.

@Sykodelc

Full-Time #Crypto | Teaching You How to Change Your Life with Crypto 💰 | Join my Free Discord by Clicking the invite link below |

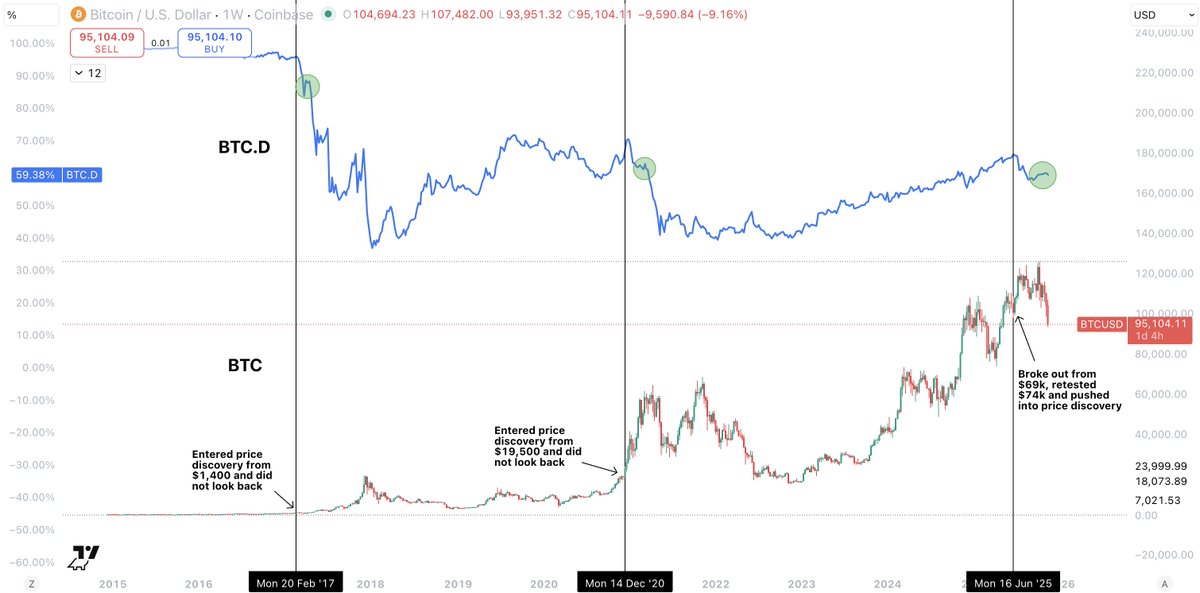

This is probably the most important post I will write in the next two weeks. And most are looking at this totally wrong. Hear me out. Right now, we have almost everyone on the timeline comparing our current market situation to 2021. But as I have been shouting for a while…

This is my worst case scenario. Firstly, I understand many of you just think im a perma-bull thats delusional. And I will admit I am very bullish... but this is because we are in a bull market. I will also admit that I did not expect such a harsh drop as this. But her we…

This is very telling. It comes as no surprise that Strategy Inc($MSTR) is highly correlated to the Bitcoin price. However, over the course of its creation, it has regularly led Bitcoin on key moves... Both up and down. And right now, $MSTR is telling us an important story.…

This is something you all need to understand. Anything that is expected by the majority is wrong. We have the whole world seemingly now aware of 4 year cycles and saying… “Relief pump to 200ma, put in right shoulder, drop 75% over 12 months into bear market” And we can just…

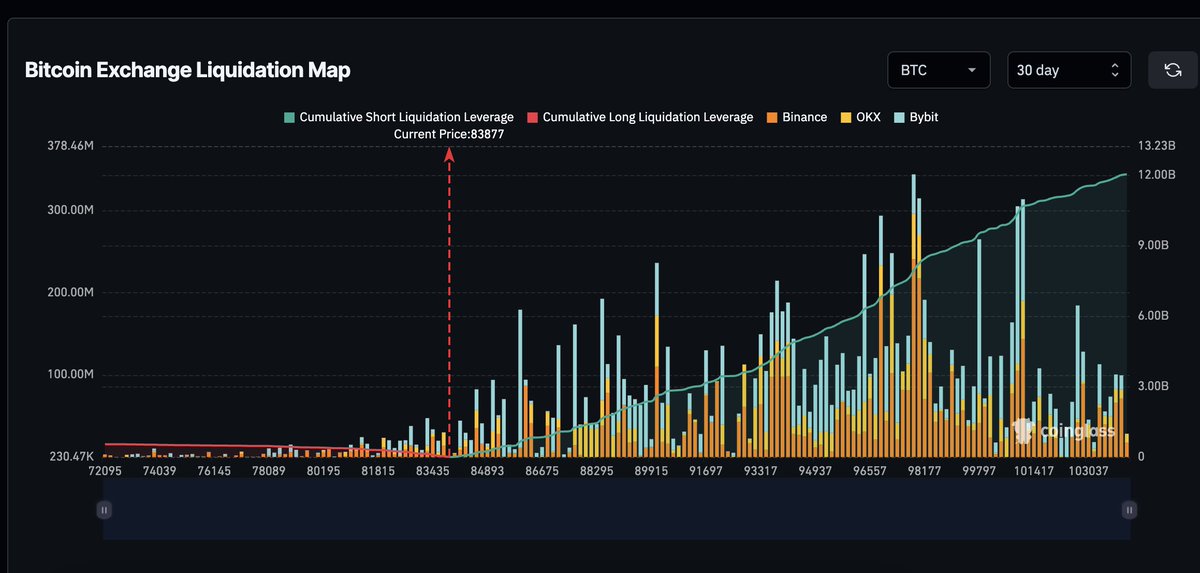

Think about it for a second. Do you honestly think that the market makers just: 1. Destroyed all leverage players across all coins on 10/10 2. Took almost every dollar of long liquidity down to $81k… To then just continue to send the market lower? No. It has been done…

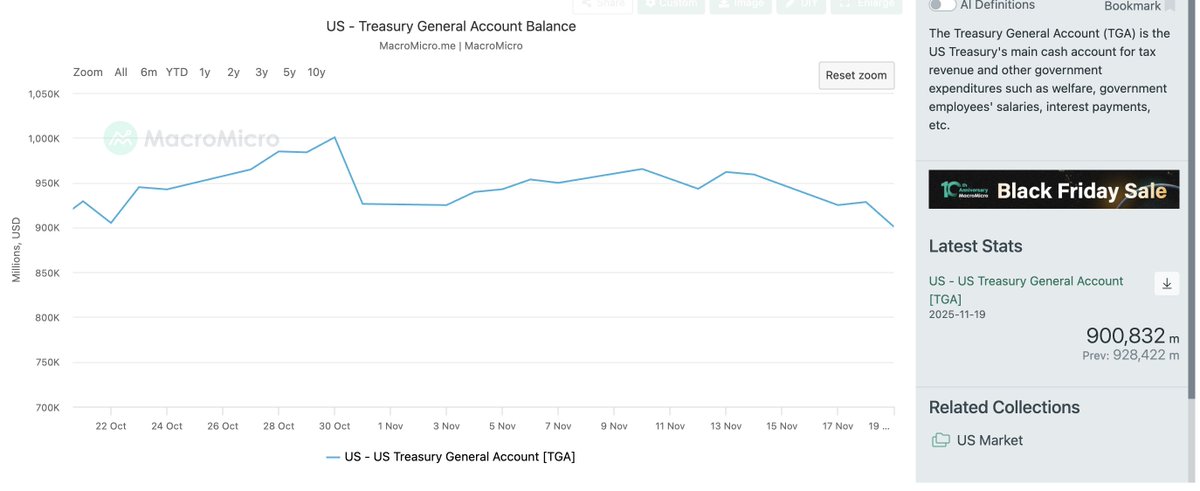

This time is different. In 2019 the FED overdid QT and broke the system. This was the 2019 repo crisis. Right now, reserves are getting pretty low, but not within danger territory just yet. In addition, we have already had the harshest drop in Bitcoins history(record breaking…

The Fed will end QT in 9 days. When the Fed did that last time, $BTC dropped even more.

It is crunch time. Bitcoin is not going to hold the 1W 50SMA this week. But as with anything in investing, we cannot rely on once metric alone to determine up or down. It is always a lot more nuanced than that. Here's my base case and what I think happens next. Bitcoin is at…

Altcoins have begun their outperformance. At the exact time that every single person has given up on them. The cycle isn't done yet. How can it possibly be when we still have dominance just under 60%, with several very key bearish confirmations? Contrary to what most people…

It is absolutely wild to me… That we can have this like of correction, with record breaking metrics being set… And almost every single person, including many bulls, have flipped. Everyone in unison chanting “bear market start, down for one year” When in reality, right now,…

Forward returns for Bitcoin $BTC after Short/Long Term Holder in Profit is under 8

Bitcoin has not topped. In fact, it has nowhere near topped. And I really want to try and help as many of you as possible understand why. Just because Bitcoin has followed a 4 year cycle so far, does not mean it will simply just do it again. And that is because it is not the…

I am getting so much hate right now. For simply sharing charts that show we are not in a bear market. And that out overall current market position is nothing like end of 2021. Here is another. Even after all this, TOTAL3 is holding HTF structure and lining up very nicely with…

The pivot us underway. More liquidity is coming. The TGA has now dropped $70bn since the Government reopened... And much more will flow. Meaning bank reserves are now increasing. Meanwhile odds for a December rate cut spiked to 70% in the last 12 hours. The market is going…

I have never seen this. The liquidation heatmap has NEVER been this skewed. They have quite literally destroyed 99% of investors that where long in any way shape or form, leverage traders or holders. This is a wipe out to a level that has never been witnessed before. Right…

97% of Crypto investors simply don't understand what's coming. I'm getting lots of comments with people sneering at my predictions for multi-billion $ market cap predictions. Let me help you understand, frens. Gold Market Cap = $13T S&P 500 Market Cap = $37T Apple's Market Cap…

United States Trends

- 1. Luka 61.8K posts

- 2. Clippers 17.9K posts

- 3. Lakers 47.8K posts

- 4. #DWTS 95.1K posts

- 5. Dunn 6,641 posts

- 6. #LakeShow 3,493 posts

- 7. Kawhi 6,208 posts

- 8. Jaxson Hayes 2,423 posts

- 9. Robert 137K posts

- 10. Reaves 11.9K posts

- 11. Ty Lue 1,562 posts

- 12. Collar 44.3K posts

- 13. Jordan 117K posts

- 14. Zubac 2,291 posts

- 15. Alix 15.1K posts

- 16. Elaine 46.2K posts

- 17. Godzilla 37.1K posts

- 18. Colorado State 2,434 posts

- 19. Dylan 35K posts

- 20. #INDvsSA 27.1K posts

Something went wrong.

Something went wrong.