CharIie BileIIo.|.xrp

@clharliebilello

Chief Market Strategist @ Creative Planning Investor | Writer | Reader | Thinker Trying to become a little wiser every day.

Tal vez te guste

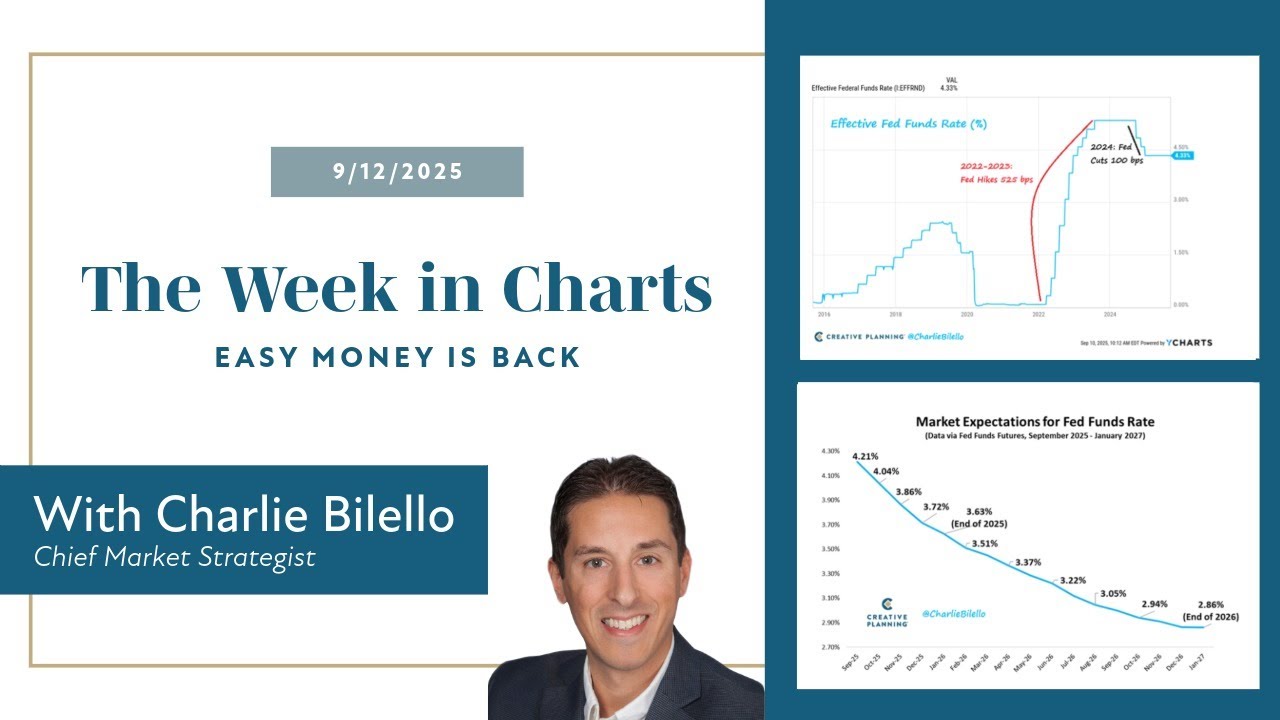

New video is up: 📈The Week in Charts - breaking down the most important charts and themes in markets... youtube.com/watch?v=ZCe_Wz…

youtube.com

YouTube

Easy Money Is Back | The Week in Charts (9/12/25) | Charlie Bilello |...

The U.S. Unemployment Rate just hit its highest level in nearly four years. And AI isn’t slowing down – it’s coming straight at this chart like a freight train.

Investing is a lifelong classroom. The wise never stop learning. The foolish think the lessons don’t apply to them.

US Federal Government Spending as % of GDP... 1950s: 17% 1960s: 18% 1970s: 21% 1980s: 22% 1990s: 21% 2000s: 20% 2010s: 23% 2020s: 27% Video: youtube.com/watch?v=YkHx_O…

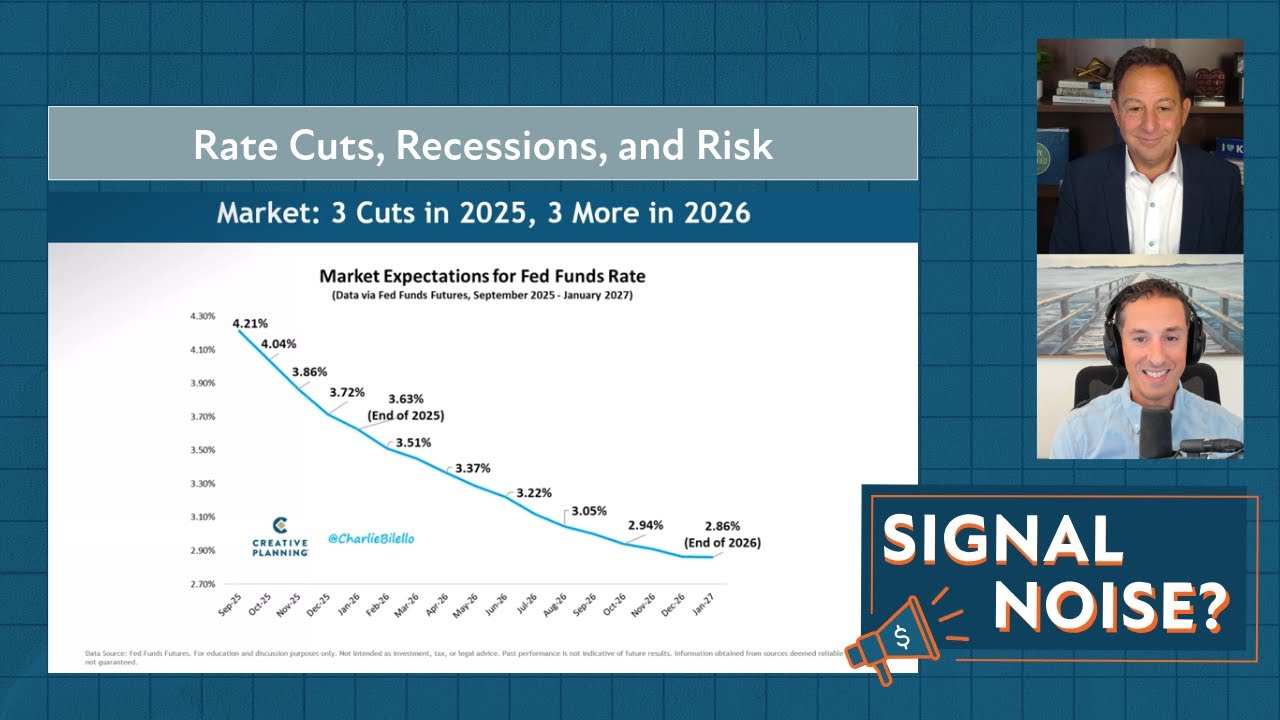

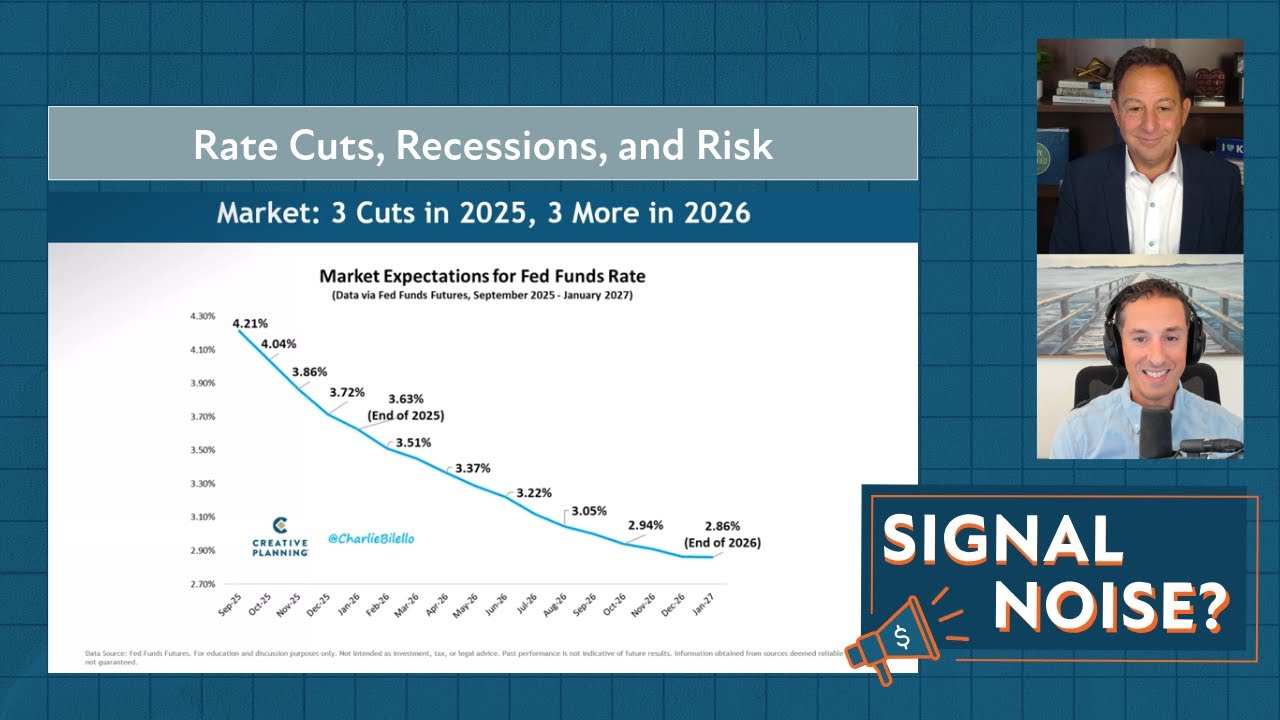

The bond market is now pricing in 3 rate cuts by year-end and 3 more cuts in 2026. That would bring the Fed Funds Rate down to 2.86%. After a brief hiatus, easy money is back. Video: youtube.com/watch?v=rnZ0qn…

After a year of pressure to cut rates, the Fed seems poised to lower rates by 0.25%-0.50% next week. @PeterMallouk and @charliebilello discuss the logic behind this imminent rate cut, the likelihood of a recession and the biggest risk for investors. youtu.be/rnZ0qnqJ6WU?si…

youtube.com

YouTube

Rate Cuts, Recessions, and Risk | Signal or Noise Ep 58 | Charlie...

What would $5k invested each year grow to by age 65 (assuming a 10% annual return)? Over $2 million if you start at age 25 but only $159k if you start at age 50. Your biggest investing edge isn’t stock picking. It’s time.

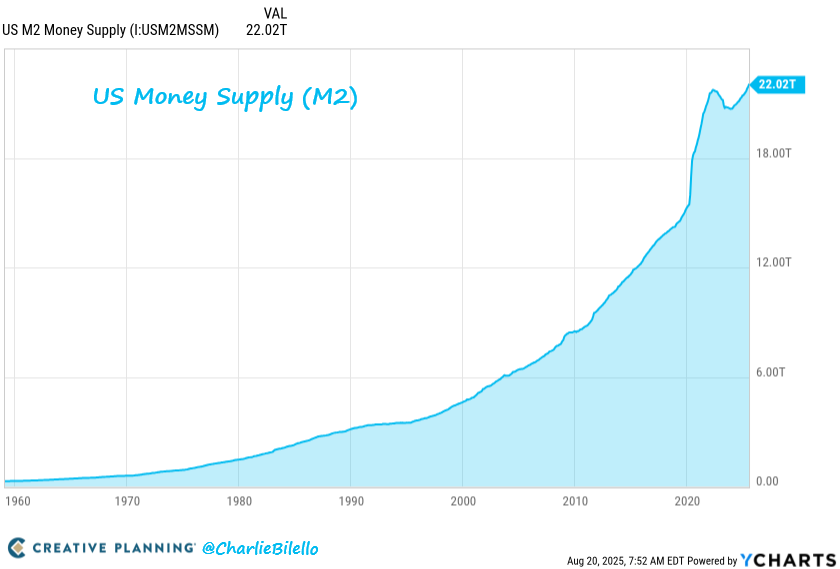

1. Stocks: all-time high 2. Home Prices: all-time high 3. Bitcoin: all-time high 4. Gold: all-time high 5. Money Supply: all-time high 6. National Debt: all-time high 7. CPI Inflation: 4% per year since Jan 2020, 2x the Fed's "target" 8. Fed: cutting interest rates next week

Every week I send a letter to tens of thousands of investors covering the most important charts and themes in markets. Join Here: bilello.blog/newsletter

Global Central Bank Update: -Peru cut rates for the 14th time in the cycle, 25 bps move down to 4.25%. -Russia cut rates for the 3rd straight meeting, 100 bps move down to 17%. bilello.blog/newsletter

Price Increases over last 5 years... CPI New Cars: +21.4% Family Health Insurance: +24.0% CPI Food at home: +24.8% CPI Used Cars: +26.7% CPI Shelter: +27.8% CPI Food away from home: +30.3% CPI Electricity: +38.6% CPI Gasoline: +41.9% CPI Transportation: +44.0% US Home Prices:…

Every week I break down the most important charts and themes in markets and investing. Subscribe to our YouTube channel HERE for all the latest content: youtube.com/channel/UCRoWR…

Including dividends, the S&P 500 has quadrupled over the last decade, up 300%. $SPX Video: youtube.com/watch?v=rnZ0qn…

Global Central Bank Update: -Turkey cut interest rates for the second straight meeting, 250 bps move down to 40.5%. bilello.blog/newsletter

The Interest Expense on US National Debt rose to a record $1.21 trillion in the last 12 months, more than doubling over the past 4 years. The US Government now spends more money on interest than it does on National Defense. Video: youtube.com/watch?v=YkHx_O…

The US collected a record $30 billion in customs duties in August 2025, which was more than 4x higher than the same month in 2024. Video: youtube.com/watch?v=Bbfdlc…

"If you're not willing to react with equanimity to a market price decline of 50% two or three times a century, you're not fit to be a common shareholder — and you deserve the mediocre result you are going to get." Charlie Munger

Rate Cuts, Recessions, and Risk. New ep of Signal or Noise w/ @PeterMallouk youtube.com/watch?v=rnZ0qn…

youtube.com

YouTube

Rate Cuts, Recessions, and Risk | Signal or Noise Ep 58 | Charlie...

I don't think the Fed or any government entity should be setting the price of money. That's a communist principle that I don't believe in. But that aside, no, I think that rates should actually be increased here because inflation is still the bigger problem and we never got close…

You don’t think the fed should cut regarding the bad job numbers?

Overall US CPI moved up to 2.9% in August, the highest level since January. US Core CPI (ex-Food/Energy) moved up to 3.1%, the highest level since February. Despite rising inflation, the Fed is expected to cut rates by 25 bps next week and another 25 bps in October & December.

United States Tendencias

- 1. Cowboys 63.3K posts

- 2. Panthers 63.2K posts

- 3. Fred Warner 2,662 posts

- 4. Ravens 60.7K posts

- 5. Browns 58.3K posts

- 6. #KeepPounding 6,228 posts

- 7. Dolphins 43.2K posts

- 8. Colts 52.8K posts

- 9. Eberflus 8,276 posts

- 10. Steelers 60.3K posts

- 11. Rico Dowdle 7,681 posts

- 12. Drake Maye 18.8K posts

- 13. Chargers 50.2K posts

- 14. James Franklin 47.5K posts

- 15. Penn State 64.7K posts

- 16. Pickens 16.3K posts

- 17. Herbert 14.2K posts

- 18. Dillon Gabriel 3,896 posts

- 19. #FTTB 2,322 posts

- 20. #HereWeGo 5,978 posts

Tal vez te guste

Something went wrong.

Something went wrong.