Jim Bianco private

@biancoresaerrch

Macro investment research at http://biancoresearch.com Our total return index is at http://biancoadvisors.com The ETF WTBN tracks our Index. biancoresearch.eth

You might like

Trump on a possible AI bubble: So everyone wants it. Yeah. I mean, the only problem is if you don’t get it. -- So, the real AI bubble is pessimism about AI leading to not owning enough of it? AI stocks are already at a record concentration for one theme, 48% of the S&P 500.

Reporter: Could I ask you — some experts warn about an AI bubble. Are you concerned? Trump: What’s the AI problem? Reporter: Some experts say that some investors are overreacting. Trump: Everybody wants AI because it’s the new internet. It’s the new everything. It’s one of the…

1/3 An Inflation concern? This measure bottomed a few days after "Liberation Day" (vertical dotted line)and has been accelerating higher, especially over the last month. @truflation

3/3 ~20% of core inflation is Goods ~40% of core inflation is Services ~40% of Core Inflation is Shelter Goods inflation orange) should continue bending higher, per @truflation above. The trends in housing and shelter inflation have not been bending down fast enough to offset…

AI mania is the only game in town as the real economy sinks. Great chart from @WarrenPies highlighting the recent divergence.

When Powell said that a December cut was not a "foregone conclusion," he looked down and read it off a script. It was a deliberate message and not an off-the-cuff remark. This updated chart says the market noted this. December cut probability was 95% yesterday; now, 62%.

*POWELL: RATE CUT IN DECEMBER IS 'FAR FROM' FOREGONE CONCLUSION Markets are selling off on this statement

Trump/Xi starting in 10 minutes. Potential market moving news coming overnight.

As highlighted on the chart below, the 10-year yield has been in a down channel since hitting 4.62% on May 22. If Gross is correct (repost below) and the 10-year yield rises to 4.25% in the short-term, it will exceed its 4.20% "lower high" in late September and mark the first…

10 year Treasury has seen its best days as well. 4.25 short term target.

1/5 JP Morgan has identified 41 AI-related stocks, 8% of the S&P 500. These stocks now account for 47% of the Index's market capitalization, a new record. The other 459 stocks, 92% of the S&P 500, are 53% of the Index's market capitalization.

1/2 I'm a big fan of @2waytvapp. They have shown time and again that they understand the vibe and thinking in DC. They offered a different opinion from the repost story below. As they see it, the "horserace" to replace Powell (in order): 1. Scott Bessent 2. Kevin Hassett 3.…

The atypically public vetting process for Trump’s Fed chair selection is officially down to five (as reported earlier by CNBC’s Steve Liesman): Bowman, Hassett, Rieder, Waller and Warsh. This contest so far appears to have accomplished two goals: Slowing down something that…

2/2 I would argue that the betting market is telling us what I described above. The chart below shows @Polymarket betting market for which of the "final five" will be the Fed Chairman. --- The leader, Kevin Hassett, is the only person Trump really knows (other than Kevin Warsh,…

*SPOT GOLD SLUMPS BELOW $4,000 AN OUNCE AS SELLOFF DEEPENS

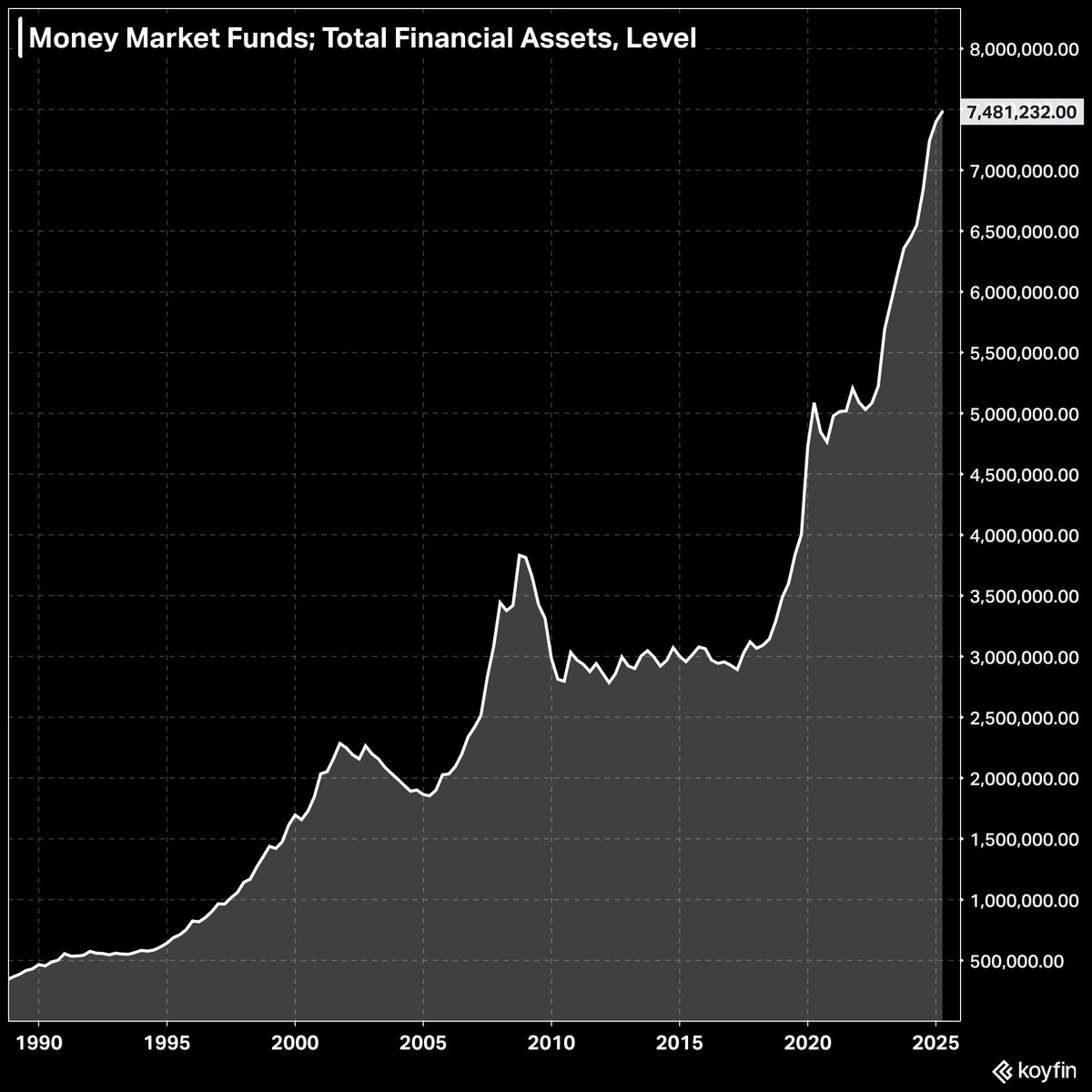

Why isn’t this money leaving the sidelines as seemingly everybody constantly predicts. The Fed started cutting rates 14 months ago. What are they getting wrong?

There is a record $7.48 trillion in money market funds right now.

Here is my answer ... MM funds are the recipient of FOMO money from bank accounts offering 0%. And these people are thrilled they are getting 4%, from 0%. MM funds are not the source of FOMO money into stocks/crypto. MAYBE short-duration bond funds, but not much more. This…

1/2 The Trump Administration is getting tough with Russia to end the Ukraine war: *US TARGETS ROSNEFT, LUKOIL IN LATEST ROUND OF RUSSIA SANCTIONS The oil market is reacting: *OIL JUMPS AS MUCH AS 2.5% AT OPEN AS US SANCTIONS RUSSIAN FIRMS

🛢️Sanctions on Russia! Jim Bianco (@biancoresearch) has an opinion... The Only Sanction That Hurts: Jim Bianco on Russia, Oil & Global Market Fallout ▶️ youtu.be/_kuZOo-aHKM?si… #Russia #Breaking #Sanctions #Ukraine #News #Media | @TMSchoenberger | @XCheckMedia

Mid-year update We review the performance of the Bianco Research Total Return Index and the ETF that tracks it, the WisdomTree Bianco Fund (WTBN). Also, the fair value of bonds and why Trump's demand that the Fed cut rates can lead to higher LT yields. biancoadvisors.com/2025-mid-year-…

Crash of correction? *SPOT GOLD FALLS 6.3% IN BIGGEST ONE-DAY DROP SINCE APRIL 2013

Crash or correction? *SPOT SILVER FALLS AS MUCH AS 8.7% IN BIGGEST DROP SINCE 2021

Among several U.S. and international asset classes tracked (including stocks, bonds, and precious metals), @biancoresearch notes that worst performer on a 6m basis is up by 2.26% ... rare to see that vs. history

1/5 Over the weekend I posted the thread below noting that liquidity was getting “worrisome.” On Thursday, SOFR was 4.30%, for a spread over IOR of 12 bps (the widest such spread since March 2020, not shown). (All this is explained in the reposted thread.)

1/6 Are Banks Having a Liquidity Problem? tl:dr, Liquidity in the plumbing of the financial system is getting scarce. It is not a crisis now, but it has been moving in this direction for weeks, and it is now at a worrisome point. When the financial plumbing gets stressed, it…

4/5 As noted above, SOFR is reported every morning for the previous day. Overnight general collateral Repo is a big part of the SOFR average reported every morning. But this metric can be plotted in real-time (that is, the last plot point is today). See the last SOFR/IOR bar,…

United States Trends

- 1. Penn State 16.8K posts

- 2. Mendoza 14.2K posts

- 3. Gus Johnson 3,303 posts

- 4. Omar Cooper 3,809 posts

- 5. #iufb 2,515 posts

- 6. Sunderland 140K posts

- 7. $SSHIB 1,484 posts

- 8. Jim Knowles N/A

- 9. James Franklin 5,802 posts

- 10. Texas Tech 11.6K posts

- 11. Arsenal 239K posts

- 12. Happy Valley 1,229 posts

- 13. WHAT A CATCH 9,180 posts

- 14. St. John 7,709 posts

- 15. Sayin 62.2K posts

- 16. Jeremiah Smith 2,281 posts

- 17. Charlie Becker N/A

- 18. CATCH OF THE YEAR 2,338 posts

- 19. #GoDawgs 4,324 posts

- 20. Raya 27.6K posts

You might like

-

HiLitr

HiLitr

@HiLitr_ -

Chumani

Chumani

@Chumani_Ngwatyu -

11:11 EP. OUT NOW!!!

11:11 EP. OUT NOW!!!

@MatebulaMpho -

siyanda mkhize

siyanda mkhize

@syanda_mkhizeh -

Khulekani

Khulekani

@swaznegger -

Simo

Simo

@simo_4u -

Flower child 💐

Flower child 💐

@mashelehasani -

LUIGI (305)🇿🇦

LUIGI (305)🇿🇦

@iamMtho_Ell -

NTOZABANTU🤘

NTOZABANTU🤘

@Sbulelo_Sbuda -

Titus not Tito

Titus not Tito

@Titus_not_Tito -

MA$T€R 🇿🇦 Tee™

MA$T€R 🇿🇦 Tee™

@Tumzaroo -

Ghost 🔴

Ghost 🔴

@K_Gaselebelwe -

Macs

Macs

@macs_moe -

Ntokozo Mbanjwa

Ntokozo Mbanjwa

@ntokozowise -

Sick boy

Sick boy

@marinegumeke

Something went wrong.

Something went wrong.

![Julius_S_Malema's profile picture. Commander in Chief of Economic Freedom Fighters [EFF] and a Revolutionary activist for radical change in Africa. No Facebook Account. fools get blocked](https://pbs.twimg.com/profile_images/1656278665708150784/nvnQIBaM.jpg)