Ryan RasmussenPRV

@RasterlyRockPRV

Head of Research @BitwiseInvest

In 2025… Bitcoin will hit $200,000, Coinbase will enter the S&P 500, stablecoin AUM will double, and more… Here are 10 Crypto Predictions for 2025 by the team at @BitwiseInvest 🧵👇

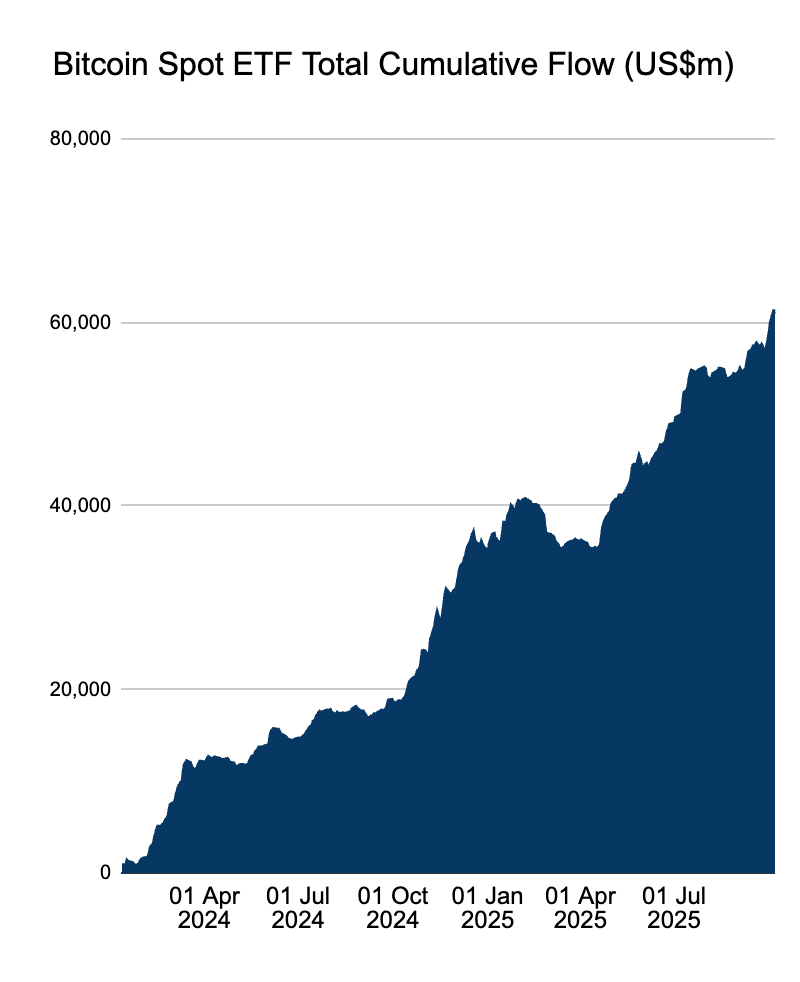

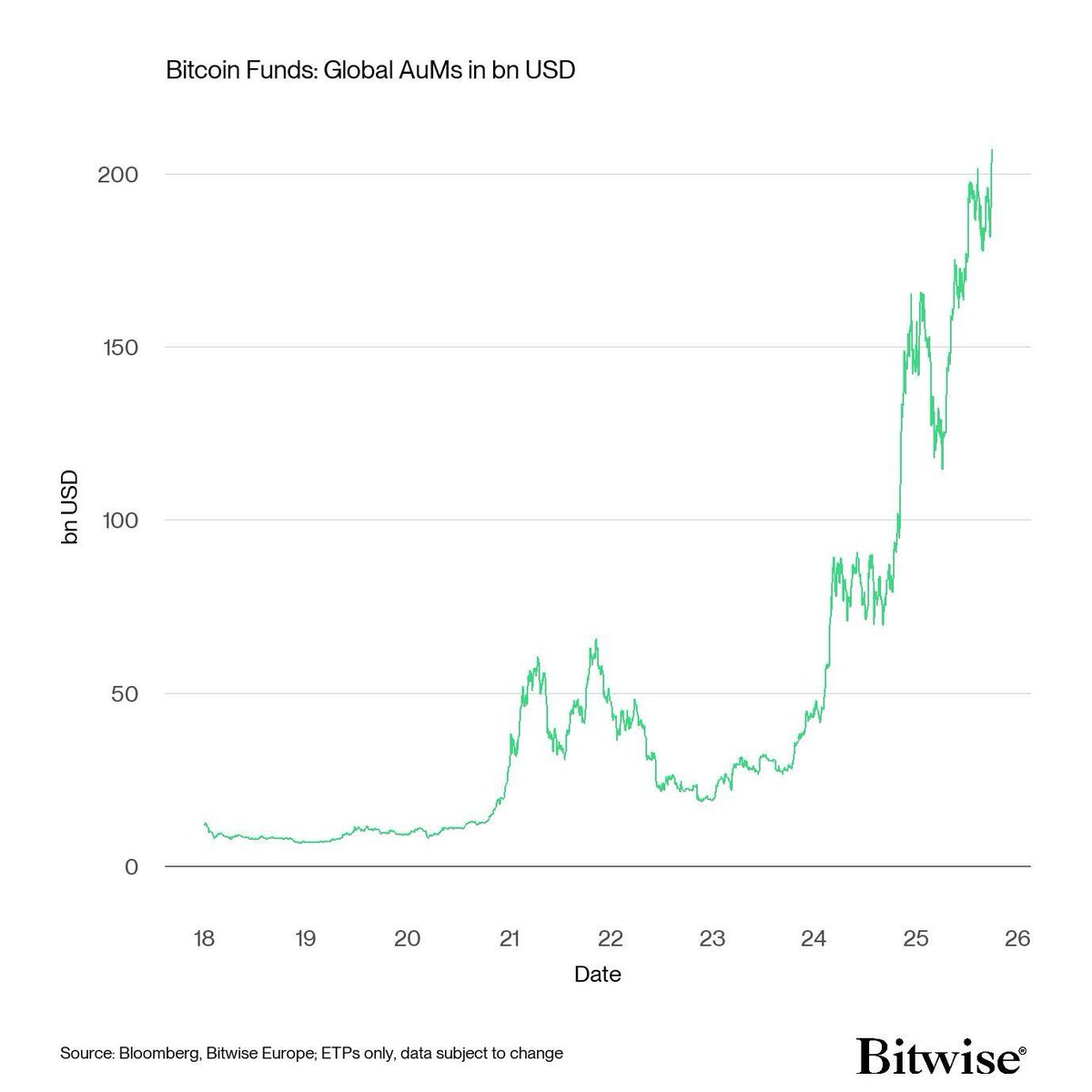

the most important chart to understand bitcoin's price movement from here bitcoin ETFs are bringing in $5-10 billion every quarter of new buying pressure into bitcoin like clockwork. absolutely no signs of slowing down this is the unstoppable secular trend that even the "4 year…

Markets on everything. We’re proud to announce that $ICE, the owner of @NYSE and the largest exchange company in the world, is making a strategic investment of $2 billion into Polymarket, valuing us at $9 billion post-money. Our partnership with ICE marks a major step in…

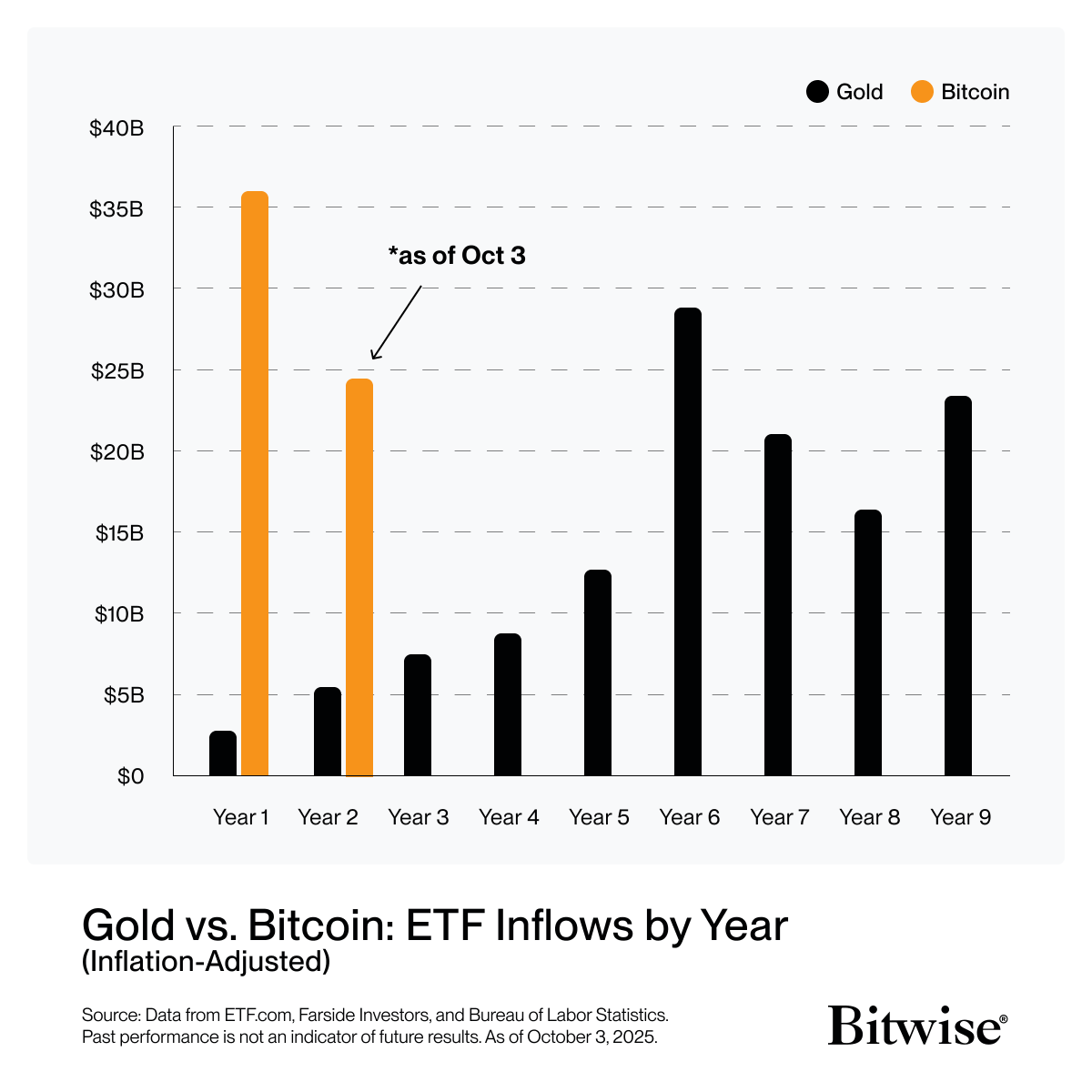

We're almost 75% through Year 2 of bitcoin ETFs. Will Year 2 flows surpass Year 1?

Solana might just be winning the GENIUS Era Solana doesn’t host the most stablecoins. And yet: it boasts the fastest-growing stablecoin supply. In the nearly 3 months since Trump signed the GENIUS Act, Solana’s stablecoins in circulation have jumped over 40%, reaching $15b.…

Bitcoin Funds globally are over $200 billion and this parabolic growth is showing no signs are slowing. Inelastic supply + insatiable demand = new ATHs

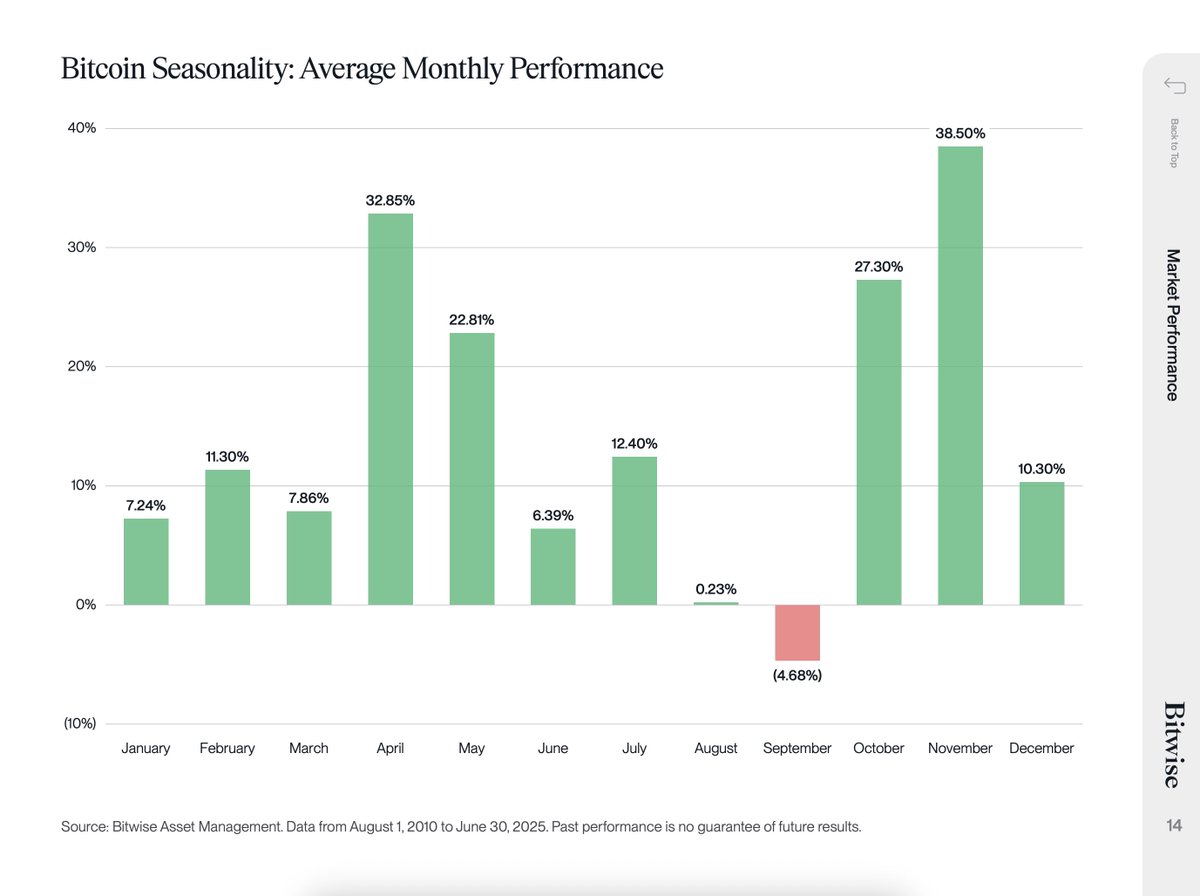

You can't spell "October" without "BTC."

Over the past 12 months, Solana holds the top spot among blockchains in both revenue and revenue growth. And it's not close. h/t @Blockworks_

A picture is worth $38T corporate bonds

Tokenization’s upside in one chart. The gray area shows the value of all corporate bonds globally ($38T). The black dot shows how much is currently onchain ($262M). Here's what that looks like.

Is this what they meant by yield-bearing stablecoins? Introducing the Bitwise CRCL Option Income Strategy ETF (ICRC), the first option income ETF for the only publicly traded pure-play stablecoin issuer, Circle. Carefully consider the investment objectives, risk factors,…

Today, we’re excited to launch $ICRC, the first ETF to apply a covered call strategy to $CRCL — the powerhouse behind one of the world’s biggest stablecoins: $USDC. Stablecoins are one of the largest and fastest-growing sectors in crypto. Circle’s USDC: - Has a $74B market cap…

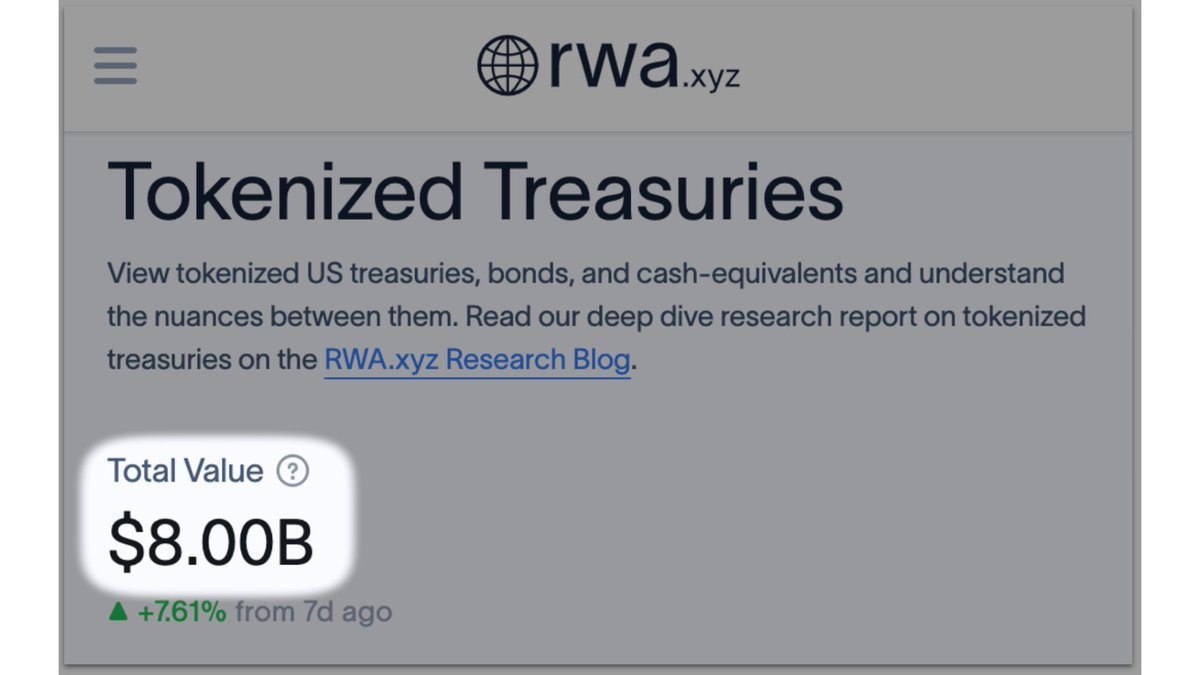

How early are we in tokenization? Today, for every $100 of U.S. Treasuries that are on a blockchain, there are $375,000 that aren’t. So, early.

Takeaway from a recent Bitwise roadshow: Clients are no longer asking what crypto is. Instead, we're diving into layer 2s and scaling, liquid staking, tokenization, stablecoins, and 401K product ideas.

gm

A friendly reminder of bitcoin seasonality

SEC staff issued a DePIN no-action letter today: sec.gov/newsroom/speec…

A leading $30B platform for wealth managers just enabled access to crypto — through Bitwise. Incredibly excited to work with Vise. 2025 is the year crypto enters the mainstream —

Vise just crossed $30B in platform assets. Now we’re teaming up with @bitwiseinvest to bring crypto to advisors—seamlessly, alongside stocks, bonds, and alts. Nearly every asset class, every opportunity—at your fingertips. Link to full announcement in the comments.

One year ago, 98% of questions from wealth managers were about bitcoin. Today, it’s 40% bitcoin, 60% stablecoins and tokenization.

Silver < Gold < Bitcoin 👇🎧

1/ 🚨 New interview just dropped: I sat down with @Matt_Hougan and @RasterlyRock to break down their new report on Bitcoin’s long-term capital market assumptions. Why this matters: 🧵

6-12 months from now, the big story in crypto is going to be credit and borrowing. It will explosively grow over the next few years. Two vectors: 1. There’s nearly $4 trillion dollars of crypto and growing: when people can borrow against this crypto, rather than sell, they…

A reminder of @BitwiseInvest's projection by end of 2025. Could be close ...

What should investors expect heading into the final stretch of 2025? Join Bitwise CEO Hunter Horsley and Head of Research Ryan Rasmussen for an exclusive webinar as they share timely insights on the key themes shaping the market. A unique opportunity to hear from two leaders…

United States Тренды

- 1. Auburn 44.2K posts

- 2. Brewers 62.3K posts

- 3. Georgia 67.3K posts

- 4. Cubs 54.8K posts

- 5. Kirby 23.4K posts

- 6. Arizona 41.8K posts

- 7. Michigan 62.6K posts

- 8. Hugh Freeze 3,154 posts

- 9. Gilligan 5,632 posts

- 10. #BYUFOOTBALL N/A

- 11. Utah 24K posts

- 12. #GoDawgs 5,511 posts

- 13. Amy Poehler 3,953 posts

- 14. Boots 50.5K posts

- 15. Kyle Tucker 3,123 posts

- 16. #ThisIsMyCrew 3,208 posts

- 17. #Toonami 2,133 posts

- 18. #AcexRedbull 2,804 posts

- 19. Tina Fey 2,991 posts

- 20. Jackson Arnold 2,182 posts

Something went wrong.

Something went wrong.