Tonewhyyouplayinwitem

@TheOrigPPChef

$

قد يعجبك

National median rent vs annual household income, per TheBeautyofData:

I’ve worked in finance for ~6 years. I’ve also spent over 3,500 hours discussing investing with experts. 99% of investment advice can be boiled down to these 21 sentences:

💵MUST SEE GIVEAWAY : Picking (1) Person who RT’s + Likes this Tweet to win a: - SAMSUNG 34 Inch ViewFinity S6 Series 4K UHD High-Resolution Monitor ($500 value) Must be following me & @EliteTraderFund to win!

#bitcoin Price by Block height spiral vs linear. Shows the craziness of exponential growth shown in the spiral. @JohnXOsterman

Wanna know what separates great investors from mediocre ones? Their investing checklist. If you don’t ask the right questions before investing, you won’t make any money. Here are 50 questions every investor should ask before buying their next stock: (bookmark this)

Thank you for reading! If you enjoyed this thread, follow me @WOLF_Financial for more. If you want me to see me explore this content some more, sign up to my weekly newsletter: marketmadness-newsletter.beehiiv.com

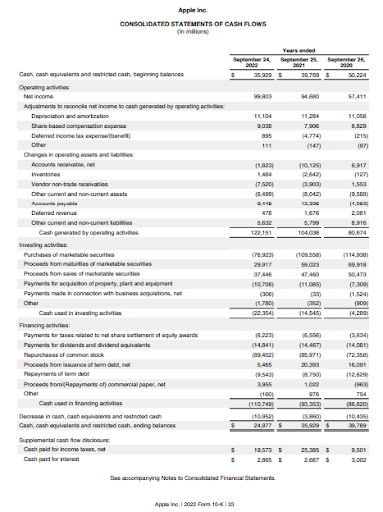

To invest in individual stocks, you must understand these 3 financial statements. To recap, they are: - Balance sheet - Income statement - Cash flow statement Bookmark this thread for future reference.

If you want to own individual stocks you must understand financial statements. Here’s how to analyze a: - Balance Sheet - Income Statement - Cash Flow Statement Without being a finance professional:

3.3 What does a cash flow statement look like?

3.2 What to look for? - Dividends - Stock buybacks - Regular debt payments - Growing operating cash flow - Operating cash flow > Capital expenditures

3.1 What do these areas look like? Financing is money that moves around due to debt and equity transactions. Operations are money that moves around due to regular business activities. Investments are money that moves around based on sales and purchases of assets.

3. Cash flow statement The cash flow statement tracks how money flows in and out of a business. It covers areas like: - Financing - Operations - Investments You’ll be able to see if money is being wasted.

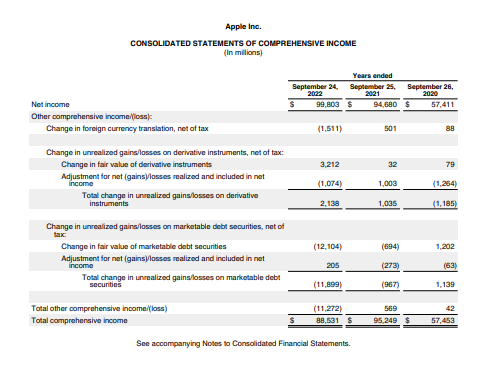

2.3 What an income statement looks like:

2.2 What to look for? - Revenue > Expenses - High profit margins (20%+) - Increasing revenue (20%+) - Consistent revenues & expenses

2.1 What do revenues and expenses look like? Revenues are how much a company makes from products or services. Gains are income from non-business activities. Expenses are the cost of goods sold. Losses are costs related to anything other than making money.

2. Income statement The income statement summarizes a company’s: - Gains - Losses - Expenses - Revenues Over a specific period in time. In other words, it shows you if a company is profitable.

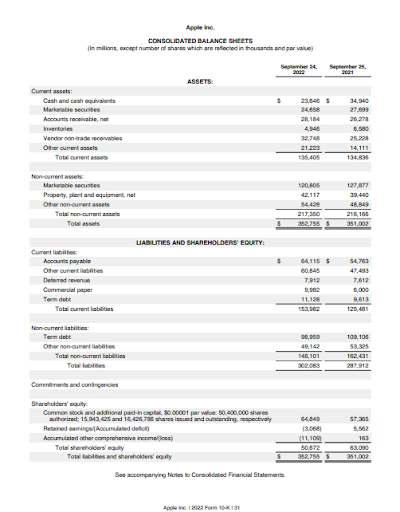

1.3 What a balance sheet looks like:

1.2 What to look for? - Little inventory - Debt/Equity ratio >2 - Cash/Liabilities ratio >1 - Less short-term liabilities than long-term

1.1 What do assets and liabilities look like? Assets: - Equity - Inventory - Cash & T-Bills - Prepaid expenses - Land & machinery - Accounts receivable - Patents & Trademarks Liabilities: - Accounts payable - Accrued expenses - Short & long-term debts

United States الاتجاهات

- 1. #GivingTuesday 23.9K posts

- 2. #twitchrecap 6,276 posts

- 3. Larry 35.9K posts

- 4. Jared Curtis 2,588 posts

- 5. Costco 49K posts

- 6. #AppleMusicReplay 8,439 posts

- 7. #DragRace 5,040 posts

- 8. So 79% 1,322 posts

- 9. Susan Dell 5,813 posts

- 10. NextNRG Inc. 2,838 posts

- 11. #csm222 7,094 posts

- 12. BT and Sal N/A

- 13. Cabinet 53.2K posts

- 14. Carton 29.4K posts

- 15. WFAN N/A

- 16. Lucario 25.9K posts

- 17. Punk and AJ 1,972 posts

- 18. King Von 1,712 posts

- 19. $BBAI 2,491 posts

- 20. Trump Accounts 12.7K posts

Something went wrong.

Something went wrong.