You might like

Cost of first home in London is now 10x average salary. Low mortgage rates help but what when interest rates rise?

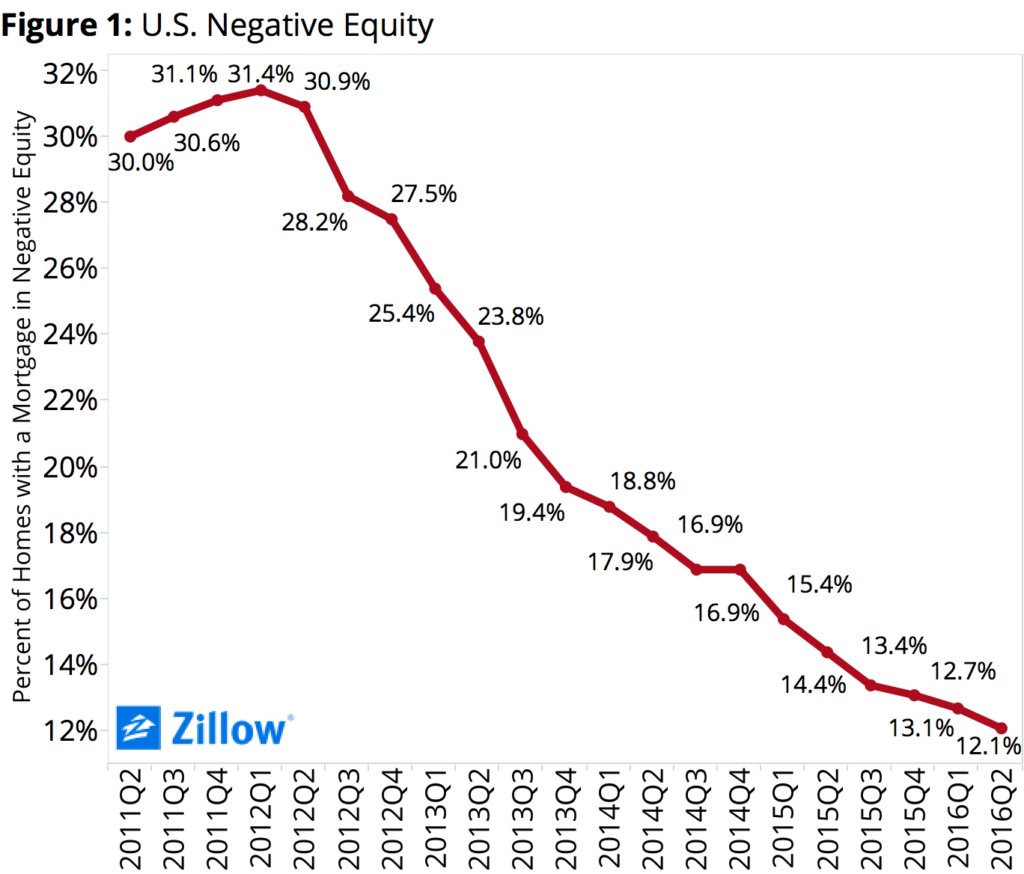

Four years ago, 28.2% of U.S. homeowners with a mortgage were underwater. Now: 12.1% zillow.com/research/q2-20…

The biggest ever fire sale of Indian corporate assets has begun to pay off big loans (via @TheHindu): m.thehindu.com/business/Indus…

"Students have been sold a bill of goods," says @GovGaryJohnson on why gov't shouldn't be involved in student loans. snpy.tv/2bj4egC

there is enough room for everyone to flourish in love, in finance, in growth; in all areas where we ask for abundance and blessings. facts.

Planning a big project? Here is what you need to know about home improvement loans: zlw.re/6012B2yds

Hillary Clinton just met with Paul McCartney at Quicken Loans Arena in Cleveland, per pooler @vaughnFNC. He has a concert there tonight.

54% of all income tax is used to finance wars- @DrJillStein #GreenTownHall

A warning about syndicated mortgage investments. Don't be naive about the high yields.

U.S. mortgage demand to buy homes hits six-month low: MBA reut.rs/2brG6ZU

U.S. mortgage demand to buy homes hits six-month low: MBA reut.rs/2biG7ig

Orrin Hatch, chair of Senate Finance, which sets tax policy, sponsored golf tournament last week. Big biz sponsors: utahfamiliesgolf.org/sponsors/

MBA Weekly Mortgage Applications Survey: average interest rate for 30-year fixed-rate #mortgage decreases to 3.64% - bit.ly/2aZsQ36

Egypt's poor suffer but Sisi buys 4 fancy presidential planes for his vanity fleet at €300M. bit.ly/2aXIuMA

Could high unemployment be caused by workers simply being in the wrong place? #econarchive econ.st/2b1EaYp

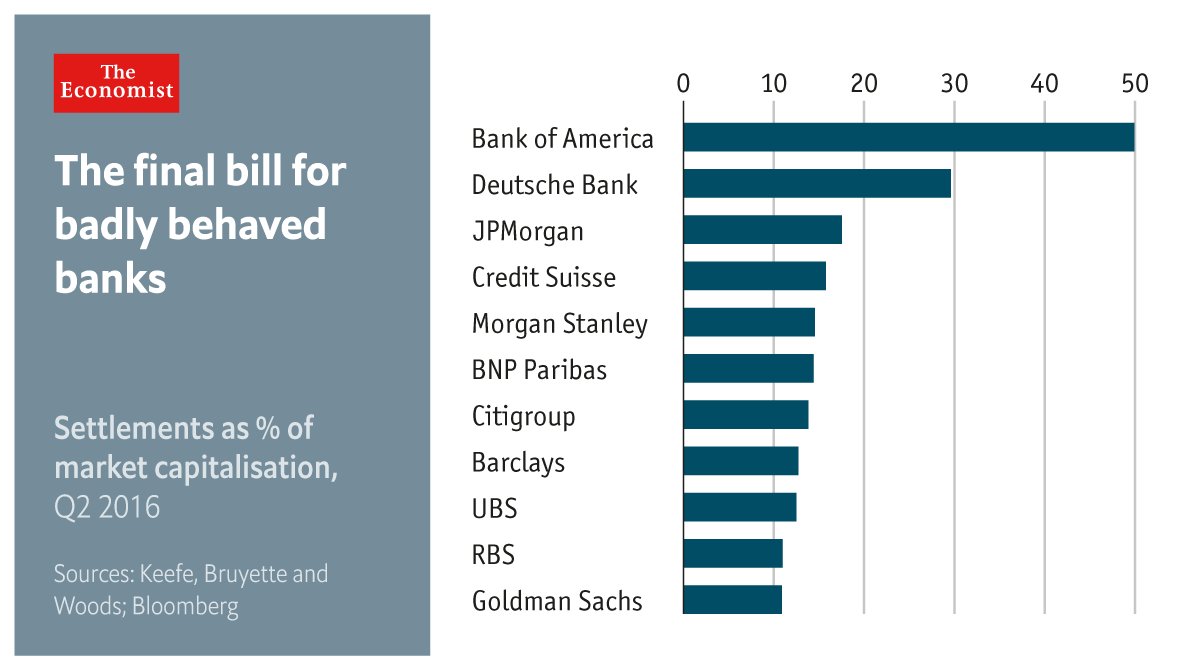

Federal prosecutions of American financial firms were almost non-existent before 2008 econ.st/2aVOxBl

It has gotten so tough in the oil patch that people have stopped paying their mortgages read.bi/2aY9VQy

Forcing lenders to have ‘skin in the game’ won’t work in Canada’s mortgage market trib.al/mtKzBtx @GlobeBusiness

theglobeandmail.com

Opinion: Canadians are right to fear housing froth, but we can’t skin the mortgage lenders

The federal government is considering the idea of an insurance deductible for mortgage lenders whose insured loans go bad, but this can have ‘far-reaching impacts’

19-I was Chairman House Committee on Finance 7th Assembly and Chairman House Committee Appropriation 8th Assembly until i resigned

United States Trends

- 1. #SmackDown 21.4K posts

- 2. Jordan Poole N/A

- 3. Melo 11.5K posts

- 4. Sixers 4,449 posts

- 5. Embiid 3,987 posts

- 6. Maxey 2,421 posts

- 7. Minnesota 469K posts

- 8. Mark Williams N/A

- 9. Jalen Smith 1,295 posts

- 10. UTSA 2,310 posts

- 11. Jalen Duren N/A

- 12. Utah 37.6K posts

- 13. Nick Nurse N/A

- 14. Crosby 13.8K posts

- 15. Kwanzaa 49.5K posts

- 16. FDNY 11.5K posts

- 17. Ilja 3,336 posts

- 18. Paolo 8,464 posts

- 19. Jaylen Brown 3,353 posts

- 20. Drew McIntyre 2,869 posts

Something went wrong.

Something went wrong.