Rob

@Rob_FSB

“I can boil an egg - I’ve seen it done.”

You might like

The plan? We’ll start a sparkling wine business out of Champaign, IL

I worry that many large endowment and pension fund managers won't get the joke.

Tucker Interviews Saruman To Talk About Rohan’s Warmongering buff.ly/F5i7d1a

Excellent summary by former head of MI6, Sir Alex Younger, of this new era in geopolitics…adapt or die

One way to get into the marriage market (H/T Eduard Koller). facebook.com/eduardk/posts/…

This video covering the 1990s boom is instructive. Not least crowding around one stock, Iomega, by retail. Plus the go-go managers of the day. Worth watching for an insight into market cycles IMO. Includes Cramer. Betting on the Market (1997): youtube.com/watch?v=JlrO1O…

youtube.com

YouTube

Trading Documentary Vintage Betting on the Markets 1997 Lessons for...

It’s an old observation that we have Anglo-Saxon words for livestock (cow, sheep) and Latin/French-derived words for the higher-status business of eating them (beef, mutton). Same thing shows up in finance: retail trades stocks and bonds, institutions do equities or credit.

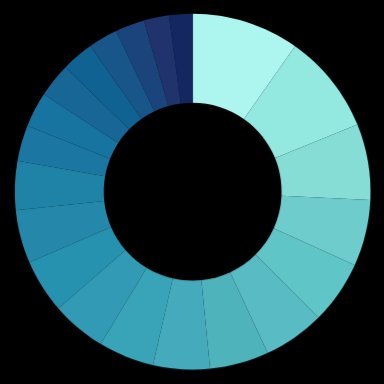

📢 NEW PAPER OUT! 🚀 We analyze 1,056 #ML models to uncover how key design choices—algorithm, target, feature, & training—affect strategy returns. Key takeaways: 📈 Returns vary widely; see graph below! 🔍 NSE exceed SE by 59% 💡Check out which ML design choices really work 👇

John Betjeman with an ode to Sunday. Looking at how Londoners spent the traditional day of rest in 1972.

"After year one, you go back to client who likes you, who chose you and you're saying, this is what happened, this is why we like it going forward. They're usually okay with that. You go back after year two, they're like that's what you said last year. And you go, yeah, it…

"God save the King" by the choir of the French Army under the Arc de Triomphe Goosebumps, chair de poule 🇨🇵🇬🇧

Congratulations, President @realDonaldTrump. Ready to work together as we did for four years. With your convictions and mine. With respect and ambition. For more peace and prosperity.

Reading Aaron Brown

New blog post on the "iterated exponentially weighted moving average" model (IEWMA) for covariance matrix forecasting -> portfoliooptimizer.io/blog/covarianc… This model, introduced by Johansson et al.[^1] bridges the gap between the simple EWMA model and the more complex DCC-GARCH model.

Cartea (papers.ssrn.com/sol3/papers.cf…) says market impact of order size V is ~V^2. Bouchaud (arxiv.org/abs/1602.03043) says it is ~sqrt(V). Quant hive mind: am I missing something? CC: @stefanoperon @choffstein

The 2024 release of the Open Source Asset Pricing dataset is up!! openassetpricing.com @TomZ_Econ+I closed 13 Github issues (github.com/OpenSourceAP/C…). Our t-stats still match the original papers nicely. I love the transparency of Github. Wish all research was done on it.

Classic example of lying with statistics. The reason this chart looks this way is that these are overlapping monthly observations. I won't go into too much statistics/econometrics, but it suffices to say that there is indeed a negative relationship but the relationship is not…

From today’s WSJ. If you don’t understand this chart, don’t have money in stocks. If you do understand this chart, why do you have money in stocks?

United States Trends

- 1. Epstein 883K posts

- 2. Steam Machine 46.6K posts

- 3. Virginia Giuffre 51.5K posts

- 4. Bradley Beal 4,547 posts

- 5. Valve 32K posts

- 6. Jake Paul 3,586 posts

- 7. Boebert 37.6K posts

- 8. Xbox 63.7K posts

- 9. Rep. Adelita Grijalva 18.8K posts

- 10. Clinton 106K posts

- 11. Anthony Joshua 2,681 posts

- 12. Dana Williamson 5,589 posts

- 13. GabeCube 3,262 posts

- 14. Scott Boras 1,098 posts

- 15. #dispatch 55.3K posts

- 16. Dirty Donald 18.2K posts

- 17. H-1B 105K posts

- 18. Michigan State 9,805 posts

- 19. Clippers 8,590 posts

- 20. Jameis 10.6K posts

You might like

-

Rosy Dawson

Rosy Dawson

@rosydawsonbooks -

Josep M. Pep Vilalta

Josep M. Pep Vilalta

@JosepMVilalta -

Trapped in Zone One

Trapped in Zone One

@TrappedZoneOne -

Lena Surzhko Harned, PhD 🇺🇸🇺🇦

Lena Surzhko Harned, PhD 🇺🇸🇺🇦

@lenasurzhko -

Varun Gangal

Varun Gangal

@VarunGangal -

Nick Heathcote

Nick Heathcote

@nickheathcote -

Nicola Robbins🏴 💙🕊️💛

Nicola Robbins🏴 💙🕊️💛

@40robbin -

Marina Robb

Marina Robb

@MarinaRobb -

KM Education Hub

KM Education Hub

@KMeducation -

Abel Moses

Abel Moses

@dayotunde25 -

meena karnik

meena karnik

@meenakarnik -

Tim Keller

Tim Keller

@timkeller -

██████████

██████████

@Bilo78836363737 -

Joey

Joey

@jcogs77

Something went wrong.

Something went wrong.