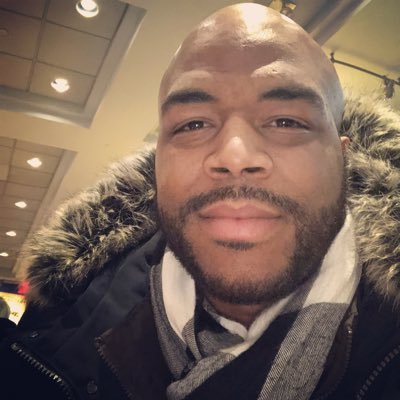

Sean Farrell

@SeanFFarrell

digital assets @fundstrat/ @fs_insight

You might like

Crypto is "Boring" because it's Maturing, and the painful transition is just beginning. Who is staying and who is moving on... CT is down because the easy money is gone. When they say crypto is "boring," they mean it’s becoming serious. The era of easy scams, TGEs with no…

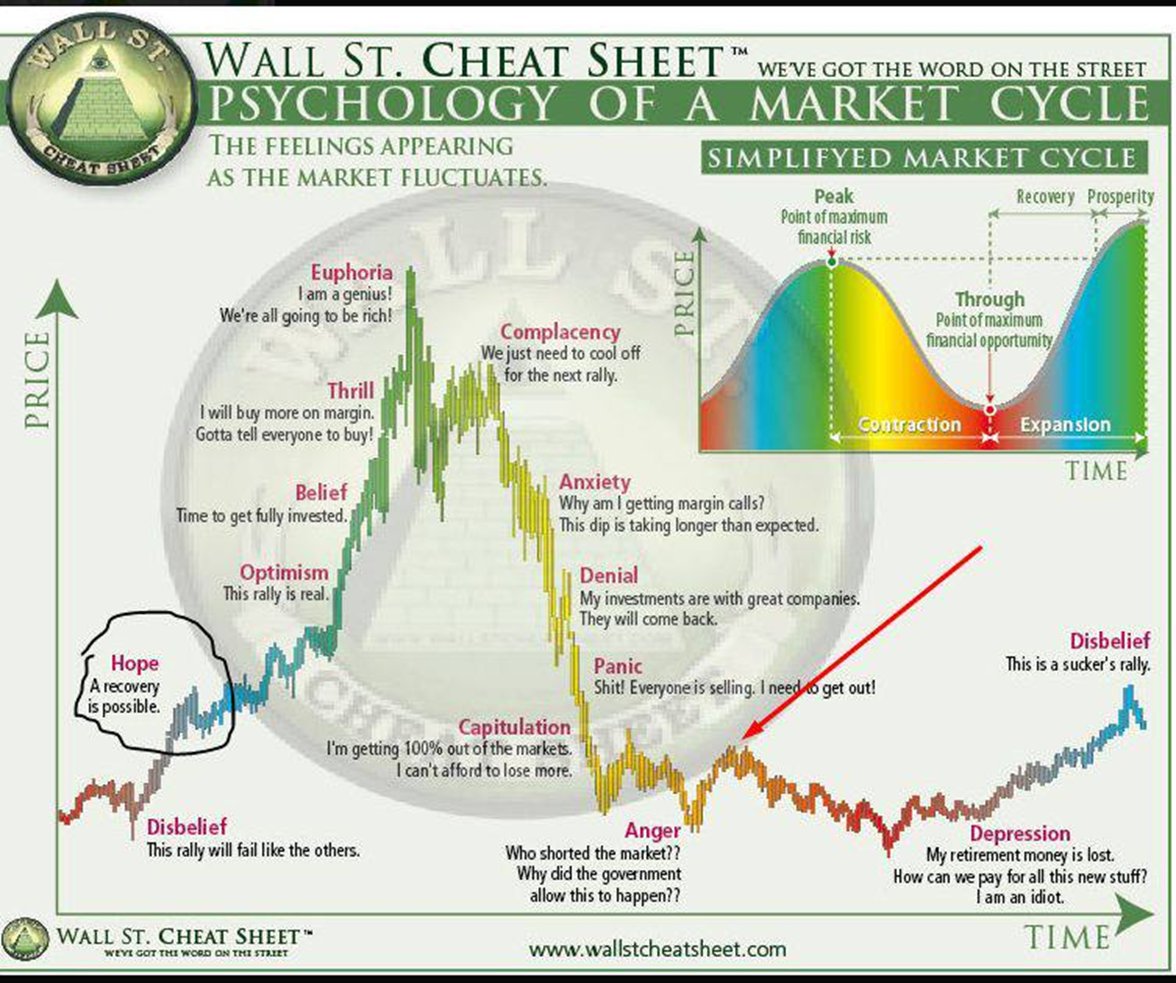

1/ Crypto markets may be entering the anger stage of the market cycle, judging by reactions to the post below. But let me explain why this is a misunderstanding of the @fundstrat process, and why you should get the first word x.com/WuBlockchain/s…

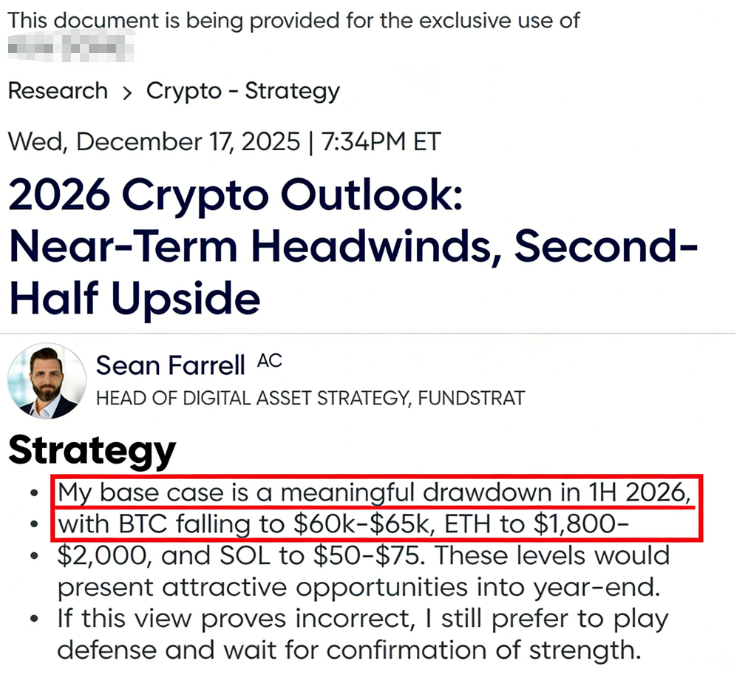

According to @_FORAB, Tom Lee's fund, Fundstrat, stated in its latest 2026 cryptocurrency strategy advice to internal clients that a significant correction is expected in the first half of the year, completely contradicting Tom Lee's public statements. The internal report sets…

10/n For those who tuned into the outlook: I still expect BTC and ETH to challenge new ATHs by year-end, effectively ending the traditional four-year cycle with a shorter, shallower bear.

11/11 @fundstrat has been one of the most consistently right voices in crypto and equities over the past decade and has done more to democratize research and investing than most realize. A subscription helps keep you informed, and avoid some of the confusion currently making the…

Plz tune in

What’s next for crypto in 2026? Join us tomorrow, December 17 at 2pm ET for a live presentation of @SeanMFarrell’s 2026 Crypto Outlook. As crypto enters a pivotal phase, Fundstrat will break down the key forces driving the next major move and where investors could find an edge.…

We don't have to call it QE, but $40B is $40B

Product idea - an @eightsleep that doesn't start leaking every 12-18 months. Who is building this?

A couple of important follow-up points made later in my video from Monday: - MSTR already has ~21 months of dividend coverage, so this is not a near-term risk - MSTR rallied ~10% intraday on heavy volume, a decent sign of capitulation

Fundstrat’s Sean Farrell says the company will consider selling Bitcoin if MicroStrategy $MSTR falls below 1x NAV - First time they’ve publicly acknowledged this - Contradicts Saylor’s “never sell” stance - Signals willingness to liquidate BTC as collateral if needed

Ngl, I didn't think this day would actually come. Happy it did. This is great for tokenholders, great for the space, great for programmable capital markets

Today, I’m incredibly excited to make my first proposal to Uniswap governance on behalf of @Uniswap alongside @devinawalsh and @nkennethk This proposal turns on protocol fees and aligns incentives across the Uniswap ecosystem Uniswap has been my passion and singular focus for…

Man it was a good day to be in absolute garbage

also funny how many of these dots are super close to that -100% ytd return limit

Some encouraging signs on the shutdown front. Election day could prove to be a turning point in congressional posturing

CoinShares miner ETF now up ~4x vs BTC over the past 6 months

$IREN is pleased to announce the signing of a $9.7bn AI Cloud contract with @Microsoft Key details of the transaction: - $9.7bn AI Cloud contract value - 5-year average term - 20% prepayment - 200MW (IT load) data centers - NVIDIA GB300 GPU deployments Refer to the press…

The bearish view: OGs continue to hammer price The bullish view: for every seller, there is a buyer, and there has been ample demand to take these coins off OG hands >$100k

Bitcoin OGs are dumping $BTC! BitcoinOG(1011short) has deposited ~13K $BTC($1.48B) to Kraken, Binance, Coinbase, and Hyperliquid since Oct 1. Owen Gunden has deposited 3,265 $BTC($364.5M) to Kraken since Oct 21. intel.arkm.com/explorer/entit… intel.arkm.com/explorer/addre…

Again, while not correlated, BTC is still compared to gold. When gold rises, BTC's ceiling is raised. A return to an ATH BTC/Gold Ratio would imply prices for BTC north of $160k

In my view, the main risk to markets lies in the ongoing U.S.–China trade negotiations. Steep tariffs could trigger a growth scare by raising costs and discouraging hiring and investment, which would weigh on risk assets. That said, both sides have strong political and economic…

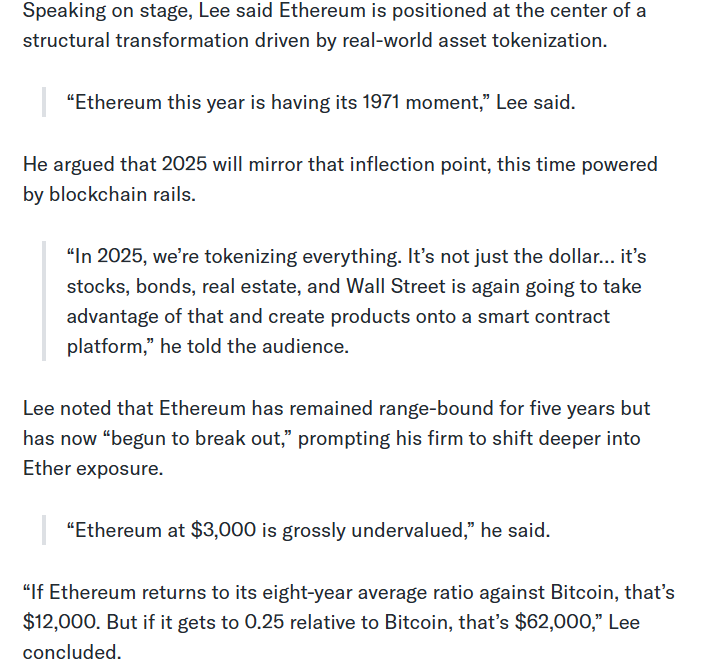

“BuT MuH fOuR yEaR CyCle.” Yes, cycles matter, but there’s nothing in Bitcoin’s code that dictates peaks must occur every four years. The marginal buyer of crypto is no longer CT, and the cycles that actually matter are the liquidity and business cycles. If this one happens to…

Some thoughts on the setup for crypto into year-end tldr: if you woke up from a coma with no knowledge of the past few years, you’d probably be twapping into crypto (and crypto equities) here

This “debasement trade” is one reason gold has performed so well, with the other being CB reserve diversification. While gold and BTC are not meaningfully correlated, they have exhibited a consistent lead-lag relationship since the start of this bull market, and that relationship…

This policy mix: looser monetary conditions, persistent inflation, and resilient nominal growth creates an environment that supports liquidity-sensitive, dollar-debasement hedges like BTC

United States Trends

- 1. #TheMaskedSinger N/A

- 2. #AEWDynamite N/A

- 3. Speedway N/A

- 4. Brody King N/A

- 5. Fredo N/A

- 6. Iceland N/A

- 7. #ChicagoMed N/A

- 8. TACO N/A

- 9. Cuomo N/A

- 10. Al Harris N/A

- 11. Al Gore N/A

- 12. Gavin N/A

- 13. Art of the Deal N/A

- 14. Charles Lee N/A

- 15. Hangman N/A

- 16. Newscum N/A

- 17. Rutte N/A

- 18. Switzerland N/A

- 19. Ted Lieu N/A

- 20. Andrej Stojakovic N/A

You might like

Something went wrong.

Something went wrong.