QuantScraper

@QuantScraper

We do quantitative analysis to find statistical patterns and regularities. Try the QuantScraper_Strategy_Backtester: https://chatgpt.com/g/g-3rutKJ7tQ-qu 🤩🚀🧠

おすすめツイート

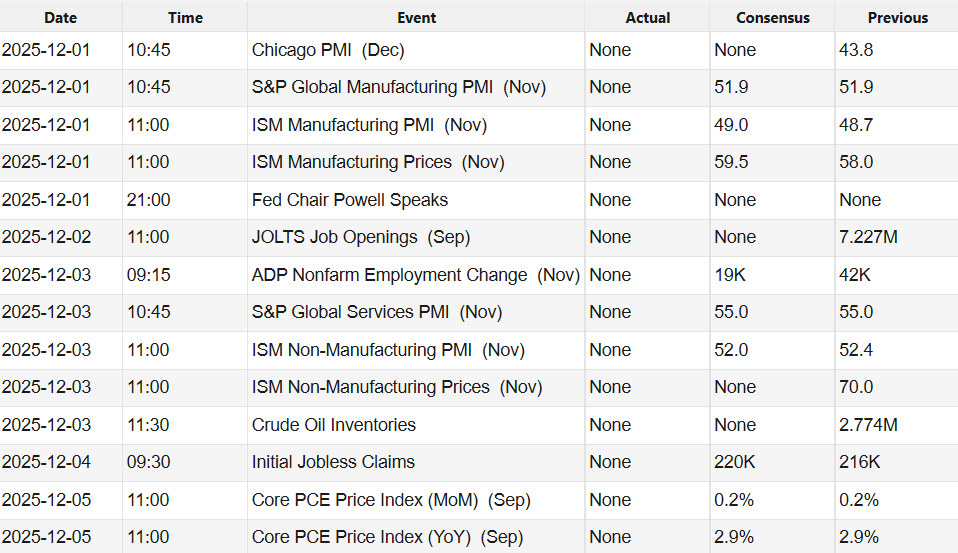

US Economic Calendar 30 NOV - 5 DIC #Economic_Calendar #ES_F $SPY $SPX #NQ #QQQ #NQ_F #GC_F $EURUSD $GLD #Bitcoin

What is the connection between $BTC and Japan bonds yield? If there is one

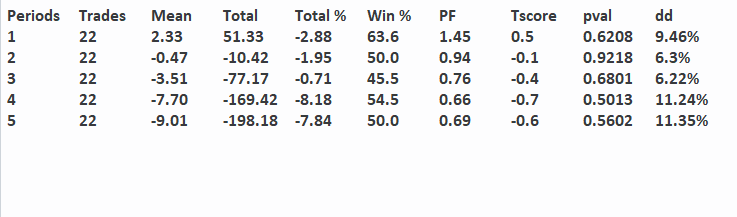

Emini S&P Futures printed 5 consecutive up days on a Friday Since 2000 it occurred 22 times. Selling after 1-5 days has not been that bullish in the past. After 5 days for example: 22 Trades, -9.01 pts Mean, 50% Wins, 0.69 Profit Factor $GLD $SPX #QQQ #ZB_F #GC_F #CL_F $TLT

Counting from a legend. @VicNiederhoffer x.com/VicNiederhoffe…

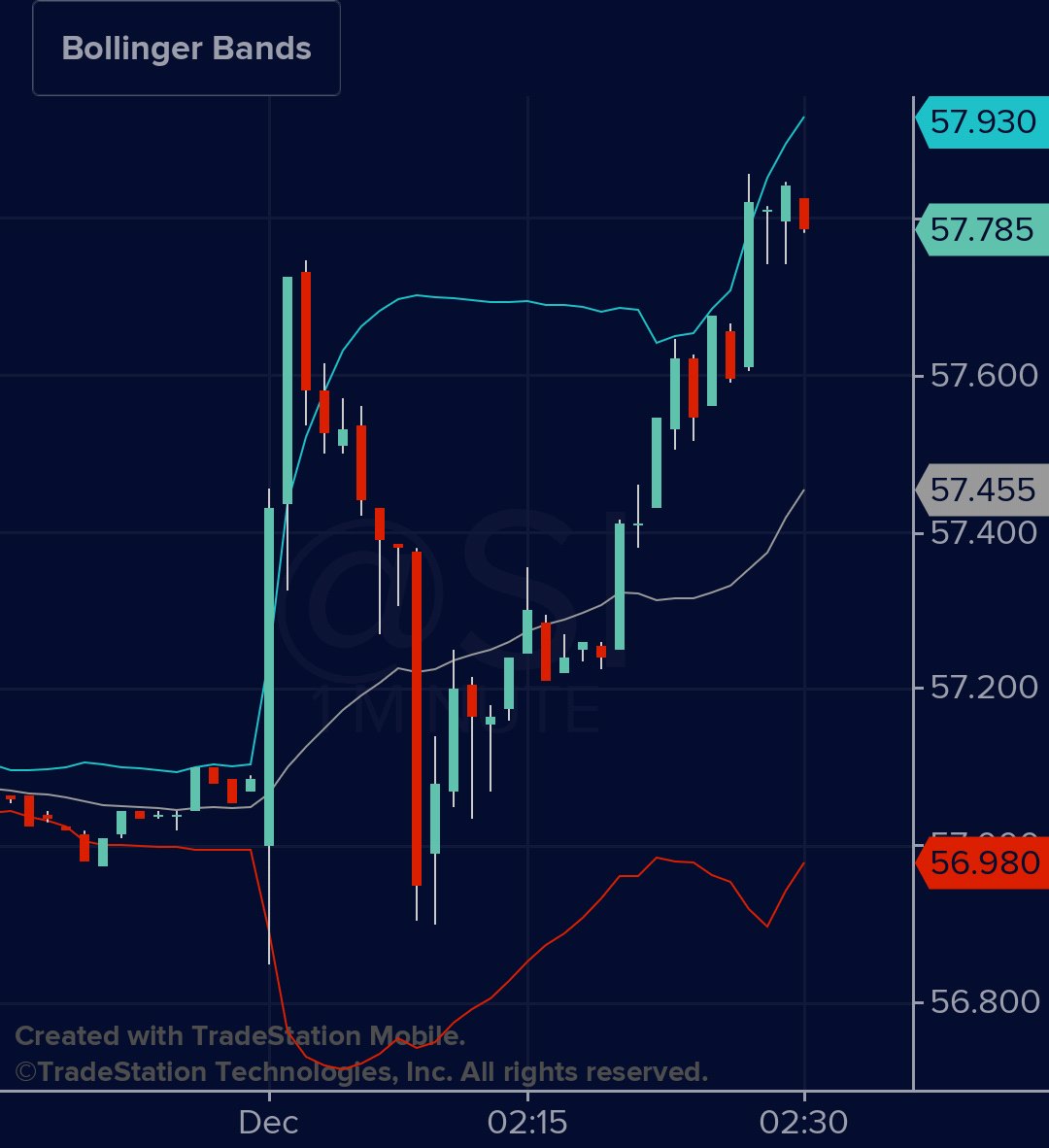

26days and 0.50 away from alst 20 day high very bull

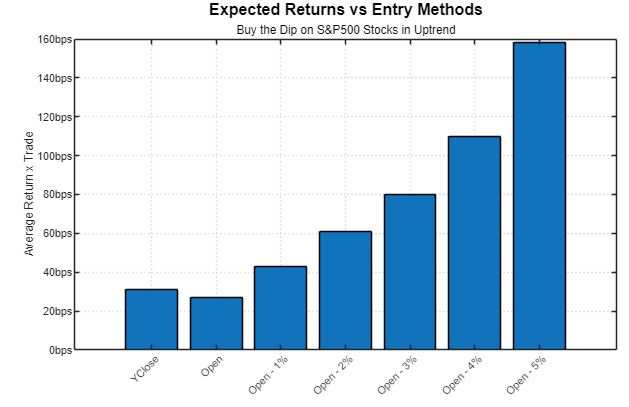

Interesting study as usual by @ConcretumR. Nothing particularly new here, but it's a concept that has stood the test of time. #Investing #InvestingPaper x.com/ConcretumR/sta…

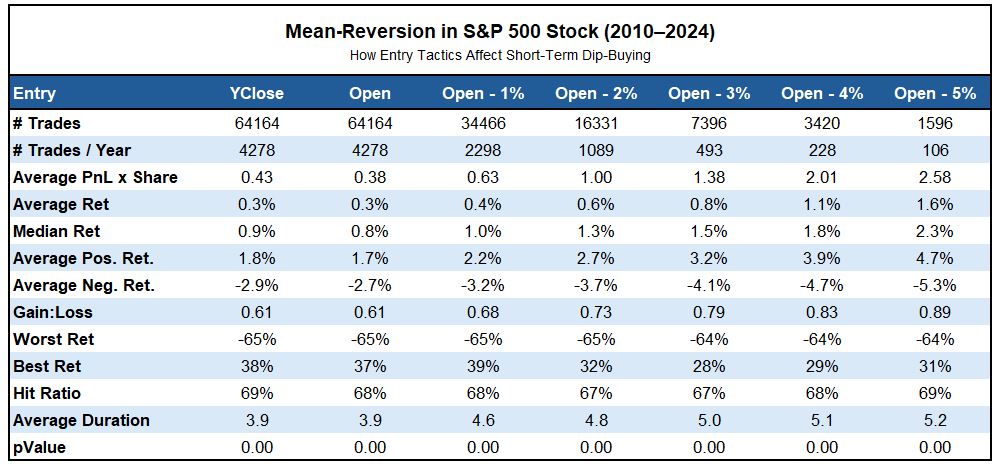

🔍 Mean-Reversion Model for US Markets 🔍 Since the late ’90s, many researchers have shown that buying short-term pullbacks in stocks that are in a medium-term uptrend can offer a small but persistent edge. The intuition is simple. A stock that has been trending higher for…

#Silver is back near ATH. This pattern is bullish although you never know with silver... x.com/PeterLBrandt/s…

More often than not charts patterns fail to deliver the implied punch -- so not sure it will happen, but the Silver chart implies a possible move to $84 $SI_F $SLV

Since 2023, we've seen 8 other times the S&P 500 was up three days in a row and up >3% (using the first signal in a cluster). One month later? Higher 7 times and up 2.1% on avg Three months later? Higher 7 times and up 7.1% on avg Six months later? Higher 7 times and up 11.2%

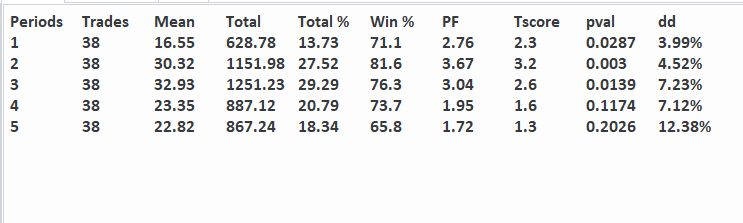

Emini S&P Futures When T-Bonds print 4 consecutive UP days, the Emini over the next 1 to 5 days since 2020 has been very bullish. For example, selling after 2 days: 38 Trades, 30.32 pts Mean, 81.6% Wins, 3.67 Profit Factor $GLD $SPX #QQQ #ZB_F #GC_F #CL_F $TLT

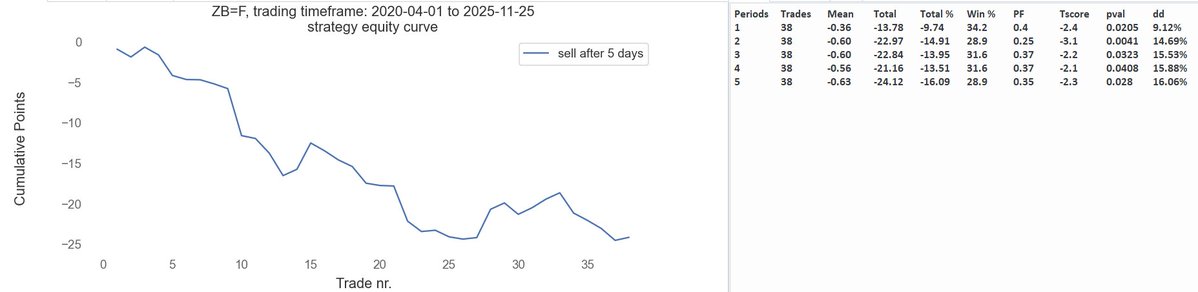

T-Bond Futures printed 4 consecutive UP days. Since 2020 it has occurred 38 times. Not bullish over the next days. After 5 days: - 0.63 pts Mean, 28.9% Wins, 0.35 Profit Factor $GLD $SPX #QQQ #ZB_F #GC_F #CL_F $TLT

When this market finally deflates, the unwind is going to be brutal. #Markets #Stocks #Investing #Finance #Macro #RiskManagement #Volatility

Hello traders! QuantAgent introduces the first multi-agent LLM framework built specifically for high-frequency trading. By combining structured signals—📈 technical indicators, 🔍 chart patterns, 📊 trend features—with specialized agents (Indicator, Pattern, Trend, Risk), it…

Hello Traders! New research maps how market trends behave from minutes to centuries. Using tick data, daily futures, 330 years of monthly prices, and even medieval financial records, we find a universal pattern: markets trend over horizons of hours to years, but mean-revert at…

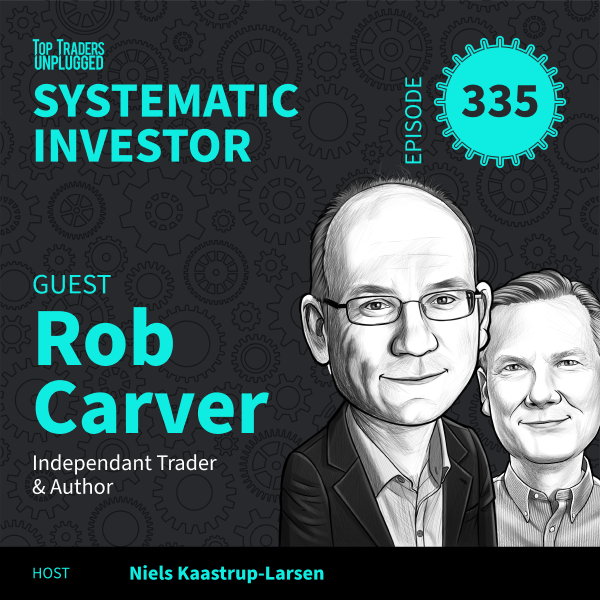

Hello Traders! Great insights from Rob Carver on Trend Following vs Mean Reversion in this episode of Top Traders Unplugged. A must-listen for anyone refining their systematic trading edge! 🎧 @investingidiocy @TopTradersLive #TrendFollowing #MeanReversion #SystematicTrading…

#GOOG is printing another ATH after the open. It is clear who, according to the markets, is the most accredited competitor in AI over the next decade. Whether it is still a good choice to buy at this level, we'll find out.

The reality is that #Bitcoin is moving like a high-risk tech stock, rather than a “store of value.” If and when this will change is not predictable. $BTC

United States トレンド

- 1. #WWERaw 13.7K posts

- 2. Kalani 8,649 posts

- 3. Stein 16.5K posts

- 4. Sidney Crosby N/A

- 5. Crumbl 1,023 posts

- 6. Abdul Carter 2,890 posts

- 7. #NEPats 1,356 posts

- 8. Penn State 10.8K posts

- 9. Admiral Bradley 18.5K posts

- 10. #Patriots 3,420 posts

- 11. Monday Night Football 3,655 posts

- 12. Ivy Nile N/A

- 13. #jeopardy N/A

- 14. REAL ID 8,605 posts

- 15. Josh Norris N/A

- 16. Hartline 4,570 posts

- 17. FEED THE STUDS N/A

- 18. Jaxson Dart 5,046 posts

- 19. Merry Christmas 59.7K posts

- 20. #NYGvsNE N/A

おすすめツイート

-

afrik

afrik

@laarrubbish -

TradeQuantiX

TradeQuantiX

@TradeQuantiX -

GammaEdge

GammaEdge

@GammaEdges -

Omar Agag

Omar Agag

@OmarAgag6 -

Ralph Sueppel

Ralph Sueppel

@macro_synergy -

Saeed

Saeed

@saeedamenfx -

....

....

@Buy__The__Dip -

Viktoriya Dimitrova

Viktoriya Dimitrova

@ViktoriyaDimit3 -

✨😇 Composite Man 👹✨

✨😇 Composite Man 👹✨

@slimbo_klice -

Rekha Musaddi

Rekha Musaddi

@RekhaMusaddi -

Steve Ellison 🐍

Steve Ellison 🐍

@SteveEllison271 -

TradingLevels

TradingLevels

@JoeyKnishPoker -

Gustav Mejlvang, CFA

Gustav Mejlvang, CFA

@GustavMejlvang -

Zach Watkins

Zach Watkins

@zachwatkinsv1 -

حنيف

حنيف

@imhanifsheikh

Something went wrong.

Something went wrong.