You might like

Trading can’t be taught, but it also isn’t gifted. It is learned because it is a craft. A craft cannot be learned through lectures or videos, nor by watching someone execute it. It is learned by doing: execute → take feedback → iterate → repeat. And this process continues…

Thank you for the overwhelming response! 🙌 I know this will help a lot of people. I tried replying to most of you in DMs, but X is blocking me for ‘too many automated responses’. So I’m dropping the link here itself — hope it helps many of you! heyzine.com/flip-book/d88b…

Before I started trading the US markets, I studied KQ's style and even printed out his trades. That helped me massively. To continue that approach, I’ve created a Trading Flag Setups – 2025 Edition 📘 ▶️ 40+ high-quality stocks setups ▶️ Simple database — no overcomplicating…

The most important trick to be happy is to realize that happiness is a choice that you make and a skill set that you develop. You choose to be happy, and then you work at it. It's just like building muscles. @naval

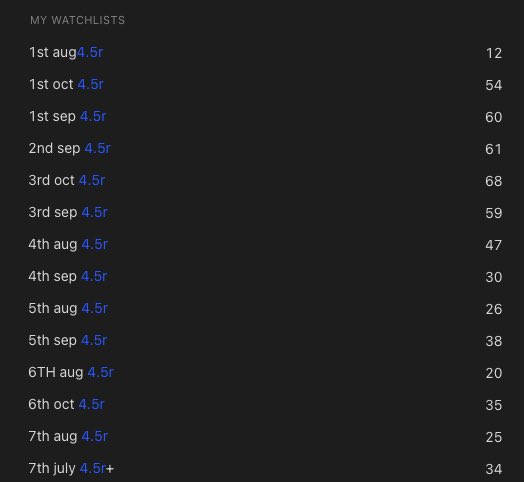

Life changing tip if you’re a momentum trader trying to train your eyes to find better setups. Run a simple scanner of stocks up by 4.5%+ in a day. Go through them and find a trade-able setup based on your rules. Take a screenshot and mark as if you traded it. Do this for 3…

If you want to make a fortune from magnitude trades, follow this three-point solution – 1) Buy the best momentum stock on the worst market day. 2) Hold it using the eight-week rule. 3) Thank me later.

ANALYZING AN #IPOBASE FORMATION: BAR-BY-BAR This is an important video where I walk through my complete process of tracking and visualizing IPO base setups. You’ll also learn how the #J_Curve was created in 2022 and how it marked a breakthrough from conventional bases - allowing…

Inside the #TMWorkshop | The early edge in IPO bases Link - youtu.be/R2tH6IoF4x8 Everyone's trading IPO bases now. But the real edge isn't in just spotting them. It's getting in early, right when momentum starts. In this video, @swing_ka_sultan breaks down recent IPO setups…

youtube.com

YouTube

Inside the #TMWorkshop | The early edge in IPO bases #bikaji and...

I got AIR 817 in NEET PG 2025. Here’s my brutally honest take on the resources & best teachers for each subject. Not just names — but what worked, what didn’t. 🧵

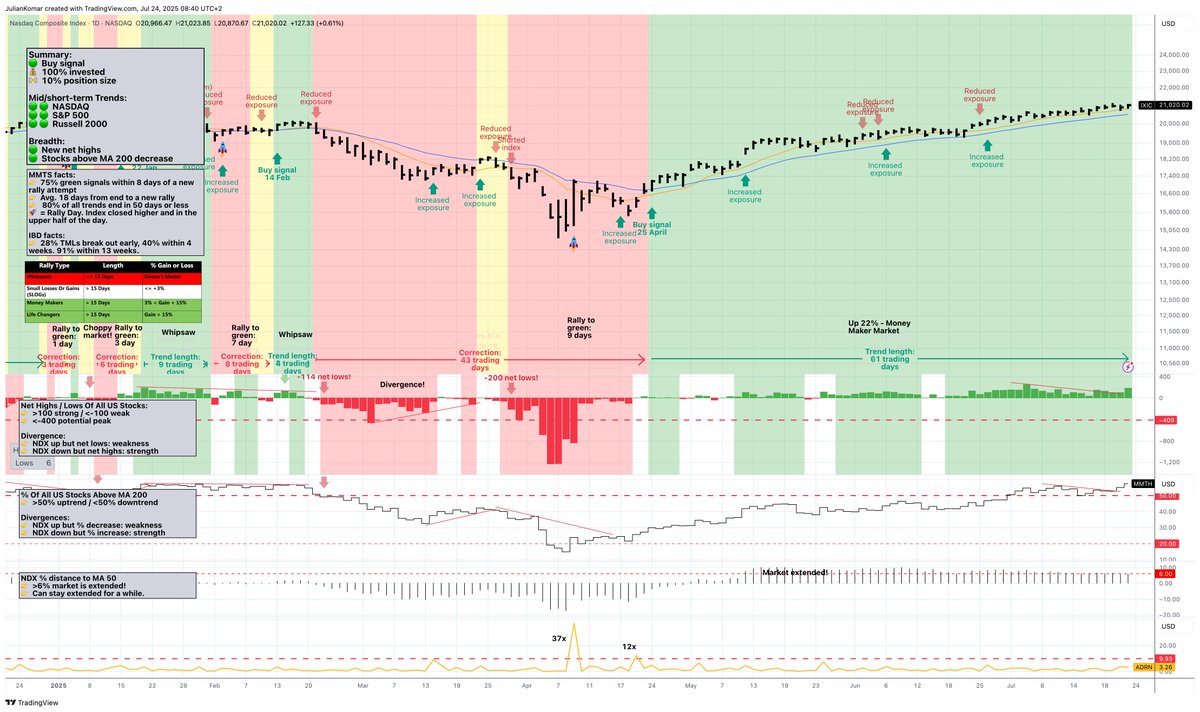

We've spent the last 10 months analyzing EVERY single tariff development: Here's the EXACT playbook for investors. 1. Trump puts out cryptic post on tariffs coming for a specific country or sector, markets drift lower 2. Trump announces large tariff rate (50%+) and markets…

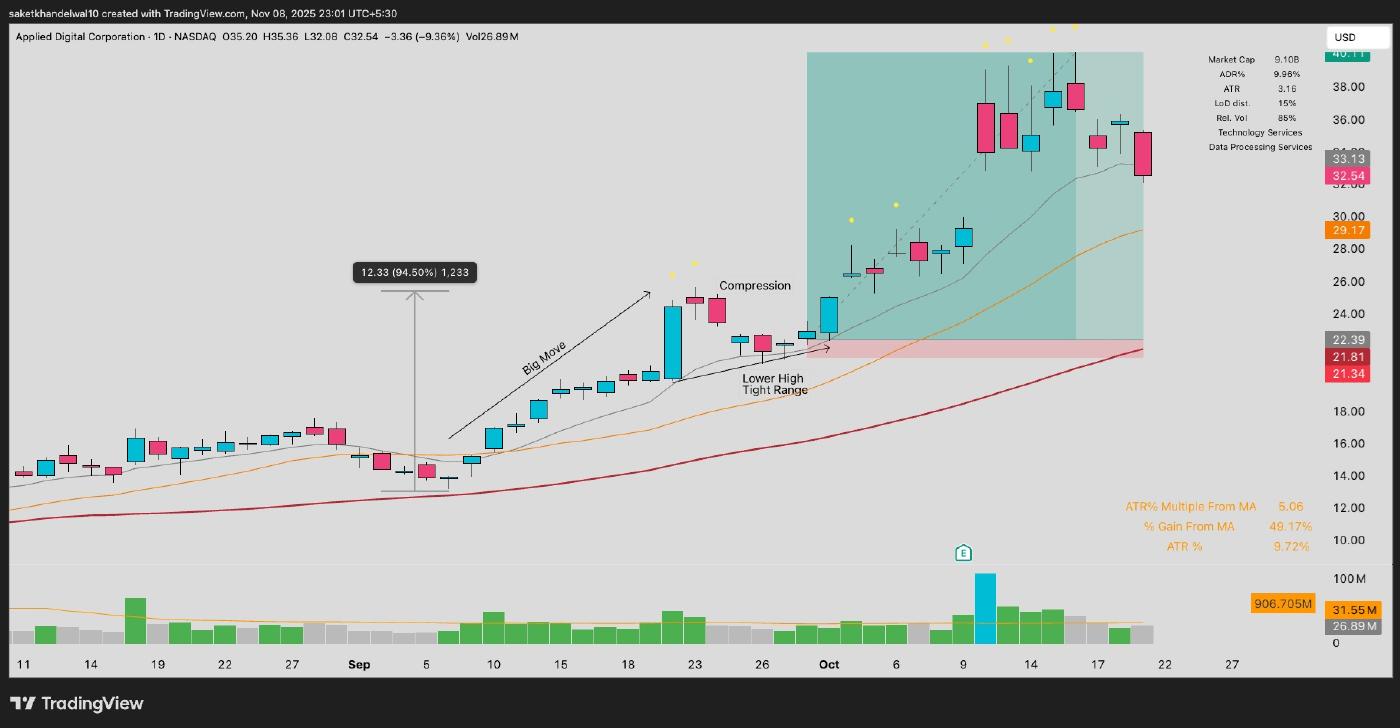

The depth of a base (flag/ 2t vcp) which occurs during an expansions range somewhere between 8-12% (for flags) or 14-16% (for vcp) which generally drifts towards 10-20 EMAs. When market turns bad suddenly and your already winning stock starts to crack this is the drawdown you…

#OperationSindoor on the games field. Outcome is the same - India wins! Congrats to our cricketers.

📑Bookmark and watch these 3 videos to up your game. You don't need anything more on stock selection. IPOs (Level : Beginner) youtube.com/watch?v=YC-D2z… Winners emerging from bear markets (Level : Beginner/ Intermediate) youtube.com/watch?v=mng4jM… Themes (Level : Intermediate)…

youtube.com

YouTube

How to Deep dive Winners stocks

This took me 5 years to learn. Cost me over 100R in losses. If you're cutting trades early to "save money," you're making the same expensive mistake I did. Stop before it's too late. [A thread] 🧵

![AnkurPatel59's tweet image. This took me 5 years to learn.

Cost me over 100R in losses.

If you're cutting trades early to "save money," you're making the same expensive mistake I did.

Stop before it's too late.

[A thread] 🧵](https://pbs.twimg.com/media/Gw2sNdHXwAA557J.jpg)

My Best YouTube Videos 👇 📌Market Analysis - x.com/stocksgeeks/st… 📌IPO Analysis - x.com/stocksgeeks/st… 📌Stock Analysis - x.com/stocksgeeks/st… If you truly understand these, you will never need any other learning content to become a great equity swing trader.

HOW TO CATCH #UPPERCIRCUIT STOCKS 📌 Analyze Base Strength 📌 What is the Readiness of a Setup 📌 Nature of a stock 📌 X-Factor 📌 Use Market Health for Sizing Higher 📌 Intraday Rules to Follow 📌 Intraday Deep Dives 📌 MAZDOCK Historical Deep Dive youtu.be/_OEjobCmsdU?si…

youtube.com

YouTube

Trading System Part 3 - How To Catch Upper Circuit Stocks

This is all you really need to succeed in stock trading 💪👇 (But most traders skip the hard part) 1. Market Trend Model: Know when to be aggressive — and when to stay out. 2. Stock Selection: Pick stocks that can move 50–100% in the right market. 3. Setup: Flags, flat bases,…

That's why only a few create real wealth, while most just dream of it. Wealth is built through a decent portfolio size, high allocation, and catching large moves—and doing it consistently. Most people are too afraid to invest in their trading, even when they can. That’s because…

its indeed a great trade but managing profit from 13 to 3% is needs tremendous discipline with such a huge numbers

As is often the case, uncertainty breeds opportunity — especially in high-quality stocks forming constructive bases aligned with our Leadership Profile. But opportunity alone means nothing without patience, discipline, and a relentless commitment to strategy and process. Not…

Traders who truly thrive aren’t just reactive, they’re relational. They don’t merely see price. They see transitions. They recognize the flow of power shifting hands and step in where others hesitate. They don’t wait for 100 people to confirm their bias. If your comfort in…

With all due respect to @Qullamaggie and his achievements, I see @markminervini’s work on #VCP as a true revolution in the trading world. This interpretation feels overly simplistic and lacks the depth and substance the concept deserves. To truly understand the contribution of…

Qullamaggie speaks on Minervini VCP Pattern vs. Higher Lows "VCP pattern. It’s another name for tightening range. You know what it stands for: volatility constriction pattern. I call it higher lows and just tightening. This is what Mark Minervini does. Look at the first…

High ADR + Liquidity Rush + MA Undercut + VCP 3T + Double/Triple Cheat Entry is the recipe for growing Small Accounts. You don't need anything else!

If you want to build real wealth, focus on four key principles: 1) Skin in the Game – You must have capital invested. If your portfolio isn’t well-funded yet, put every rupee you can save early in your career. Without skin in the game, you won’t develop conviction—and without…

You don’t need to chase every breakout you see each day. Once you're in and it starts working, focus on holding your winners for larger gains. It took a mindset shift for me, but I follow the same approach now and that’s probably because of you. Thanks, Chirag Sir...

United States Trends

- 1. Purdy 20.2K posts

- 2. #WWERaw 34.4K posts

- 3. Panthers 26.7K posts

- 4. Mac Jones 3,939 posts

- 5. 49ers 28.7K posts

- 6. Jaycee Horn 1,621 posts

- 7. Gunther 11.2K posts

- 8. Melo 16.6K posts

- 9. #KeepPounding 4,283 posts

- 10. #FTTB 3,849 posts

- 11. Canales 9,981 posts

- 12. Niners 4,049 posts

- 13. #RawOnNetflix 1,359 posts

- 14. #MondayNightFootball N/A

- 15. Kittle 2,962 posts

- 16. Syracuse 6,579 posts

- 17. Mark Kelly 152K posts

- 18. Joe Buck N/A

- 19. Comey 216K posts

- 20. 3 INTs 1,964 posts

Something went wrong.

Something went wrong.