🟠 Checkmate 🔑⚡☢️🛢️

@checkmatey_new

Helping navigate #Bitcoin's volatility Newsletter http://newsletter.checkonchain.com Onchain Analyst @_checkonchain Charting Suite http://charts.checkonchain.com

Personal Update: I am very proud to announce I'm launching the @_checkonchain Newsletter on Substack! After 6 years studying and educating folks on the power of #Bitcoin onchain data, it's time to put my skills to the test. Our first edition is live! checkonchain.substack.com 🧵

🚀 My book No Tenants, No Troubles: The Case for Digital Gold Over Real Estate is OUT NOW! 🪙 Bitcoin beats investment properties — faster, stronger, lighter, & sovereign. Love your home? Great! But for wealth, property’s trade-offs pale next to digital gold. Hardcopy will be…

In this must-watch interview, we sit down with the King of On-Chain Analysis, @_Checkmatey_! Check cuts through the noise on bitcoin's price action. We talk on-chain metrics, cycles and bitcoin treasuries. 📺Watch on YouTube: youtu.be/_mZqfx-Y3Q4 🕒Timestamps: 00:00 Cold…

👀🍽️Looking for a pre-game meal to warm up for @MSTRTrueNorth? Watch my video with @_Checkmatey_! We talk cycles, MSTR and on-chain analysis. x.com/TylerCompiler/…

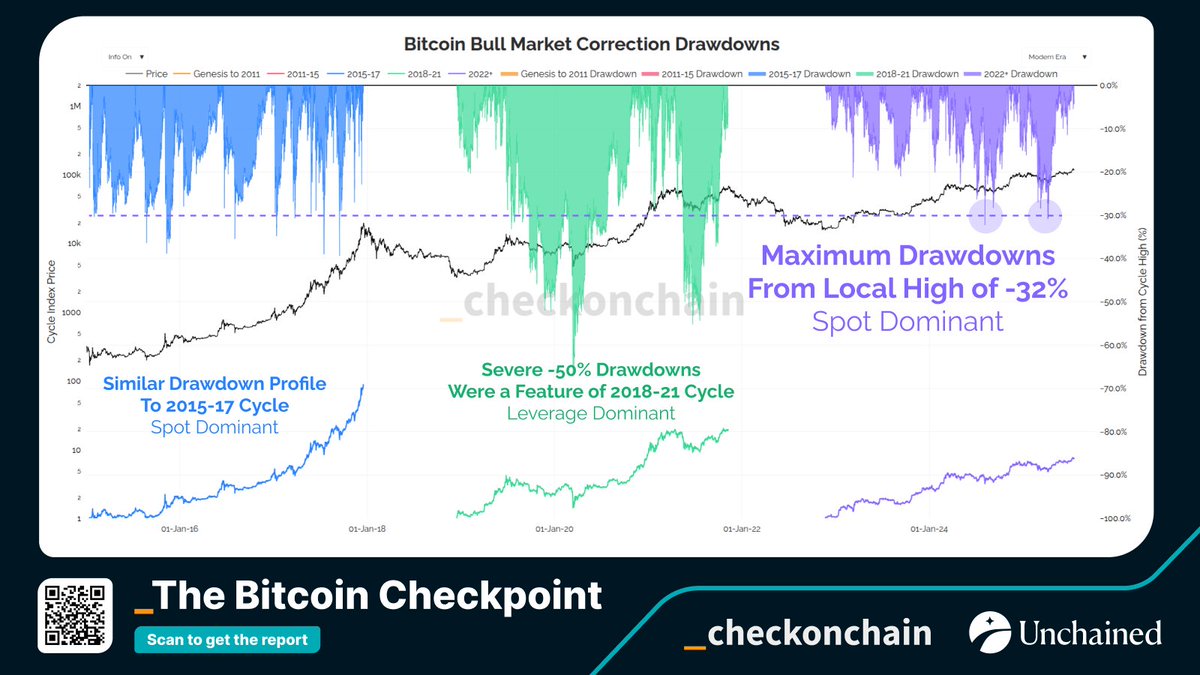

The deepest drawdown this cycle has been -32%, compared to -50%+ in prior cycles. Shallow corrections reflect a spot-driven market, where ETFs and Long-Term Investors steadily absorb supply. Get 43 full-page market insights in The Bitcoin Checkpoint Report by @checkonchain &…

If folks are still debating filters at the end of the next bear market, I think we should put Bitcoin down, to end the misery. The death of Bitcoin will be a result of rough consensus forming to quietly euthanise it, just to shut everyone up about fucking filters.

Honest truth, there has never been a more mundane, mind-numbing, and meaningless debate in the history of mankind, than the prevailing one about Bitcoin filter. Never. Guinness world record for the most boring, least productive group chat that has ever been, and ever will be.

I love sarcasm. It gets far too many people.

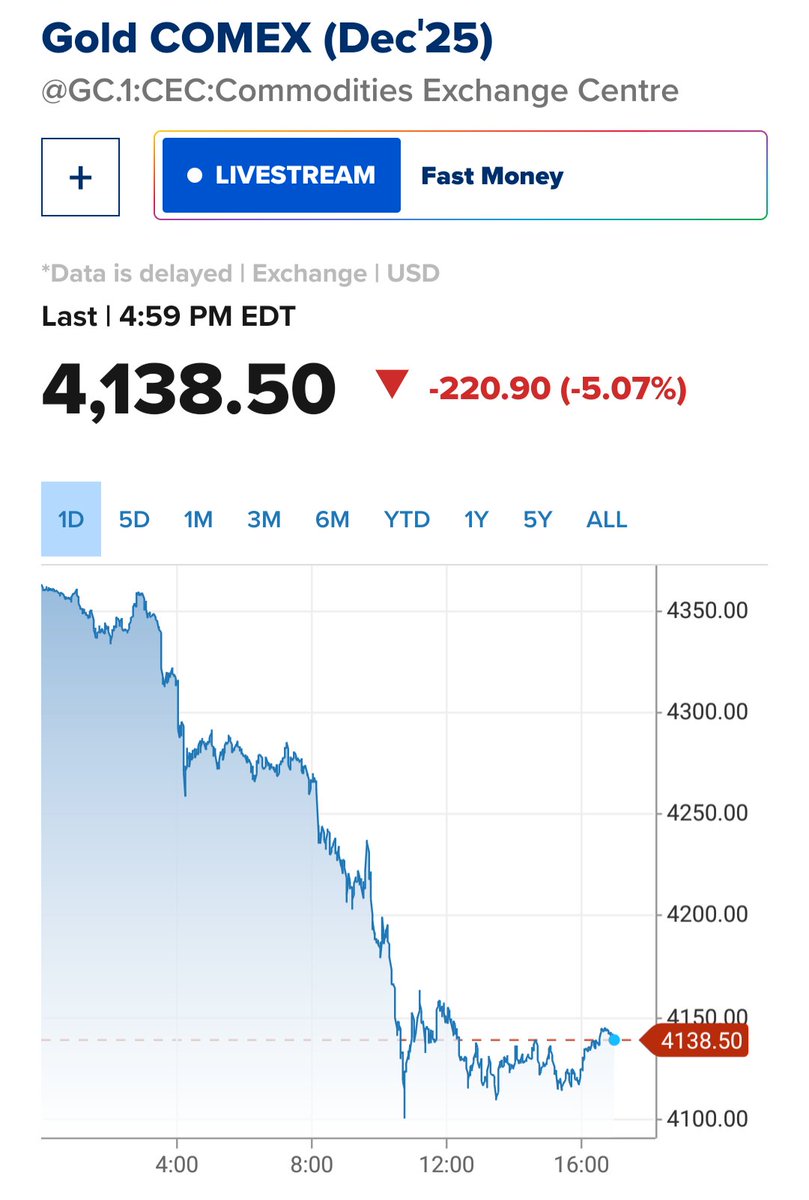

Gold and silver collectively destroyed trillions of dollars of market value held by all those poor retail investors lining up to buy it recently. I don't know how those metal-pumper crooks can look themselves in the mirror after fleecing these people of their hard earned savings

"STORE OF VALUE" "you can't use gold rocks as money! Imagine the cafe accepts your yellow rock and the next day it's worth 5% less! Gold will never be money!!"

Gold and silver collectively destroyed trillions of dollars of market value held by all those poor retail investors lining up to buy it recently. I don't know how those metal-pumper crooks can look themselves in the mirror after fleecing these people of their hard earned savings

...so when it doesn't die.. ...wat do?

Bitcoin is a 2.8% move away from October being a green month.

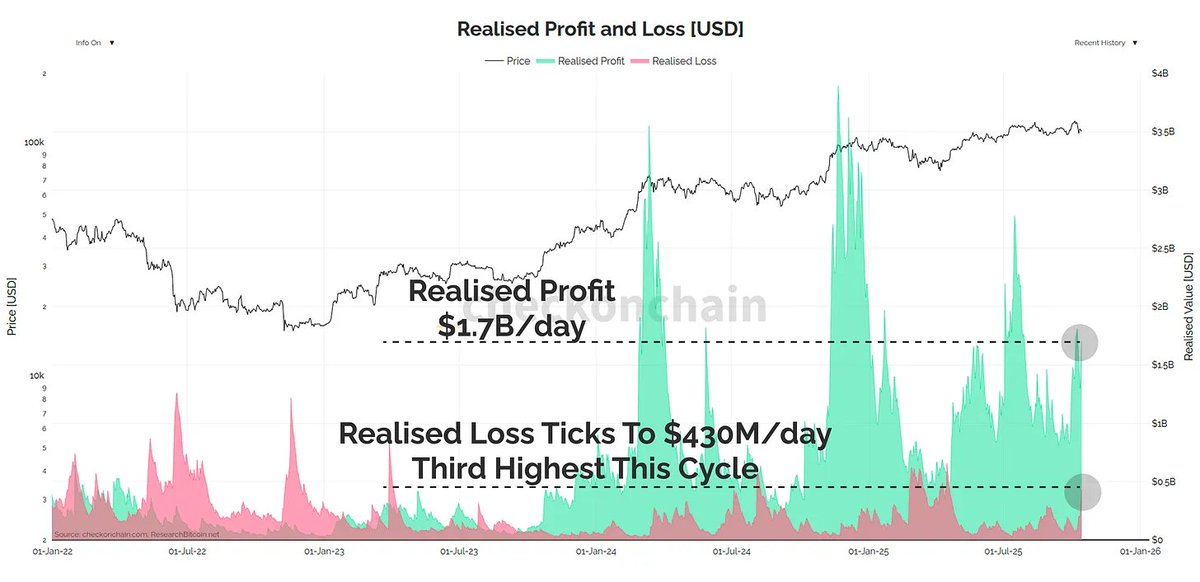

The sheer volume of sell-side pressure from existing Bitcoin holders is **still** not widely appreciated, but it has been THE source of resistance. Not manipulation, not paper Bitcoin, not suppression. Just good old fashioned sellers. Also, it won't become irrelevant.

After some thinking this weekend, I believe the last year of relative weakness for BTC has mostly been transfer of supply from OGs to tradfi, can see this in on chain data. This dynamic will be mostly irrelevant in coming years, just as everyone is focused on BTC’s rel weakness.

youtube.com

YouTube

Gold Is Pumping, Bitcoin Is Next — Inside the Debasement Trade with...

The modern altseason is a recognition that it's probably over for altcoins.

The number of Transactions sending Altcoins into exchanges has hit a new YTD high.

A LOT of posts on my timeline comparing BTC to gold and thinking the market will figure out which one is "better money". Gold spent the first 13 years of Bitcoin's life stuck in a huge range. It finally broke out last year and is repricing to a level that better reflects current…

New episode of The Last Trade, out now! We're joined by @_Checkmatey_ to discuss... ➤ Gold pumping, why BTC is next ➤ Inside the “debasement trade” ➤ Why 4-year cycles may be dead ➤ Treasury company reckoning ➤ Retail flows & ETF demand ➤ Altcoin crash & BTC dominance

Debasement is inevitable. Protect purchasing power with sound money. @_Checkmatey_ explains on The Last Trade 👇

“On the cusp” one of your best videos yet! Thank you for the stellar insights backed up with data! ❤️🙏

Bitcoiners upset about gold... ...looks just like Ethereans being upset about Bitcoin. Except the key difference is, Bitcoin and gold are both serious assets worth owning.

United States Trends

- 1. #hazbinhotelseason2 31.5K posts

- 2. Northern Lights 47.5K posts

- 3. #HazbinHotelSpoilers 2,981 posts

- 4. Good Wednesday 18K posts

- 5. #huskerdust 8,752 posts

- 6. #chaggie 4,652 posts

- 7. #Auroraborealis 4,732 posts

- 8. ADOR 20.6K posts

- 9. MIND-BLOWING 34.8K posts

- 10. Vaggie 5,982 posts

- 11. Carmilla 2,528 posts

- 12. H-1B 38.6K posts

- 13. SPECTACULAR 25K posts

- 14. Superb 22.4K posts

- 15. Wike 232K posts

- 16. H1-B 4,423 posts

- 17. Justified 18.3K posts

- 18. Sabonis 6,269 posts

- 19. TERRIFIC 15.6K posts

- 20. STEM 15.2K posts

Something went wrong.

Something went wrong.