control^3

@controlcubed

technicals, fundamentals, sentiment analysis

You might like

U.S LAYOFFS IN OCTOBER HIGHEST SINCE 2003

⚠️US consumers are DEFAULTING at a CRISIS pace: Student loan SERIOUS (90+ days) delinquencies EXPLODED to 14.3% in Q3 2025, the highest on record. Auto loan delinquencies rose to 3.0%, the highest since 2010. Credit card delinquencies hit 7.1%, near the highest in 14 YEARS.

UNITED STATES: US household debt reaches record high of $18.59 trillion

Container shipping traffic from China to the US is in freefall: The cargo vessel count from China to the US has dropped to 41, the lowest since February 2024. The number of large cargo ships has declined -30, or -42%, over the last 3 weeks. This is well below the average of…

Housing data shows home sellers now outnumber buyers by more than 500,000, the largest imbalance ever recorded in the market. Home sales are headed for their worst year since 1995.

October ISM Services PMI up to 52.4 vs. 50.8 est. & 50 prior; new orders up to 56.2 vs. 50.4 prior; employment up to 48.2 vs. 47.2 prior

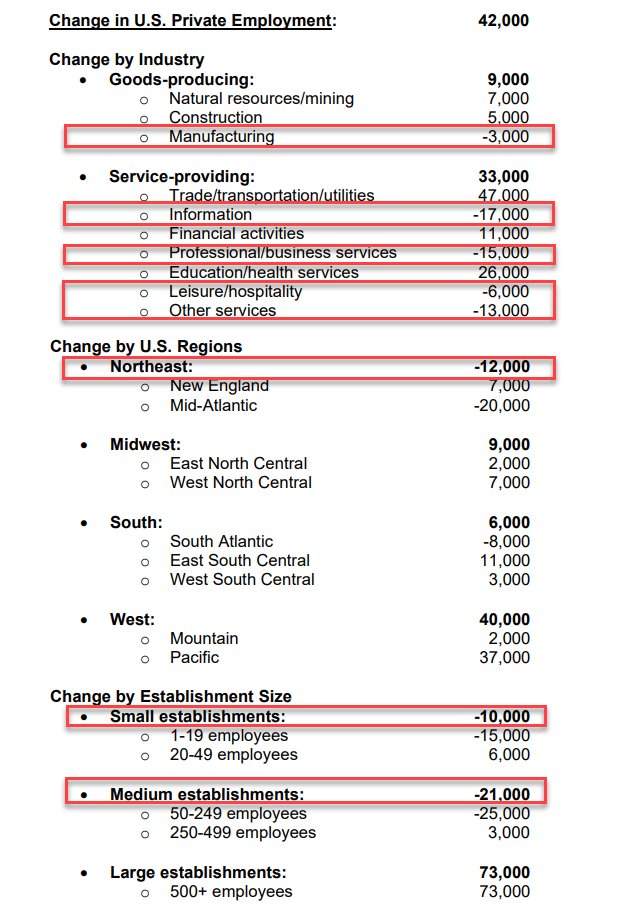

October @ADP payrolls +42k vs. +30k est. & -29k prior (rev up from -32k)

ADP: Job losses in the northeast, and among small and medium enterprises

🚨Liquidity STRESS is surging: Banks’ demand for the Fed’s Standing Repo Facility hit $50 BILLION on Friday, the highest since its 2021 launch. SRF lets banks to borrow cash from the Fed using Treasuries as collateral to support liquidity. QE or, 'Not QE' first, is coming.

JUST IN 🚨: U.S. Dollar Index $DXY hits 100 for the first time since August 1 💵🇺🇸

BREAKING: The delinquency rate on Commercial Mortgage-Backed Securities (CMBS) for offices surged +63 basis points in October, to a record 11.8%. This is now over a full percentage point above the post-2008 Financial Crisis peak of 10.7%. Since October 2022, the CMBS…

HOUSING TURNOVER HAS OFFICIALLY BEEN IN HISTORICALLY LOW BOUNDS FOR THREE YEARS

US Mfg PMI Oct Final 52.5, Exp. 52.2, Prelim 52.2

PMI beat so of course ISM missed: ISM Manufacturing Oct 48.7, Exp. 49.5, Last 49.1 Employment 46.0, vs 45.3 Prices Paid 58.0, Last 61.9 New Orders 49.4, Last 48.9

The elephant in the room: AI stocks are outperforming consumer stocks by 20%+ over the last 60 DAYS. And, as AI investment exceeds $1 TRILLION per year, car repossessions are at 2009 levels. There are 2 US economies: Rich vs Poor, and AI is the lifeline of it all. (a thread)

The US housing market is frozen: Only 28 out of every 1,000 homes, or 2.8%, changed hands in the first 9 months of 2025, the least in at least 30 years. The turnover rate has declined -38% since the 2021 peak, when 44 out of every 1,000 homes were sold. By comparison, the rate…

U.S. Dollar survives 📈📈 14-Year Support proves invincible again 💵

U.S. Bank Reserves fall to $2.8 Trillion, the lowest level since 2020 🚨🚨

It's amazing how people still believe govts are central to everything, economy, markets, currencies, etc. They don't matter. Stimulus never stimulates (have to keep doing it over and over), FX interventions do nothing. China is proving bazooka failure and India with FX. INR…

Month end pushes liquidity off a cliff: standing repo facility surges to $20.35BN, highest on record. Expect some normlization after month end passes but stress will persist.

United States Trends

- 1. #CARTMANCOIN 1,701 posts

- 2. Broncos 65.5K posts

- 3. yeonjun 206K posts

- 4. Raiders 65.8K posts

- 5. Bo Nix 18K posts

- 6. Geno 18.5K posts

- 7. Sean Payton 4,748 posts

- 8. daniela 42.7K posts

- 9. #criticalrolespoilers 4,858 posts

- 10. #TNFonPrime 4,008 posts

- 11. Kenny Pickett 1,510 posts

- 12. Jalen Green 7,410 posts

- 13. Chip Kelly 1,967 posts

- 14. Bradley Beal 3,484 posts

- 15. Kehlani 9,300 posts

- 16. Pete Carroll 1,950 posts

- 17. TALK TO YOU OUT NOW 26.6K posts

- 18. #Pluribus 2,612 posts

- 19. byers 29.4K posts

- 20. Jeanty 6,495 posts

You might like

-

Gio | Income Roots

Gio | Income Roots

@DividendRoots -

Jtrades

Jtrades

@Jhswings27 -

Andre-ACGT

Andre-ACGT

@Andre_AGTC -

The Stock Trader Hub Zee

The Stock Trader Hub Zee

@TSTHZeee -

LSTrade

LSTrade

@LSTrade2 -

TT Day Trading Alerts ™

TT Day Trading Alerts ™

@trooper_trading -

Parabolic Scan

Parabolic Scan

@ParabolicScan -

👁️ __👁️

👁️ __👁️

@marketeyes444 -

PTG

PTG

@PowerTradingGrp -

FDA Stock Picks

FDA Stock Picks

@fdastocks -

The Open Bible

The Open Bible

@Open_Bible -

SqueezeDeezChurtz

SqueezeDeezChurtz

@SquZeDeezChurtz -

Precedence Research

Precedence Research

@Precedence_R -

Earnings Ahead 📌

Earnings Ahead 📌

@EarningsAhead -

Charlie Mike

Charlie Mike

@airborne__

Something went wrong.

Something went wrong.