你可能會喜歡

“No crying in the casino.” Great thread on the latest crypto liquidation. After months of everyone showing triple-digit YTD returns, this kind of flush reminds you why risk management so crucial. The secret isn’t finding the next 10x. It’s avoiding the blow-up.

It's official: Crypto just saw its LARGEST liquidation event in history with 1.6 MILLION traders liquidated. Over $19 BILLION worth of leveraged crypto positions were liquidated in 24 hours, 9 TIMES the previous record. Why did this happen? Let us explain. (a thread)

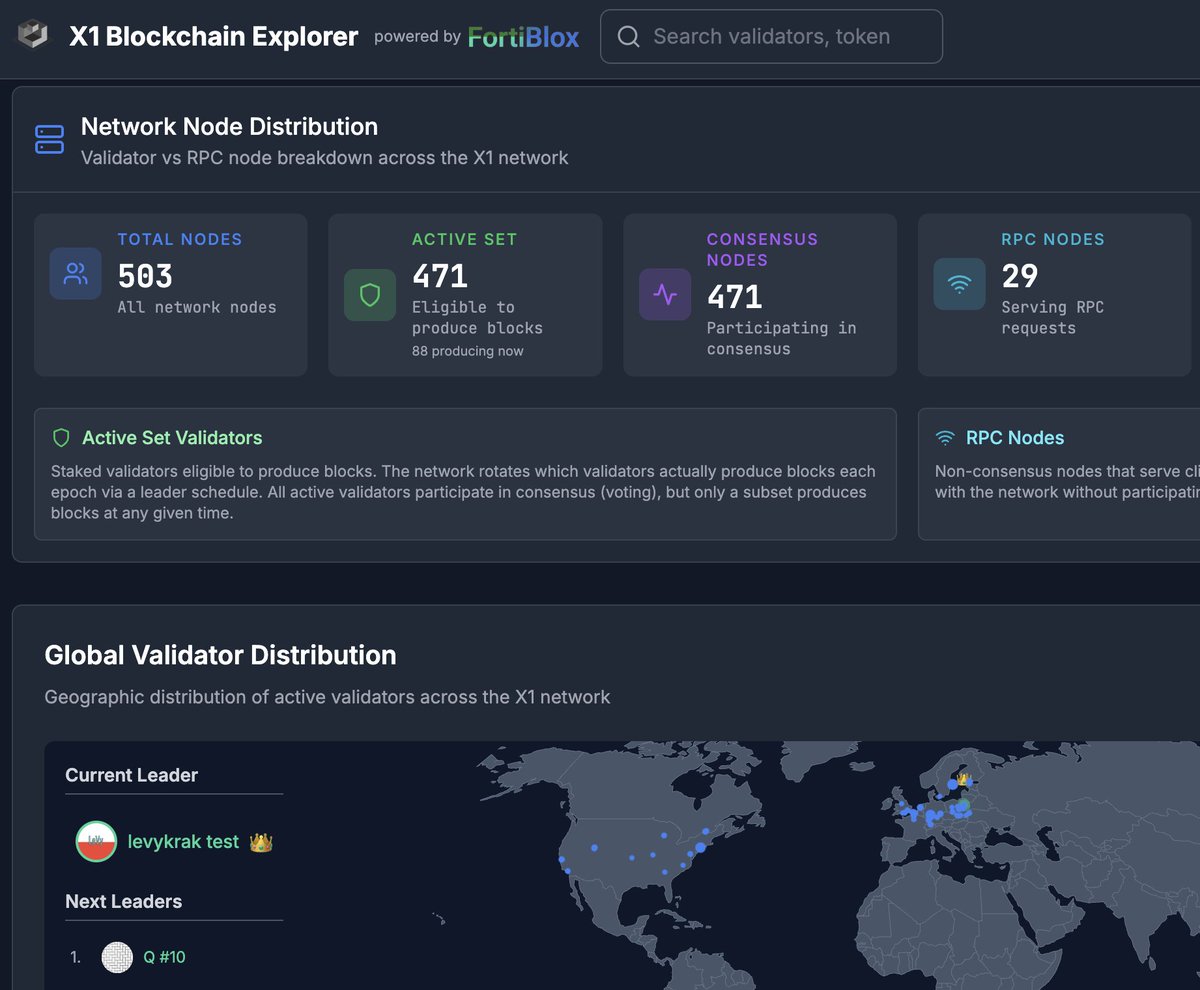

We've launched X1 Mainnet on Oct 6th, the day crypto hits all time high. Now 4 days later we've cross over 500 Validators connected to the Network (On the day when crypto had its largest liquidation). #X1 explorer.fortiblox.com

Ethereum scalability ... thats why no-one trades on it anymore; SVM and others (SUI, Aptos, HL) and soon X1, show how it's done.

Crypto is… Desperate gamblers chasing their first bag. Investors funding the buildout of the global casino. Bankers hypnotizing the masses to collect their vig. …all meaningless and ephemeral without the cypherpunks, who defend the dream of encrypted and unstoppable cash.

Covid crash: $1.2 Billion in liquidations FTX crash: $1.6 Billion in liquidations Today: $19.16 Billion in liquidations This is Biggest liquidation event in history of crypto and almost 20x bigger than the Covid crash of March 2020.

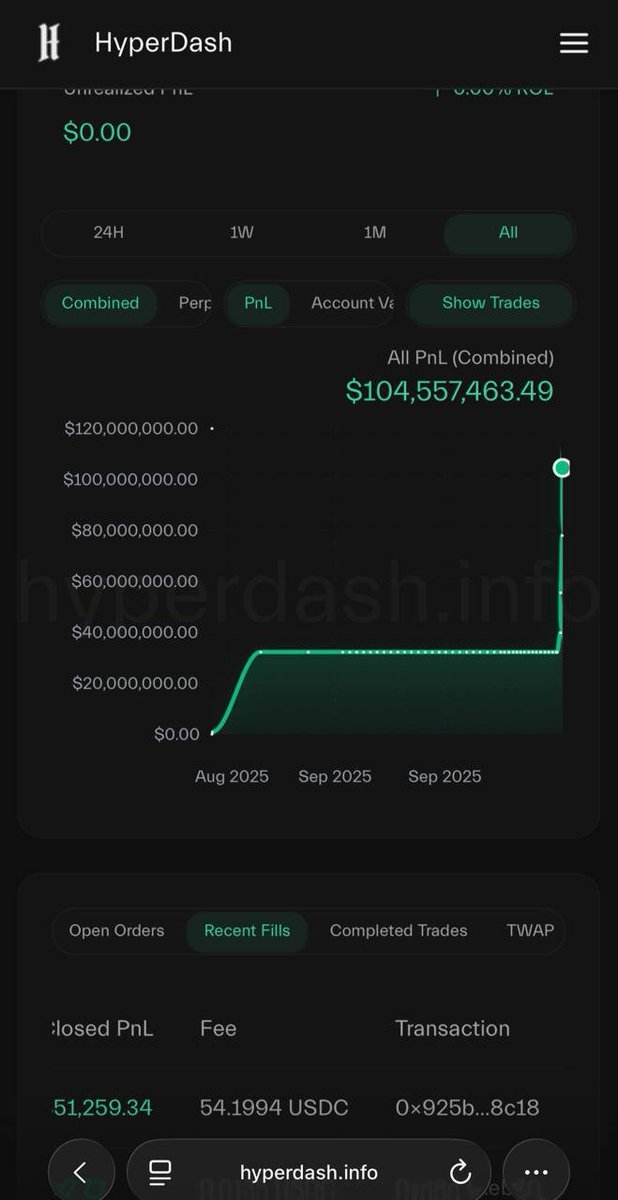

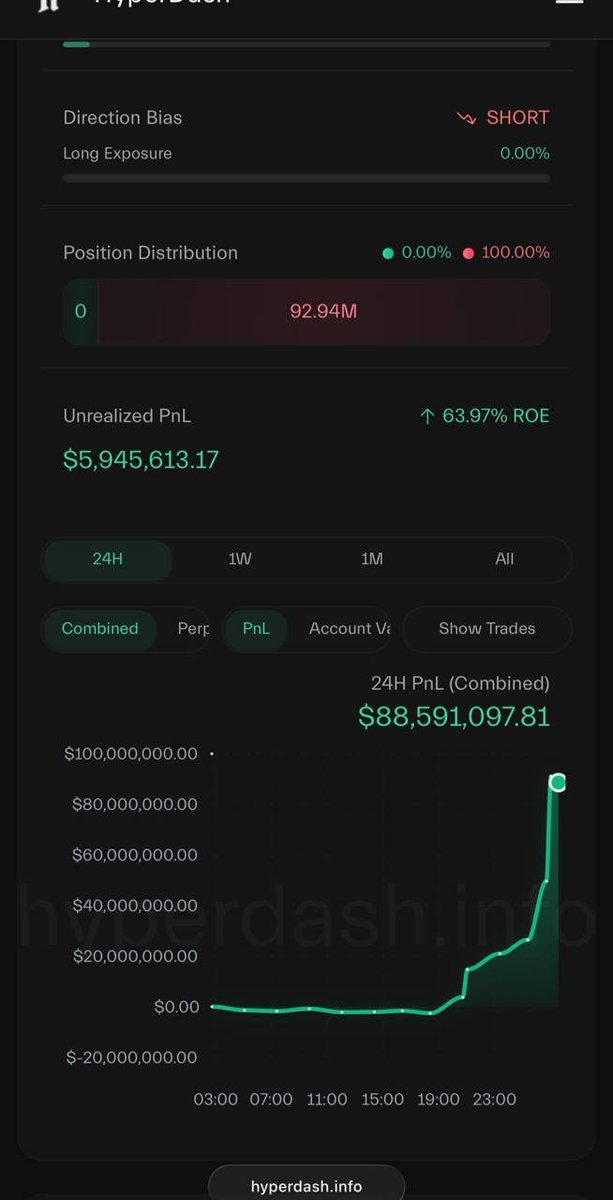

The insider who opened trades 30 mins before Trumps tarrif announcement closed the trades for $104m+$88m=$192m profits. The @HyperliquidX accounts were opened today.

Did you know the U.S.'s most lucrative "export" is its own dollar? 📈 Ehsan Soltani visualized the cumulative exports of dollar banknotes from 1970-2025: voronoiapp.com/category/-US-E…

The US market is on fire: The market cap of US stocks relative to the US M2 money supply hit 305%, the highest since 2000. Over the last 3 years, this percentage has grown a whopping +125 points. This has now officially surpassed the pre-2008 Financial Crisis peak of ~290%.…

What is happening? The S&P 500 is up +40% in 6 months, Gold is nearing $4,000/oz, and Bitcoin hit a record $2.5 TRILLION market cap. Meanwhile, the US Dollar is set for its WORST year since 1973. Are markets THAT strong or is the US Dollar just crashing? (a thread)

Based on some reports I’m seeing, losses on Hyperliquid, one of the largest crypto derivatives exchanges have been massive. Over 1,000 traders lost more than $100,000 each. More than 200 traders were down over $1 million, and 358 accounts were completely wiped including one…

What just happened? At 3:00 PM ET, President Trump confirmed a 100% tariff on all Chinese imports starting November 1st, alongside export controls on “any and all critical software.” Within minutes, the S&P 500 fell 2.7%, erasing over $1.5 TRILLION in market value as panic…

Today, the US Stock Market Cap to M2 Money Supply ratio is APPROACHING DOT COM BUBBLE level. THE STOCK MARKET IS OVERHYPED, OVERPRICED, & OVERVALUED.

BREAKING: Yesterday's crypto liquidation led to Bitcoin's first ever $20,000 daily swing. Bitcoin alone erased -$380 BILLION in market cap over just 8 hours. That's more than the market cap of all but 25 public companies in the world.

It's official: Crypto just saw its LARGEST liquidation event in history with 1.6 MILLION traders liquidated. Over $19 BILLION worth of leveraged crypto positions were liquidated in 24 hours, 9 TIMES the previous record. Why did this happen? Let us explain. (a thread)

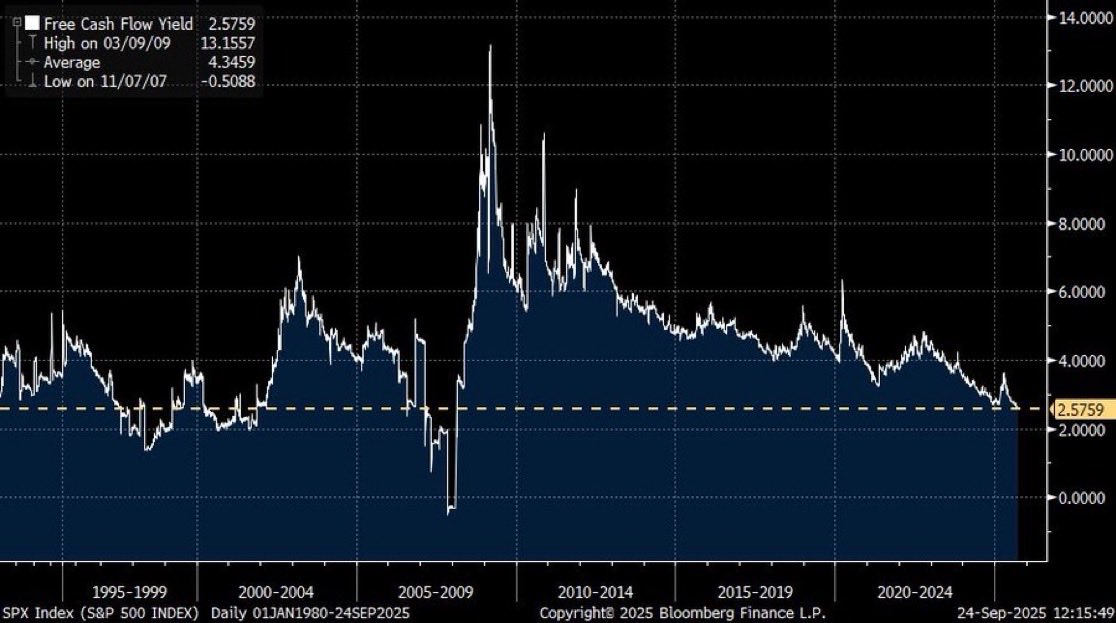

S&P 500 free cash flow yield has fallen to 2.58%, the lowest level since the Global Financial Crisis 🚨🚨🚨

John 14:6 "Jesus answered, I am the way and the truth and the life. No one comes to the Father except through me." ❤️- Aj Green

BREAKING: Global debt jumped +$14 TRILLION in Q2 2025, to a record $337.7 trillion. In the first half of 2025, world debt surged by a massive +$21 trillion, a rise comparable to H2 2020, when pandemic responses drove an unprecedented spike in debt. The US, China, France,…

China is relentlessly piling up on gold, this is also why it’s harder and harder for the BIS to keep a lid on the price as it used to do in the past, on behalf of western central banks, to hide the fast depreciation of their fiat currencies

The arrow points to the moment when I warned about mounting FOMO for physical gold in China - Something I went to check myself personally at that time. Those who followed technical analysis instead of fundamentals at that time were calling for a top in gold. Funny isn’t it?

By 2028, U.S. data centers are projected to use between 6.7% and 12% of the nation’s total electricity, according to Lawrence Berkeley National Laboratory. That’s a difference of 255 terawatt-hours of energy equivalent to the consumption of over 24 million households. A…

America is in the middle of a massive construction shift. Over $40 billion worth of data centers are being built right now, up 400% since 2022. For the first time ever, data centers being built will outnumber office buildings. (a thread)

Truly amazing how people refuse to do any due diligence on 30 year commitments. PT Barnum was right- there’s a sucker born every minute.

CHINA JUST WEAPONIZED THE ENTIRE RARE EARTH SUPPLY CHAIN get used to reading chinese MOFCOM bulletins because they're writing american industrial policy now. announced today: any product containing >0.1% chinese rare earth materials needs beijing's approval before re-export to…

Regional banks A largely overlooked sector, yet few realize that in 2023, it prompted the Fed to inject $3 trillion into the financial system, surpassing 2008 efforts. Signs of weakness are emerging again. Trendline breaches are widespread. Hope this helps.

United States 趨勢

- 1. Auburn 45.3K posts

- 2. Brewers 64.2K posts

- 3. Georgia 67.3K posts

- 4. Cubs 55.6K posts

- 5. Kirby 23.9K posts

- 6. Utah 24.6K posts

- 7. Arizona 41.4K posts

- 8. #byucpl N/A

- 9. Gilligan 5,936 posts

- 10. #AcexRedbull 3,831 posts

- 11. #BYUFootball 1,007 posts

- 12. Michigan 62.5K posts

- 13. Hugh Freeze 3,233 posts

- 14. #Toonami 2,704 posts

- 15. Boots 50K posts

- 16. Amy Poehler 4,463 posts

- 17. Kyle Tucker 3,178 posts

- 18. Dissidia 5,771 posts

- 19. #GoDawgs 5,561 posts

- 20. Tina Fey 3,477 posts

你可能會喜歡

-

Grant Jones

Grant Jones

@grantjonesx -

KicsiVedi ᛤ $DOG 🛞X1 $XEN $XNM

KicsiVedi ᛤ $DOG 🛞X1 $XEN $XNM

@Vedi_T_ -

YNWA_HEX

YNWA_HEX

@YNWA_HEX -

Whisper

Whisper

@fieldwhisper333 -

Investalogic

Investalogic

@Investalogic -

❌ Now And XEN 🙅🏻

❌ Now And XEN 🙅🏻

@now_and_xen -

nicklz.pls

nicklz.pls

@Nicklz87 -

ange de la mar

ange de la mar

@_angedelamar -

NC_state_parks

NC_state_parks

@NC_state_parks -

PK_Dreambuilder.eth

PK_Dreambuilder.eth

@PK_Dreambuilder -

Tyler Bond

Tyler Bond

@TylerBondX -

Titi

Titi

@Alexhandru -

Ghostjitsu

Ghostjitsu

@J_rodent_ -

Jonathan Stern

Jonathan Stern

@Jonatha95981848

Something went wrong.

Something went wrong.