Seth Golden

@SeithCL

I specialize in VIX,Retail,Consumer Goods.Hedge fund consultant, chief market strategist Finom Group

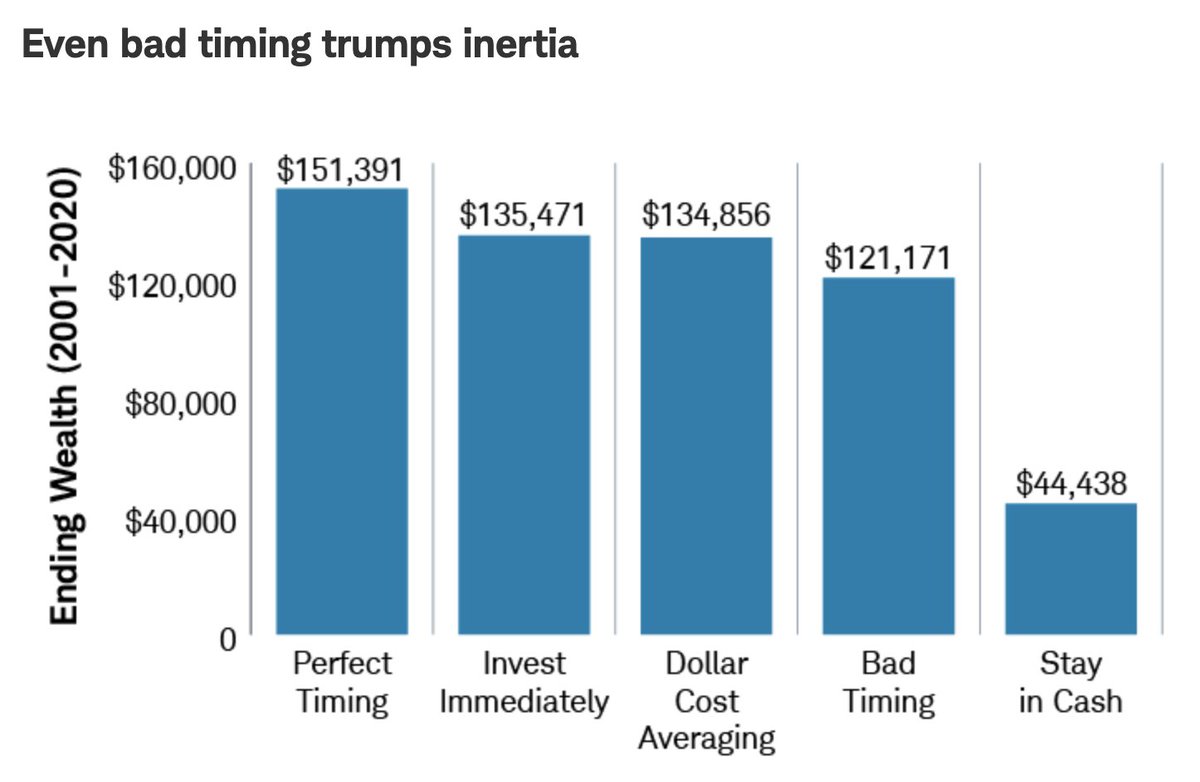

The lure of outperforming $SPX w/mkt timing often sign of ignorance or a "non-investor" altogether, putting on shows of analyzing mkt conditions, while maintaining a perma-cash pile. Even the best mkt timer has minimally better performance than Buy Any Time/DCA/Bad Timer $SPY

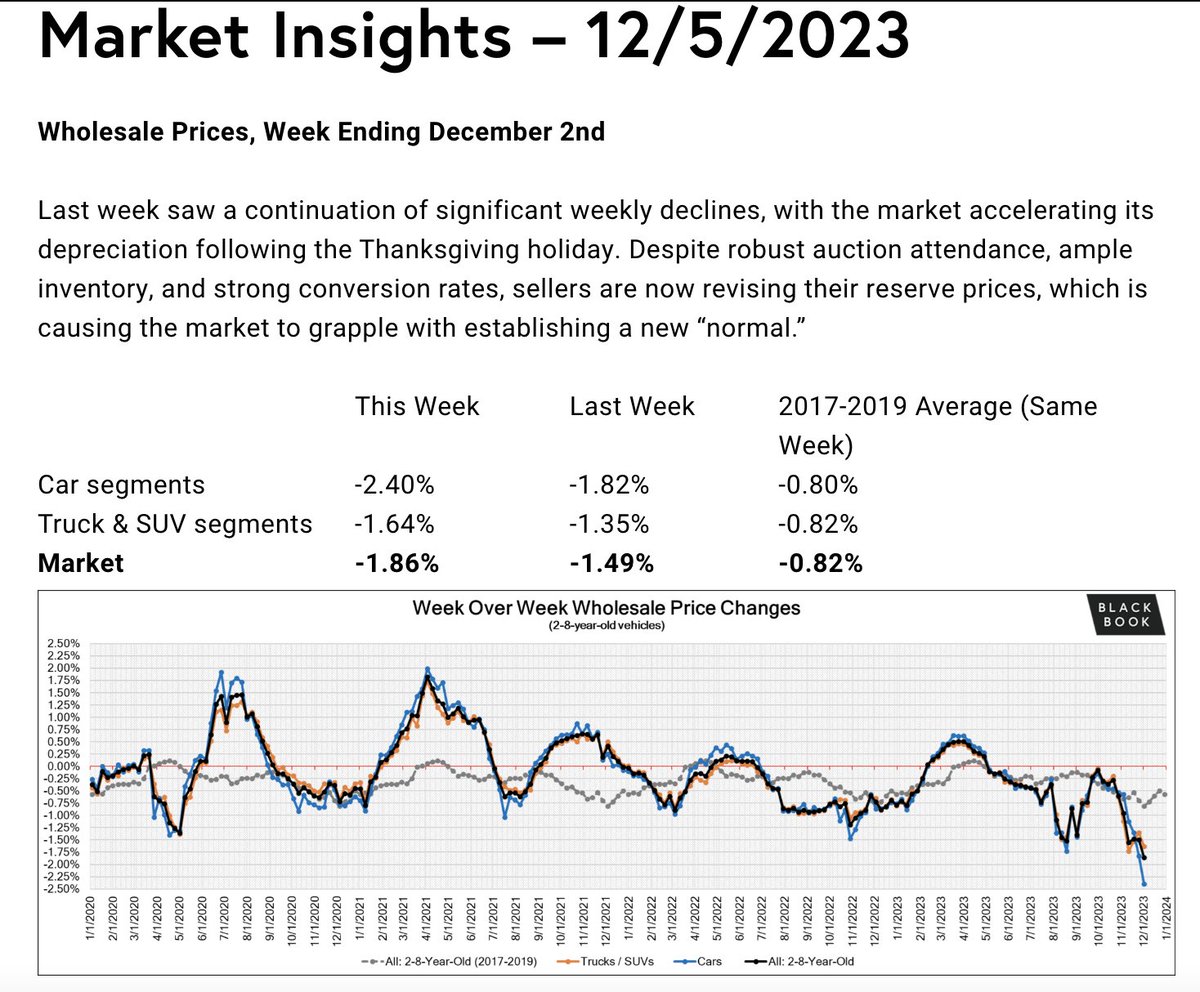

Deflation: Continuation of sharp weekly declines with market accelerating its depreciation following Thanksgiving. All nine Car segments decreased last week, with four of those segments reporting declines greater than 2%. #CPI #Fed

So far, a perfect bounce off of 50-DMA support... so far! $NDX $SPX $QQQ

Have mercy babe, I hope you don't mind, let me clear my throat (hot dam_!) $RTY $IWM

$RTY $IWM premarket outside reversal may complete the seasonal catch-up trade imo. I would be looking for intra-day confirmation, and if achieved, resumption of Growth leadership.

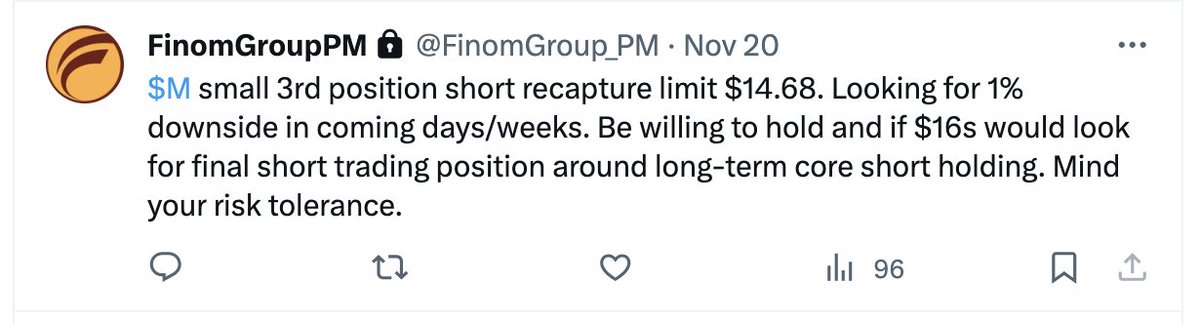

Story has not changed... Short $M $17.05 covered $16.73. You can trade/invest with us at finomgroup.com $TGT $KSS $SPX $QQQ $SPY $NDX $VIX $MA

Gonna run this into bankruptcy! Short $M $14.68 covered $14.50. You can trade/invest with us at finomgroup.com $TGT $KSS $SPX $QQQ $SPY $NDX $VIX $MA

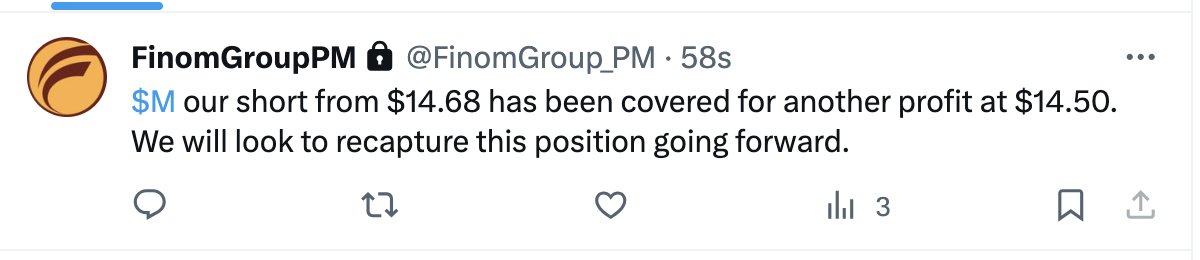

Last week, the Equal-weight S&P 500 saw the most weekly inflows in 10 years! $SPX $SPY $QQ $RSP $DIA $NYA

Just a heads-up, hearing from CSI's CEO that their Gatorade volumes are now down 20% on the quarter and not seeing any deceleration from Prime share grab. $PEP foodnavigator-usa.com/Article/2023/1…

foodnavigator-usa.com

PepsiCo raises 2023 full-year earnings outlook on Q3 performance, Gatorade loses market share to...

PepsiCo released its 2023 third quarter fiscal year report and beat Wall Street estimates, citing increased demand for smaller-sized snacks and healthier options, as the company faces challenges from...

Uncertainty about macro-market outlook is no better depicted than in rate sensitive, cyclically nuanced Small-Caps Usually, the bounce and surge above 200-WMA is a CERTAIN sign of future macro-market strength. Only thing clear hear is long-term support, muddled outlook $IWM $RTY

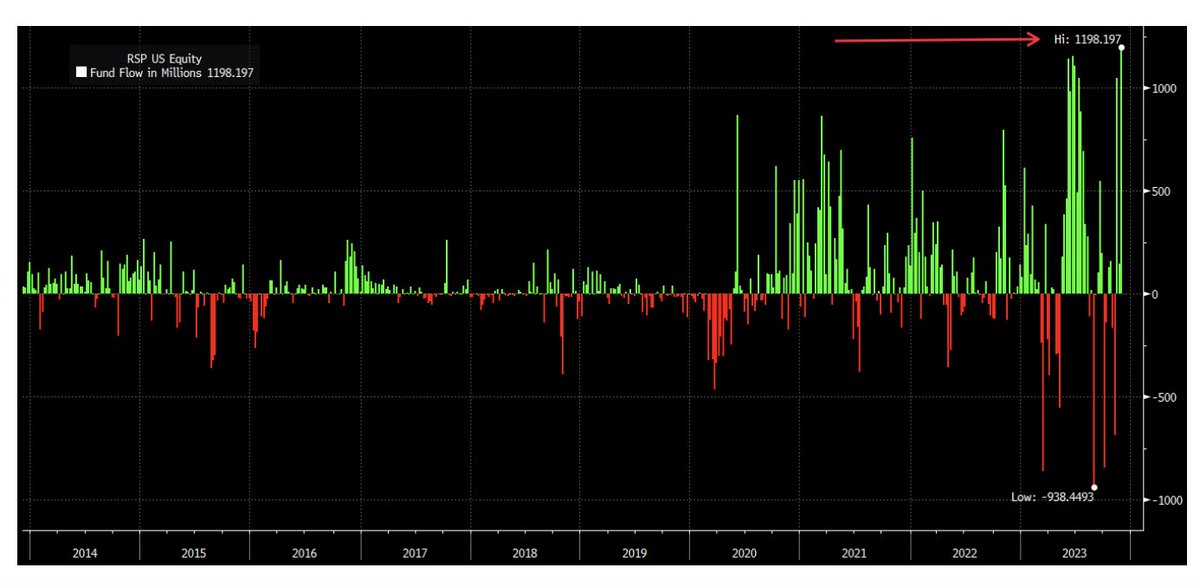

J.P.M Kolanovic 2024 Outlook "..large-cap to form short-term distribution... or for signs that laggards starting to break out. The latter is risk scenario for our base case outlook..having to rethink 2024 trajectory" Um, laggards (small-caps) just broke out? $SPX $SPY $QQQ $IWM

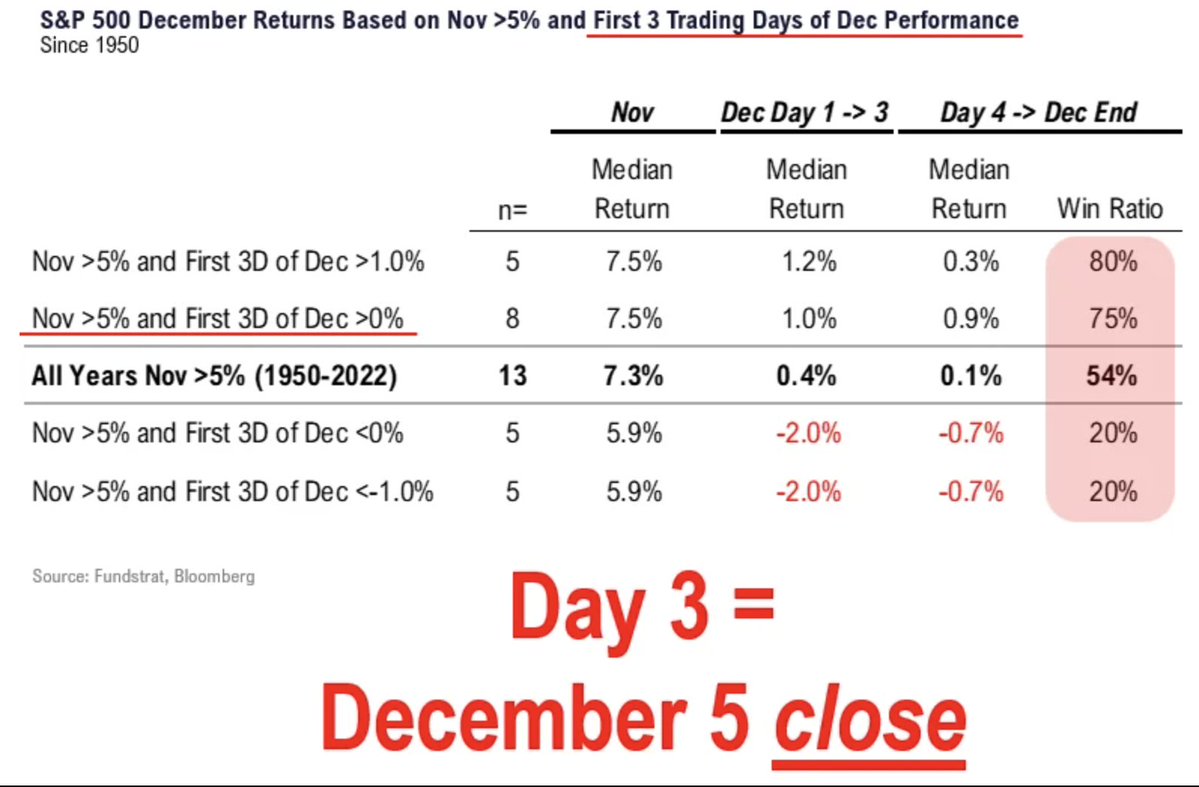

Fundstrat Tom Lee "We are dip buyers over next 9 days if there is weakness... we are in zone of uncertainty” If $SPX up 1st 3 days after a >5% Nov, Equities rise into YE 75% of time If down 1st 3 days after a >5% Nov, Equities rise into YE 20% of time $SPY $QQQ $DIA @fundstrat

J.P. Morgan's chief global equity strategist Dubravko is highly bearish on 2024... 📢 ...just sayin'... Nobody's perfect! $SPX $QQQ $SPY #SPX500

Hanging out in Denver next couple of days! Gorgeous! Brought the warm weather with me from Florida, upper 60s!

$RTY $IWM premarket outside reversal may complete the seasonal catch-up trade imo. I would be looking for intra-day confirmation, and if achieved, resumption of Growth leadership.

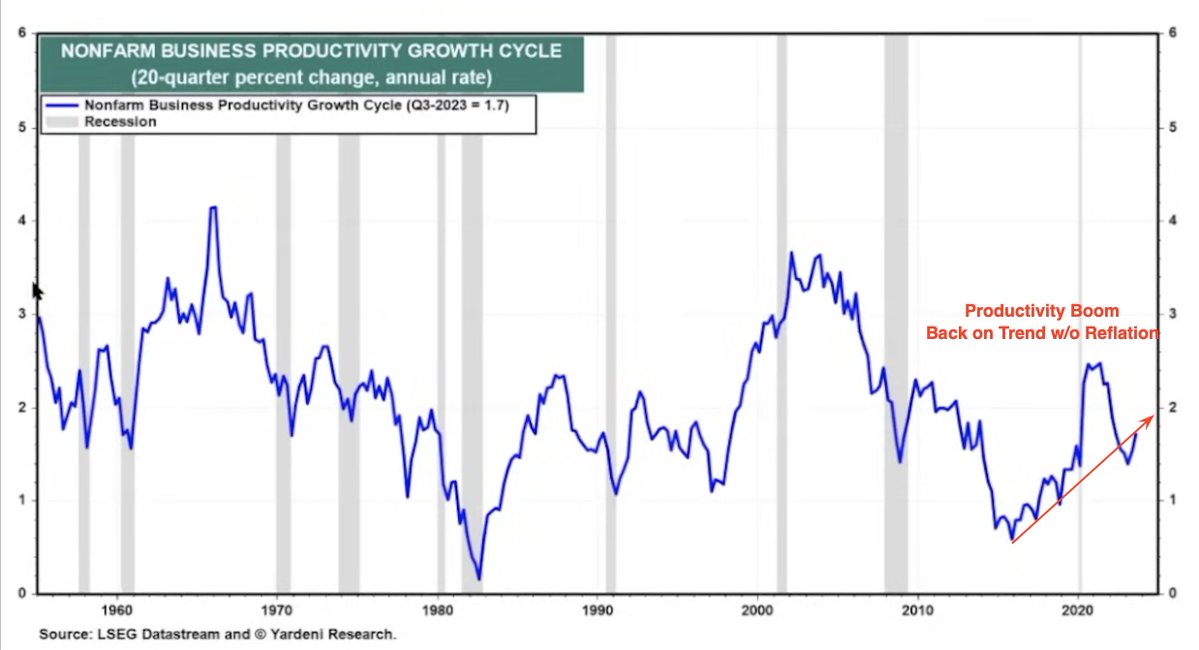

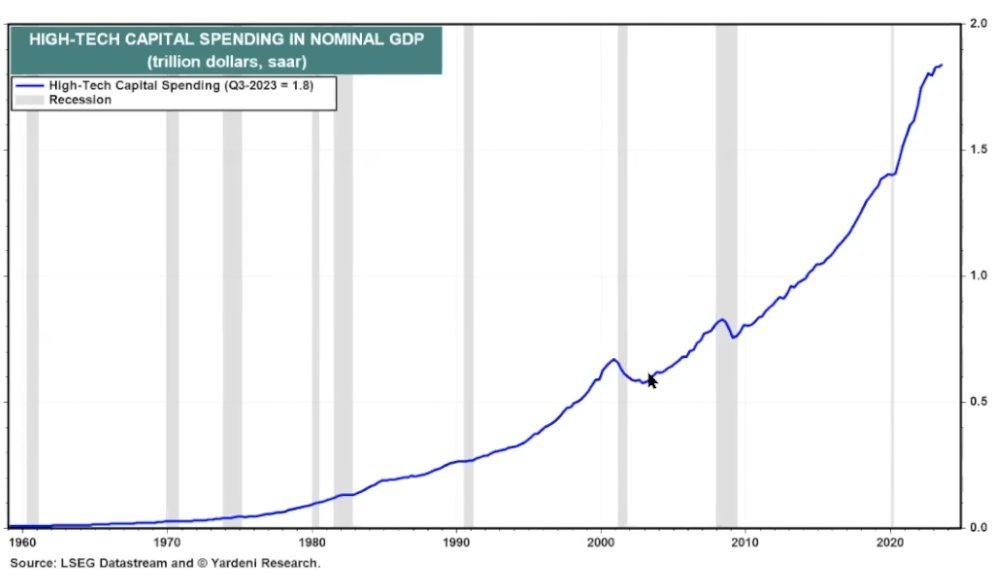

The Productivity boom💥has been in place since 2015. Aside from the pandemic-inflation fueled abnormality in trend, the productivity boom is back on track w/o reflation detractor. #Macro #economy @fundstrat @RyanDetrick

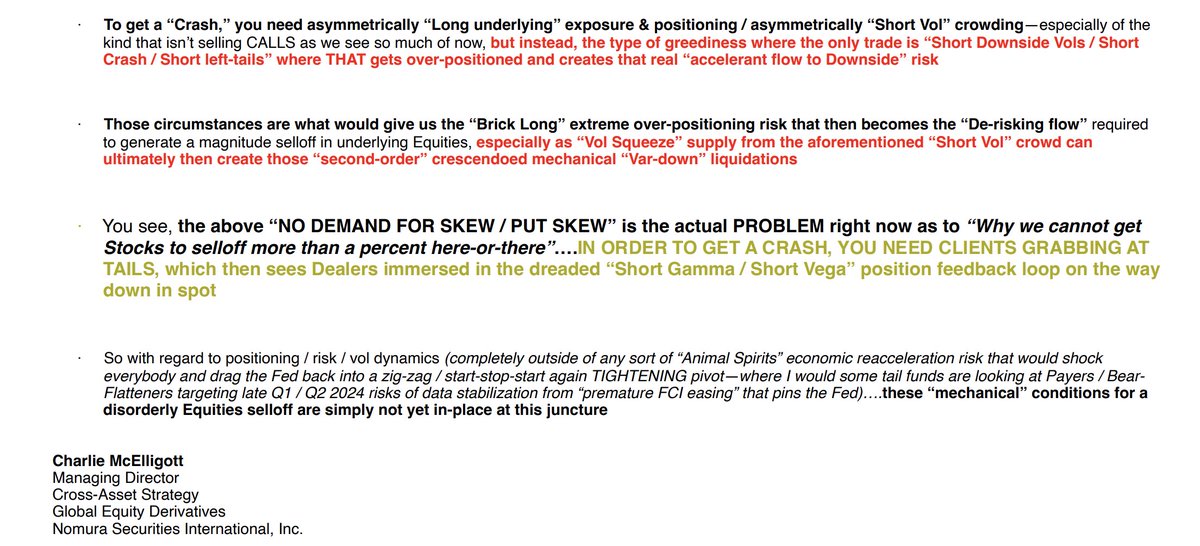

Nomura's McElligott: "Why a market crash ISN'T possible, based on positioning and appetite" $SPX $SPY $QQQ $DIA

I'm just sayin'. Either the vast majority of investors are stunads, or the economy is trending better than the pundits would have you believe. Tremendous trend line break UP in the Container & Packaging Index $SPX $DIA $QQQ $XLY $SPY

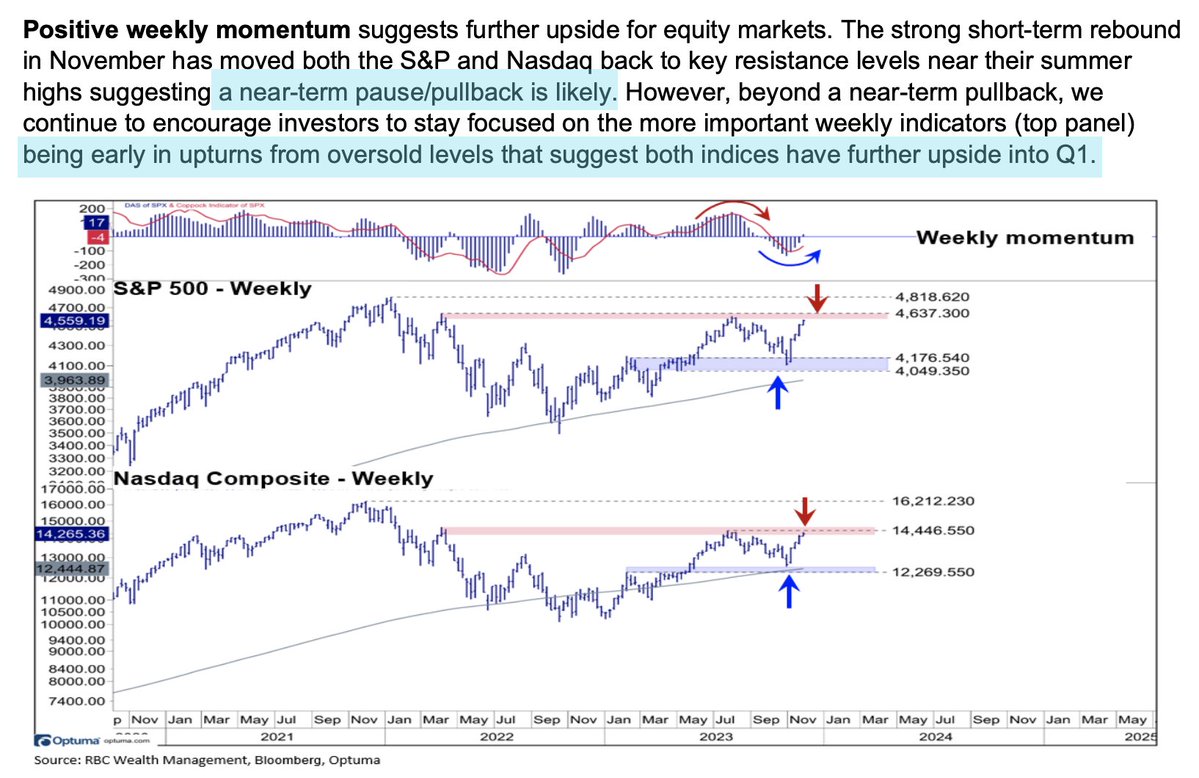

RBC's Sluymer: Investors should remain focused on weekly momentum having turned up 🆙 Pullbacks likely short-lived and more upside potential into Q1 2024. $SPX $SPY $QQQ $DIA

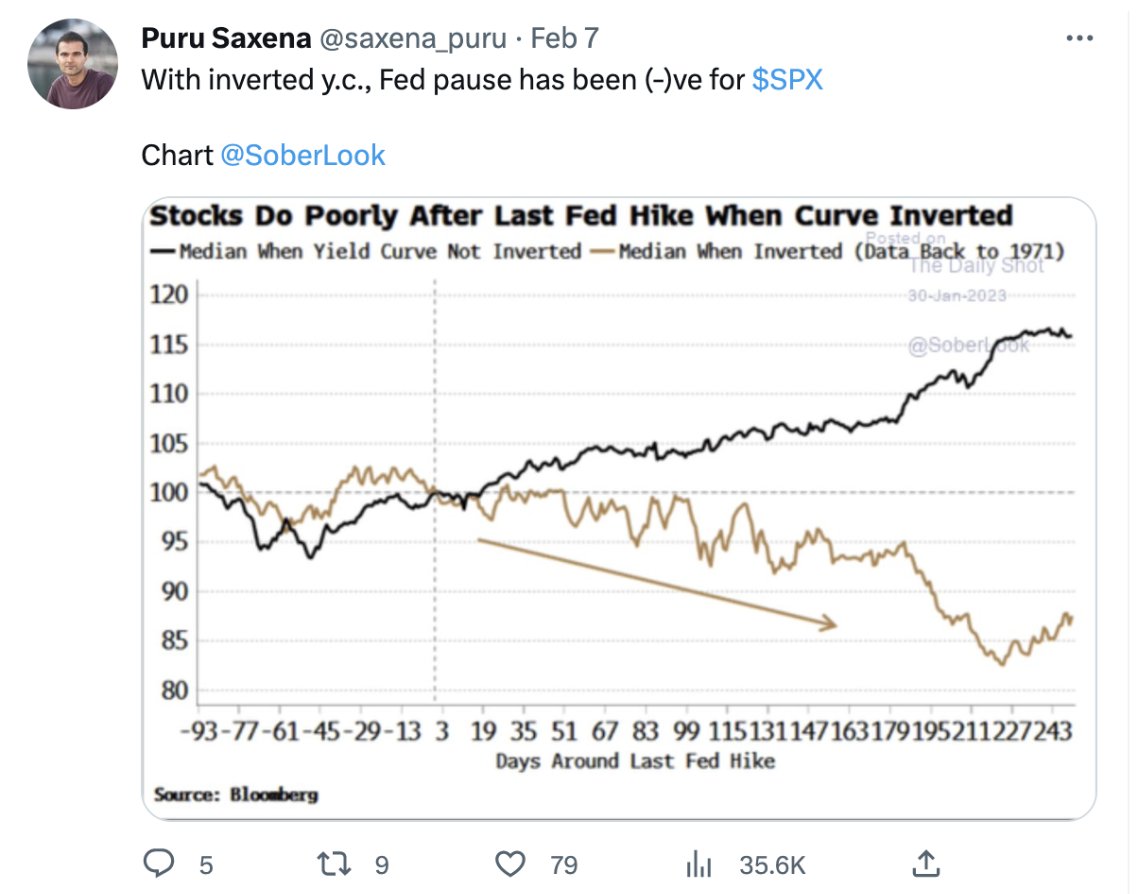

From Dec '22 (left) From Feb '23 (right) A "Ru", but clearly not a GuRu! And he loves to fear monger throughout Q4 periods. Scroll, it's almost as if he gets paid to do so this time of year. Aint he a sweetie pie?

I'm just saying, Tech spending (in Nom GDP) post-pandemic has taken a sharper. legger. higher. (2 of 3 are words) Where are you putting your investing dollars, cuz I know where $SPX corporations are putting theirs! $NDX $QQQ $SPY @DivesTech

The market is embracing the Fed’s progress on inflation like it just won second place at the Special Olympics. 😀🍻

United States Trends

- 1. Christmas 8.66M posts

- 2. Santa 1.49M posts

- 3. Hawaii 22.6K posts

- 4. Feliz Navidad 803K posts

- 5. #ShowSVPTheTree N/A

- 6. Timmy Chang N/A

- 7. Dan Fouts N/A

- 8. Rainbow Warriors 1,151 posts

- 9. Merry Xmas 274K posts

- 10. Drew Brees N/A

- 11. Micah Alejado N/A

- 12. Wonderful Life 14.8K posts

- 13. Rudolph 32.6K posts

- 14. Stan Humphries N/A

- 15. Marty Supreme 16.9K posts

- 16. Carti 13.4K posts

- 17. Home Alone 36.7K posts

- 18. Go Bows N/A

- 19. Midnight Mass 9,710 posts

- 20. George Bailey 2,218 posts

Something went wrong.

Something went wrong.