Jim Biancos

@bianc0search

Macro investment research at http://biancoresearch.com Our total return index is at http://biancoadvisors.com the ETF WTBN tracks our index. biancoresearch.eth

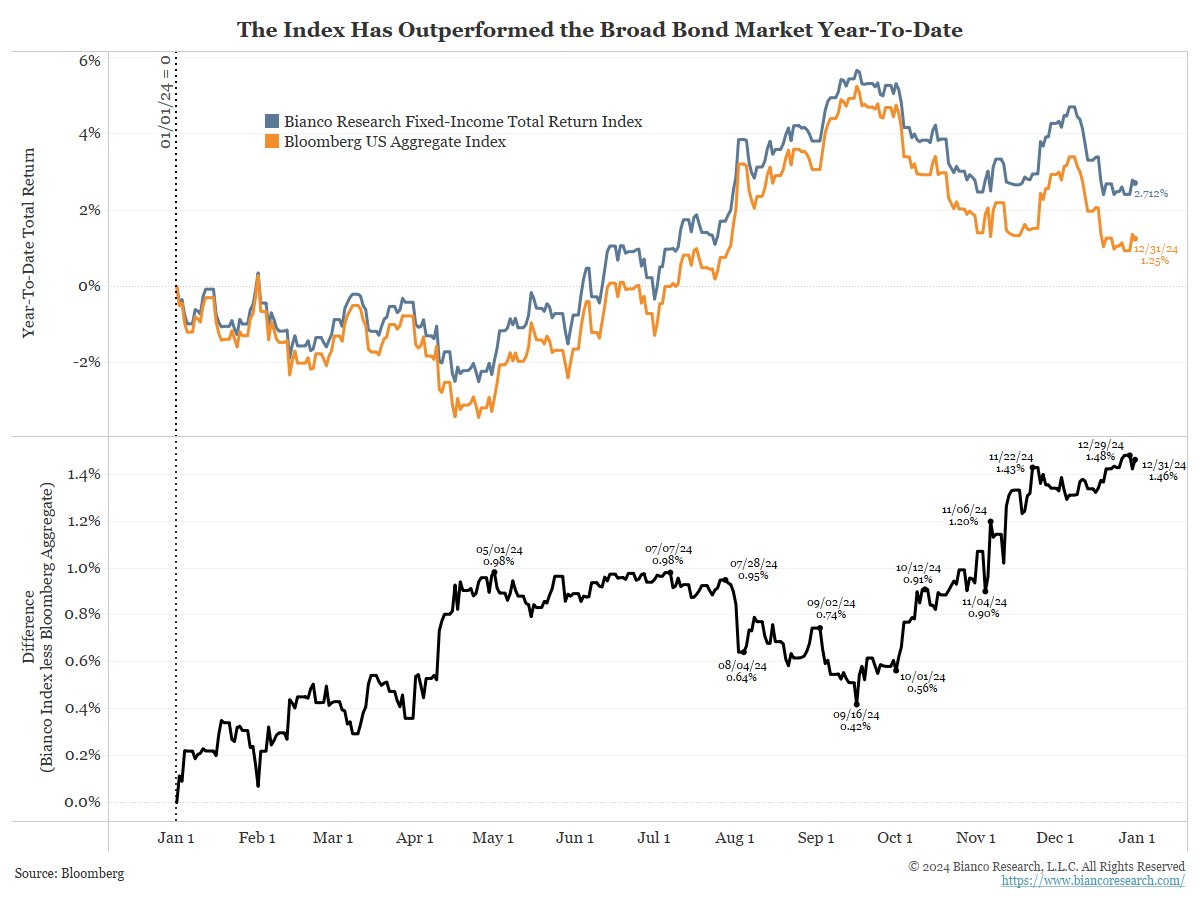

What I Learned in My First Year Managing Fixed-Income * Performance Review * ETFs Are Eating the World * Actively Managed Bond Funds Work! * Investing Is More Than Momentum * Valuations Always Matter * Bonds Are No Longer Crash Insurance biancoadvisors.com/what-i-learned…

We just updated our tariff paper. We now assign products to precise HS-10 codes—replacing the older COICOP-HS mapping—and extend the price data through June 12. Imported prices are up ~3% since early March, a modest increase given the scale of announced tariffs. Most of the…

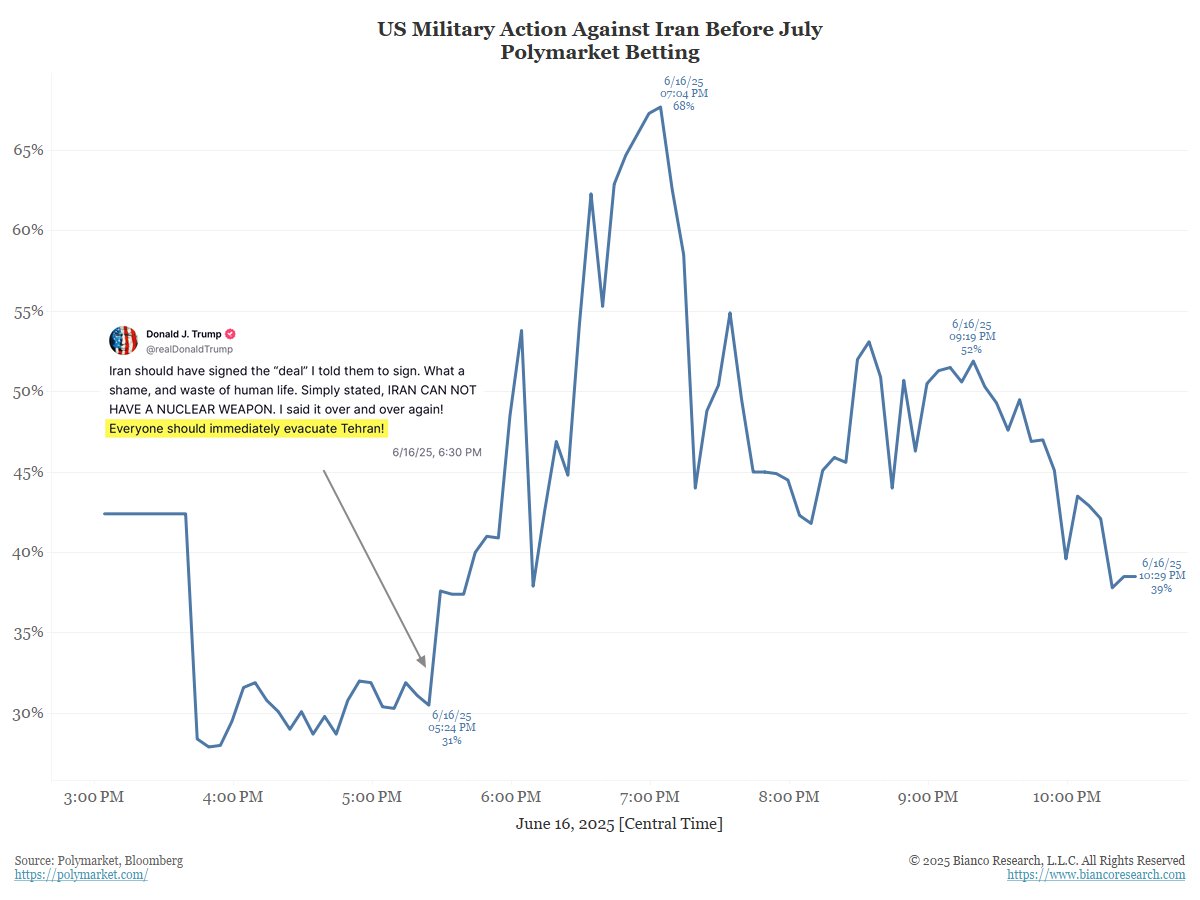

Trump is giving Iran an ultimatum: cut a deal now, or he will provide Israel with bunker buster bombs. This story has deflated the betting that the US will enter the War.

🚨🇺🇸🇮🇷The White House is discussing with Iran the possibility of a meeting this week between U.S. envoy Steve Witkoff and Iranian Foreign Minister Abbas Araghchi, according to four sources briefed on the issue. @MarcACaputo and I report for @axios axios.com/2025/06/17/tru…

The "truth" below shot up expectations that the US would enter this war, as indicated by this chart. Right now, the reason is unclear.

FOX: TRUMP REQUESTS NSC BE PREPARED IN SITUATION ROOM

S&P futures are trading now and have given back half of today's gains. Trump's "truth" is being looked at as a warning that "something big" is about to happen.

*TRUMP TO RETURN TO WASHINGTON TONIGHT, WHITE HOUSE SAYS (He is in Banff, Canada, for the G7 meeting now. So, whatever it is must be big to get him to immediately leave.)

Trump stated on Truth Social that Iran should’ve signed the deal he offered to them, calling it a “shame” and “waste of human life” that they didn’t. “Everyone should immediately evacuate Tehran!” Follow: @AFpost

1/2 Market signals about the progress of the Iran-Israel war... The Israeli Shekel strengthened against the dollar by the most in 28 years (bottom panel). It is also STRONGER now than it was on June 12.

2/2 Second ... Friday, June 13, was the holiday of Shavuot, and the Israeli market was closed.. Today, the Tel Aviv 35 stock index (35 largest Israeli stocks) rose 1.82% to a new all-time high. Israeli stock investors NEVER lost money over this attack.

As this thread detailed, the market was NOT viewing Israel/Iran as the start of WW III. It was correct to do so.

1/8 Why are we not seeing a "flight-to-quality" into the dollar? Why are bond yields rising? The answer, I believe, is the markets are NOT viewing Israel/Iran as a safe haven event, but rather a crude oil supply shock story. IOW, this is NOT viewed as the start of WW III. 🧵

How has college enrollment changed over the past year in your state?

How does the Strait of Hormuz “close?” Insurance rates. The P&I (Protection and Indemnity) clubs that offer marine insurance will set the coverage rates and the shippers will have to decide of it is worth the risk. It never really closes, it’s about the all-in price to ship.

Closing Hormuz is not as much a factor in Iran launching attacks on ships. Instead, it is how shipping companies and insurance companies react. 1️⃣ We have the ongoing example of the Houthis in the Red Sea. Over a hundred ships have been attacked; two have been sunk and four…

Also … modern P&I (Marine) shipping insurance traces back to the 16th century in Italy (Genoa). Through The last ~400 years, these rates have been the motivating factors for send the marines to the Barbary Coast (“The shores of Tripoli”) around 1800 to fight piracy, to the…

Closing Hormuz is not as much a factor in Iran launching attacks on ships. Instead, it is how shipping companies and insurance companies react. 1️⃣ We have the ongoing example of the Houthis in the Red Sea. Over a hundred ships have been attacked; two have been sunk and four…

Lots of reactions "Iran doesn't have the means to close Hormuz"... If you understand shipping, you know that that's not the question you need to ask. The question you need to ask is : "Can Iran convince maritime insurers that the insurance risk is high enough" And if so, will the…

More energy related news this weekend.

Steep losses in markets in the Middle East this Sunday, losses of around 3-6% in main board benchmarks

1/8 Why are we not seeing a "flight-to-quality" into the dollar? Why are bond yields rising? The answer, I believe, is the markets are NOT viewing Israel/Iran as a safe haven event, but rather a crude oil supply shock story. IOW, this is NOT viewed as the start of WW III. 🧵

Dollar’s Tepid Rebound Reinforces Questions Around Haven Role finance.yahoo.com/news/dollar-ha…

7/8 Given this, the yield move higher makes sense, it was the expected reaction to higher energy prices leading to greater inflation fears.

8/8 Summary Market moves yesterday were not about WW III. They were the expected reaction to a crude oil supply shock. In the coming days we'll see if this narrative changes. Until then there will be no shortage of these guys

United States 트렌드

- 1. Jets 101K posts

- 2. Justin Fields 19.1K posts

- 3. Broncos 42.5K posts

- 4. Drake Maye 7,137 posts

- 5. Aaron Glenn 7,852 posts

- 6. George Pickens 2,741 posts

- 7. London 209K posts

- 8. Sean Payton 3,516 posts

- 9. Tyler Warren 1,898 posts

- 10. Cooper Rush 1,224 posts

- 11. Jerry Jeudy N/A

- 12. Garrett Wilson 4,722 posts

- 13. Steelers 29.1K posts

- 14. TMac N/A

- 15. Bo Nix 4,749 posts

- 16. #Pandu N/A

- 17. Pop Douglas 1,476 posts

- 18. Karty 1,546 posts

- 19. #Patriots 2,768 posts

- 20. Tyrod 2,595 posts

Something went wrong.

Something went wrong.