Auto M&A Guys

@automnaguys

Investment Bankers at FOCUS Investment Banking serving the automotive aftermarket | Tires | Collision | Distribution | Parts | HD | Accessories and more

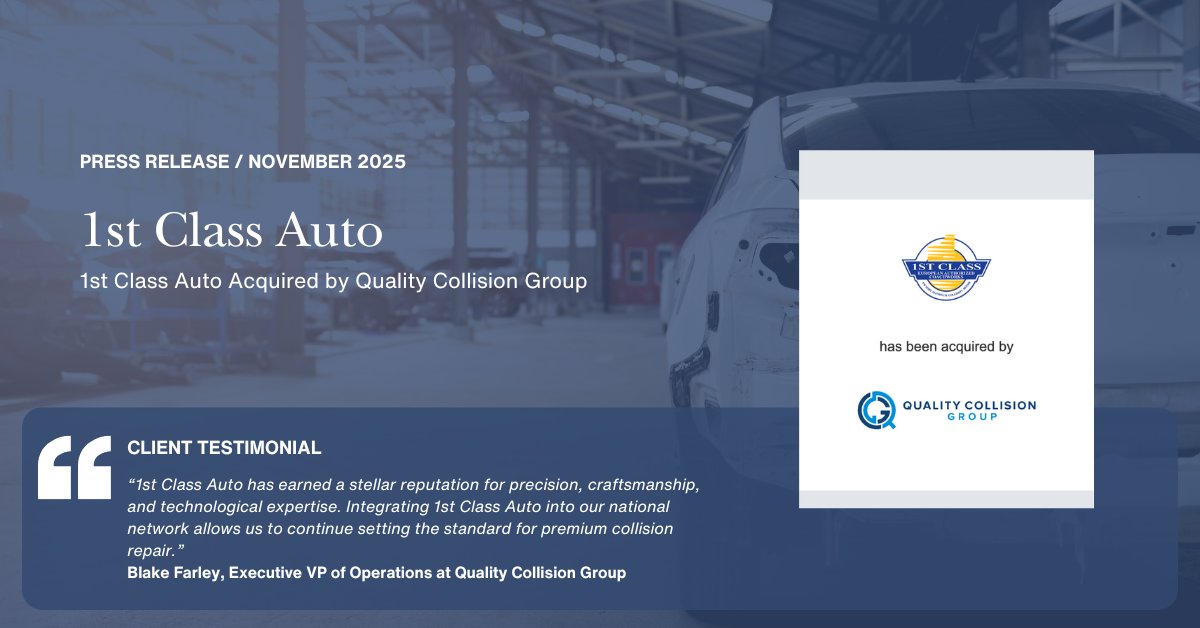

FOCUS Investment Banking Advises 1st Class Auto on Sale to Quality Collision Group We are proud to have served as the exclusive financial advisor to 1st Class Auto in its sale to Quality Collision Group (QCG), marking QCG’s expansion into Florida as its 13th state. Based in…

Navigating M&A: When direct talks derail deals Entrepreneurs, have you ever bypassed your advisors in a deal? In the high stakes world of mergers and acquisitions, direct negotiations between buyers and sellers can foster chemistry and expedite the process. However, they can…

FOCUS Investment Banking’s Legal Industry M&A Advisory team has decades of experience guiding Am Law 100 and 200 firms through the acquisition of practice groups, and full-firm mergers. Beyond traditional firms, the Alternative Legal Services Provider (ALSP) market — now a $28.5…

Investors seek more than just your financial metrics The real value? Your qualitative story Financials are the picture of today and yesterday. The qualitative story tells the future Where have you been and what can you achieve? Focus on painting a picture not just for now…

“Should I sell to a strategic or a PE firm?” I get this question all the time, and the answer isn’t one-size-fits-all. Both can lead to a solid exit. But the experience, deal structure, and what comes after? Totally different. Here’s how it breaks down: ❗Strategic Buyers…

Great businesses don’t chase buyers. The best time to sell your business isn’t when you get your first good offer. It’s when you’re holding the leverage. Buyers aren’t just buying what you’ve built today. They’re buying the momentum, the consistency, and the relationships that…

The human side of business acquisitions is critical. Employees can make or break a transition. From staggered announcements to clean slates, every strategy has risks. Empathy + decisiveness = success. We've come across three options for employee transitions: Option 1:…

Tire & auto owners: we’re grinders, desk bound, scarfing fast food, always on. I’ve done it too and happens to me even now. But low energy & tight pants hurt more than your body, they dull your business edge. I’ve seen clients sell due to health crises. Don’t let that be you. A…

Tire & auto owners: we’re grinders, desk bound, scarfing fast food, always on. I’ve done it too and happens to me even now. But low energy & tight pants hurt more than your body, they dull your business edge. I’ve seen clients sell due to health crises. Don’t let that be you. A…

Don't just build for today. Build for the day you're ready to exit and make sure nothing silently eats away at the value you've worked so hard to create moderntiredealer.com/operations/art…

What’s Hurting Your Business Value? Everyone talks about the things that increase business value, but what about the hidden deal-killers that can quietly scare buyers away? From customer concentration and owner dependency to outdated facilities, sloppy books, and weak brand…

In this episode of the Collision Vision driven by @autobodynews, Cole Strandberg chats with Jay Goninen. During this discussion, they zoom out for a high-level look at the current state of the industry: technician shortages, economic slowdowns, generational shifts, and how…

Listen to our latest podcast with @HunterEngCo

Thinking about bringing alignments or ADAS in-house? On The Collision Vision Podcast, Bill Keyes of @HunterEngCo breaks down ROI, financing, and how the right equipment fuels shop growth. Watch here: youtu.be/GO_9vsV9KmQ?si…

Anyone on here looking at distressed opportunities? Send a DM!

In this episode of the Collision Vision driven by @autobodynews, Cole Strandberg sits down with Greg Peters, the CEO of Car ADAS Solutions, a company at the forefront of licensing and supporting dedicated ADAS calibration facilities across the country. Greg and his team are…

Sell your company without walking away. Private equity loves minority rollovers and many times requires it. Sell 100%, then reinvest 30% back to ride the next growth wave. The Second exit can multiply your first win. Although you’ll have less control, you’ll have leveraged…

Owner dependence is one of the most common (and costly) killers of valuation. I see it all the time. The founder is the rainmaker, the decision-maker, the glue holding everything together. Impressive? Absolutely. But to a buyer, that’s a big risk. If your business can’t…

United States Trends

- 1. #ALLOCATION 217K posts

- 2. The BIGGЕST 456K posts

- 3. #JUPITER 217K posts

- 4. #GMMTVxTPDA2025 565K posts

- 5. Good Tuesday 28K posts

- 6. #GivingTuesday 8,818 posts

- 7. Kanata 24.1K posts

- 8. rUSD N/A

- 9. #AreYouSure2 52K posts

- 10. JOSSGAWIN AT TPDA2025 82.3K posts

- 11. JIMMYSEA TPDA AWARD 2025 60.7K posts

- 12. Snow Day 7,580 posts

- 13. Dart 39K posts

- 14. Costco 29K posts

- 15. Lakers 49.4K posts

- 16. Bron 26.6K posts

- 17. Hololive 16.3K posts

- 18. Dillon Brooks 8,188 posts

- 19. Pentagon 56.2K posts

- 20. Penny 23.1K posts

Something went wrong.

Something went wrong.