Flux Premia

@ZeroDayModel

Trader

You might like

Twitter helps one understand why we have a market: -@FinanceGhost is selling META as it has run too hard and to pay divorce fees. Another holds the LT trend. -Folks get stopped out, my friend @Mercedarians steps in. -PMs crow BTI is too cheap, others say trends have changed

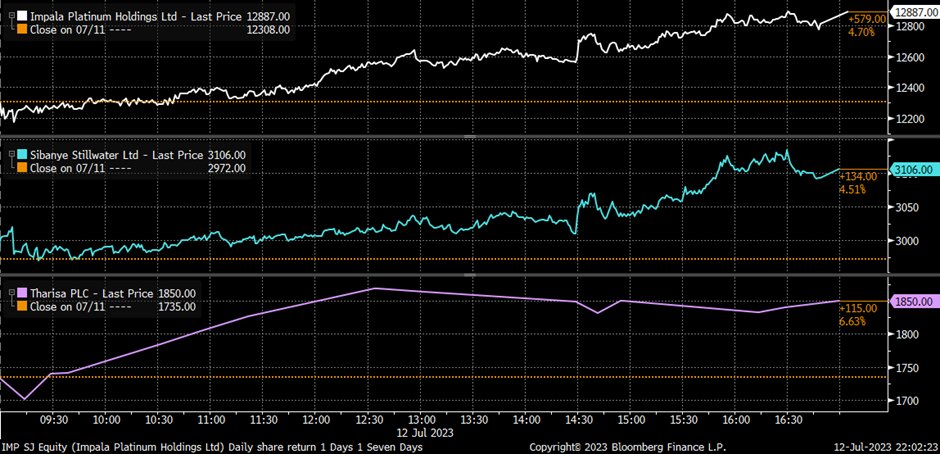

Today was a great day for JSE investors - ALSI up 2.23% on better than expected US CPI data. Precious metal producers stole the show with the index up nearly 4.5% on the day. Some stand outs from the portfolio: Impalts $JSEIMP +4.7% Sibanye $JSESSW +4.5% Tharisa $JSETHA +6.6%

$NVDA: KeyBanc raises target price to $550 from $500

"Lowest level on record"

South Africa’s highest earners saw their confidence worsen to the lowest level on record on concerns about the economy’s prospects and their finances trib.al/RcfPAaS

bloomberg.com

South Africa’s Richest Consumers Lose Confidence in the Economy

South Africa’s highest earners saw their confidence worsen to the lowest level on record on concerns about the economy’s prospects and their finances.

I've bought 500,000 USD at 18.20 TP 19.94 #OneExSettler and all of that

$DIS Disney going for the higher-low double bottom breakout? 🐭

$JSESPP Spar - Bullish breakout above 105 targets 113/122.

10Y-3M - WTF is going to happen here... I just know one thing - Something really big.

SARB hikes by 50 basis points. There can be no doubt. @SAReserveBank is fiercely independent and Guardian of the Rand.

Rates up strengthening ZAR, bringing down fuel price, rewarding savers, crushing inflation, helping the poorest, & you're bitching because you can't afford the adjusted payment on your dream home & Audi A4? Fu#k right off!! You borrowed happiness from tomorrow. Payback time 🥺

TWO MAJOR BANKS IN EUROPE EXAMINE SCENARIOS OF CONTAGION AND LOOK TO THE ECB AND FED TO STEP IN WITH STATEMENTS OF SUPPORT, ACCORDING TO SOURCES.

"Any fool can know. The point is to understand." -- A. Einstein (1879 - 1955)

Don't get caught up in doomscrolling. S&P 500 is up around 0.5% as of now. Markets recognize - correctly - that SVB is a micro- and not a macro-story. It changes little about the trajectory of the US economy, which is the same as it was a week ago. Recession is NOT imminent...

RUSSIA WILL CONVENE THE UNITED NATIONS SECURITY COUNCIL ON FEBRUARY 22 TO DISCUSS THE SABOTAGE OF THE NORD STREAM PIPELINES - RUSSIAN MISSION TO U.N., CITED BY RIA.

Markets are fixated on the idea that the US is already in recession or is about to go into one. Yesterday's Q4 GDP should end that fixation. US consumption is a bit above its pre-COVID trend. Momentum is strong in the US economy and the Fed pivoted just in time. No recession...

United States Trends

- 1. #DWTS 10.5K posts

- 2. Elaine 29.3K posts

- 3. Alix 5,080 posts

- 4. Jalen Johnson 2,564 posts

- 5. Kingston Flemings N/A

- 6. Hazel 9,821 posts

- 7. Godzilla 28K posts

- 8. Wizards 7,046 posts

- 9. Araujo 192K posts

- 10. Joey Galloway 1,201 posts

- 11. Seton Hall 2,208 posts

- 12. Bishop Boswell N/A

- 13. Chelsea 667K posts

- 14. Barca 267K posts

- 15. House Party 7,330 posts

- 16. Daniella 2,182 posts

- 17. BRUNO IS 70 N/A

- 18. Estevao 278K posts

- 19. Leftover 7,259 posts

- 20. Witkoff 74.5K posts

Something went wrong.

Something went wrong.