Energy Web

Energy Web

@energywebx -

Chainlink

Chainlink

@chainlink -

Injective 🥷

Injective 🥷

@injective -

dYdX

dYdX

@dYdX

Something went wrong.

Something went wrong.