“We are going to see a market comeback in Q1 of 2026. February and March will be a bull market again, based on a combination of macro indicators.” - Alice Liu, Head of Research at CMC, on market cycles

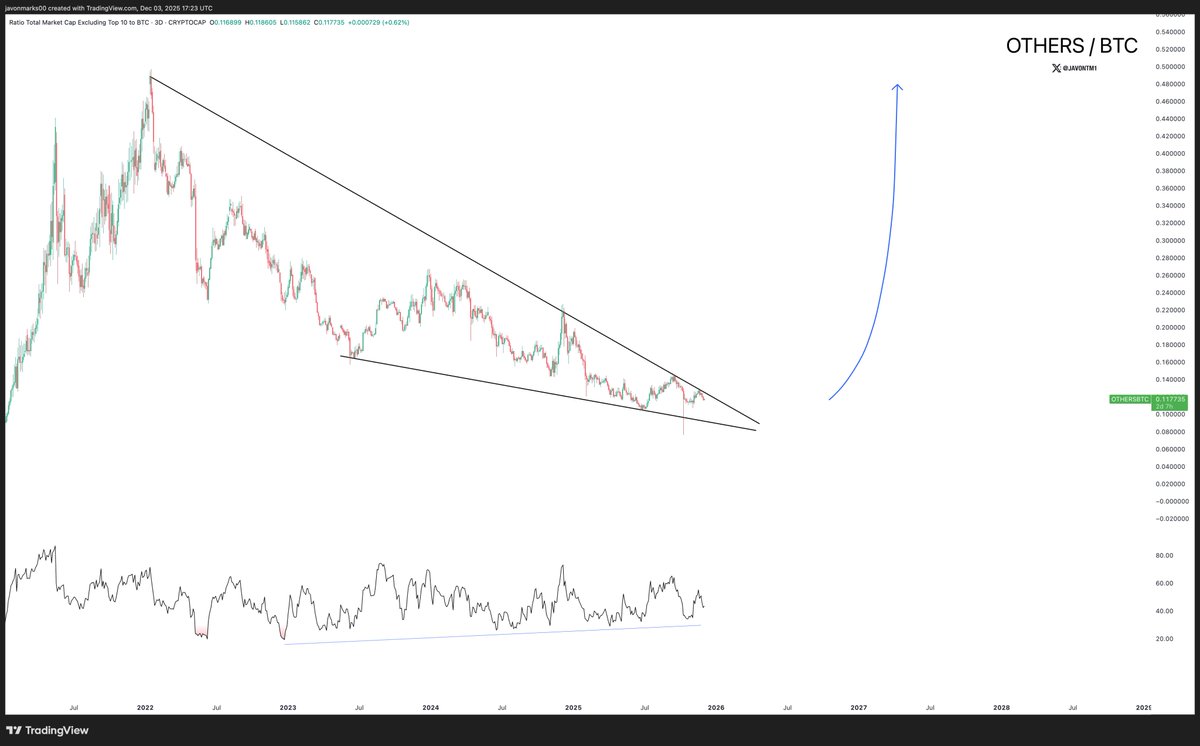

A beautiful falling wedge pattern in alts against Bitcoin and a beautiful bullish divergence with the RSI which is hinting at a bull breakout of the wedge pattern! $OTHERSBTC

Tom Lee predicts that #Bitcoin could hit new ATH in Jan 2026. Like if you agree. 🔥🔥🔥

President Trump effectively announces that Kevin Hassett will be the next Fed Chair. 2026 is going to be a wild year.

#BTC outlook for the rest of 2025! #Bitcoin Currently, we're waiting to reach the ~$87.9k resistance (red .5 fib) but its getting stuck under the price MA... I think it just needs a little time. Remember, during this retrace up, I'm prepared for it to go as high as $89k. We…

IMO: This marks the B O T T O M I S I N

Breaking: Vanguard's Shift on Crypto: Confirmation and Details - cleints can access Crypto ETFs from TOMORROW. @Bloomberg is reporting that @Vanguard_Group, the world's second-largest asset manager with over $10 trillion in assets under management, will begin allowing its U.S.…

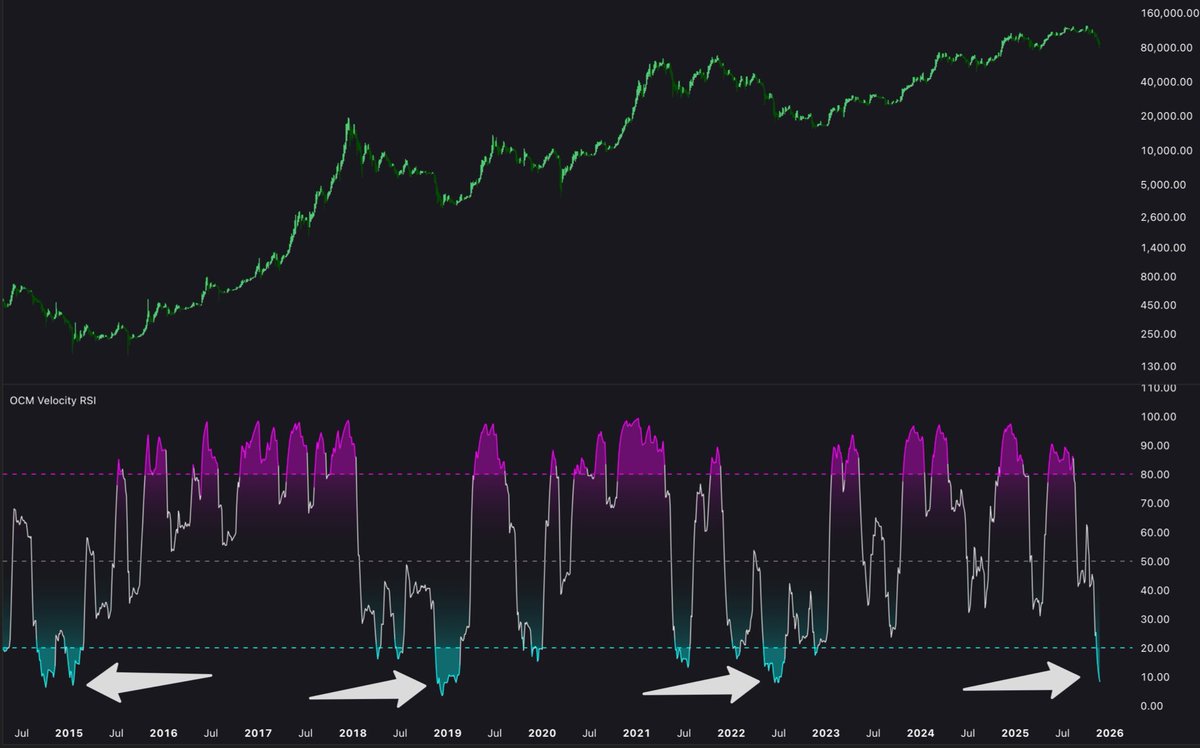

The Velocity RSI on the 3-day chart has just hit its lowest reading since the bottoms of the last 3 bear markets. It’s one of the more reliable, widely-tracked momentum exhaustion indicators, and it’s now flashing a level we only see at major cyclical resets. An interesting…

BTC.D (5D) vs OTHERS - most traders are misreading this phase. The Gaussian Channel on the 5-day just flipped from green → red after almost 1,000 days of expansion. Last cycle, this happened twice. First flip in May 2020: BTC.D dropped into the 58% zone, printed a local…

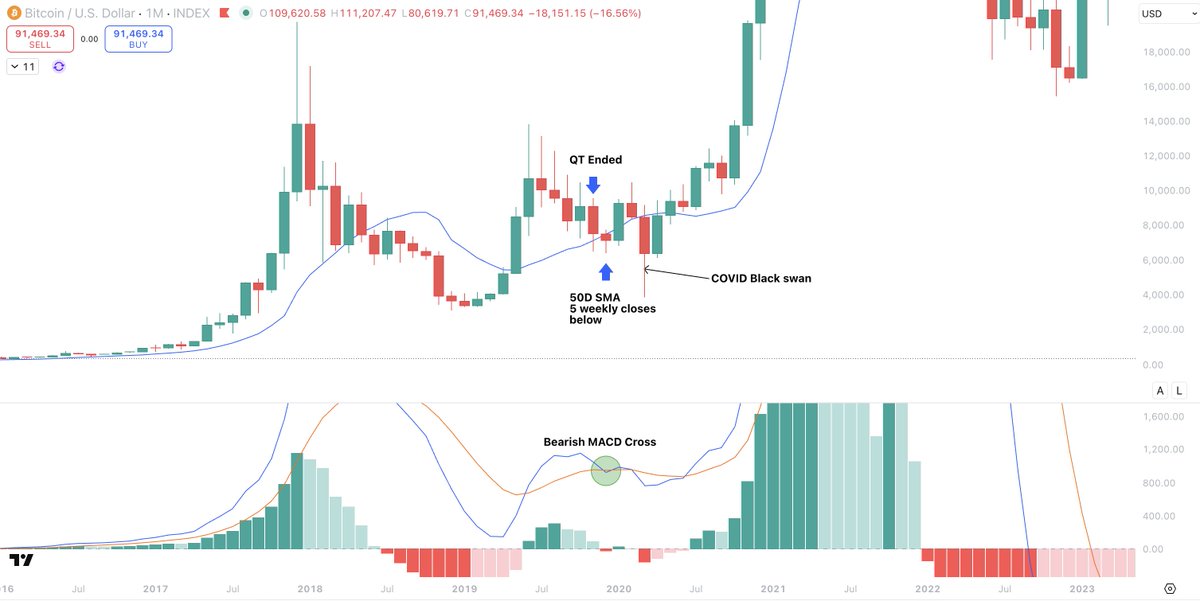

You are going to see this shared a lot. There will be a very high number of accounts posting this like robots... "1M MACD crossed bearish + multiple closes under 50SMA, every time that happened it means the cycle is over" But it's not true. I've been saying to you all for a…

$NEAR is just accumulating, and was ready to break upwards. NEAR Intents has accelerated massively with its revenue and interest. Therefore, the mispricing between the price of the $NEAR token and the amount of fundamental growth is significant. Both the USD and BTC…

$BTC.D – The #1 trigger for altseason 👇 Every cycle… the same thing happens. And we’re right back at the spot where it usually begins. Here’s the pattern: When BTC.D drops below 58%, it doesn’t “pull back” slowly… It falls off a cliff. That drop = massive rotation from BTC…

Most people don’t realize how tight @NEARProtocol real float is. ~46% of all $NEAR is staked. Out of ~1.51B circulating, only ~816M NEAR is actually liquid. That means every dollar of buy pressure hits a supply that’s smaller than Polygon, smaller than most L1s, and shrinking…

$NEAR is the one alt coin I am most bullish on chart analytic wise. In my opinion there are 3 bullish scenarios The most pessimistic would be +75% Base scenario would be +350% And my bullish scenario would be +1000% from current prices.

#NEAR Falling Wedge is complete✅ Also I like the small accumulating below the 0.382 fib level👌 Send it📈 1TP - 6.415$ 2TP - 11.000$ $NEAR

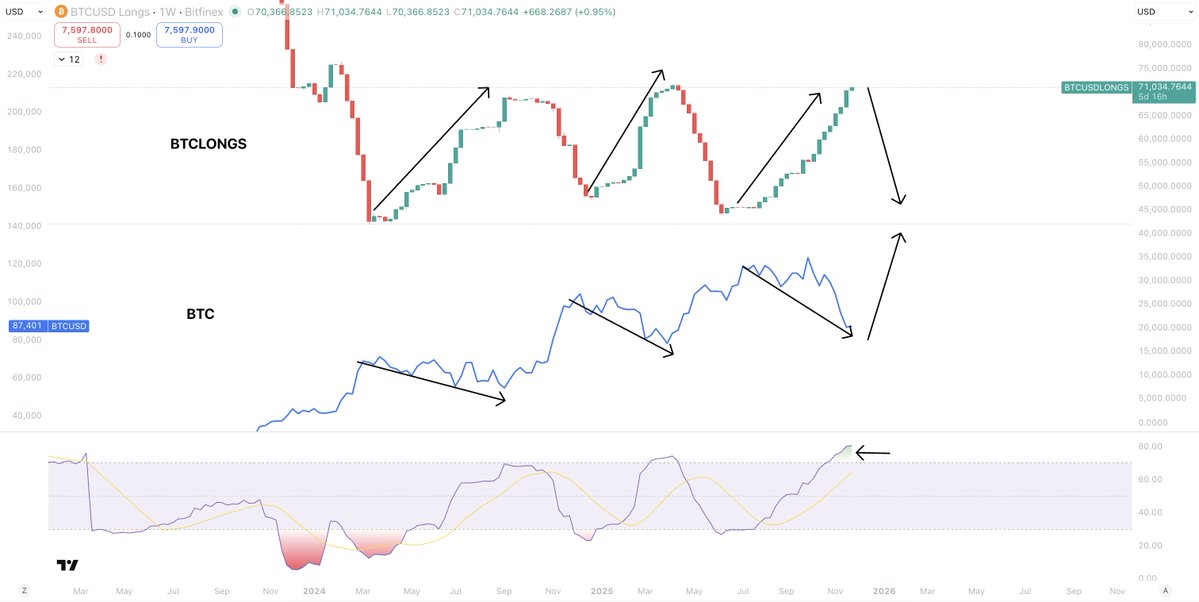

These whales have built MASSIVE longs. A pretty significant update on the Bitfinex OG Whales chart here. These chads have now built the most amount of longs throughout the entire period of this cycle. So much so, the RSI has entered very overbought levels. So far this cycle,…

$NEAR Double Bottom Complete + 3-Year Resistance Break – NEAR Is About to Go Nuclear! 🚀🔥 Pioneers, this is one of the CLEANEST setups in the entire market! NEAR just confirmed a massive Double Bottom (Bottom 1 → Bottom 2) at the multi-year support (~$1.50–$1.70) and is now…

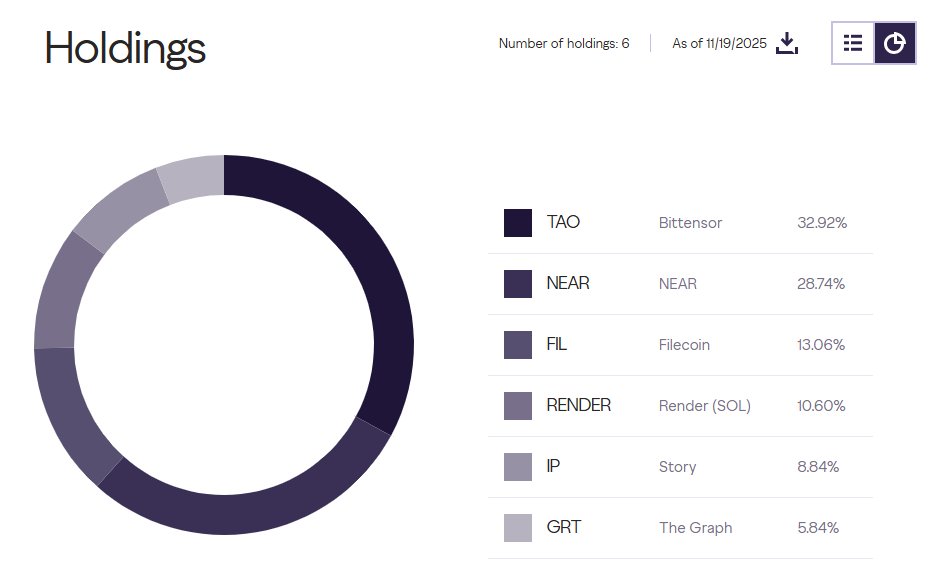

Grayscale continues to be bullish on $TAO & $NEAR allocating 61,66% of its Decentralized AI Fund to the 2 AI projects.

United States トレンド

- 1. #DMDCHARITY2025 746K posts

- 2. #TusksUp N/A

- 3. #AEWDynamite 20.9K posts

- 4. #TheChallenge41 2,221 posts

- 5. Diddy 75.4K posts

- 6. #Survivor49 2,905 posts

- 7. seokjin 158K posts

- 8. Earl Campbell 2,155 posts

- 9. Yeremi N/A

- 10. Free Tina 13.7K posts

- 11. Steve Cropper 6,524 posts

- 12. Jamal Murray 7,385 posts

- 13. Monkey Wards N/A

- 14. Milo 12.8K posts

- 15. Achilles 5,643 posts

- 16. Californians 6,702 posts

- 17. Ryan Nembhard 3,821 posts

- 18. fnaf 2 17.4K posts

- 19. Rizo N/A

- 20. Halle Berry 3,172 posts

Something went wrong.

Something went wrong.