𝙲𝚊𝚞𝚕𝚍𝚛𝚘𝚗

@WhaleEngine

Freelance C++ dev. Building a high-performance grid-search backtesting engine for algorithmic trading. Results aligned with TradingView.

You might like

Mon bot de trading #Binance (algo TRIX) est live ! Il scanne 3 paires et prend la meilleure opportunité : SOL/USDC, DOGE/USDC, XRP/USDC. Backtest 1 an ≈ +500%. Ubuntu, alertes Telegram à chaque trade. (Pas un conseil d’investissement) #crypto #python Merci @CryptoRobotfr

Capital % and leverage are now tunable hyper-params in my C++17 backtester. One grid search maps the full risk/return landscape, so sizing trades is data-driven instead of guesswork. Backtest results match TradingView bit-for-bit.

My backtesting engine processes 880 millions candles on an Intel 14900K for a 4h strategy with 2 entry conditions (CMO + price > MA) and 2 exit conditions (CMO + SL). Results match TradingView's, with a pinescript export to verify. Download likely this year, maybe summer.

Gave ChatGPT the trade logs from my backtest and asked it to plot the wins and losses. It made this chart. Pretty cool !

The majority of altcoins, even those with large market caps, have economic models that are highly inflationary. These models often rely on optimistic assumptions that the market will absorb the inflation over the long term, but in reality, this is rarely the case.

On Solana $SOL, the 170-day EMA is equivalent to the 100-day EMA on BTC. It's central among the most profitable EMAs, with strategies to buy when the price crosses above and sell when it crosses below.

$AZERO (Aleph Zero) is a promising blockchain, but its inflation exerts significant downward pressure on its value.

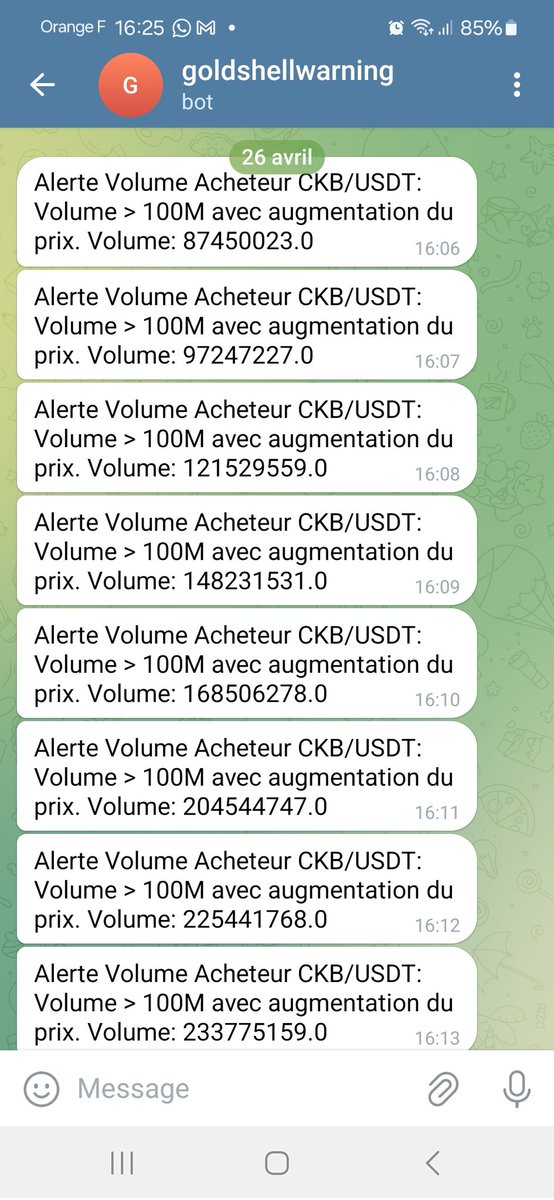

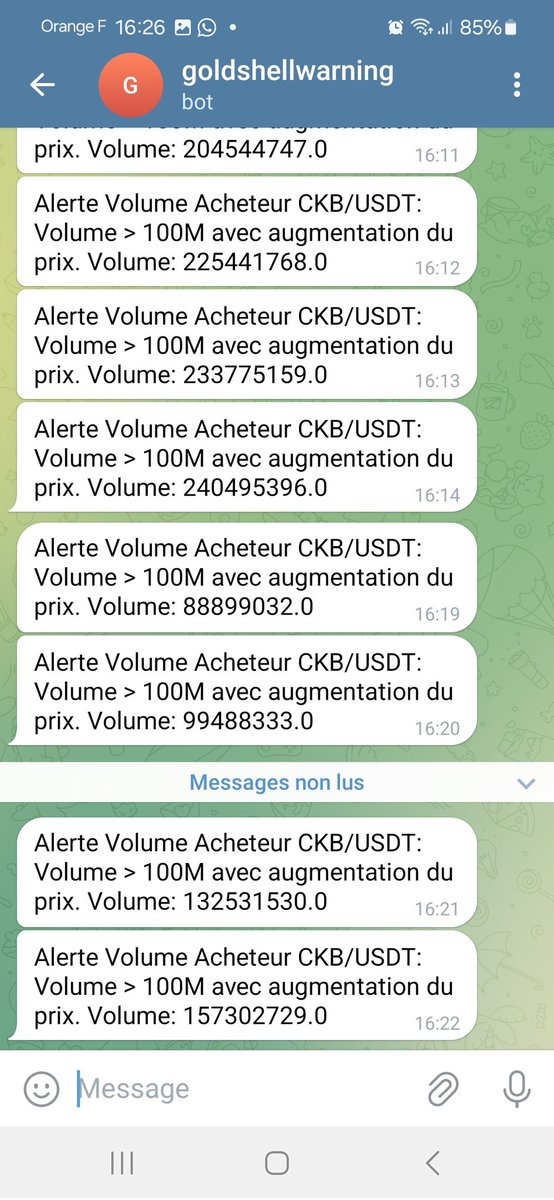

My signal robot is working like a charm. This week end I ll convert it to a robot capable of entering into trades.

I've tweaked the ETH strategy once more, hopefully this is the charm! $ETH / $USD timeframe: 1 Day Enter: Close price > EMA(31) and RSI(2) > 92 Exit: RSI(4) < 51 Stop Loss: 12.5% I'll share the performance updates in a few months.

Thanks . learning how to so the same :)

A simple SMA(25) / SMA(47) crossover strategy on $ETH has delivered an 85% win rate since January 2020.

My bots use a realtime trailing buy/sell strategy to increase the number of profitable trades. A trailing buy sets a dynamic purchase target that shifts to capture lower prices as the market changes. To evaluate the best trailing percentage, I backtest using 1-minute candle data.

Instead of holding crypto, track a trend line, like buying $BTC above the EMA 100 daily and selling below. It beats just watching your portfolio dip, promising bigger returns over time. A reliable trend line sits at the center of a value range yielding good results.

Crypto bull runs are traps that tempt you to buy at the worst possible time. Many then watch their tokens' value plummet by 70% without taking action. The real winners are the token creators, who sell off during the spike.

Crypto investors often put their faith in certain projects, not seeing that the project leaders, living the high life, are the ones selling off the most tokens. Personally, I'm not sold on crypto for the long haul.

I've spent a bit more time on the strategy of @PKycek. Here's a variant that seems better than my initial analysis which was solely based on 2023. $BTC / $USDT Daily Entry: Close > MA(70) and RSI(4) > 82 Exit: RSI(17) < 46 This strategy yielded a 260% return from Jan 2023. 1/2

On the 1-hour timeframe, buying when the moving averages cross and selling at the upper Bollinger band wins 58% of 697 trades. But, the big problem is the high risk shown by a large maximum drawdown. $MATIC / $USDT

En train d'adapter le code python @CryptoRobotfr en C++ Arduino pour le faire tourner sur un ESP32 et permettre à la communauté opensource d'avoir des trading bots capables de tourner sur des machines a 2 EUR :)

Great job on the test run! 🤖

Scored a +9% gain in 24 hours with my bot on @kryll_io, started just yesterday. Wanted to test grid search over 33h historical data. Given the token's steady rise, it's no surprise there weren't any losses. Now shutting down this bot. x.com/gridsearch/sta…

United States Trends

- 1. Kevin James 2,066 posts

- 2. Bubba 27.6K posts

- 3. Jack Hughes 1,078 posts

- 4. RIP Coach Beam N/A

- 5. Bill Clinton 114K posts

- 6. #BravoCon 4,282 posts

- 7. Last Chance U 3,709 posts

- 8. Metroid 10.5K posts

- 9. Hunter Biden 19.8K posts

- 10. Wale 46.8K posts

- 11. Oakland 8,773 posts

- 12. Zverev 3,023 posts

- 13. Crooks 80K posts

- 14. Vatican 14.8K posts

- 15. #CashAppGreen 1,298 posts

- 16. Paul Blart N/A

- 17. Hayley 18.7K posts

- 18. $GOOGL 20.8K posts

- 19. Rondo 2,699 posts

- 20. Catholic Charities 2,423 posts

Something went wrong.

Something went wrong.