Rupert Capital

@RupertCapital

Long uranium and bitcoin miners into 2024

You might like

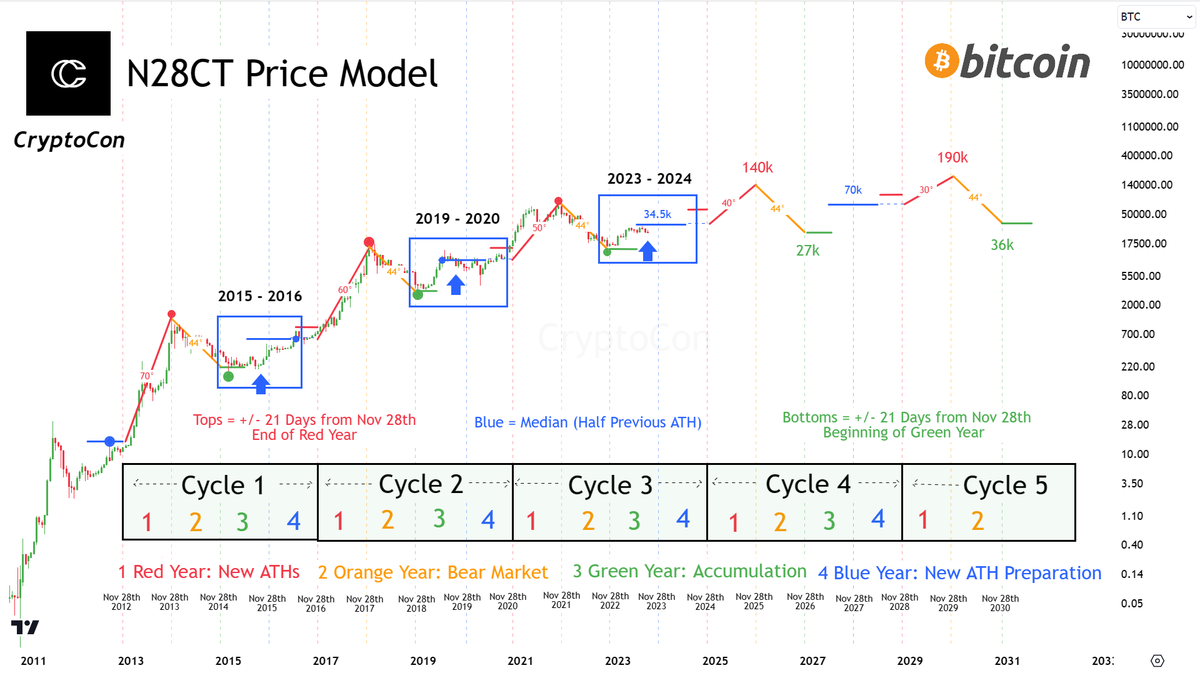

The N28CT Price model gave you the #Bitcoin bottom at 15.5k in Nov 22, coming +/- 21 days from Nov 28th then. It gave and continues to give you the best cycle buying prices during accumulation year. It gave you a move to the median ($34,500 blue line) in green year. Now…

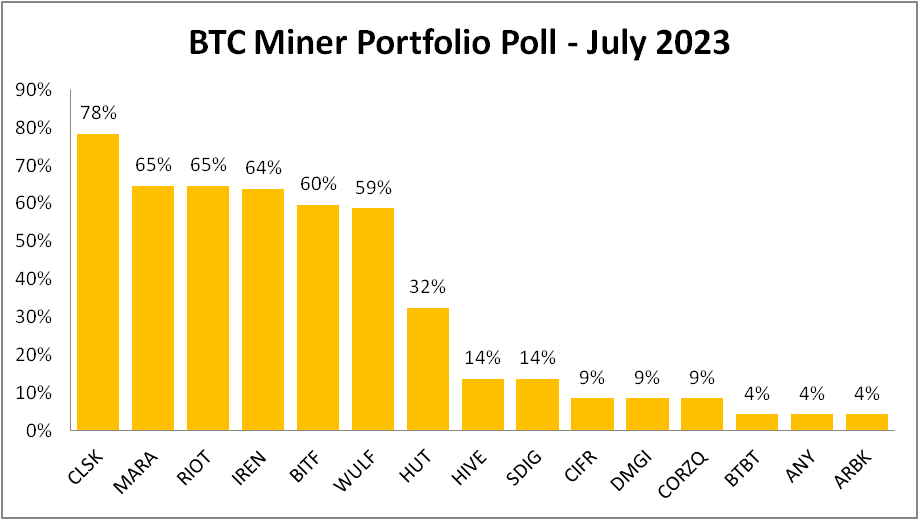

The results are out out from my recent poll on which 5 #BTC mining stock you would currently hold in your portfolio. Amazingly 583 of you took the time to respond 🙏 $CLSK came out as the most popular miner choice and was effectively included in 78% of all responses. $MARA and…

🧵2/7 We are are a mission-driven team of the best minds in tokenomics, supporting protocols that view censorship-resistance as a core function.

Something magic happened in July 2020. Since then, you can predict the future. With 95% accuracy. It's worked perfectly for over 2 years. The 1% who know have made billions betting on it. But nobody else is paying attention. Here's how you can use this too 👇

I used to think Solana was doomed. I have changed my opinion. Here's why:

I grew Mint from 0-1M users in 6 months Here's the 7 step quant-based growth marketing framework I used that you can steal

2021 was good to crypto. Next year things will look different b/c of changes in macro environment & tech adoption cycle. Here are top 3 crypto investment themes I’m bullish 📈 & bearish 📉 about for 2022 👇

How to buy $BTC at the global bottoms: 1. $BTC drops hard over -30% 2. All Exchange Inflow Mean (MA7) spikes over 2.5 BTC 3. The indicator cools down 4. ALL-IN $BTC 5. Become a billionaire and give a tip to @cryptoquant_com Chart 👉 cryptoquant.com/overview/full/…

With Jeff Bezos stepping down as CEO, here’s a thread of the best things I’ve learned from him. 1. Be willing to change your mind. As Bezos famously said: "Anybody who doesn’t change their mind a lot is dramatically underestimating the complexity of the world we live in.”

1/ Why Bitcoin may be going through a "Supercycle" This time is different: COVID, Gold 2.0 narrative, institutional herd, and ease of use have set a new stage. Instead of a normal bull/bear cycle, Bitcoin would break convention and enter a “Supercycle” Thread 👇

Brokerage cash falls to record lows as retail investors go all in on stocks bloomberg.com/news/articles/…

"Things I Learned After 15 Years of Trading" theimpatienttrader.blogspot.com/2011/10/things… This blog post from 7 years ago was by far one of the most popular posts I've ever written... I read it again this morning and most of the things in it are as relevant now, more than ever!

United States Trends

- 1. Fanone N/A

- 2. harry styles N/A

- 3. Jack Smith N/A

- 4. #BTS_WORLDTOUR N/A

- 5. #Aperture N/A

- 6. Fable N/A

- 7. Minter N/A

- 8. WE BELONG TOGETHER N/A

- 9. Sinners N/A

- 10. Maki N/A

- 11. #YIAYhouse N/A

- 12. #RavensFlock N/A

- 13. He-Man N/A

- 14. #BTS_ARIRANG N/A

- 15. Ivan N/A

- 16. Massie N/A

- 17. Hanoi Jane N/A

- 18. JUNGKOOKS N/A

- 19. Trinity Rodman N/A

- 20. Walter Martínez N/A

Something went wrong.

Something went wrong.